An escrow agreement involves the deposit of a written instrument or something of value (like funds from a check) with a third person (the escrow agent) with instructions to deliver it to another party when a stated condition is performed or a specified event occurs.

Alabama Escrow Check Receipt - Real Estate Sale

Description

How to fill out Escrow Check Receipt - Real Estate Sale?

If you require to completely, download, or produce authentic document templates, utilize US Legal Forms, the largest selection of legitimate forms, which are accessible online.

Take advantage of the website's user-friendly and efficient search to find the documents you require. Numerous templates for business and personal purposes are categorized by types and states, or keywords.

Utilize US Legal Forms to acquire the Alabama Escrow Check Receipt - Real Estate Sale with just a few clicks.

Every legal document template you obtain is yours indefinitely. You will have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

Be proactive and download, and print the Alabama Escrow Check Receipt - Real Estate Sale with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, sign in to your account and click the Download button to retrieve the Alabama Escrow Check Receipt - Real Estate Sale.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/country.

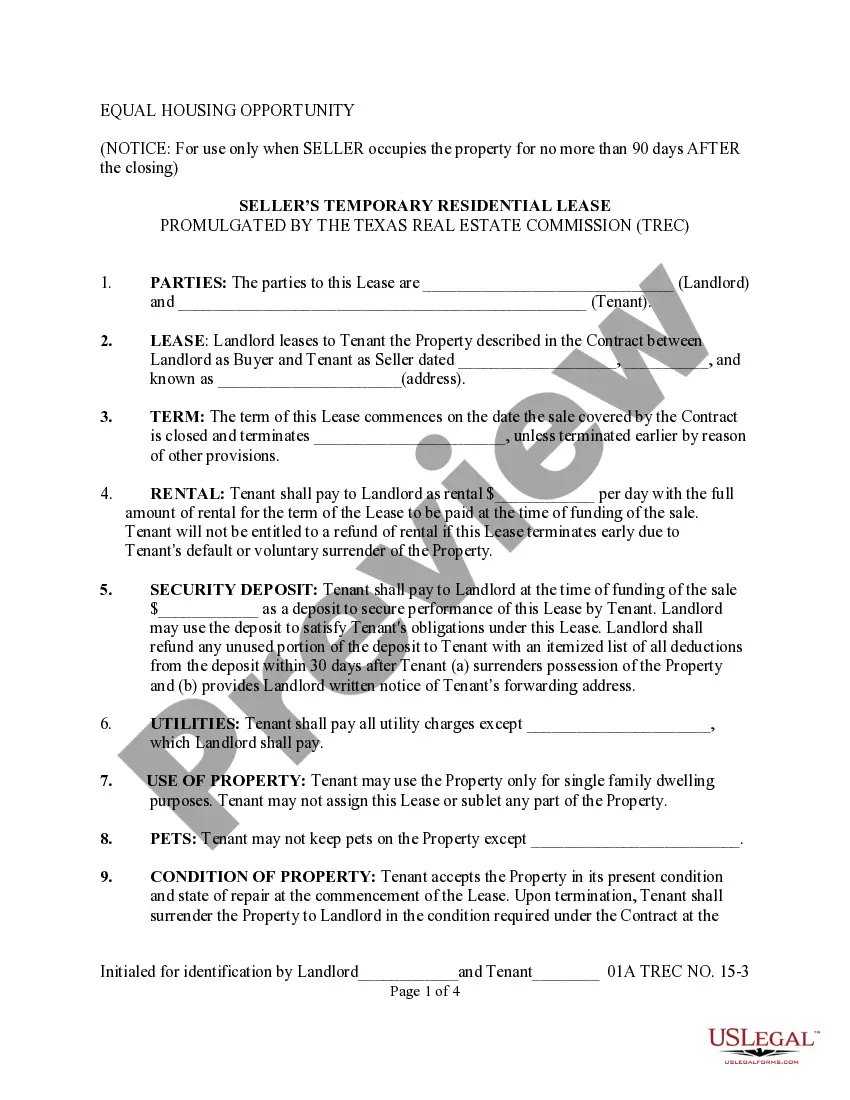

- Step 2. Use the Preview option to review the form's content. Do not forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search feature at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have identified the form you need, select the Get now button. Choose the pricing plan you prefer and provide your credentials to register for the account.

- Step 5. Process the transaction. You can use your credit card or PayPal account to complete the purchase.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Alabama Escrow Check Receipt - Real Estate Sale.

Form popularity

FAQ

In Alabama, the escrow period usually lasts between 30 to 60 days, depending on the complexity of the transaction. The timeline may vary based on various factors such as inspections, financing, and seller concessions. Understanding the timeline associated with the Alabama Escrow Check Receipt - Real Estate Sale will help you plan your move more effectively. Clear communication with your escrow agent can help you stay on track.

Alabama is primarily considered an escrow state, allowing parties to use escrow services during real estate transactions. However, having an attorney can provide additional guidance and protection throughout the buying or selling process. Familiarizing yourself with the Alabama Escrow Check Receipt - Real Estate Sale is crucial, as it will ensure that all parties meet legal requirements. You might want to consult a professional for further clarity.

You can obtain an escrow statement from your escrow company, real estate agent, or attorney involved in the transaction. This statement will detail all financial transactions, ensuring transparency regarding the Alabama Escrow Check Receipt - Real Estate Sale. If you need assistance, consider using the U.S. Legal Forms platform, which provides resources and templates to streamline your process.

Escrow requirements vary from state to state. States such as California, Florida, and New York have strict escrow requirements during real estate transactions. In Alabama, while not mandatory, using an escrow service increases security and efficiency in handling the Alabama Escrow Check Receipt - Real Estate Sale. It is advisable to check local regulations to understand the specific requirements.

Yes, when you sell your house, you generally receive an escrow check as part of the closing process. This check represents the net proceeds from the sale after all fees and costs are deducted. Familiarizing yourself with the Alabama Escrow Check Receipt - Real Estate Sale can ensure you comprehend all relevant details. It’s essential to verify the amount before signing any documents.

An escrow check in real estate refers to a payment held in a secure account until certain conditions are met. This ensures that both the buyer's and seller's interests are protected throughout the sale process. The Alabama Escrow Check Receipt - Real Estate Sale provides an official record of the check and the terms surrounding its release, making it essential for a smooth transaction.

You may receive an escrow check as part of the closing process in a real estate sale. This check represents your share of the funds held in escrow, often after all conditions have been met or upon the sale's completion. The Alabama Escrow Check Receipt - Real Estate Sale outlines the transaction details, providing clarity on what the check represents and why you are receiving it.

When a check is in escrow, it is held by a neutral third party until specific conditions are met in the transaction. This process helps ensure that both buyers and sellers are protected during the real estate sale. The Alabama Escrow Check Receipt - Real Estate Sale verifies that the funds are secure and allocated correctly once the terms of the sale are fulfilled.

No, while escrow is commonly associated with real estate, it is not limited to that field. Escrow can also be used in various types of transactions, such as online sales or large purchases, to secure buyer and seller interests. This flexibility provides safety for both parties, allowing them to proceed with confidence. For more detailed information on the Alabama Escrow Check Receipt - Real Estate Sale, explore options available through US Legal Forms.