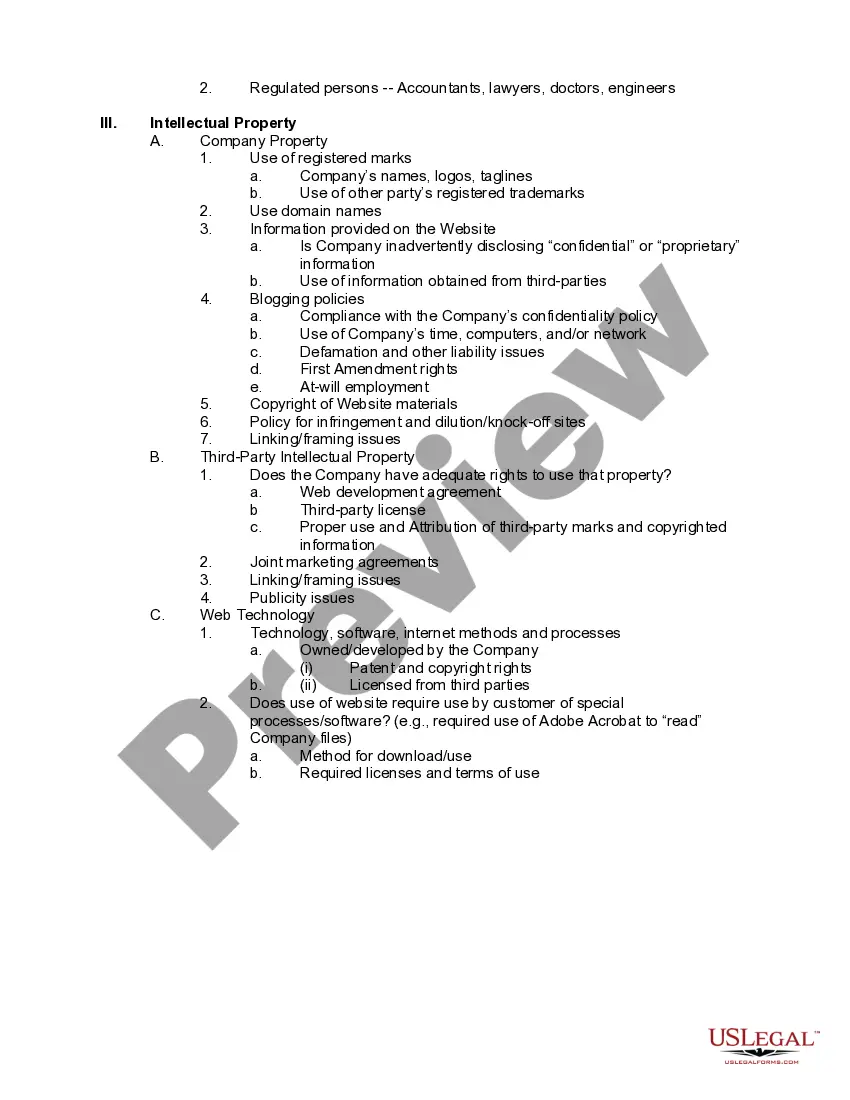

Alabama Compliance Checklist For Company Websites is a comprehensive set of guidelines and requirements that businesses operating in Alabama must adhere to in order to ensure their websites are in compliance with state laws and regulations. A company website serves as a vital tool for businesses to engage with their customers, provide information, and conduct online transactions. It is crucial for businesses to comply with these Alabama compliance checklists to avoid legal issues and protect the privacy and rights of their website users. The Alabama compliance checklist for company websites consists of various elements that businesses need to address to meet state-specific requirements. Some key components of the checklist include: 1. Accessibility Compliance: Businesses must ensure their websites are accessible to individuals with disabilities, in line with the Alabama Disabled Accessibility Act (ADAM). This includes providing alternative text for images, using accessible colors and font sizes, enabling keyboard navigation, and providing captions for multimedia content. 2. Privacy Policy: Companies need to have a clear and comprehensive privacy policy on their websites, outlining how they collect, use, store, and protect user data. The policy should comply with the Alabama Privacy Protection Act and clearly state how personal information will be handled. 3. Data Protection: Businesses must have appropriate measures in place to protect the personal data collected from users. This includes implementing secure data encryption, robust firewalls, and regular security audits. Compliance with the Alabama Data Breach Notification Act is also essential. 4. Terms and Conditions: A website's terms and conditions must be clearly stated and easily accessible. They should cover important aspects such as liability, intellectual property rights, user responsibilities, and dispute resolution. 5. E-commerce Compliance: Companies engaged in online transactions must comply with Alabama's e-commerce laws, ensuring transparent pricing, offering accurate product descriptions, and providing clear refund and cancellation policies. 6. Intellectual Property Rights: Businesses should respect and protect intellectual property rights on their websites, including trademarks, copyrights, and patents. Unauthorized use of copyrighted content or trademarks should be avoided. 7. Online Marketing Compliance: Companies must comply with Alabama laws related to online advertising, email marketing, and spam regulations. This includes obtaining consent for email subscriptions, clearly identifying advertisements, and adhering to opt-out requirements. 8. Children's Online Privacy: If a website targets users under the age of 13, compliance with the Children's Online Privacy Protection Act (COPPA) is essential. Businesses must obtain parental consent for collecting personal information from children and provide appropriate safeguards. In addition to the general Alabama compliance checklist, there may be specific sector or industry-related compliance requirements for company websites. For example, healthcare providers may need to comply with the Health Insurance Portability and Accountability Act (HIPAA), while financial institutions may have specific guidelines related to financial data security. In conclusion, the Alabama Compliance Checklist For Company Websites encompasses a range of crucial compliance requirements, ensuring businesses provide a secure, transparent, and legally compliant online experience for their users. By adhering to these guidelines, businesses can avoid legal ramifications, protect their reputation, and build trust with their customers.

Alabama Compliance Checklist For Company Websites

Description

How to fill out Alabama Compliance Checklist For Company Websites?

Finding the right legitimate papers design might be a battle. Of course, there are tons of themes available online, but how will you get the legitimate form you need? Use the US Legal Forms internet site. The services offers 1000s of themes, including the Alabama Compliance Checklist For Company Websites, which you can use for enterprise and private requires. All of the forms are examined by pros and fulfill state and federal demands.

When you are previously authorized, log in to your accounts and click the Obtain button to get the Alabama Compliance Checklist For Company Websites. Utilize your accounts to check from the legitimate forms you might have acquired previously. Go to the My Forms tab of your respective accounts and have one more duplicate in the papers you need.

When you are a fresh end user of US Legal Forms, here are easy recommendations for you to adhere to:

- Initially, make sure you have chosen the correct form for the area/county. It is possible to look through the shape making use of the Preview button and study the shape information to make certain this is the best for you.

- If the form is not going to fulfill your requirements, utilize the Seach discipline to obtain the proper form.

- Once you are positive that the shape would work, select the Acquire now button to get the form.

- Select the pricing prepare you want and type in the essential details. Create your accounts and pay for your order with your PayPal accounts or charge card.

- Choose the file structure and download the legitimate papers design to your device.

- Complete, modify and print out and signal the acquired Alabama Compliance Checklist For Company Websites.

US Legal Forms is definitely the biggest local library of legitimate forms that you can see different papers themes. Use the company to download professionally-manufactured files that adhere to condition demands.

Form popularity

FAQ

All corporations and limited liability entities (Limited Partnerships, Limited Liability Partnerships, and Limited Liability Companies) are required to file and pay Alabama Business Privilege Tax no later than 2½ months after the taxpayer comes into existence, qualifies, or registers to do business or com- mences to do

A business tax registration, commonly called a seller's permit, is required for any business selling or renting tangible property in the state of Alabama. This registration allows you to sell your products and services, whether in store or online, as well as collect sales tax on any taxable goods.

The Certificate of Compliance will be issued if the Department is able to verify that an entity has filed all returns required to be submitted and paid the taxes shown due as payable on those returns.

Certificate of Good Standing FAQ A certificate of good standing is a legal document that confirms that your business is compliant with state regulations. Certificates of good standing are sometimes also known as certificates of status, certificates of existence, or certificates of compliance.

The Alabama Certificate of Existence will show that your LLC in Alabama or Alabama corporation exists and is what you'll need to provide if registering your business in a different state.

You can obtain your certificate of good standing, known as a certificate of compliance in Alabama, by requesting it from the Alabama Department of Revenue.

A Certificate of Compliance is a document issued by the Alabama Department of Revenue showing the official existence of an LLC, Corporation, LP, LLP, or Not-for-Profit that is authorized to do business in Alabama. This certificate is also commonly known as the Certificate of Good Standing or Certificate of Existence.