A Grantor Charitable Lead Annuity Trust (CLAT) is an irrevocable split-interest trust that provides for a specified amount to be paid to one or more charitable beneficiaries during the term of the trust. The principal remaining in the trust at the end of the term is paid over to, or held in a continuing trust for, a non-charitable beneficiary or beneficiaries identified in the trust. If the terms of a CLAT created during the donor's life satisfy the applicable statutory and regulatory requirements, a gift of the charitable lead annuity interest will qualify for the gift tax charitable deduction under § 2522(c)(2)(B) and/or the estate tax charitable deduction under § 2055(e)(2)(B). In certain cases, the gift of the annuity interest may also qualify for the income tax charitable deduction under § 170(a). The value of the remainder interest is a taxable gift by the donor at the time of the donor's contribution to the trust.

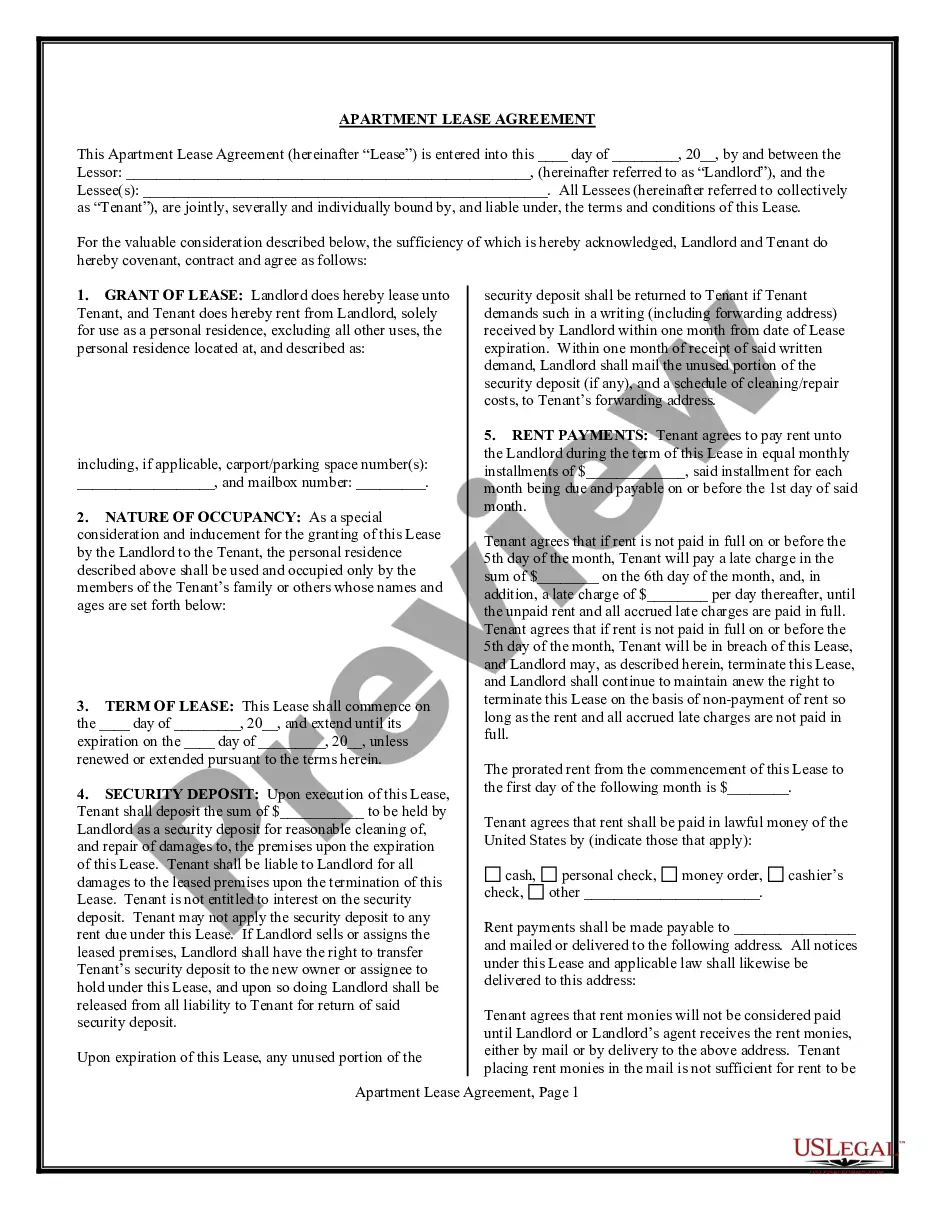

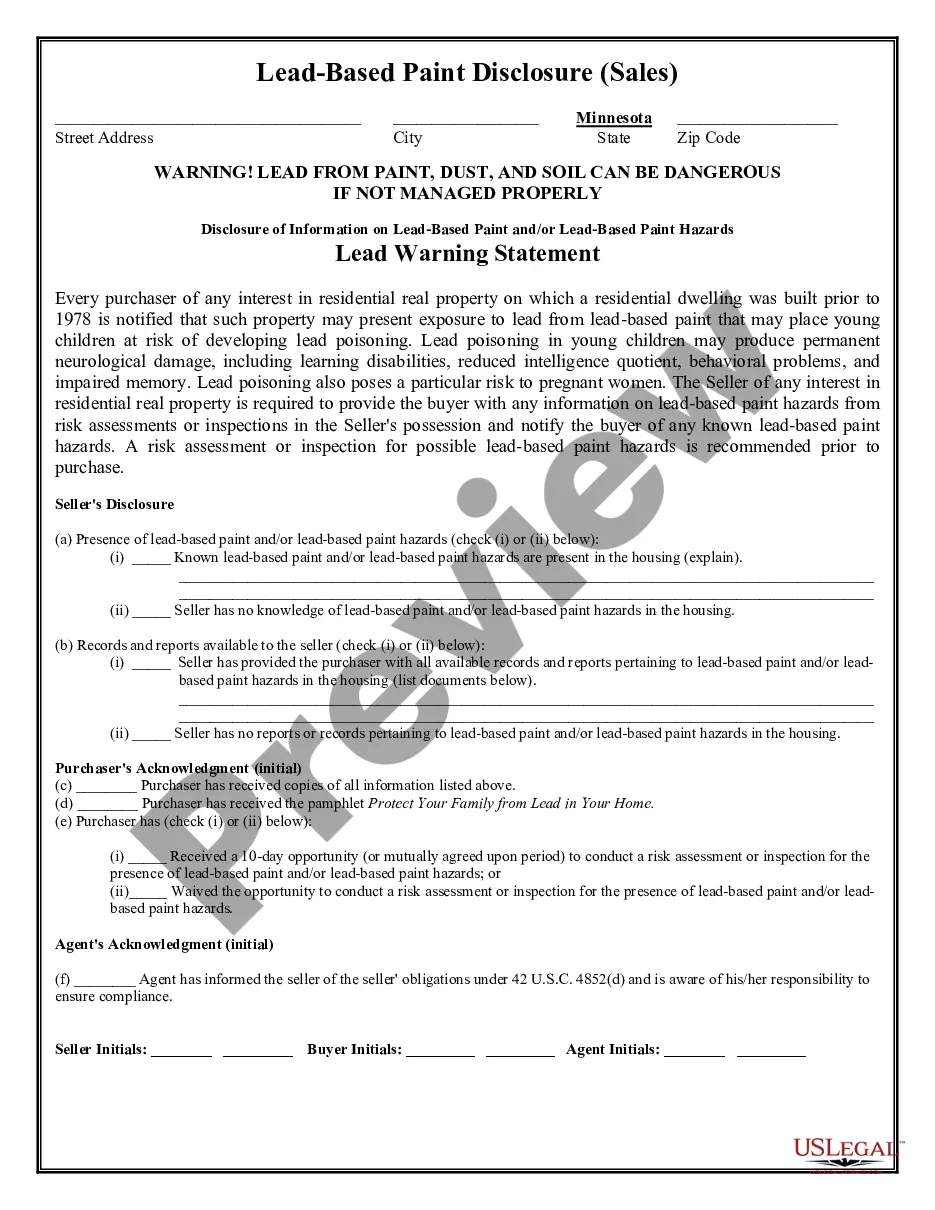

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Alabama Inter Vivos Granter Charitable Lead Annuity Trust (ILG) is a type of trust that allows individuals to provide financial support to charitable organizations while also benefiting from potential tax advantages. This trust is established during the granter's lifetime, making it an inter vivos trust. The Alabama Inter Vivos Granter Charitable Lead Annuity Trust involves three main parties: the granter, the charitable lead beneficiary, and the remainder beneficiary. The granter, who creates and funds the trust, transfers assets to the trust. The charitable lead beneficiary is the charity or charitable organization that receives an annuity payment from the trust for a specified duration. The remainder beneficiary is the individual or entity that will receive any remaining trust assets after the charitable payments have ceased. There are different types of Alabama Inter Vivos Granter Charitable Lead Annuity Trusts, including: 1. Non-Grantor Charitable Lead Annuity Trust: In this type of trust, the granter does not retain any interest in the trust, and therefore, it is not included in their estate for estate tax purposes. The charitable payments are fixed annuity payments made for a defined period. 2. Granter Charitable Lead Annuity Trust: This trust is considered a granter trust for income tax purposes. The granter retains certain rights or interests in the trust, leading to potential income tax benefits. The annuity payments made to the charitable lead beneficiary are fixed, providing a reliable income stream for the charitable organization. 3. Flip Charitable Lead Annuity Trust: This trust starts as a non-grantor trust, but upon the occurrence of a specified event, it "flips" into a granter trust. This can be advantageous for granters who want the flexibility to control certain aspects of the trust but also seek income tax benefits. 4. Increasing Charitable Lead Annuity Trust: In this type of trust, the annuity payments made to the charitable lead beneficiary increase over time. This allows the granter to potentially decrease their taxable estate while still supporting charitable causes. By establishing an Alabama Inter Vivos Granter Charitable Lead Annuity Trust, individuals can provide ongoing financial support to charitable organizations while enjoying potential tax advantages. However, it is important to consult with legal and financial professionals to ensure proper implementation and adherence to relevant laws and regulations.