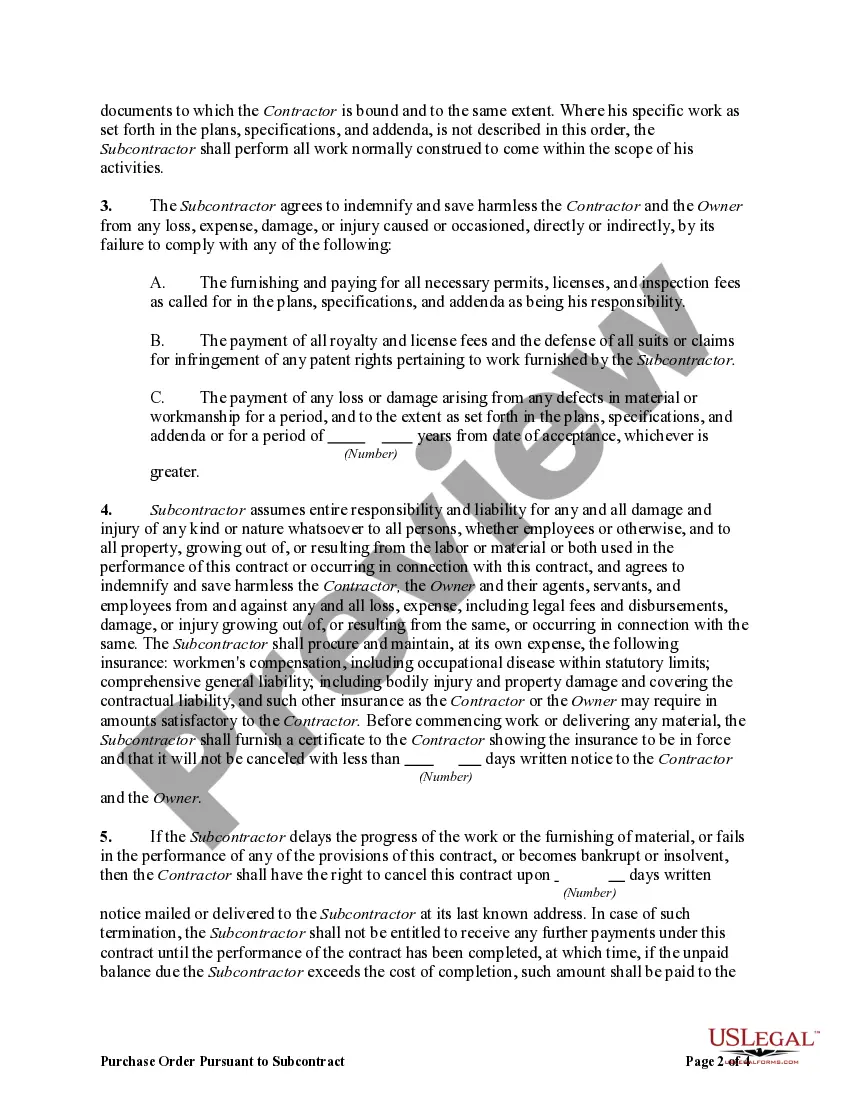

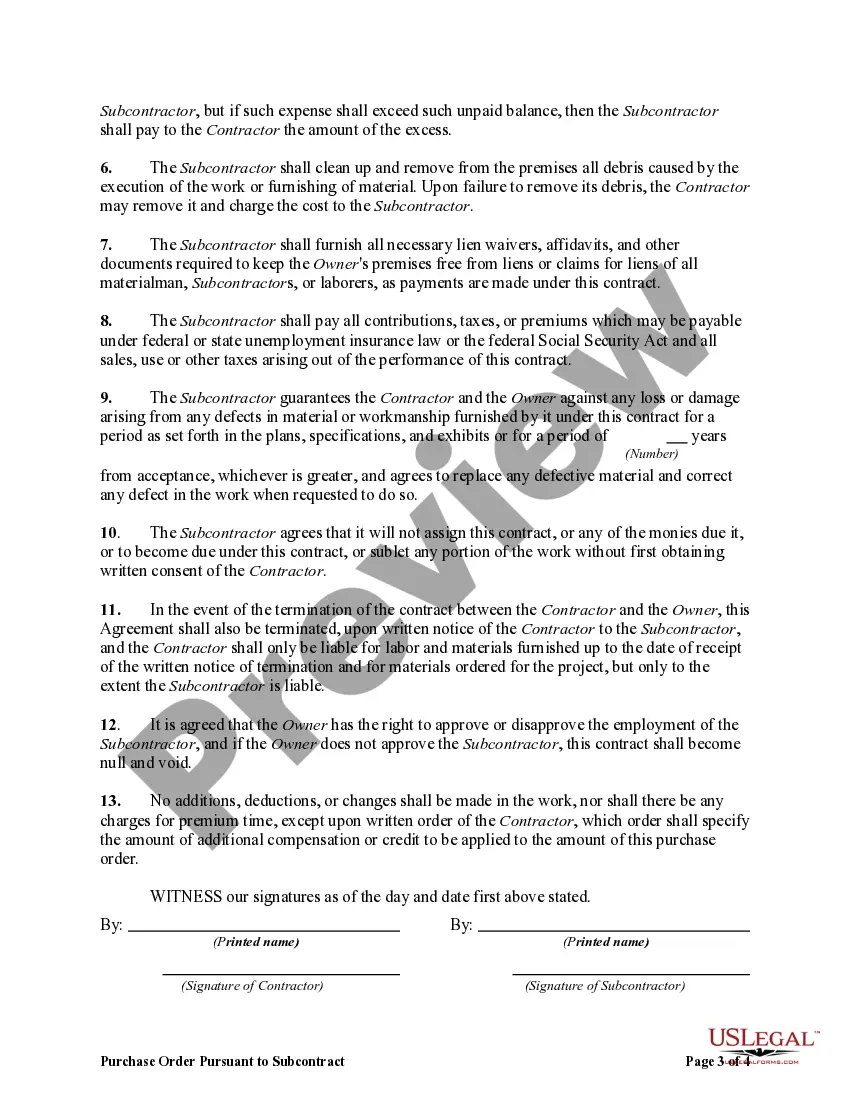

Alabama Purchase Order Pursuant to Subcontract for Labor and Materials

Description

How to fill out Purchase Order Pursuant To Subcontract For Labor And Materials?

Are you presently in a position where you frequently require documents for business or particular purposes.

There are numerous authentic document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the Alabama Purchase Order Pursuant to Subcontract for Labor and Materials, designed to comply with federal and state regulations.

Once you locate the correct form, click Get now.

Choose the pricing plan you prefer, complete the necessary information to create your account, and process your order using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Alabama Purchase Order Pursuant to Subcontract for Labor and Materials template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and make sure it is for the correct city/area.

- Utilize the Preview button to review the form.

- Check the description to confirm that you have selected the appropriate form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Tax-exempt customers Some customers are exempt from paying sales tax under Alabama law. Examples include government agencies, some nonprofit organizations, and merchants purchasing goods for resale. Sellers are required to collect a valid exemption or resale certificate from buyers to validate each exempt transaction.

The following clauses from the Standard General Conditions from EJCDC, 2002 clearly allocate the distinct roles and responsibility of the owner, engineer, and contractor relative to means and methods. Contractor shall be solely responsible for the means, methods, techniques, sequences, and procedures of construction.

A "changes in the work" clause is an essential part of any construction contract and allows the parties to agree in advance to a process for making changes to the work and pricing those changes. All major standard form agreements address changes in the work, usually as part of the general conditions.

FURNISH: The word "furnish" shall be understood to mean "purchase and/or fabricate and deliver to the jobsite or other location when so designated." INSTALL: The word "install" shall mean to build in, mount in positions, connect or apply any object specified ready for the intended use.

Contractors are considered the end user and are responsible for remitting the applicable sales or use tax on their purchases of building material, equipment, etc., for construction projects.

Competitive Bid LawThe Basics County commissions and municipalities, among others, are governed by Article 3 of Chapter 16 when more than $15,000 will be expended on labor, services, and work; the purchase of materials, equipment, supplies, or other personal property; and certain leases.

Services in Alabama are generally not taxable. However, if the service you provide includes creating or manufacturing a product, you may have to deal with the sales tax on these products. Tangible personal property is generally taxable in Alabama, with a few exceptions for items used in agriculture or industry.

Are services subject to sales tax in Alabama? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Alabama, services are generally not taxable.

Are services subject to sales tax in Alabama? "Goods" refers to the sale of tangible personal property, which are generally taxable. "Services" refers to the sale of labor or a non-tangible benefit. In Alabama, services are generally not taxable.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...