Alabama Sample Letter for Breakdown of Account Arrearage

Description

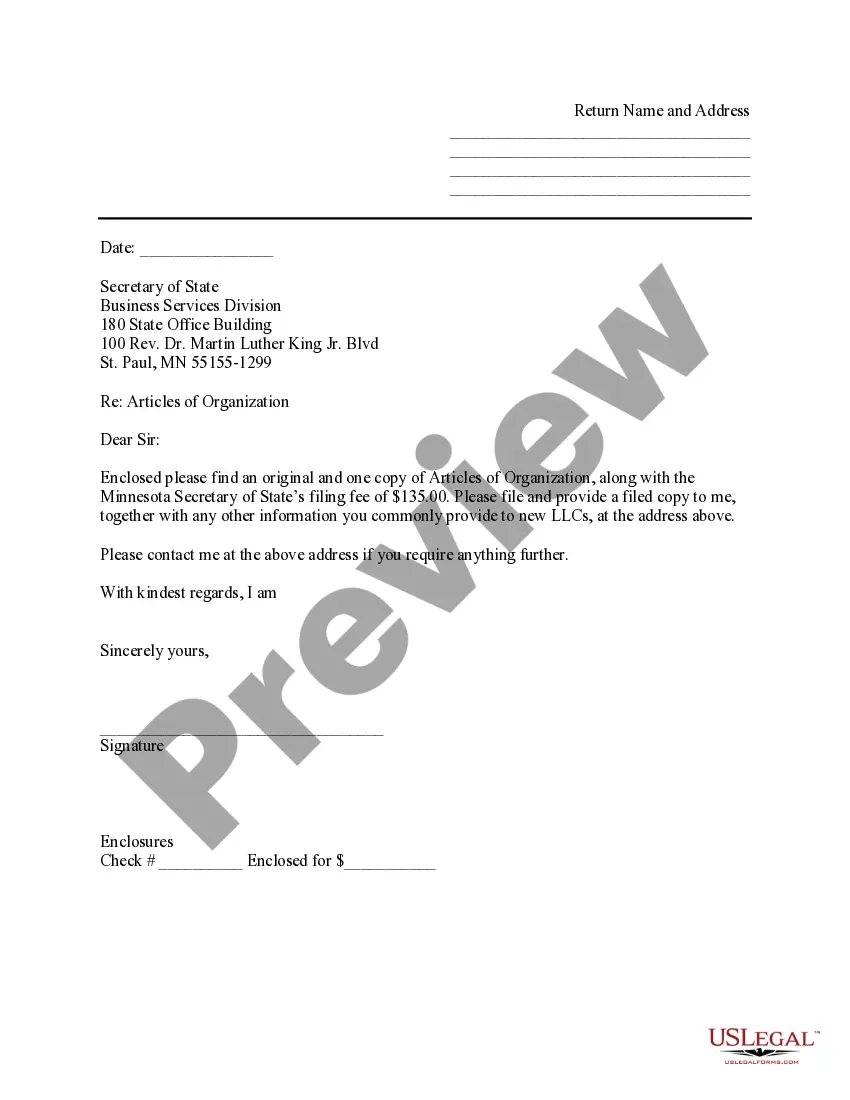

How to fill out Sample Letter For Breakdown Of Account Arrearage?

Choosing the best authorized document web template could be a have difficulties. Naturally, there are a variety of templates available on the net, but how will you get the authorized form you require? Use the US Legal Forms website. The assistance offers a huge number of templates, like the Alabama Sample Letter for Breakdown of Account Arrearage, which you can use for enterprise and personal needs. All of the forms are inspected by specialists and satisfy federal and state requirements.

When you are currently signed up, log in to your profile and click the Obtain switch to find the Alabama Sample Letter for Breakdown of Account Arrearage. Make use of your profile to search through the authorized forms you may have ordered earlier. Check out the My Forms tab of your profile and obtain one more copy from the document you require.

When you are a fresh user of US Legal Forms, allow me to share basic guidelines for you to adhere to:

- Initially, make certain you have chosen the right form for your town/area. You may look through the form while using Review switch and look at the form description to make sure this is basically the right one for you.

- If the form will not satisfy your expectations, take advantage of the Seach industry to discover the appropriate form.

- Once you are positive that the form would work, click the Acquire now switch to find the form.

- Choose the pricing strategy you need and enter in the necessary info. Make your profile and pay money for your order utilizing your PayPal profile or Visa or Mastercard.

- Opt for the submit file format and obtain the authorized document web template to your device.

- Full, modify and print out and indication the attained Alabama Sample Letter for Breakdown of Account Arrearage.

US Legal Forms will be the largest collection of authorized forms for which you can discover different document templates. Use the service to obtain appropriately-created paperwork that adhere to express requirements.