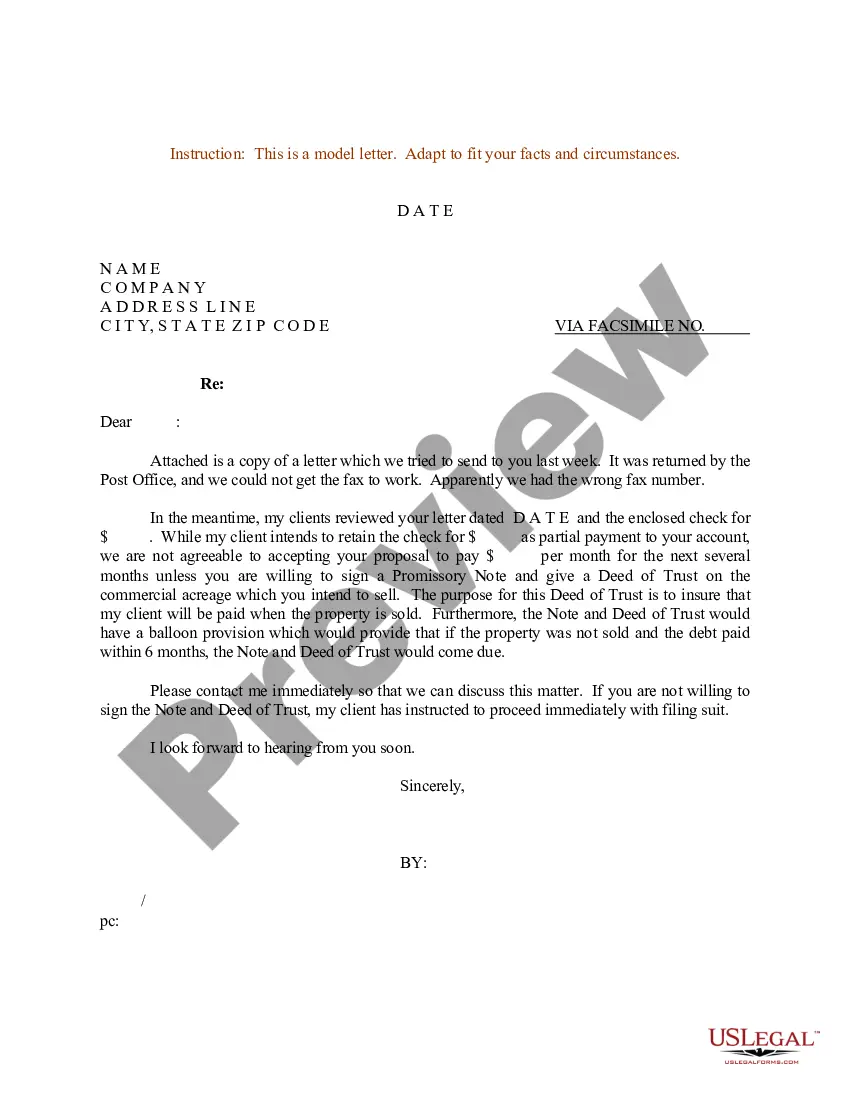

Alabama Sample Letter for Deed of Trust and Promissory Note

Description

How to fill out Sample Letter For Deed Of Trust And Promissory Note?

Discovering the right authorized file template could be a struggle. Needless to say, there are a lot of layouts available on the Internet, but how can you obtain the authorized type you want? Take advantage of the US Legal Forms site. The assistance delivers thousands of layouts, for example the Alabama Sample Letter for Deed of Trust and Promissory Note, which can be used for enterprise and private demands. All of the types are inspected by pros and meet state and federal specifications.

When you are previously authorized, log in to your accounts and then click the Obtain key to find the Alabama Sample Letter for Deed of Trust and Promissory Note. Utilize your accounts to appear through the authorized types you might have purchased in the past. Go to the My Forms tab of the accounts and obtain an additional backup of the file you want.

When you are a whole new user of US Legal Forms, listed below are easy recommendations for you to stick to:

- Initially, be sure you have selected the proper type for the town/state. It is possible to check out the shape making use of the Review key and read the shape description to ensure it is the right one for you.

- When the type fails to meet your needs, make use of the Seach discipline to get the proper type.

- Once you are certain that the shape would work, select the Acquire now key to find the type.

- Pick the prices plan you desire and type in the required information. Create your accounts and purchase your order with your PayPal accounts or Visa or Mastercard.

- Choose the submit structure and download the authorized file template to your product.

- Complete, revise and print and indication the received Alabama Sample Letter for Deed of Trust and Promissory Note.

US Legal Forms is definitely the largest library of authorized types that you can discover different file layouts. Take advantage of the company to download appropriately-produced papers that stick to state specifications.

Form popularity

FAQ

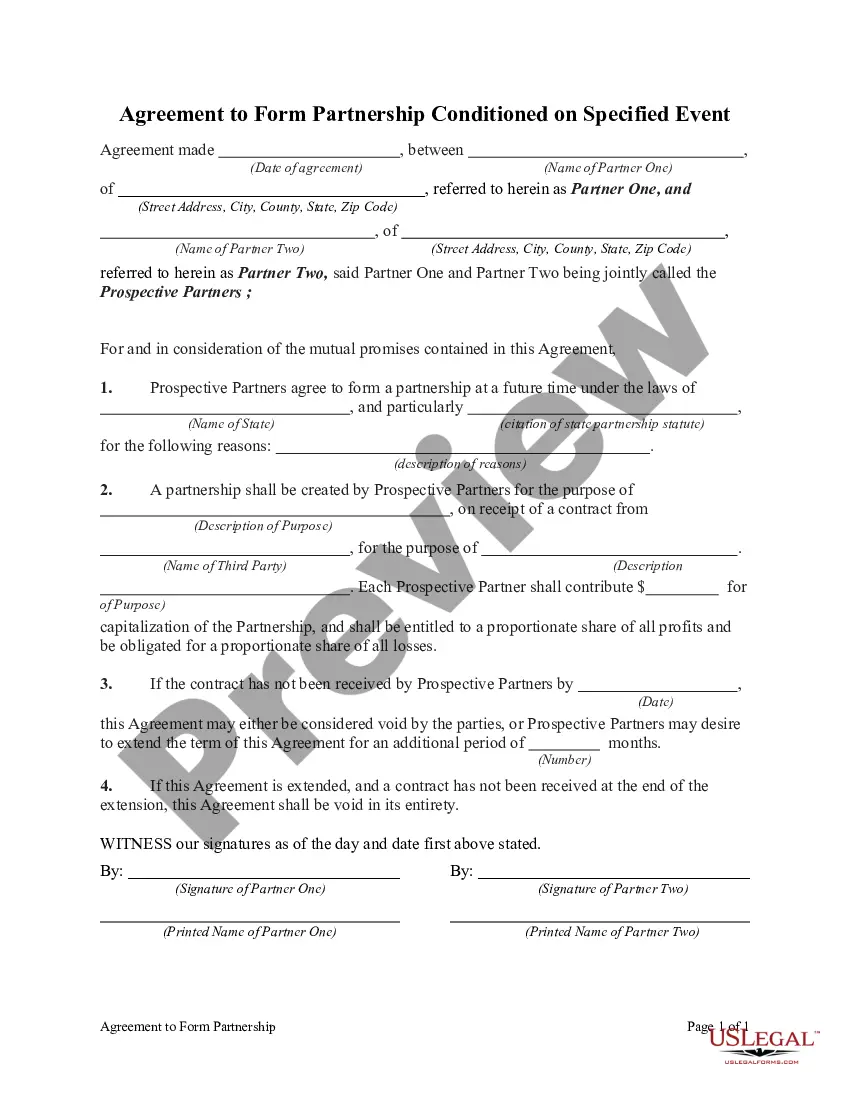

A Standard Document used for transferring an interest in an unsecured promissory note to a revocable trust that can be customized for use in any US jurisdiction. This Standard Document contains integrated notes and drafting tips.

While most states have either mortgages or deeds of trust, there are a few states that allow you to choose which is better for you. These states include Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, and Montana.

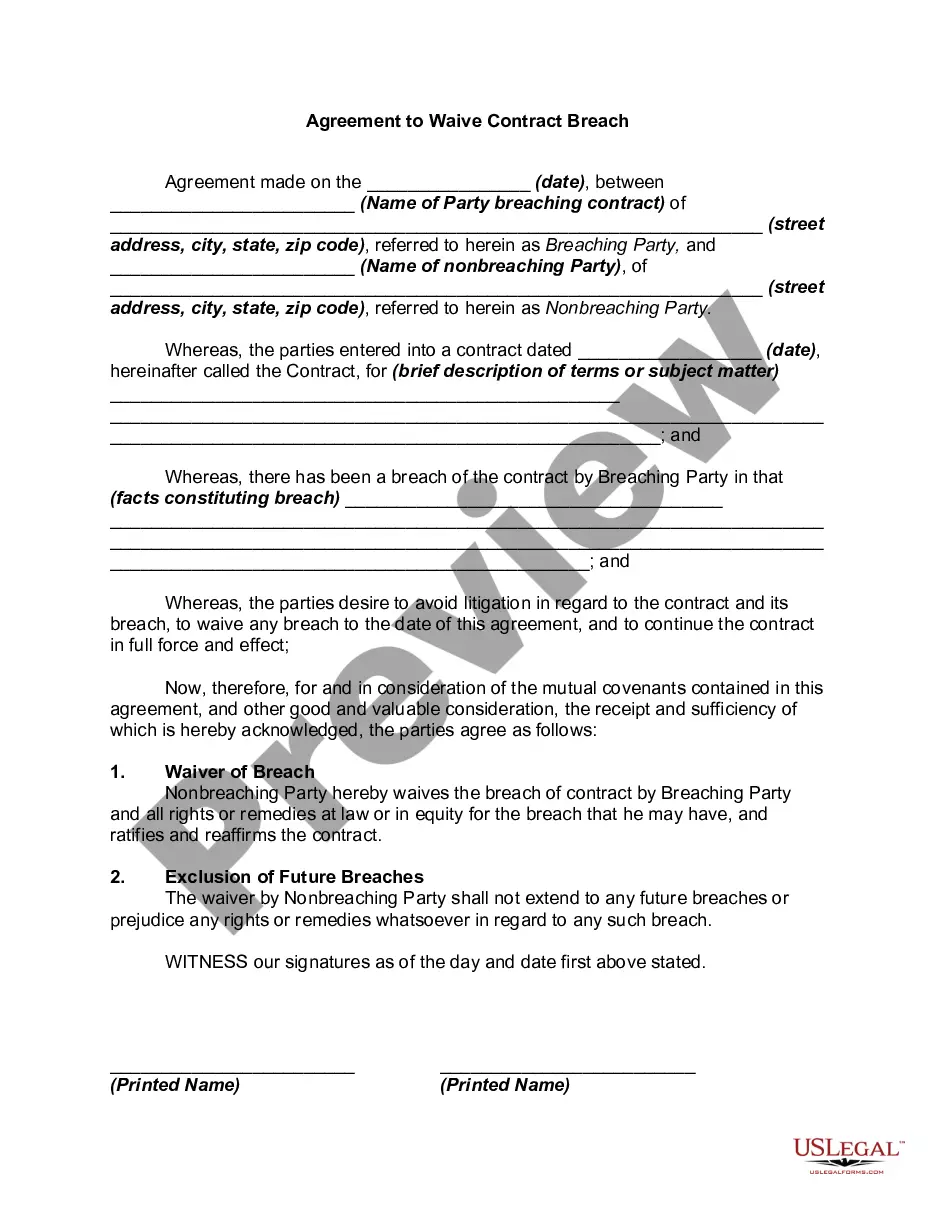

Foreclosure process: Mortgages typically go through a judicial foreclosure process, through your county court system. Deeds of trust use a non-judicial foreclosure process. Length of time to foreclose: Mortgage foreclosures usually take significantly longer than non-judicial foreclosures with a deed of trust.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A trust deed is always used together with a promissory note that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money.

The two main differences between a mortgage and a deed of trust are: a mortgage involves two parties, while a deed of trust has three, and. mortgages are usually foreclosed judicially, while deeds of trust typically go through a nonjudicial foreclosure process (but not always).

Passage of Title. -The fundamental distinction between deeds of trust and mortgages in California is that in the case of a mortgage legal title does not pass from the debtor,5 whereas the converse is true in con- nection with a trust deed.

The Note is signed by the people who agree to pay the debt (the people that will be making the mortgage payments). The Deed and the Deed of Trust are signed by those who will own the property that is being mortgaged.