Title: Understanding the Alabama Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock Introduction: In Alabama, small businesses seeking to maximize their tax benefits and protect their personal liability often consider incorporating as an S Corporation (S Corp) and qualifying for Section 1244 stock. This article will provide a detailed description of the Alabama Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock, including its benefits and requirements. 1. What is an S Corporation (S Corp)? An S Corporation is a special type of corporation that enables small business owners to enjoy limited liability protection while offering pass-through taxation to shareholders. By electing S Corporation status, business owners can avoid double taxation, as corporate profits and losses are "passed through" to individual shareholders' personal tax returns. 2. Benefits of Incorporating as an S Corp in Alabama: — Limited liability protection: Shareholders are typically not personally liable for the corporation's debts and legal obligations. — Pass-through taxation: S Corps are not subject to federal income tax on their earnings, but instead, shareholders report their prorated share of corporate income on their personal tax returns. — Avoiding self-employment taxes: Shareholders of an S Corp may be able to reduce their self-employment tax liability by classifying a portion of their income as distributions rather than salary. 3. Qualification for Section 1244 Stock: Section 1244 of the Internal Revenue Code allows small business shareholders to classify certain losses stemming from the sale or worthlessness of their stock as ordinary losses, instead of capital losses. This special provision applies to domestic corporations that meet specific criteria regarding the corporation's paid-in capital and industry classification. 4. Different Types of Alabama Agreements to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock: — Alabama S Corporation Election: This agreement outlines the procedure for electing S Corporation status with the Alabama Secretary of State. It includes details about the corporation's formation, eligibility requirements, and tax implications. — Alabama Articles of Incorporation: This document outlines the basic information required to form a corporation in Alabama, including the corporation's name, purpose, registered agent, and initial stock issuance. — Alabama Section 1244 Stock Qualification: This agreement specifies the requirements and qualifications necessary to issue Section 1244 stock, including the corporation's paid-in capital, industry classification, and investor reporting obligations. Conclusion: Incorporation as an S Corporation in Alabama, alongside qualification for Section 1244 stock, can offer substantial tax benefits and liability protection for small businesses. By navigating the Alabama Agreement to Incorporate as an S Corp and as a Small Business Corporation with Qualification for Section 1244 Stock, business owners can optimize their financial strategies and ensure compliance with state and federal regulations.

Alabama Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Alabama Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

If you need to comprehensive, download, or produce legitimate document themes, use US Legal Forms, the most important variety of legitimate forms, which can be found on the web. Make use of the site`s basic and handy look for to get the paperwork you need. Different themes for company and personal purposes are categorized by types and says, or search phrases. Use US Legal Forms to get the Alabama Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock with a couple of clicks.

In case you are already a US Legal Forms client, log in to your account and then click the Obtain option to find the Alabama Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock. You can also access forms you formerly saved in the My Forms tab of your own account.

If you are using US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Make sure you have selected the form for the correct town/land.

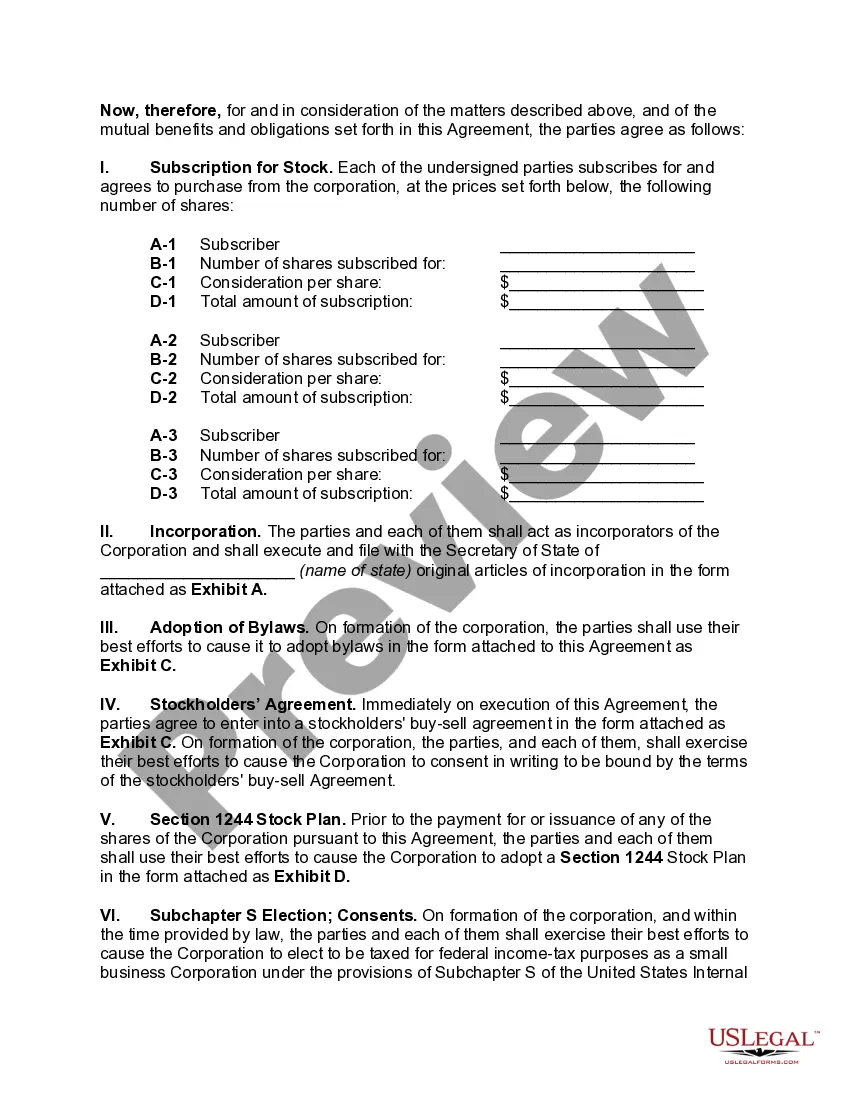

- Step 2. Use the Preview method to look through the form`s articles. Never overlook to see the outline.

- Step 3. In case you are unsatisfied with the kind, make use of the Research area on top of the display to get other models of your legitimate kind web template.

- Step 4. Upon having found the form you need, go through the Buy now option. Pick the prices program you favor and put your qualifications to register for the account.

- Step 5. Approach the financial transaction. You can use your charge card or PayPal account to finish the financial transaction.

- Step 6. Pick the file format of your legitimate kind and download it on your own product.

- Step 7. Total, change and produce or signal the Alabama Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock.

Every legitimate document web template you buy is the one you have forever. You may have acces to each kind you saved inside your acccount. Click on the My Forms area and select a kind to produce or download once more.

Remain competitive and download, and produce the Alabama Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock with US Legal Forms. There are many skilled and condition-distinct forms you may use to your company or personal needs.