Alabama Self-Assessment Worksheet is a resource designed to aid individuals in evaluating their personal assets, debts, income, and expenses. This assessment serves as a valuable tool for understanding one's financial status and making informed decisions regarding budgeting, debt management, and financial planning. By completing this worksheet, individuals can gain a comprehensive overview of their financial situation, identify areas for improvement, and develop a personalized action plan for achieving their financial goals. The Alabama Self-Assessment Worksheet encompasses various sections that cover different aspects of personal finance. It includes categories such as income, where individuals can list their salaries, wages, pensions, investments, and any other sources of revenue. Additionally, there is a section dedicated to documenting expenses, allowing individuals to track their spending habits and identify potential areas of excessive or unnecessary expenditure. Furthermore, the worksheet examines assets, which include properties, vehicles, savings, investments, and valuable possessions. By listing these assets, individuals can gauge their net worth and determine their overall financial standing. Debts also form a critical component of the self-assessment, encompassing liabilities such as mortgages, loans, credit card debts, and other outstanding payments. Calculating the difference between assets and debts provides individuals with a clear picture of their financial health. The Alabama Self-Assessment Worksheet also incorporates sections for documenting tax information, insurance coverage, and retirement planning. By including these aspects, individuals can holistically evaluate their financial well-being, ensuring that they have sufficient protection, align their savings with retirement goals, and stay up-to-date on their tax obligations. While the term "Alabama Self-Assessment Worksheet" generally refers to the comprehensive financial assessment described above, there may be specific variations available to address more targeted areas of personal finance. For instance, there might be worksheets focused solely on budgeting and expense tracking or ones specifically tailored for retirement planning. These specialized worksheets can provide individuals with a detailed analysis of specific financial aspects and aid in making informed decisions related to their unique circumstances. In conclusion, the Alabama Self-Assessment Worksheet is an invaluable resource for individuals seeking to understand and manage their personal finances effectively. It covers numerous aspects of financial evaluation, including income, expenses, assets, debts, tax planning, insurance coverage, and retirement planning. By utilizing this worksheet, individuals can gain a comprehensive overview of their financial status, identify areas for improvement, and develop a personalized financial plan to achieve their goals.

Alabama Self-Assessment Worksheet

Description

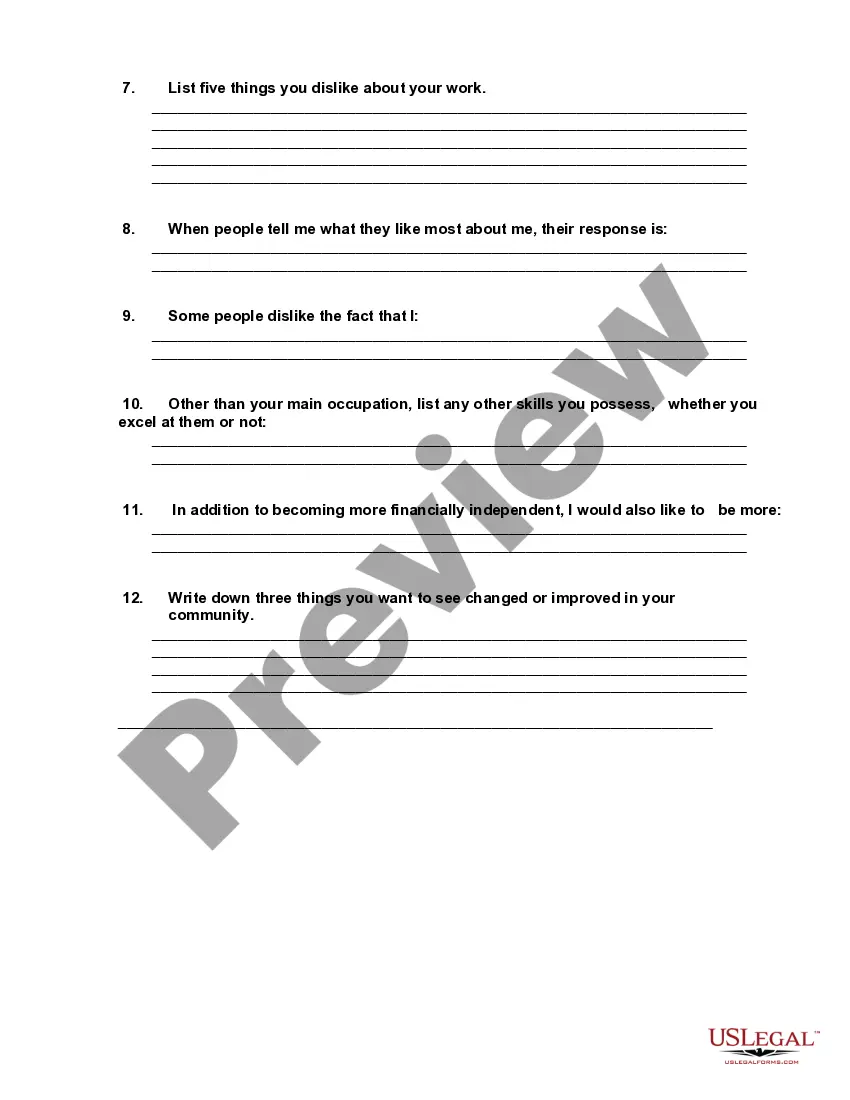

How to fill out Alabama Self-Assessment Worksheet?

US Legal Forms - one of many largest libraries of legal forms in the States - delivers a wide range of legal record web templates you can acquire or print. While using site, you may get a large number of forms for organization and person functions, sorted by groups, claims, or keywords and phrases.You will discover the most up-to-date models of forms much like the Alabama Self-Assessment Worksheet within minutes.

If you already possess a registration, log in and acquire Alabama Self-Assessment Worksheet in the US Legal Forms library. The Obtain key will appear on every type you perspective. You gain access to all earlier acquired forms inside the My Forms tab of your own profile.

If you want to use US Legal Forms initially, listed below are basic recommendations to help you get started off:

- Make sure you have picked the proper type for the area/area. Go through the Preview key to analyze the form`s information. See the type outline to ensure that you have selected the right type.

- When the type doesn`t satisfy your demands, make use of the Research discipline towards the top of the screen to find the one which does.

- If you are satisfied with the shape, verify your option by simply clicking the Purchase now key. Then, choose the prices program you prefer and provide your references to sign up for the profile.

- Approach the deal. Use your Visa or Mastercard or PayPal profile to perform the deal.

- Pick the file format and acquire the shape on your own product.

- Make alterations. Load, change and print and sign the acquired Alabama Self-Assessment Worksheet.

Every template you included with your bank account lacks an expiration time and is your own permanently. So, in order to acquire or print one more copy, just go to the My Forms area and click on in the type you will need.

Obtain access to the Alabama Self-Assessment Worksheet with US Legal Forms, one of the most considerable library of legal record web templates. Use a large number of expert and state-certain web templates that satisfy your small business or person needs and demands.