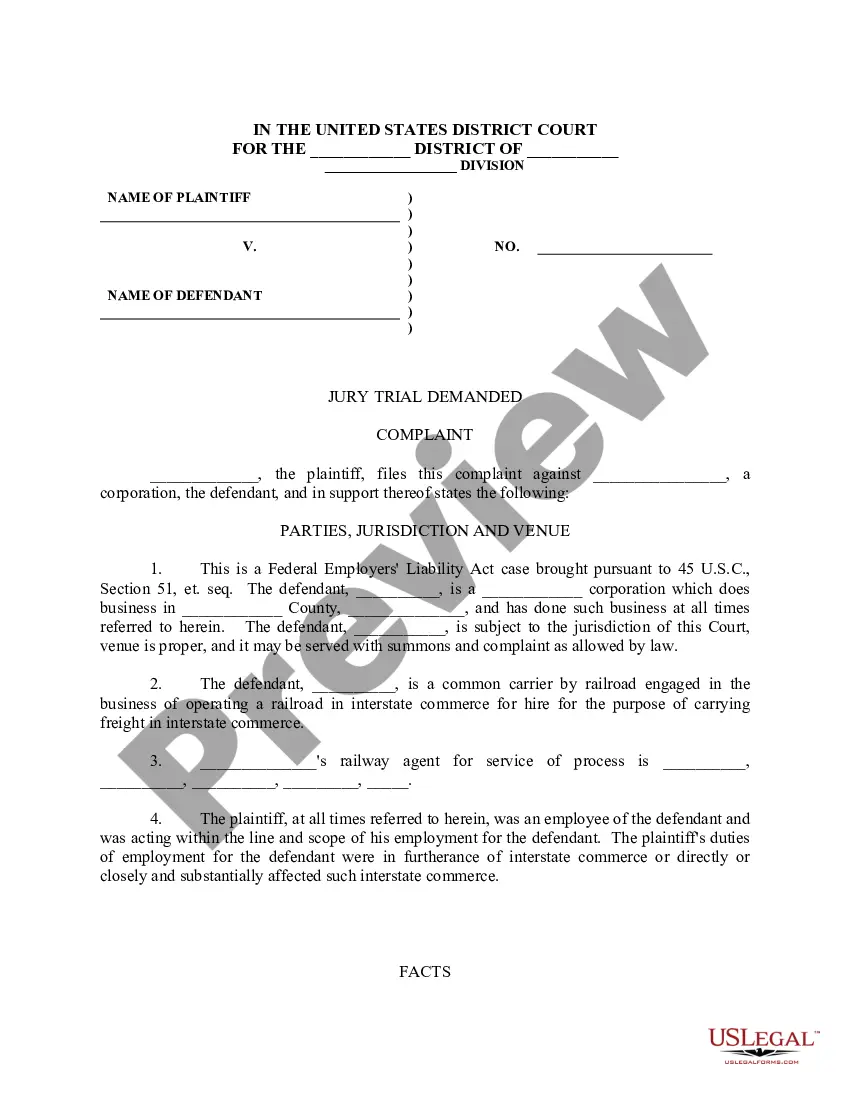

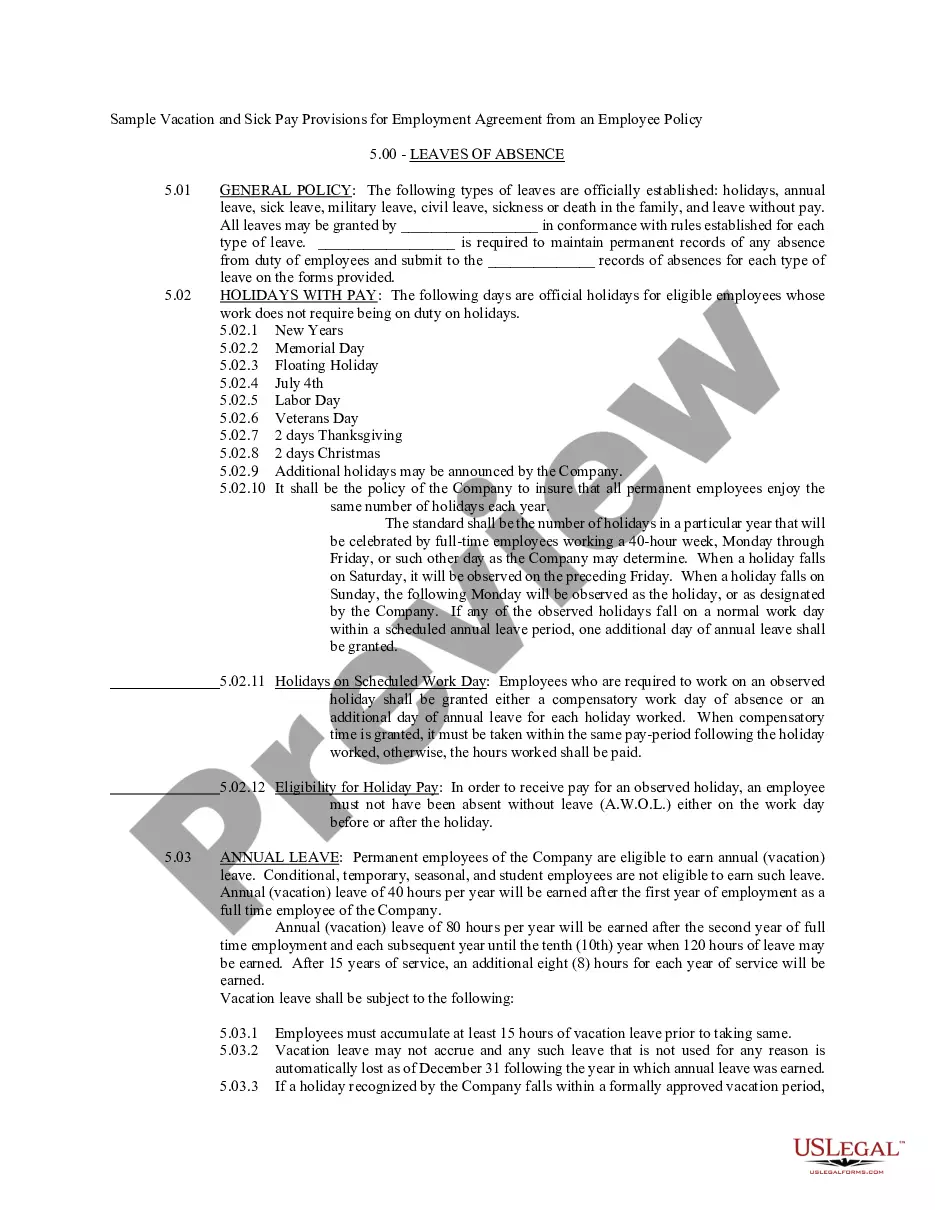

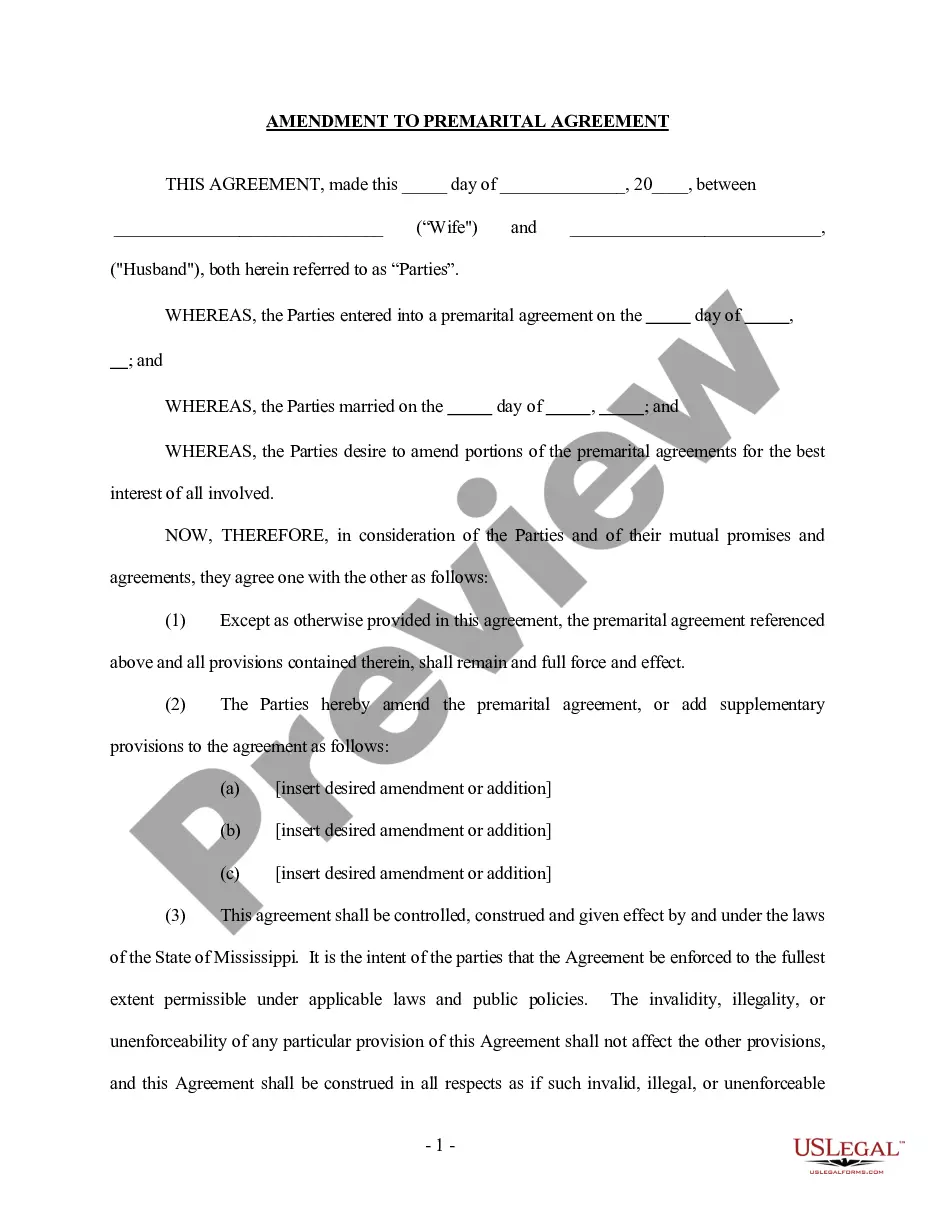

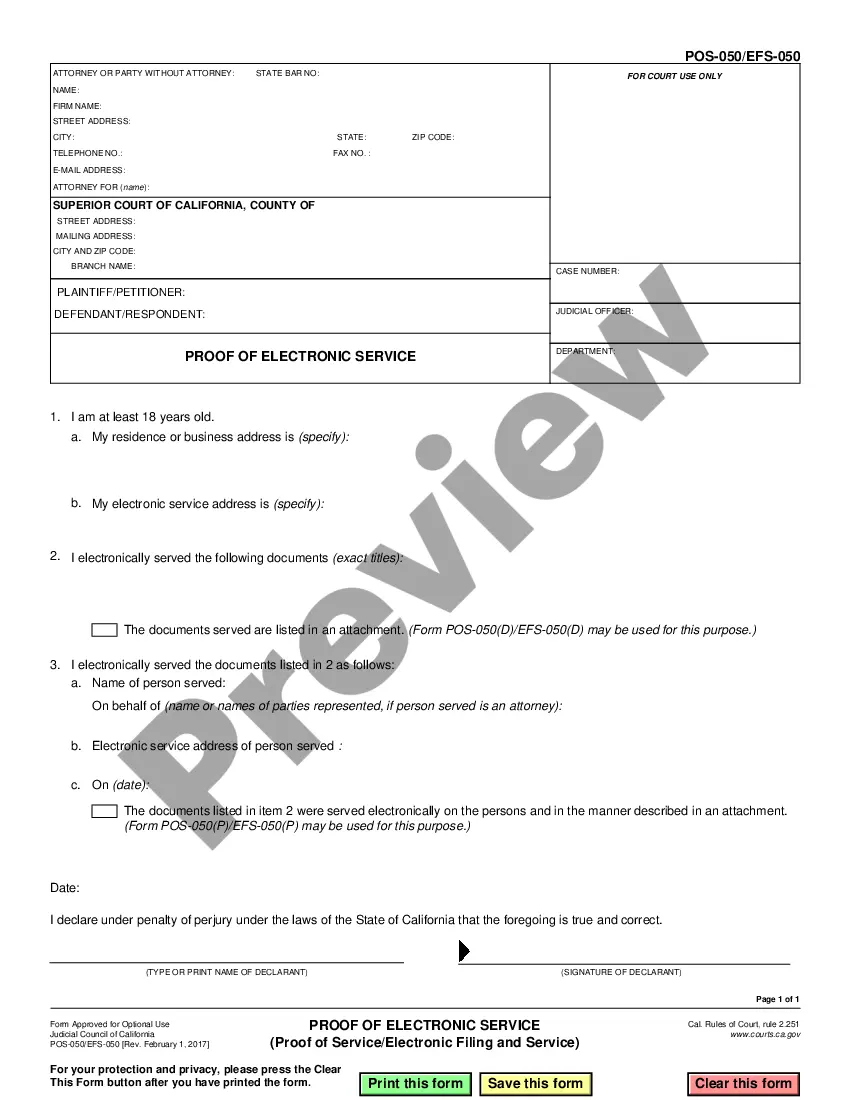

Alabama Collection Report is a comprehensive document that provides detailed information about the various collections pertaining to the state of Alabama. It serves as a valuable resource for individuals, businesses, researchers, and government agencies seeking knowledge about Alabama's diverse collection activities. The Alabama Collection Report encompasses a wide range of collections across different sectors, including financial, tax, property, and legal collections. It aims to provide an overview of the collections process, outline the types of collections undertaken, and highlight key information related to each collection. Key elements featured in the Alabama Collection Report include: 1. Financial Collections: This section focuses on collections related to unpaid debts, fines, and fees owed to various state agencies, such as the Department of Revenue, Department of Finance, and Alabama State Treasury. Keywords: financial collections, unpaid debts, fines, fees, Department of Revenue, Department of Finance, Alabama State Treasury. 2. Tax Collections: This segment delves into the collection of various taxes, such as income tax, sales tax, property tax, and business privilege tax. It outlines the procedures for tax collection, including enforcement actions taken by the Alabama Department of Revenue to collect delinquent taxes. Keywords: tax collections, income tax, sales tax, property tax, business privilege tax, Alabama Department of Revenue, delinquent taxes. 3. Property Collections: This category highlights collections related to property, including foreclosures, tax liens, and mobile home repossessions. It provides information on the process involved in property collections and the entities responsible for managing these collections, such as county tax authorities and the Alabama Department of Revenue. Keywords: property collections, foreclosures, tax liens, mobile home repossessions, county tax authorities, Alabama Department of Revenue. 4. Legal Collections: This section covers collections carried out through legal proceedings, including civil judgments, court-ordered payments, and restitution orders. It outlines the steps involved in legal collections, such as filing lawsuits, obtaining judgments, and enforcing payment through garnishments or seizures. Keywords: legal collections, civil judgments, court-ordered payments, restitution orders, lawsuits, garnishments, seizures. By providing a comprehensive overview of collections in Alabama, the Alabama Collection Report aids in understanding the state's debt recovery system, promoting transparency, and enabling individuals and businesses to navigate collection processes effectively. It offers insights into various collection types and assists in identifying the relevant agencies responsible for managing collections in Alabama.

Alabama Collection Report

Description

How to fill out Alabama Collection Report?

Choosing the best lawful document design can be a battle. Naturally, there are a variety of web templates available on the Internet, but how will you discover the lawful kind you need? Take advantage of the US Legal Forms website. The services offers 1000s of web templates, like the Alabama Collection Report, that can be used for company and personal needs. Each of the kinds are inspected by professionals and meet state and federal needs.

In case you are presently listed, log in to your accounts and click the Down load button to find the Alabama Collection Report. Utilize your accounts to look from the lawful kinds you might have purchased in the past. Check out the My Forms tab of the accounts and acquire an additional duplicate of your document you need.

In case you are a new end user of US Legal Forms, listed below are straightforward directions that you can follow:

- First, make sure you have chosen the appropriate kind for your personal area/region. It is possible to check out the form while using Review button and read the form explanation to ensure it will be the right one for you.

- If the kind fails to meet your needs, utilize the Seach field to get the right kind.

- When you are certain that the form is proper, go through the Get now button to find the kind.

- Choose the rates plan you want and enter the required information. Build your accounts and buy the transaction making use of your PayPal accounts or bank card.

- Select the submit structure and down load the lawful document design to your device.

- Complete, edit and printing and indicator the obtained Alabama Collection Report.

US Legal Forms will be the greatest catalogue of lawful kinds where you will find various document web templates. Take advantage of the service to down load appropriately-made documents that follow condition needs.

Form popularity

FAQ

In most cases, the Department has three years from the date a tax return is due or filed, whichever is later, to audit your tax return and assess any additional tax, penalty, and interest due. A taxpayer also generally has three years to claim a refund of any tax overpaid.

The Alabama Department of Revenue administers over 50 different state and local taxes. Most of the taxes administered by the Revenue Department will affect busi- nesses only.

Collection Services This division acts as an in-house collection agency for the Alabama Department of Revenue. When the taxpayer's assessment reaches the Collection Services Division, the tax liability already has the full force and effect of a court judgment.

Time Limitations In most cases, the Department has three years from the date a tax return is due or filed, whichever is later, to audit your tax return and assess any additional tax, penalty, and interest due.

How to find information on state-issued checks, tax refunds and moreAlabama Department of Revenue. (334) 309-2612. Website.Department of Human Resources (DHR) Public Assistance. (334) 242-9485. Website.State Comptroller's Office. (334) 242-7063. Website.

If there is a question about your return, you may receive a request for information letter that asks for missing or additional information or a tax computation change letter that provides explanation of changes made to the tax return.

How to find information on state-issued checks, tax refunds and moreAlabama Department of Revenue. (334) 309-2612. Website.Department of Human Resources (DHR) Public Assistance. (334) 242-9485. Website.State Comptroller's Office. (334) 242-7063. Website.

Where's My Alabama State Tax RefundState: Alabama.Refund Status Website: Status Phone Support: 1-855-894-7391.Hours: Mon. Fri. a.m. 5: 00 p.m.General Information: 1-334-242-1175.2020 State Tax Filing Deadline: 4/15/2021.

Time Limitations A taxpayer also generally has three years to claim a refund of any tax overpaid. However, if the tax was paid by withholding or estimated payments, and you failed to timely file a return, any refund must be claimed within two years from the original due date of the return.