Alabama Loan Agreement for Family Member is a legally binding document that outlines the terms and conditions of a loan between family members in the state of Alabama. This agreement ensures that both the lender and borrower are protected and establishes clear expectations for repayment. The Alabama Loan Agreement for Family Member typically includes the following details: 1. Parties involved: It identifies the lender (family member providing the loan) and the borrower (family member receiving the loan). Their legal names and addresses are specified. 2. Loan amount: The agreement specifies the exact amount of money being loaned to the borrower. 3. Loan terms: This section outlines the repayment terms, including the interest rate, if applicable, and the repayment schedule. It states whether the loan is interest-free or carries a specific interest rate. 4. Repayment schedule: The agreement specifies how the loan will be repaid, whether through regular installments or in a lump sum on a specified date. It may also include any penalties or late fees for missed payments. 5. Collateral (if applicable): If the loan is secured by collateral, such as a vehicle or property, the details of the collateral are mentioned in the agreement. 6. Default and remedies: This section explains the consequences if the borrower fails to repay the loan as agreed. It outlines the lender's options, including legal action or seizing collateral. 7. Governing law: The agreement states that it is governed by the laws of the state of Alabama and any disputes will be resolved in the appropriate Alabama court. There are no specific types of Alabama Loan Agreement for Family Member based on different categories. However, these agreements can vary in terms of loan amounts, interest rates (if any), repayment durations, and specific provisions tailored to the individual needs of the family members involved. In conclusion, an Alabama Loan Agreement for Family Member is a vital legal document that helps ensure transparency, trust, and accountability between family members involved in a loan transaction. Its purpose is to protect both parties' interests by clearly defining the terms and conditions of the loan, repayment schedule, and remedies in case of default.

Alabama Loan Agreement for Family Member

Description

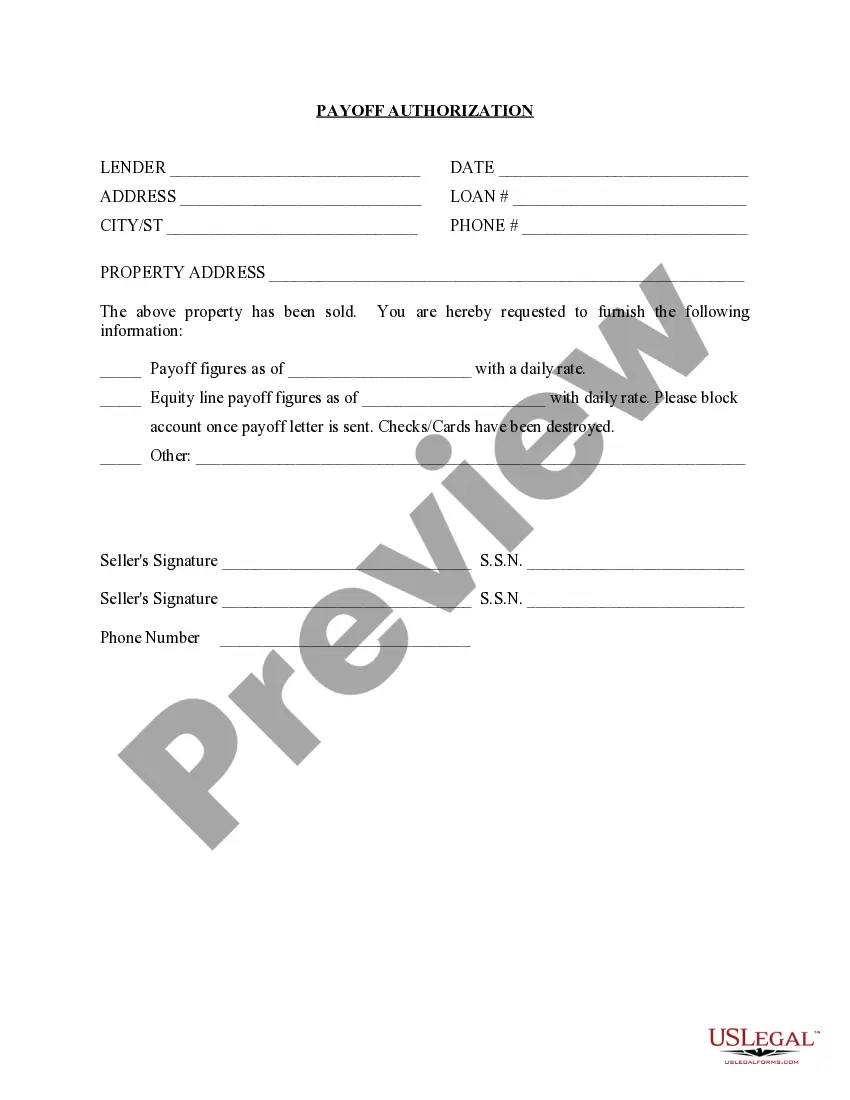

How to fill out Loan Agreement For Family Member?

If you have to full, down load, or produce authorized papers templates, use US Legal Forms, the most important selection of authorized varieties, that can be found on-line. Utilize the site`s simple and easy handy look for to get the files you need. A variety of templates for organization and personal uses are categorized by groups and claims, or search phrases. Use US Legal Forms to get the Alabama Loan Agreement for Family Member within a handful of clicks.

In case you are currently a US Legal Forms buyer, log in to your profile and click the Download option to have the Alabama Loan Agreement for Family Member. You can also accessibility varieties you previously saved within the My Forms tab of the profile.

If you are using US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have selected the form for that proper metropolis/nation.

- Step 2. Use the Preview option to look over the form`s information. Do not forget to read the outline.

- Step 3. In case you are not happy with the develop, use the Lookup field at the top of the monitor to get other versions of the authorized develop format.

- Step 4. Once you have found the form you need, select the Purchase now option. Choose the rates program you like and add your qualifications to sign up on an profile.

- Step 5. Process the transaction. You may use your charge card or PayPal profile to finish the transaction.

- Step 6. Choose the structure of the authorized develop and down load it on your own gadget.

- Step 7. Comprehensive, edit and produce or indication the Alabama Loan Agreement for Family Member.

Each and every authorized papers format you acquire is your own property forever. You possess acces to each and every develop you saved inside your acccount. Click on the My Forms portion and choose a develop to produce or down load once again.

Be competitive and down load, and produce the Alabama Loan Agreement for Family Member with US Legal Forms. There are millions of specialist and condition-distinct varieties you can utilize to your organization or personal demands.

Form popularity

FAQ

If you loan a significant amount of money to your kids ? over $10,000 ? you should consider charging interest. If you don't, the IRS can say the interest you should have charged was a gift. In that case, the interest money goes toward your annual gift-giving limit of $17,000 per individual (as of tax year 2023).

In the case of gift loans between individuals where the total amount outstanding does not exceed $100,000, the amount deemed transferred from the borrower to the lender at the end of the year will be imputed to the lender only to the extent of the borrower's annual net investment income.

Use a family loan agreement to avoid issues that may arise during the repayment period. This is a contract that spells out the terms and conditions of the loan. Having a notarized and signed agreement with a family member may seem impersonal, but having things in writing can prevent misunderstandings and frustrations.

Once executed a loan agreement will be legally binding and in effect.

The tax code provides a couple of notable exceptions to the imputed interest rules: Gift loans to family members of less than $10,000 are exempt, as long as the money isn't used to buy income-producing assets.

The $100,000 De Minimis Exception If the total sum of lending is less than $100,000, the IRS allows you to charge interest based on the lesser of either the AFR rate or the borrower's net investment income for the year. If their investment income was $1,000 or less, the IRS allows them to charge no interest.

How to make a family loan agreement The amount borrowed and how it will be used. Repayment terms, including payment amounts, frequency and when the loan will be repaid in full. The loan's interest rate. ... If the loan can be repaid early without penalty, and how much interest will be saved by early repayment.

If you loan a significant amount of money to your kids ? over $10,000 ? you should consider charging interest. If you don't, the IRS can say the interest you should have charged was a gift. In that case, the interest money goes toward your annual gift-giving limit of $17,000 per individual (as of tax year 2023).