Alabama Loan Agreement for Employees is a legal document that outlines the terms and conditions of a loan agreement between an employer and an employee in the state of Alabama. This agreement defines the loan amount, repayment terms, interest rates, and any other relevant details regarding the loan. In Alabama, there are various types of loan agreements that employers can offer to their employees: 1. Short-term Loan Agreement: This type of loan agreement provides employees with a temporary financial solution for unexpected expenses or emergencies. The terms of a short-term loan typically have a shorter repayment period and a relatively smaller loan amount. 2. Salary Advance Loan Agreement: This agreement allows employees to request an advance on their upcoming salaries. It helps employees cover immediate financial needs before their next payday. The loan amount is usually deducted from the employee's salary in subsequent pay periods. 3. Education Loan Agreement: Alabama employers may offer education loans to their employees to support their educational pursuits. This type of loan allows employees to pay for tuition fees, books, or any other education-related expenses. Repayment terms are determined based on mutual agreement between the employer and the employee. 4. Home Purchase Loan Agreement: Employers can provide employees with a loan to assist them in purchasing a home. This type of loan agreement typically involves a larger loan amount and longer repayment period. 5. Employee Assistance Loan Agreement: This loan agreement serves as a means of financial assistance to the employee during times of personal crisis, such as medical emergencies or unexpected expenses related to housing or transportation. It is crucial to note that the specific terms and conditions of these loan agreements may differ based on the employer's policies and practices. Employers must ensure compliance with the applicable Alabama state laws, including usury laws and fair lending practices, while drafting these agreements. In conclusion, the Alabama Loan Agreement for Employees is a legally binding document that establishes the terms and conditions of loans provided by employers to their employees. Different types of loan agreements cater to specific employee needs, such as short-term financial assistance, education funding, home purchasing, or general employee assistance. These agreements must be carefully drafted in compliance with applicable state regulations to protect the interests of both parties involved.

Alabama Loan Agreement for Employees

Description

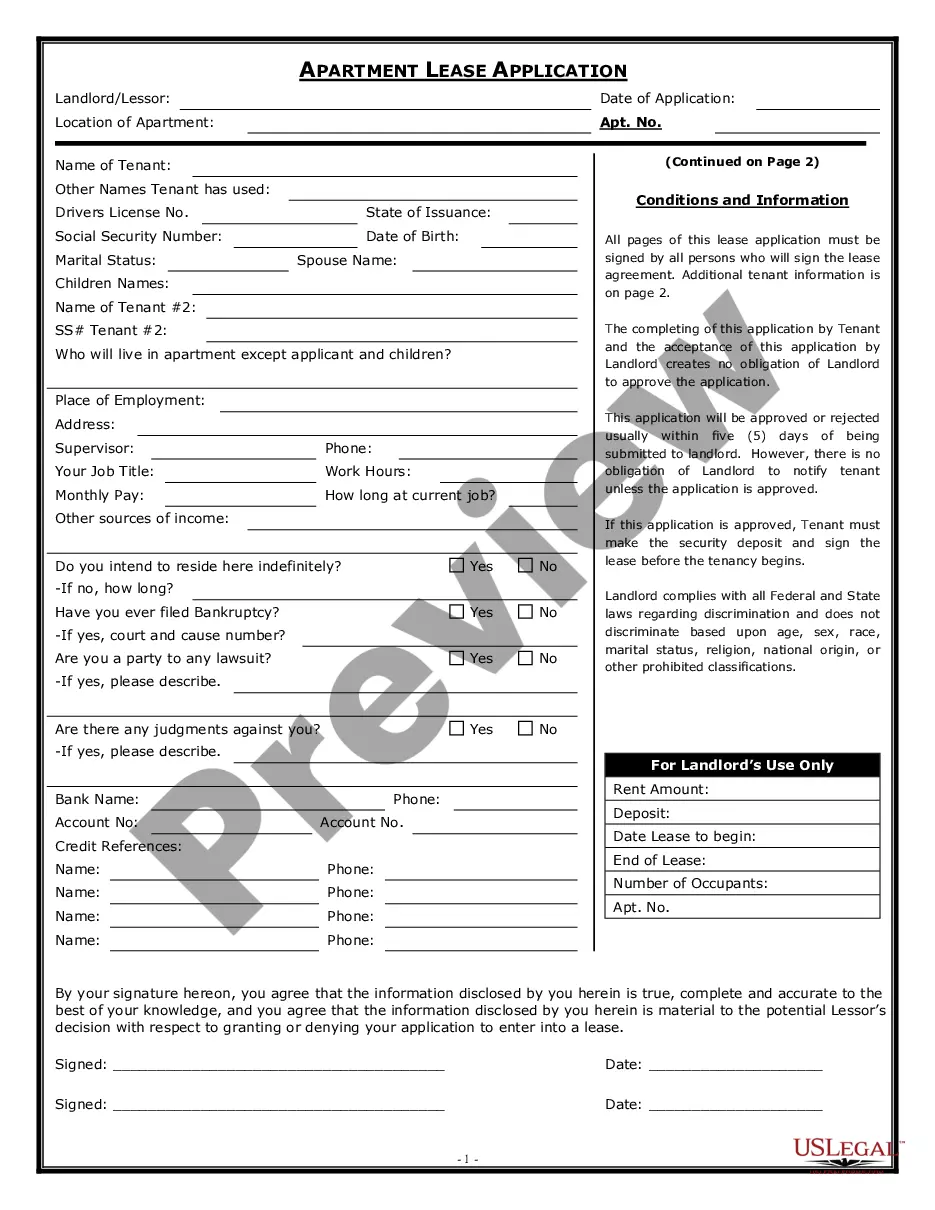

How to fill out Alabama Loan Agreement For Employees?

It is possible to invest hours on-line searching for the legal file template that suits the state and federal demands you will need. US Legal Forms supplies thousands of legal types which are reviewed by pros. It is simple to download or printing the Alabama Loan Agreement for Employees from the assistance.

If you currently have a US Legal Forms account, it is possible to log in and click on the Download option. Afterward, it is possible to full, revise, printing, or indicator the Alabama Loan Agreement for Employees. Each legal file template you get is the one you have forever. To get yet another version of any purchased form, proceed to the My Forms tab and click on the corresponding option.

If you use the US Legal Forms site initially, follow the straightforward instructions listed below:

- First, be sure that you have chosen the correct file template to the region/city of your choosing. Browse the form information to make sure you have picked out the appropriate form. If offered, utilize the Preview option to check throughout the file template too.

- If you would like locate yet another model of your form, utilize the Look for field to discover the template that meets your requirements and demands.

- After you have discovered the template you would like, just click Purchase now to proceed.

- Find the costs plan you would like, type your credentials, and sign up for an account on US Legal Forms.

- Full the transaction. You may use your Visa or Mastercard or PayPal account to pay for the legal form.

- Find the file format of your file and download it to your system.

- Make alterations to your file if necessary. It is possible to full, revise and indicator and printing Alabama Loan Agreement for Employees.

Download and printing thousands of file layouts while using US Legal Forms Internet site, that offers the biggest collection of legal types. Use professional and state-particular layouts to deal with your small business or specific requirements.

Form popularity

FAQ

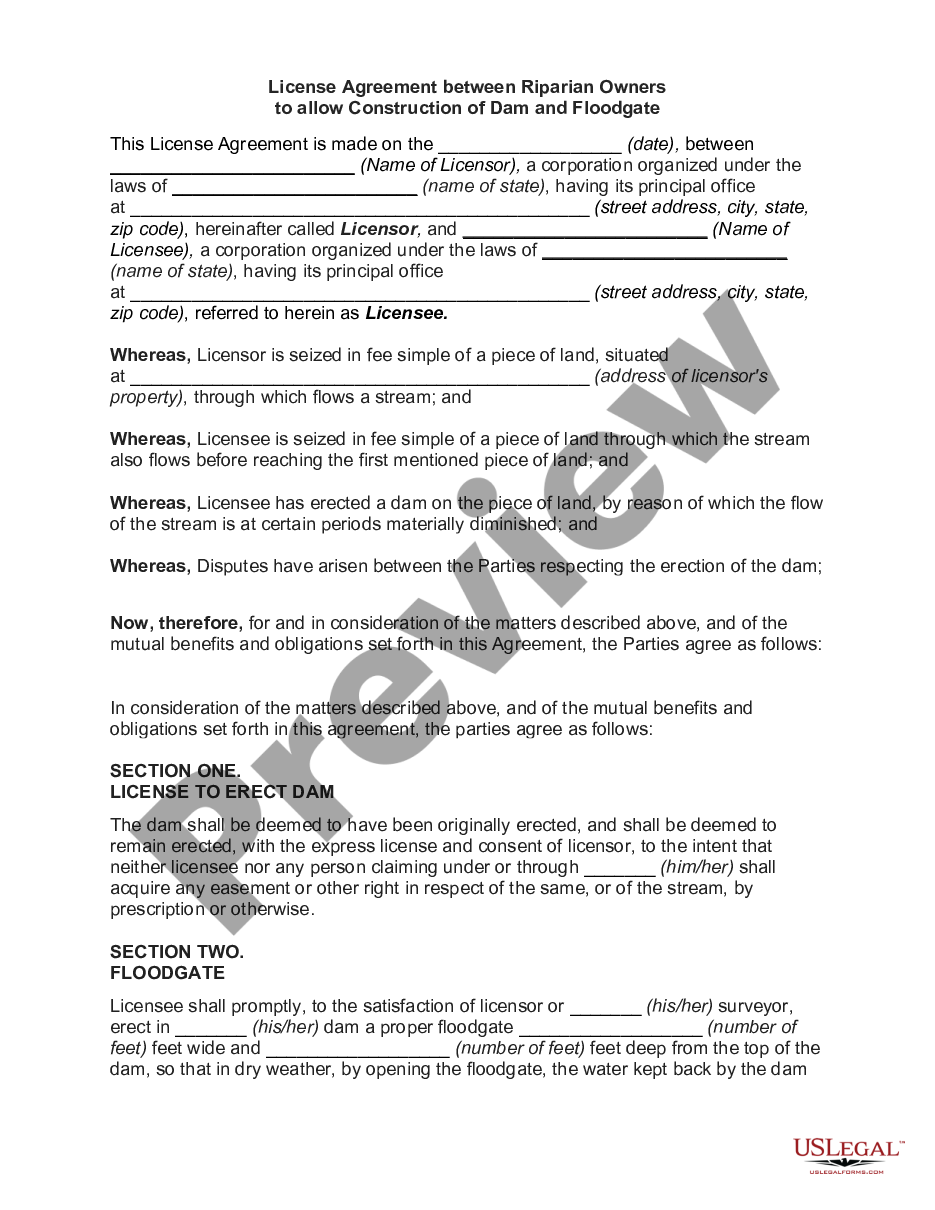

Include key terms of the loan, such as the lender and borrower's contact information, the reason for the loan, what is being loaned, the interest rate, the repayment plan, what would happen if the borrower can't make the payments, and more. The amount of the loan, also known as the principal amount.

There are 10 basic provisions that should be in a loan agreement. Identity of the parties. The names of the lender and borrower need to be stated. ... Date of the agreement. ... Interest rate. ... Repayment terms. ... Default provisions. ... Signatures. ... Choice of law. ... Severability.

Promissory notes are quite simple and can be prepared by anyone. They do not need to be prepared by a lawyer or be notarized. It isn't even particularly significant whether a promissory note is handwritten or typed and printed.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

Promissory notes don't have to be notarized in most cases. You can typically sign a legally binding promissory note that contains unconditional pledges to pay a certain sum of money. However, you can strengthen the legality of a valid promissory note by having it notarized.

Loan agreements are binding contracts between two or more parties to formalize a loan process. There are many types of loan agreements, ranging from simple promissory notes between friends and family members to more detailed contracts like mortgages, auto loans, credit card and short- or long-term payday advance loans.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

Promissory notes are legally binding whether the note is secured by collateral or based only on the promise of repayment. If you lend money to someone who defaults on a promissory note and does not repay, you can legally possess any property that individual promised as collateral.