Alabama Assignment of LLC Company Interest to Living Trust is a legal process that allows an LLC member to transfer their ownership interest in the company to a living trust. This assignment is commonly used as part of estate planning strategies to ensure the smooth transfer of ownership and management of LLC assets upon the member's death or incapacity. The living trust acts as a holding entity for the LLC interest and provides a mechanism for the seamless transition of ownership to the designated beneficiaries or trustees. When an Alabama LLC member assigns their company interest to a living trust, they are effectively transferring their ownership rights and responsibilities to the trust. This transfer is done through a formal document known as the Assignment of LLC Company Interest to Living Trust, which outlines the terms and conditions of the transfer. The assignment document typically includes essential information such as the LLC member's name, the living trust's name, and the detailed description of the LLC interest being assigned. It may also specify any limitations or conditions on the assignment, such as restrictions on transferring the interest to third parties or limitations on the trustee's authority. There are various types of Alabama Assignment of LLC Company Interest to Living Trust, each designed to meet specific needs and objectives. Some common types include: 1. Full Assignment: This type involves the complete transfer of the LLC member's interest to the living trust. The living trust becomes the new owner of the interest, with the designated beneficiaries or trustees ultimately benefiting from the LLC's profits and distributions. 2. Partial Assignment: As the name suggests, this type involves the transfer of only a portion of the LLC member's interest to the living trust. The remaining interest is typically retained by the member or assigned to another party. 3. Revocable Assignment: A revocable assignment allows the LLC member to retain the power to revoke or modify the assignment during their lifetime. It provides flexibility and control over the LLC interest transfer and can be particularly useful for estate planning purposes. 4. Irrevocable Assignment: In contrast to a revocable assignment, an irrevocable assignment is binding and cannot be altered or revoked once executed. This type of assignment ensures a more permanent transfer of the LLC interest to the living trust. It's important to consult with an attorney or legal professional experienced in LLC and estate planning matters when considering an Alabama Assignment of LLC Company Interest to Living Trust. They can provide specific guidance tailored to your unique circumstances and help ensure compliance with relevant state laws and regulations.

Alabama Assignment of LLC Company Interest to Living Trust

Description

How to fill out Alabama Assignment Of LLC Company Interest To Living Trust?

If you wish to comprehensive, obtain, or print out authorized record themes, use US Legal Forms, the largest selection of authorized forms, which can be found on the web. Make use of the site`s easy and convenient research to obtain the documents you require. Numerous themes for company and personal uses are sorted by groups and says, or keywords. Use US Legal Forms to obtain the Alabama Assignment of LLC Company Interest to Living Trust in a couple of clicks.

When you are currently a US Legal Forms customer, log in to the bank account and click on the Down load switch to have the Alabama Assignment of LLC Company Interest to Living Trust. You may also access forms you formerly delivered electronically from the My Forms tab of your bank account.

If you use US Legal Forms the very first time, refer to the instructions under:

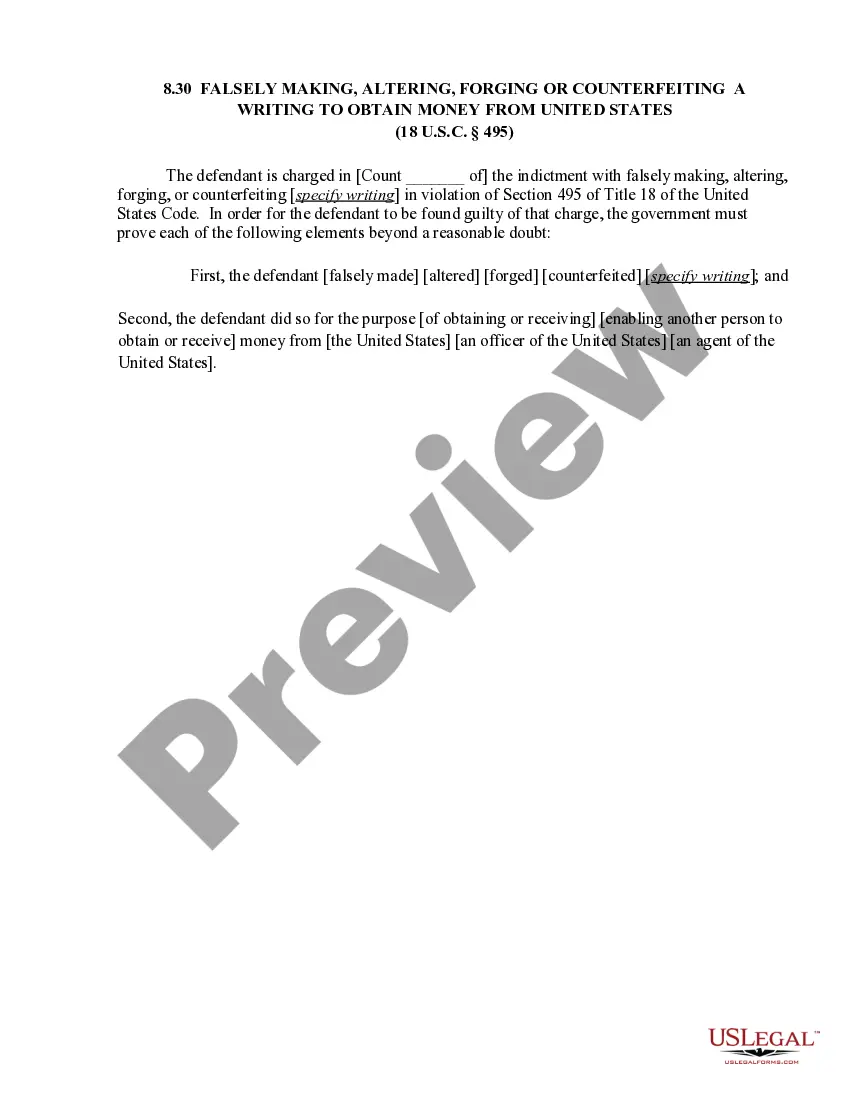

- Step 1. Ensure you have selected the shape for your correct metropolis/country.

- Step 2. Use the Review option to examine the form`s articles. Do not neglect to learn the information.

- Step 3. When you are unhappy using the kind, take advantage of the Search area at the top of the monitor to locate other types from the authorized kind template.

- Step 4. Upon having located the shape you require, click on the Get now switch. Choose the rates program you prefer and add your accreditations to sign up for the bank account.

- Step 5. Approach the financial transaction. You should use your charge card or PayPal bank account to finish the financial transaction.

- Step 6. Select the structure from the authorized kind and obtain it on your own product.

- Step 7. Comprehensive, modify and print out or indicator the Alabama Assignment of LLC Company Interest to Living Trust.

Every authorized record template you get is your own eternally. You possess acces to every single kind you delivered electronically in your acccount. Click on the My Forms portion and pick a kind to print out or obtain once again.

Be competitive and obtain, and print out the Alabama Assignment of LLC Company Interest to Living Trust with US Legal Forms. There are thousands of professional and condition-specific forms you can use for your personal company or personal requires.