The Alabama Qualified Subchapter-S Trust for the Benefit of a Child with Crummy Trust Agreement is a legal arrangement designed to provide financial benefits and protection for children in Alabama. This trust is specifically structured to meet the requirements set out by the Internal Revenue Service (IRS) for Subchapter S corporations, offering favorable tax treatment for income generated by the trust. A Crummy Trust Agreement is an integral part of this arrangement, allowing the transfer of assets to the trust while utilizing the annual gift tax exclusion. This agreement enables the trust creator to make annual gifts to the trust on behalf of the child, while the child has the right to withdraw the gifted funds for a certain period, typically 30 days. By allowing this withdrawal right, the annual gift qualifies for the gift tax exclusion. The Alabama Qualified Subchapter-S Trust for the Benefit of a Child can have different variations based on individual circumstances. These may include: 1. Irrevocable Trust: Once assets are transferred into the trust, they cannot be withdrawn or altered by the trust creator. This provides greater protection and control over the assets for the benefit of the child. 2. Testamentary Trust: This type of trust is created through the provisions of a Last Will and Testament. It comes into effect upon the death of the trust creator and ensures that the child's financial needs are met according to the specified terms. 3. Supplemental Needs Trust: This trust is designed to provide for a child with special needs while preserving their eligibility for government assistance programs. It can supplement the government benefits received and be used for specific additional expenses that may arise. 4. Discretionary Trust: In this type of trust, the trustee has the discretion to determine when and how funds are distributed to the child. The trustee considers the child's needs, financial situations, and any other factors specified in the trust document. 5. Educational Trust: This specific trust focuses on providing funds for the child's educational expenses, including tuition, books, and other related costs. It ensures that the child's educational endeavors are well-funded and supported. The Alabama Qualified Subchapter-S Trust for the Benefit of a Child with Crummy Trust Agreement offers numerous advantages, including potential tax savings and financial security for children. It is crucial to consult with an experienced attorney or financial advisor to determine the most suitable type of trust based on individual goals and circumstances.

Alabama Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement

Description

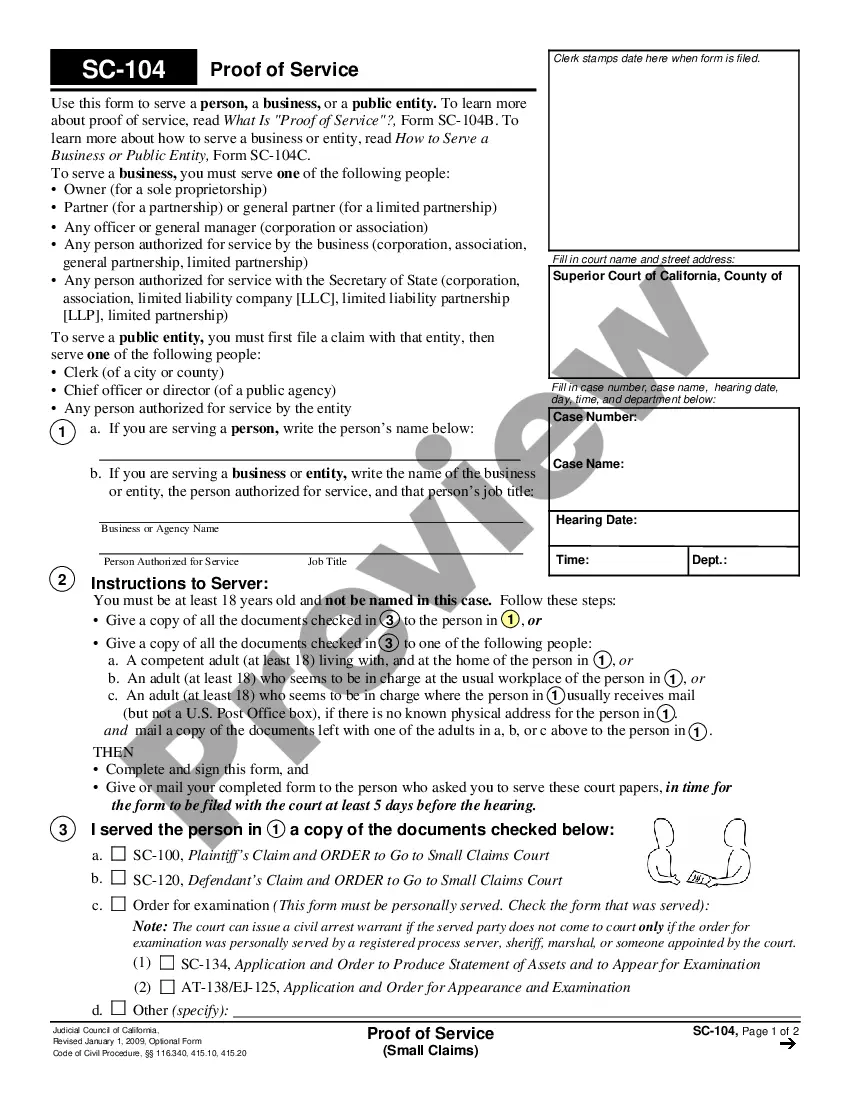

How to fill out Alabama Qualified Subchapter-S Trust For Benefit Of Child With Crummey Trust Agreement?

Discovering the right lawful file template might be a battle. Naturally, there are tons of layouts available online, but how will you find the lawful kind you want? Take advantage of the US Legal Forms web site. The support gives a huge number of layouts, like the Alabama Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement, that you can use for organization and private demands. All of the forms are checked out by professionals and meet state and federal specifications.

If you are presently signed up, log in to your profile and then click the Download button to find the Alabama Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement. Utilize your profile to look with the lawful forms you might have acquired formerly. Visit the My Forms tab of your respective profile and get another backup from the file you want.

If you are a new customer of US Legal Forms, listed below are easy guidelines for you to adhere to:

- First, make sure you have chosen the appropriate kind for your city/county. You are able to examine the shape while using Review button and study the shape information to make certain it is the best for you.

- In case the kind fails to meet your requirements, make use of the Seach industry to find the right kind.

- When you are certain that the shape is acceptable, click on the Buy now button to find the kind.

- Pick the pricing program you would like and type in the needed details. Create your profile and purchase an order making use of your PayPal profile or charge card.

- Opt for the document file format and acquire the lawful file template to your gadget.

- Total, edit and produce and signal the obtained Alabama Qualified Subchapter-S Trust for Benefit of Child with Crummey Trust Agreement.

US Legal Forms is definitely the largest catalogue of lawful forms that you can see different file layouts. Take advantage of the service to acquire appropriately-created paperwork that adhere to express specifications.