Alabama Provisions for Testamentary Charitable Remainder Unit rust for One Life A testamentary charitable remainder unit rust is a legal provision established in Alabama to allow individuals to donate assets to a charitable organization while retaining an income for themselves or their beneficiaries during their lifetime. This type of trust provides flexibility for donors who wish to make a lasting impact on charitable causes while also ensuring their financial well-being. The Alabama provisions for a testamentary charitable remainder unit rust for one life require the following: 1. Individual Trustee: The donor must appoint an individual trustee who will be responsible for managing the trust assets and ensuring compliance with Alabama state laws. 2. Charitable Remainder Beneficiary: The donor must designate a qualified charitable organization as the remainder beneficiary of the trust. This organization will receive the remaining assets in the trust upon the death of the income beneficiary. 3. Unit rust Payment Percentage: The donor must specify the payment percentage that will be distributed annually to the income beneficiary. This percentage can range from a minimum of 5% to a maximum of 50% of the fair market value of the trust assets. 4. Irrevocability: Once established, the testamentary charitable remainder unit rust becomes irrevocable, meaning that the terms of the trust cannot be altered or revoked by the donor. However, the donor can specify successor beneficiaries in case the initial beneficiary predeceases them. 5. Tax Benefits: The Alabama provisions for testamentary charitable remainder unit rust provides certain tax benefits. The donor may be eligible for a charitable income tax deduction for the present value of the charitable remainder interest. Additionally, the trust assets are exempt from capital gains tax upon their sale. Types of Alabama Provisions for Testamentary Charitable Remainder Unit rust for One Life: 1. Charitable Remainder Annuity Trust (CAT): This type of unit rust provides a fixed income to the beneficiary, regardless of the trust's investment performance. The donor selects a fixed payment percentage, which remains constant throughout the trust's term. 2. Charitable Remainder Unit rust (CUT): Unlike a CAT, a CUT determines the income payment based on a fixed percentage of the trust's annual asset valuation. This allows the income to fluctuate with the market, potentially increasing or decreasing over time. In conclusion, Alabama provisions for testamentary charitable remainder unit rust for one life enable individuals to support charitable causes while ensuring a consistent income throughout their lifetime. By carefully considering the various types of unit rusts available, donors can tailor their estate plans to align with their charitable goals and maximize tax benefits.

Alabama Provisions for Testamentary Charitable Remainder Unitrust for One Life

Description

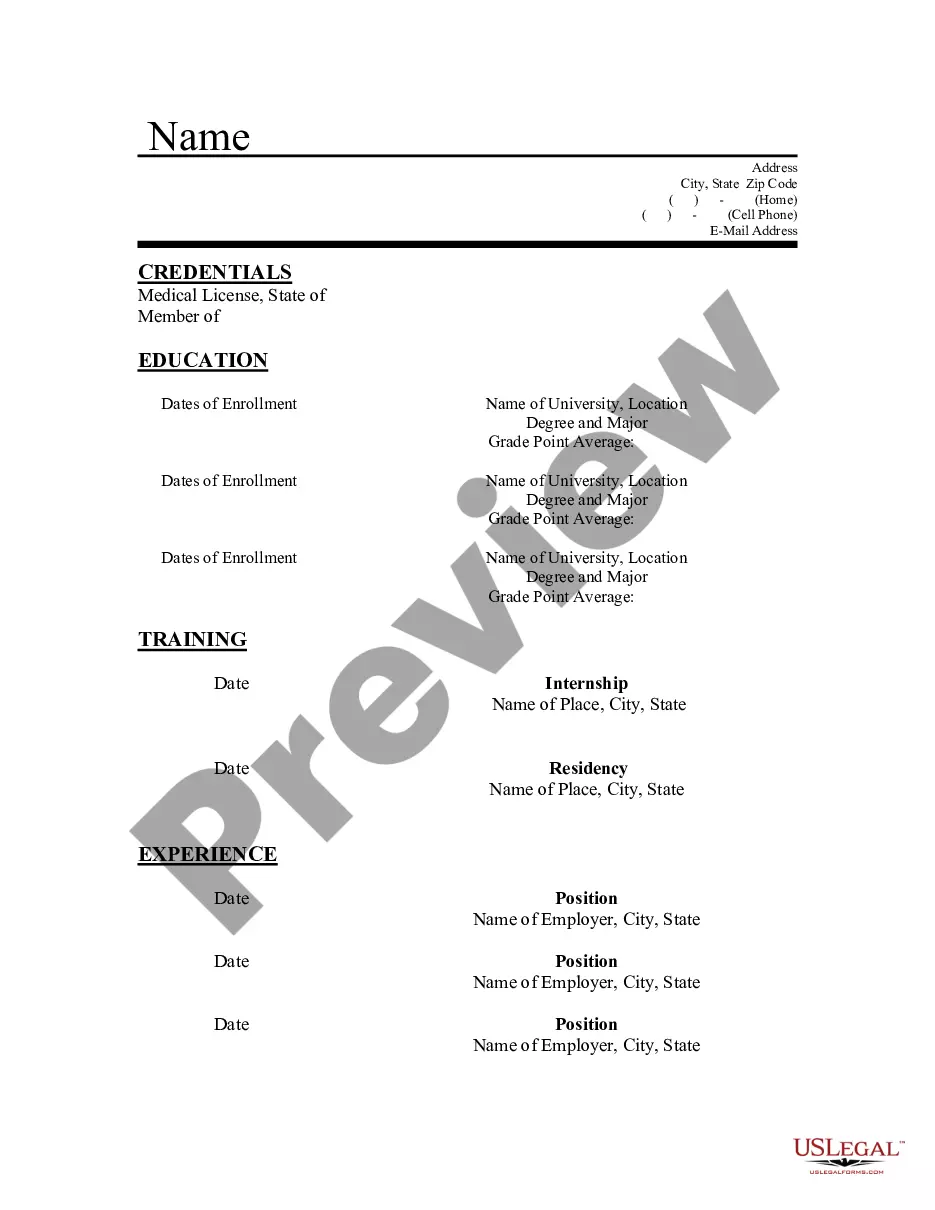

How to fill out Alabama Provisions For Testamentary Charitable Remainder Unitrust For One Life?

Are you presently in a place the place you need documents for sometimes organization or person reasons virtually every time? There are plenty of legitimate file web templates available on the net, but locating kinds you can depend on is not easy. US Legal Forms delivers a huge number of kind web templates, much like the Alabama Provisions for Testamentary Charitable Remainder Unitrust for One Life, which can be published to meet state and federal specifications.

In case you are already informed about US Legal Forms web site and also have a free account, just log in. Following that, you can down load the Alabama Provisions for Testamentary Charitable Remainder Unitrust for One Life template.

If you do not provide an profile and want to start using US Legal Forms, adopt these measures:

- Obtain the kind you want and make sure it is for that appropriate town/region.

- Use the Review switch to review the shape.

- Read the explanation to ensure that you have selected the proper kind.

- If the kind is not what you`re seeking, take advantage of the Search field to obtain the kind that meets your requirements and specifications.

- If you obtain the appropriate kind, just click Buy now.

- Choose the prices program you want, fill in the required information and facts to produce your money, and buy an order utilizing your PayPal or Visa or Mastercard.

- Choose a practical paper file format and down load your duplicate.

Find all of the file web templates you have bought in the My Forms food selection. You can aquire a further duplicate of Alabama Provisions for Testamentary Charitable Remainder Unitrust for One Life at any time, if necessary. Just go through the required kind to down load or produce the file template.

Use US Legal Forms, one of the most considerable collection of legitimate forms, to save lots of some time and prevent errors. The support delivers professionally manufactured legitimate file web templates that you can use for a variety of reasons. Generate a free account on US Legal Forms and begin generating your daily life easier.