Alabama Sample Letter regarding Cancellation of Deed of Trust

Description

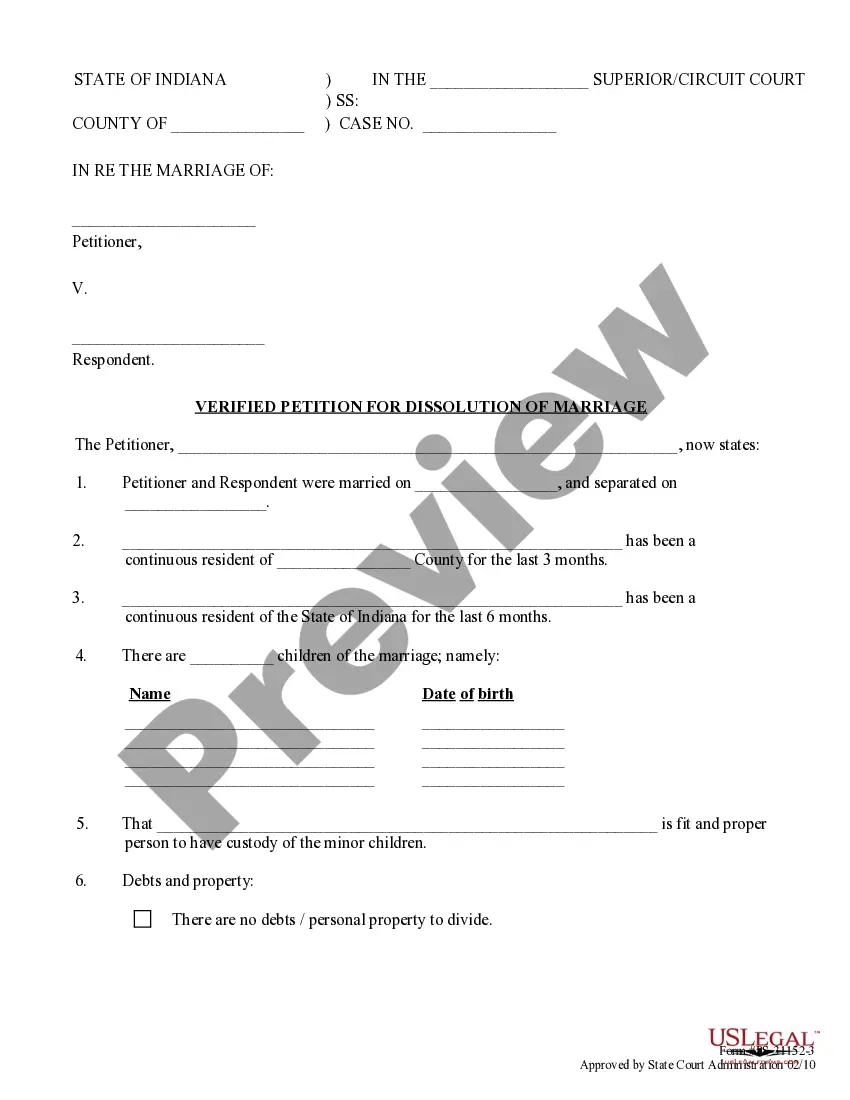

How to fill out Sample Letter Regarding Cancellation Of Deed Of Trust?

You are able to invest hours on the Internet attempting to find the authorized file format that fits the federal and state requirements you will need. US Legal Forms gives thousands of authorized types that happen to be evaluated by professionals. You can easily acquire or print the Alabama Sample Letter regarding Cancellation of Deed of Trust from our support.

If you have a US Legal Forms bank account, you can log in and click on the Download switch. After that, you can total, modify, print, or sign the Alabama Sample Letter regarding Cancellation of Deed of Trust. Each authorized file format you purchase is your own property for a long time. To have another copy of any bought develop, visit the My Forms tab and click on the related switch.

If you are using the US Legal Forms site initially, adhere to the simple directions beneath:

- Very first, make certain you have selected the proper file format to the state/town of your choice. See the develop information to make sure you have picked the right develop. If offered, make use of the Review switch to appear through the file format at the same time.

- In order to locate another version of your develop, make use of the Search area to get the format that meets your requirements and requirements.

- After you have identified the format you need, click Get now to carry on.

- Pick the costs strategy you need, enter your accreditations, and register for an account on US Legal Forms.

- Complete the deal. You may use your Visa or Mastercard or PayPal bank account to purchase the authorized develop.

- Pick the structure of your file and acquire it for your gadget.

- Make alterations for your file if possible. You are able to total, modify and sign and print Alabama Sample Letter regarding Cancellation of Deed of Trust.

Download and print thousands of file web templates making use of the US Legal Forms web site, that provides the biggest selection of authorized types. Use expert and status-particular web templates to take on your company or personal needs.

Form popularity

FAQ

A Trust deed is a legal document that comprises and sets out the terms and conditions of creating and managing a trust. It involves the objective of the trust established , the names of the beneficiaries and the amount of lump sum income they will receive and even the method by which they will receive the payment.

While most states have either mortgages or deeds of trust, there are a few states that allow you to choose which is better for you. These states include Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, and Montana.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A trust deed ?also known as a deed of trust?is a document sometimes used in real estate transactions in the U.S. It is a document that comes into play when one party has taken out a loan from another party to purchase a property.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

While most states have either mortgages or deeds of trust, there are a few states that allow you to choose which is better for you. These states include Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, and Montana.