Alabama Sample Letter for Request for IRS not to Off Set against Tax Refund

Description

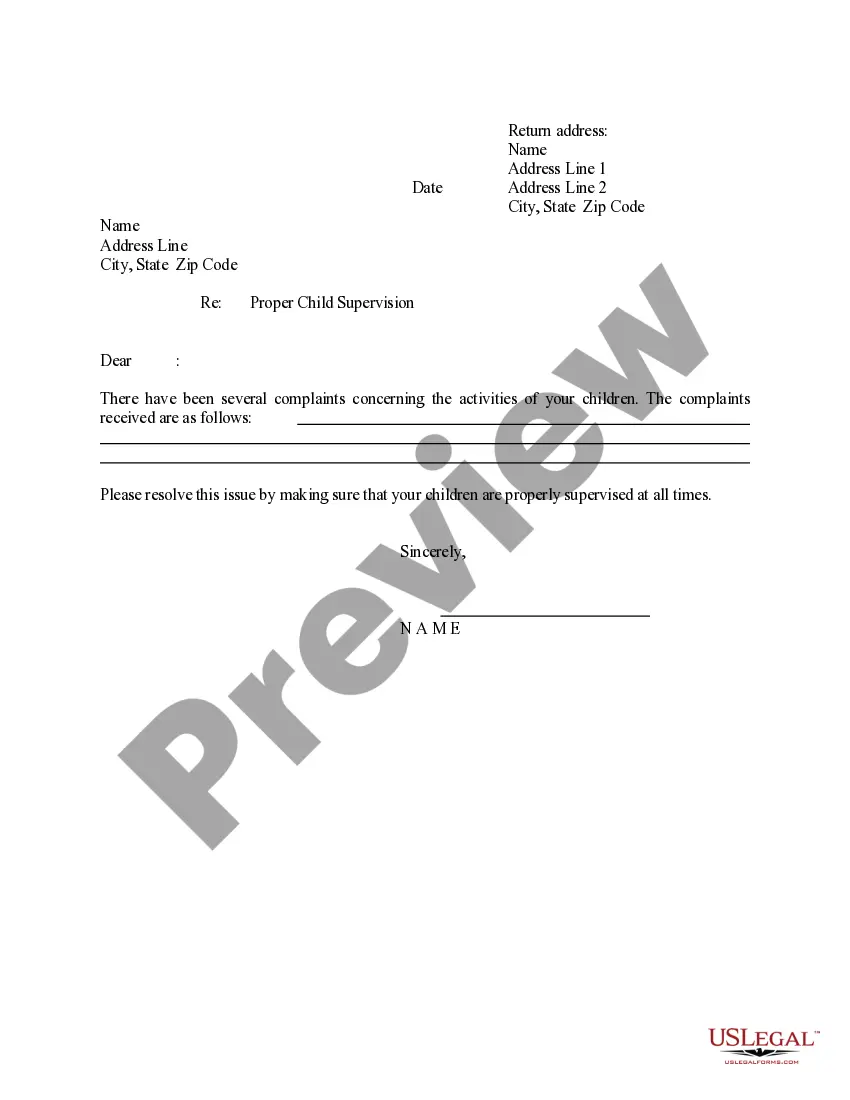

How to fill out Sample Letter For Request For IRS Not To Off Set Against Tax Refund?

Have you been within a place in which you will need documents for sometimes company or specific uses nearly every time? There are plenty of lawful file themes accessible on the Internet, but finding kinds you can depend on is not simple. US Legal Forms provides thousands of form themes, just like the Alabama Sample Letter for Request for IRS not to Off Set against Tax Refund, which are created in order to meet state and federal specifications.

If you are already familiar with US Legal Forms site and have a free account, just log in. Next, you can acquire the Alabama Sample Letter for Request for IRS not to Off Set against Tax Refund format.

Unless you have an profile and need to begin to use US Legal Forms, follow these steps:

- Discover the form you need and make sure it is for your proper city/county.

- Make use of the Review option to analyze the shape.

- Read the outline to ensure that you have chosen the right form.

- If the form is not what you are seeking, take advantage of the Search industry to discover the form that meets your requirements and specifications.

- Once you discover the proper form, just click Buy now.

- Choose the rates program you want, complete the required details to produce your bank account, and purchase the order making use of your PayPal or credit card.

- Select a convenient data file file format and acquire your version.

Get every one of the file themes you have bought in the My Forms menu. You can aquire a more version of Alabama Sample Letter for Request for IRS not to Off Set against Tax Refund anytime, if required. Just click the required form to acquire or print the file format.

Use US Legal Forms, the most extensive collection of lawful forms, to conserve time and steer clear of mistakes. The services provides expertly produced lawful file themes which you can use for a selection of uses. Create a free account on US Legal Forms and initiate creating your life a little easier.

Form popularity

FAQ

An offset is when the Alabama Department of Revenue intercepts your income tax refund and applies the refund to a balance owed to the State of Alabama. If the full amount owed is not collected in 180 days, the Alabama Department of Revenue may offset future federal payments to satisfy your state tax debt.

The notice you received from the Department of the Bureau of the Fiscal Service-Debt Management will outline the name of the state agency (or agencies) that requested the offset of your federal income tax refund, along with contact information for those agencies. A letter is sent for each offset.

The IRS may, for example, choose not to offset an overpayment against an outstanding federal tax refund because of undue hardship. However, the IRS's authority not to offset generally disappears once the offset has been done?it cannot reverse an offset.

Ing to the IRS, your letter should include the following: Taxpayer's name, address, and contact information. A statement expressing your desire to appeal IRS's findings to the Office of Appeals. The tax period in question. A list of the items you do not agree with and the corresponding reasons.

You should contact the agency shown on the notice if you believe you don't owe the debt or if you're disputing the amount taken from your refund. Contact the IRS only if your original refund amount shown on the BFS offset notice differs from the refund amount shown on your tax return.

The ?Notice of Intent to Offset? tells you that you have a delinquent debt and part or all of your federal payments will be seized by the government. Federal tax refunds are typically offset by the IRS, although they may also accept other forms of federal payments.

Offset letter The letter explains that we plan to notify BFS of the debt if you do not pay in full within 60 days. BFS will send you a letter explaining why your federal refund was reduced and that it may take several weeks before the federal refund reaches FTB.

If you have a past due, legally enforceable California income tax debt and are entitled to a federal income tax refund, we are authorized to have your refund withheld (offset) to pay your balance due. We may charge a fee for federal offsets.