Title: Alabama Sample Letter for Tax Return for Supplement — An In-Depth Walkthrough Introduction: In Alabama, taxpayers often find the need to request a supplement to their tax return due to various reasons. This detailed description provides an overview of Alabama's sample letter for tax return for supplement, showcasing its importance and highlighting the different types available. 1. Alabama Sample Letter for Tax Return for Supplement: Explained A sample letter for tax return supplement helps taxpayers in Alabama to communicate effectively with the state's tax authorities. It provides a structured format to request a revision or inclusion of additional information to an already filed tax return. This letter serves as documentation and evidence, ensuring clarity and prompt action by the tax department. 2. Purpose and Benefits of an Alabama Sample Letter for Tax Return for Supplement: — Correcting any errors or inaccuracies in the previously filed tax return. — Requesting an amendment due to the receipt of additional income or deductions. — Disclosing overlooked credits or exemptions that may affect the tax liability. — Seeking permission to revise the tax return for any other reasons deemed necessary. — Ensuring compliance with Alabama tax laws and regulations. 3. Common Types of Alabama Sample Letters for Tax Return Supplements: a. Alabama Supplementary Information Request Letter: This type of letter is used when tax authorities require additional information supporting certain items or deductions claimed in the original tax return. Taxpayers are requested to furnish specified documents or details within a stipulated timeframe. b. Alabama Amended Return Request Letter: When errors, omissions, or changes occur in the original tax return, taxpayers may submit an amended return request letter to the Alabama Department of Revenue. This letter explains the reasons necessitating the amendment and encloses the corrected or newly provided information. c. Alabama Extension Request Letter: If taxpayers require an extension beyond the standard tax filing deadline, an extension request letter is submitted. This letter outlines the reason for the extension and may require a proper explanation if late filing penalties are to be avoided. d. Alabama Documentation Submission Letter: In cases where taxpayers need to submit specific documents related to their tax return, such as proof of eligible expenses, income sources, or other supporting records, a documentation submission letter is utilized. This letter ensures proper evidence is provided along with the tax return to avoid reassessment or inquiries. 4. Key Components of an Alabama Sample Letter for Tax Return for Supplement: Every Alabama sample letter for tax return for supplement should include the following details: — Taxpayer's name, address, and contact information. — Alabama taxpayer identification number or social security number. — Reference to the original tax return, including filing year and tax form used. — Clear and concise explanation of the requested supplement or amendment. — Supporting evidence or documentation (if applicable). — Date of submission and signature of the taxpayer. Conclusion: An Alabama sample letter for tax return for supplement is an essential tool for taxpayers who require revisions, amendments, or additional information to be added to their filed tax return. By following the provided structure and including relevant details, taxpayers can ensure effective communication with the Alabama Department of Revenue, leading to accurate tax filings and compliance with state regulations.

Alabama Sample Letter for Tax Return for Supplement

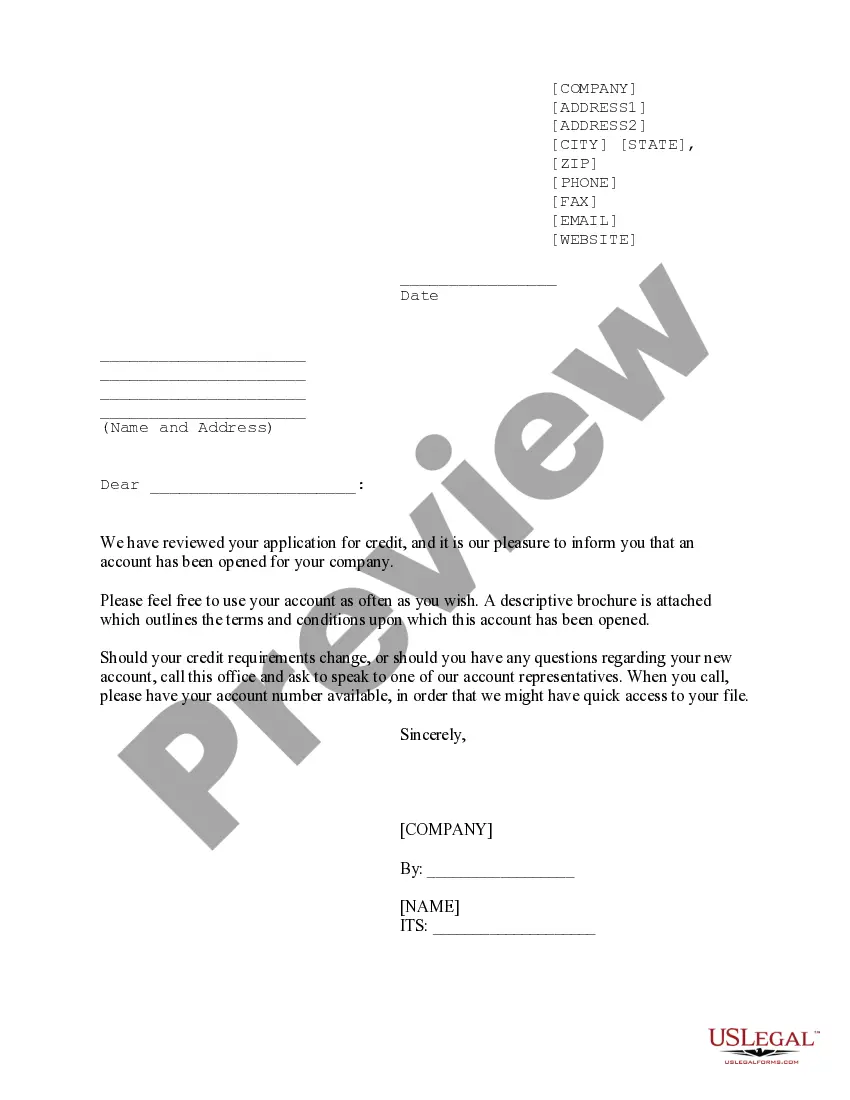

Description

How to fill out Alabama Sample Letter For Tax Return For Supplement?

US Legal Forms - one of several biggest libraries of legal forms in America - offers a variety of legal file themes it is possible to acquire or produce. While using internet site, you can find 1000s of forms for enterprise and person reasons, categorized by groups, states, or search phrases.You can find the newest versions of forms such as the Alabama Sample Letter for Tax Return for Supplement in seconds.

If you already possess a monthly subscription, log in and acquire Alabama Sample Letter for Tax Return for Supplement through the US Legal Forms catalogue. The Down load button will show up on each type you look at. You have access to all previously downloaded forms in the My Forms tab of your accounts.

If you wish to use US Legal Forms initially, allow me to share simple instructions to obtain began:

- Make sure you have picked out the right type to your city/region. Select the Preview button to check the form`s information. Read the type description to ensure that you have selected the correct type.

- In case the type does not suit your demands, take advantage of the Look for area at the top of the display to obtain the the one that does.

- If you are content with the shape, validate your decision by clicking the Buy now button. Then, select the pricing program you like and give your qualifications to register to have an accounts.

- Procedure the deal. Make use of your bank card or PayPal accounts to perform the deal.

- Choose the file format and acquire the shape in your gadget.

- Make changes. Complete, change and produce and indication the downloaded Alabama Sample Letter for Tax Return for Supplement.

Every single web template you included in your bank account lacks an expiry day and is also your own property for a long time. So, if you would like acquire or produce another copy, just proceed to the My Forms section and click on on the type you need.

Get access to the Alabama Sample Letter for Tax Return for Supplement with US Legal Forms, by far the most substantial catalogue of legal file themes. Use 1000s of expert and condition-distinct themes that meet your organization or person needs and demands.