Alabama Accredited Investor Representation Letter is a legal document that serves as a representation of an individual or entity's status as an accredited investor in the state of Alabama. This letter is a crucial component in various investment transactions and offerings, ensuring compliance with the state's securities laws. An accredited investor, according to the Securities and Exchange Commission (SEC), is an individual or entity that meets specific financial criteria and possesses the necessary knowledge and experience to participate in certain investment opportunities. The Alabama Accredited Investor Representation Letter typically includes important information such as the name, address, and contact details of the investor. It also outlines the investor's qualifications and eligibility as an accredited investor in the state. This letter acts as proof that the investor satisfies the requirements set forth by the Alabama Securities Commission (ASC) to engage in certain investment activities. There are different types of Alabama Accredited Investor Representation Letters that may be used depending on the specific investment opportunity or transaction. Some common types include: 1. Individual Investor Representation Letter: This type of letter is used when an individual meets the necessary financial criteria and provides evidence of their financial standing, such as income or net worth, to qualify as an accredited investor. 2. Entity Investor Representation Letter: When an entity, such as a corporation, partnership, or limited liability company (LLC), wishes to engage in investment activities as an accredited investor, an entity representation letter is used. This letter typically includes relevant information about the entity, its authorized representatives, and its financial qualifications. 3. Trust Investor Representation Letter: Trusts can also qualify as accredited investors if they meet specific requirements. A trust representation letter is used to outline the details of the trust, including its purpose, beneficiaries, trustees, and financial qualifications. It's crucial to note that the content and format of Alabama Accredited Investor Representation Letters may vary depending on the specific requirements of the investment opportunity, the parties involved, and any additional disclosures or agreements that need to be included. It is advisable to consult with legal professionals familiar with Alabama securities laws to ensure accurate and compliant representation.

Alabama Accredited Investor Representation Letter

Description

How to fill out Alabama Accredited Investor Representation Letter?

If you wish to comprehensive, acquire, or produce authorized document web templates, use US Legal Forms, the most important variety of authorized kinds, which can be found on-line. Make use of the site`s basic and practical research to discover the documents you will need. Different web templates for enterprise and person reasons are sorted by classes and claims, or keywords and phrases. Use US Legal Forms to discover the Alabama Accredited Investor Representation Letter in a number of mouse clicks.

Should you be previously a US Legal Forms consumer, log in to your bank account and click on the Acquire option to obtain the Alabama Accredited Investor Representation Letter. You can also entry kinds you in the past acquired within the My Forms tab of your bank account.

Should you use US Legal Forms the very first time, follow the instructions under:

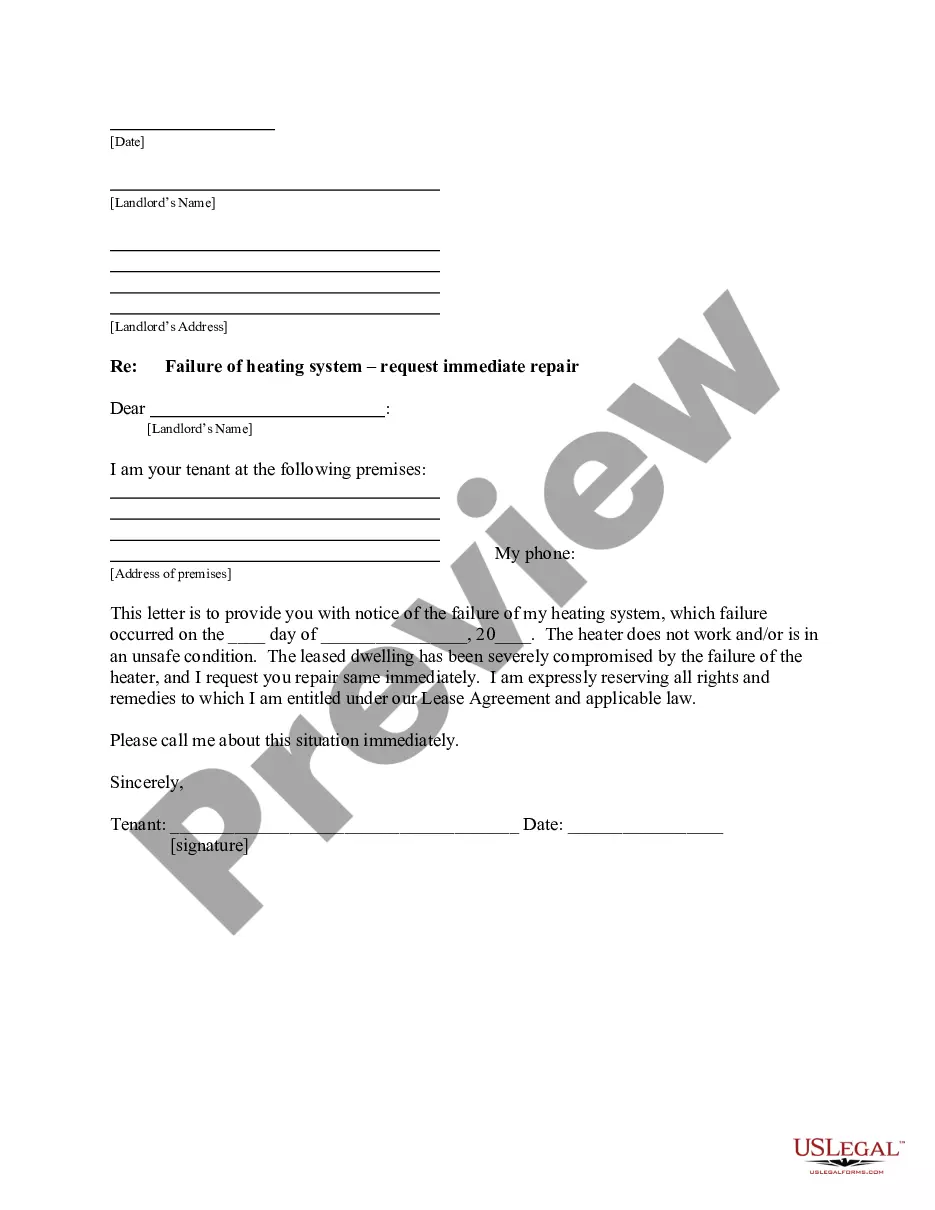

- Step 1. Be sure you have chosen the form for that proper metropolis/land.

- Step 2. Use the Preview method to look over the form`s content material. Do not overlook to read the outline.

- Step 3. Should you be unhappy using the develop, take advantage of the Research industry towards the top of the screen to locate other versions in the authorized develop web template.

- Step 4. Once you have discovered the form you will need, select the Buy now option. Pick the prices program you prefer and put your accreditations to register to have an bank account.

- Step 5. Approach the transaction. You should use your credit card or PayPal bank account to perform the transaction.

- Step 6. Pick the structure in the authorized develop and acquire it on the product.

- Step 7. Total, revise and produce or indicator the Alabama Accredited Investor Representation Letter.

Each and every authorized document web template you purchase is yours for a long time. You possess acces to each develop you acquired in your acccount. Select the My Forms area and decide on a develop to produce or acquire once again.

Compete and acquire, and produce the Alabama Accredited Investor Representation Letter with US Legal Forms. There are millions of specialist and status-certain kinds you may use for the enterprise or person demands.