Alabama Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate

Description

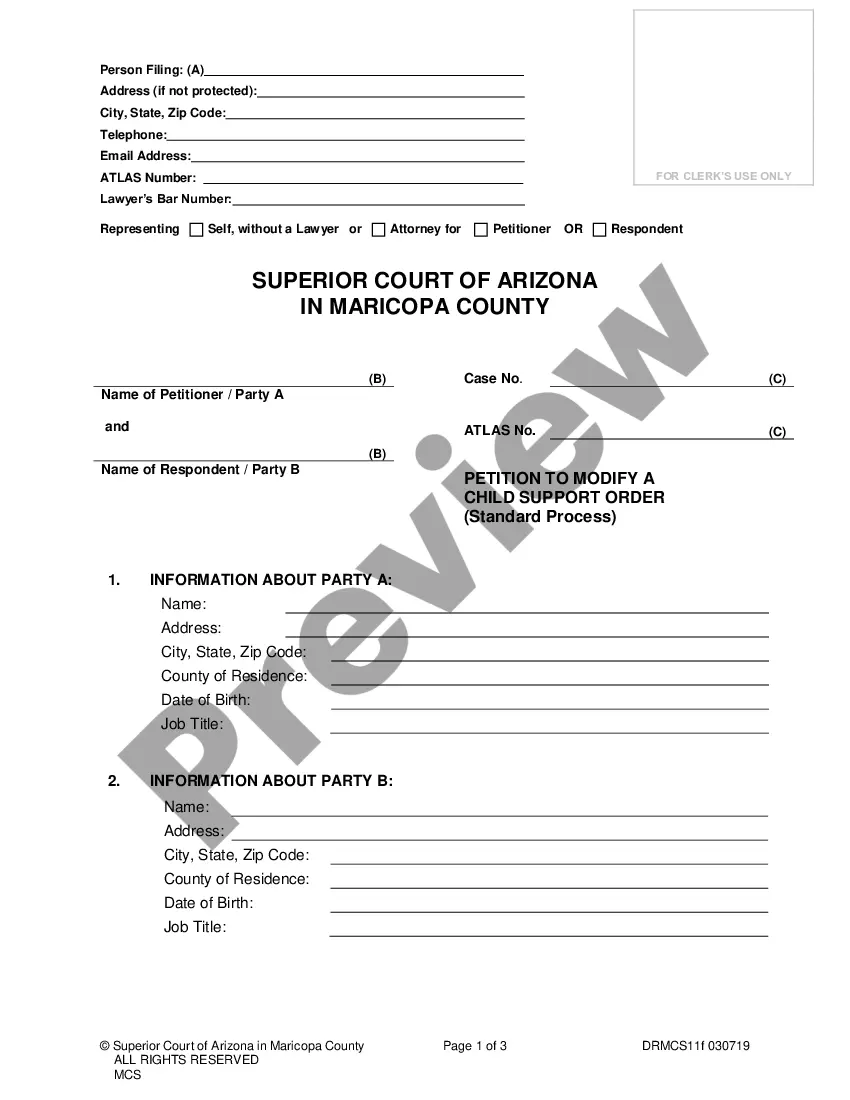

How to fill out Indemnity Bond To Replace Lost, Destroyed, Or Stolen Stock Certificate?

If you have to total, down load, or produce legitimate record templates, use US Legal Forms, the greatest selection of legitimate kinds, which can be found on-line. Make use of the site`s simple and handy research to obtain the papers you will need. A variety of templates for enterprise and specific purposes are categorized by types and suggests, or keywords and phrases. Use US Legal Forms to obtain the Alabama Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate with a handful of clicks.

When you are previously a US Legal Forms consumer, log in for your accounts and click on the Down load button to find the Alabama Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate. You can also gain access to kinds you earlier saved from the My Forms tab of your respective accounts.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for the right metropolis/land.

- Step 2. Utilize the Preview choice to check out the form`s content. Do not forget to read the description.

- Step 3. When you are unhappy using the form, use the Lookup field at the top of the screen to discover other versions in the legitimate form web template.

- Step 4. Upon having found the form you will need, click on the Purchase now button. Choose the prices strategy you choose and include your credentials to register to have an accounts.

- Step 5. Approach the purchase. You may use your bank card or PayPal accounts to accomplish the purchase.

- Step 6. Select the file format in the legitimate form and down load it on your gadget.

- Step 7. Total, edit and produce or signal the Alabama Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate.

Each and every legitimate record web template you purchase is your own property permanently. You might have acces to each and every form you saved in your acccount. Go through the My Forms portion and pick a form to produce or down load once more.

Contend and down load, and produce the Alabama Indemnity Bond to Replace Lost, Destroyed, or Stolen Stock Certificate with US Legal Forms. There are thousands of skilled and status-distinct kinds you may use for your personal enterprise or specific requires.

Form popularity

FAQ

The owner must buy an indemnity bond to protect the corporation and the transfer agent against the possibility that the lost certificate may be presented later by an innocent purchaser. The bond usually costs between two or three percent of the current market value of the missing certificates; and.

A Lost Securities surety bond is a bond required by banks or other financial instrument transfer agents for persons who have lost or misplaced bond or stock certificates or a payment check.

If an investor does not have or loses their stock certificate, they are still the owner of their shares and entitled to all the rights that come with them. If an investor wants a stock certificate, or if it is lost, stolen, or damaged, they can receive a new one by contacting a company's transfer agent.

The shareholder should make an application for the issue of a duplicate share certificate with the required documents to the company. The documents sent to the company should have the shareholder's signature whose share certificate is lost or misplaced.

The lost instrument bond guarantees the owner of the lost document will indemnify the bank or other entity for any loss it suffers because of the duplicate securities or other issued instruments.

The owner must buy an indemnity bond to protect the corporation and the transfer agent against the possibility that the lost certificate may be presented later by an innocent purchaser. The bond usually costs between two or three percent of the current market value of the missing certificates; and.

The fee for this service is normally around 1% of the value of the shares represented by the missing share certificate, making it a cost-effective service.

If you misplace your stock certificate or believe it was stolen or destroyed, you should immediately contact your transfer agent, or business that handles the records for the company of the stock you hold, and request that a "stop-transfer" order be put against it, similar to what you would do with a lost check.