Alabama Debt Adjustment Agreement with Creditor

Description

How to fill out Debt Adjustment Agreement With Creditor?

US Legal Forms - one of the most prominent collections of legal documents in the United States - provides a vast array of legal form templates for you to download or print.

By utilizing the website, you will find thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can access the latest forms such as the Alabama Debt Adjustment Agreement with Creditor in just minutes.

If you currently hold a membership, Log In to obtain the Alabama Debt Adjustment Agreement with Creditor from the US Legal Forms library. The Download button will appear on every form that you view. You can retrieve all previously saved forms from the My documents section of your account.

Select the format and download the form to your device.

Make amendments. Fill out, modify, and print and sign the downloaded Alabama Debt Adjustment Agreement with Creditor. Each document you add to your account does not expire and remains yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Alabama Debt Adjustment Agreement with Creditor with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- If you are new to US Legal Forms, here are simple steps to get started.

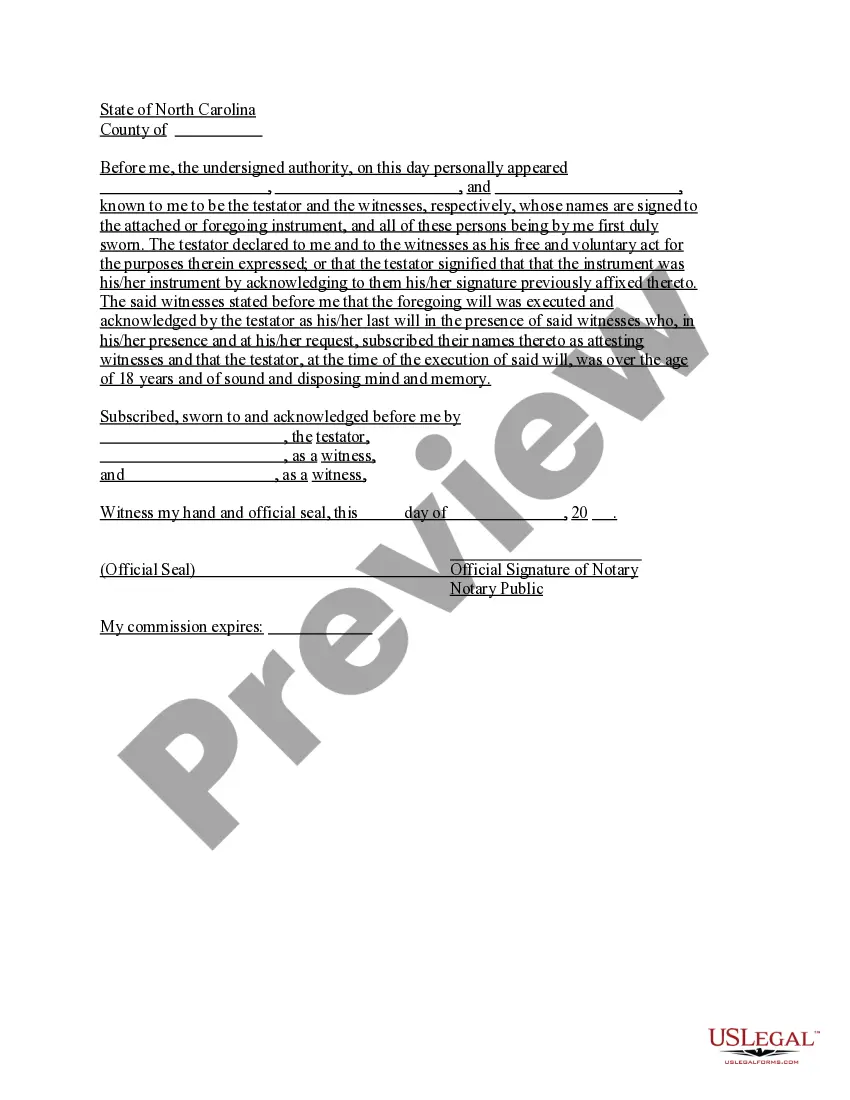

- Make sure you have selected the correct form for your area/state. Click the Review button to examine the form's details.

- Check the form description to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search box at the top of the page to find one that does.

- Once you're satisfied with the form, finalize your selection by clicking the Purchase now button. Then, choose the pricing plan you desire and provide your credentials to register for an account.

- Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Form popularity

FAQ

To request debt validation from a collection agency, start by sending a written request within 30 days of first contact. In your request, include your name, account number, and a clear statement that you are requesting validation of the debt. This process helps to ensure that the collection agency has the right to collect on the debt and shows that you are proactive about your finances. Utilizing an Alabama Debt Adjustment Agreement with Creditor can further aid in negotiating your debt and reaching a fair settlement.

Your creditors do not have to accept your offer of payment or freeze interest. If they continue to refuse what you are asking for, carry on making the payments you have offered anyway. Keep trying to persuade your creditors by writing to them again.

10 Tips for Negotiating with CreditorsIs Negotiation the Right Move For You? It's important to think carefully about negotiation.Know Your Terms.Keep Your Story Straight.Ask Questions, and Don't Tolerate Bullying.Take Notes.Read and Save Your Mail.Talk to Creditors, Not Collection Agencies.Get It in Writing.More items...?

Your creditors are not obligated to accept your offer at any point. They can keep on refusing your payment offers as well as your requests to freeze interest.

The language can be as simple as: In order to settle this matter amicably, I offer you the sum of amount (inclusive of interests and costs) as the full and final settlement of the above claim/debt.

The following terms and conditions should be included in a settlement.Original creditor and collection agent's company name.Date the letter was written.Your name.Your account number.Outstanding balance owed on the account (optional)Amount agreed to as settlement.More items...

Your debt settlement proposal letter should contain the following:Your current financial situation.Debt settlement offer.Personal information.What you expect in return.Acceptance of the proposal.Acceptance of the proposal upon adjusting (negotiating) the amount to be paid.Rejection of the proposal.

Creditors are not obliged to accept a debt solution but they could accept a Debt Management Plan if they feel this is the best way for them to recover the money owed to them. You will have to put forward a firm and fair offer of payment to your creditors and outline how much you can afford to pay back each month.

When you work with a credit counseling agency, you'll meet with a counselor who will review your financial situation and help you understand your options. If a DMP is a good fit, the counselor can negotiate with your creditors on your behalf to create new payment plans.

Can creditors refuse your DMP? Yes. Creditors are not obliged to accept a debt solution but they could accept a Debt Management Plan if they feel this is the best way for them to recover the money owed to them.