Alabama Monthly Cash Flow Plan is a comprehensive financial tool that helps individuals and families in Alabama effectively manage their income and expenses. This plan allows users to allocate their money wisely, ensuring that they can meet their financial obligations and achieve their financial goals. By implementing this monthly cash flow plan, individuals can take control of their finances, track their spending patterns, and ultimately improve their financial well-being. The Alabama Monthly Cash Flow Plan consists of various components that enable users to create a detailed budget and monitor their cash flow. It starts with determining the total monthly income, including salary, wages, bonuses, and any additional sources of income. Next, users need to list all their monthly expenses, which may include rent or mortgage payments, utilities, food, transportation, insurance, debt payments, and other recurring costs. Once all the income and expenses are accurately listed, the Alabama Monthly Cash Flow Plan helps users allocate their money into different categories. These categories can include essential living expenses, debt payments, savings, investments, and discretionary spending. By setting aside a specific amount for each category, the plan helps individuals prioritize their spending and ensure that all financial obligations are met. Additionally, the Alabama Monthly Cash Flow Plan encourages users to plan for unexpected expenses by establishing an emergency fund. This fund acts as a safety net, providing financial security during unforeseen events or emergencies. By including this component in the cash flow plan, individuals can mitigate the impact of unexpected expenses on their monthly budget. Different types of Alabama Monthly Cash Flow Plan may exist, tailored to the specific needs and financial goals of different individuals or families. These variations can include plans for individuals with fluctuating income, plans that focus on debt repayment strategies, plans for retirement savings, plans for students or young adults transitioning into financial independence, or plans for families with unique financial circumstances. In summary, the Alabama Monthly Cash Flow Plan is a powerful financial tool that allows individuals and families in Alabama to gain control over their finances. By tracking income and expenses, prioritizing spending, and planning for unexpected events, this plan enables users to achieve their financial goals and build a secure financial future.

Dave Ramsey Allocated Spending Plan

Description

How to fill out Alabama Monthly Cash Flow Plan?

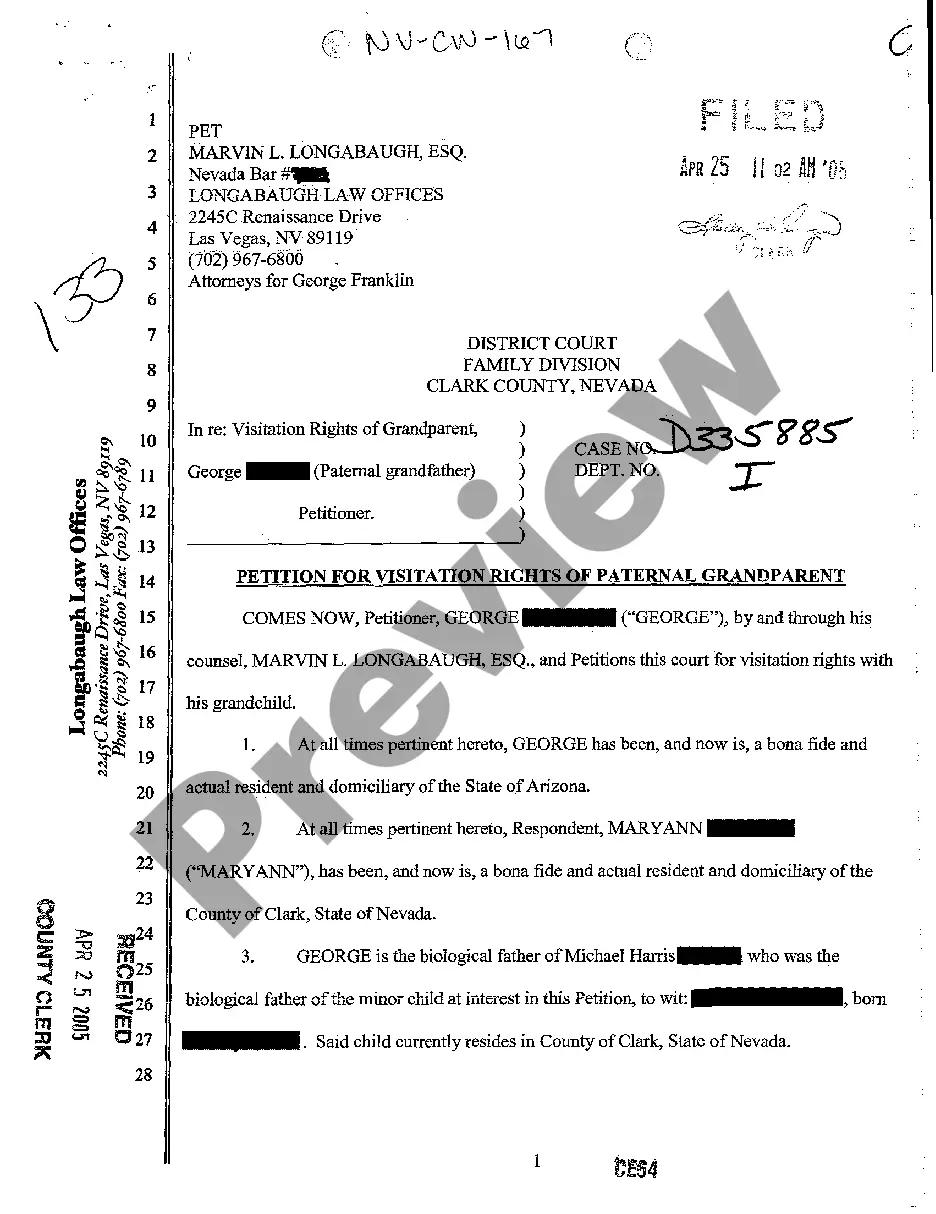

If you need to comprehensive, down load, or produce authorized document templates, use US Legal Forms, the largest collection of authorized forms, which can be found on the Internet. Use the site`s basic and hassle-free lookup to discover the documents you want. A variety of templates for enterprise and person uses are sorted by categories and says, or keywords. Use US Legal Forms to discover the Alabama Monthly Cash Flow Plan within a few clicks.

Should you be previously a US Legal Forms client, log in in your account and click the Obtain option to get the Alabama Monthly Cash Flow Plan. You can also accessibility forms you in the past acquired within the My Forms tab of your own account.

If you work with US Legal Forms the first time, refer to the instructions below:

- Step 1. Be sure you have selected the shape for your correct area/land.

- Step 2. Use the Preview method to examine the form`s content material. Do not overlook to learn the description.

- Step 3. Should you be unsatisfied together with the type, use the Look for industry towards the top of the monitor to discover other models of the authorized type design.

- Step 4. After you have identified the shape you want, go through the Get now option. Select the pricing strategy you choose and include your qualifications to sign up on an account.

- Step 5. Procedure the financial transaction. You should use your credit card or PayPal account to complete the financial transaction.

- Step 6. Find the file format of the authorized type and down load it on your gadget.

- Step 7. Complete, change and produce or indicator the Alabama Monthly Cash Flow Plan.

Every single authorized document design you purchase is yours forever. You possess acces to every type you acquired in your acccount. Select the My Forms segment and pick a type to produce or down load yet again.

Remain competitive and down load, and produce the Alabama Monthly Cash Flow Plan with US Legal Forms. There are many skilled and express-distinct forms you can utilize to your enterprise or person requirements.

Form popularity

FAQ

Cash flow is the money that is moving (flowing) in and out of your business in a month. Although it does sometimes seem that cash flow only goes one wayout of the businessit does flow both ways. Cash is coming in from customers or clients who are buying your products or services.

Do one month at a time.Enter Your Beginning Balance. For the first month, start your projection with the actual amount of cash your business will have in your bank account.Estimate Cash Coming In. Fill in all amounts you expect to take in during the month.Estimate Cash Going Out.Subtract Outlays From Income.

The difference between a budget and a cash flow forecast is that the budget will show expected income and expenditure for a full twelve-month period, whereas the cash flow forecast will break down month by month when you expect the money to actually be spent or received.

Your Monthly Cash Flow Plan. (BUDGET) A monthly cash flow plan or budget gives you more control over your money and sets you up to achieve short-term and long-term financial goals and dreams. It is important to have a zero based cash flow plan which means your monthly income minus your expenses should equal ZERO.

Four steps to a simple cash flow forecastDecide how far out you want to plan for. Cash flow planning can cover anything from a few weeks to many months.List all your income. For each week or month in your cash flow forecast, list all the cash you've got coming in.List all your outgoings.Work out your running cash flow.

, follow these steps to prepare an emergency management cash flow budget.Step 1: Determine the time frame.Step 2: Estimate sales units.Step 3: Estimate sales income.Step 4: Estimate timing of income.Step 5: Itemise and add expenditure.Step 6: Work out surplus or deficit.Step 7: Review sales units.More items...?

In a general sense, a cash flow plan allows a company to plan its incoming and outgoing cash to ensure it can meet expenses. Cash flow activities include operating activities, investing activities, and financing activities.

Cash flow plans, in insurance, are plans that allow policyholders to use their own cash flow to finance their insurance premiums. Cash flow plans can also refer to an insurance company's assessment of a company's cash flow, income streams, and expenses, along with a plan to coordinate the payment of insurance premiums.

Four steps to a simple cash flow forecastDecide how far out you want to plan for. Cash flow planning can cover anything from a few weeks to many months.List all your income. For each week or month in your cash flow forecast, list all the cash you've got coming in.List all your outgoings.Work out your running cash flow.