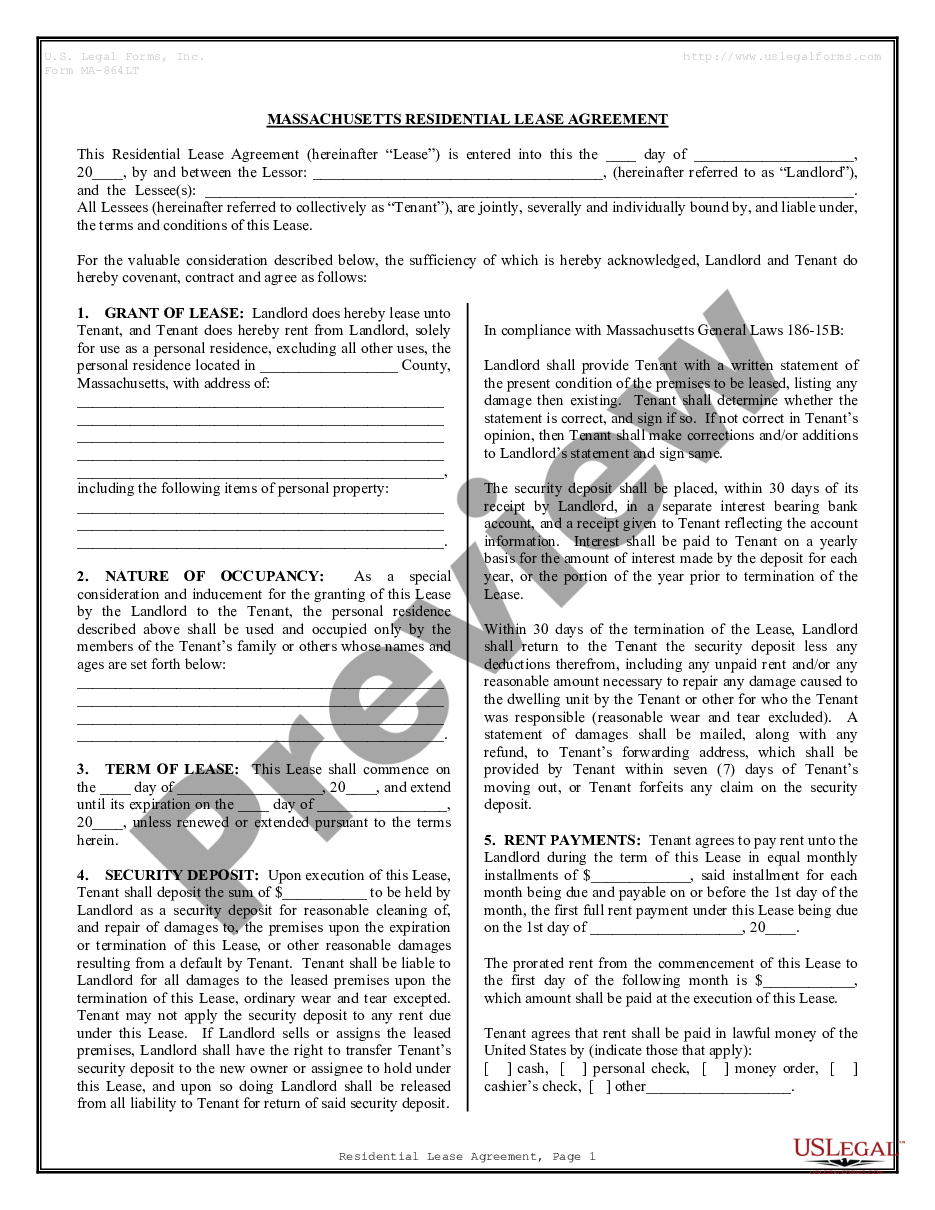

The Alabama Post Bankruptcy Petition Discharge Letter is a formal document issued after an individual has successfully completed the bankruptcy process in the state of Alabama. This letter signifies the final stage of the bankruptcy proceedings and serves as proof that the debtor's debts have been discharged, providing them with a fresh financial start. Keywords: Alabama, bankruptcy, post-bankruptcy, petition, discharge letter, debts, fresh start, bankruptcy proceedings. There are two main types of Alabama Post Bankruptcy Petition Discharge Letters: 1. Chapter 7 Bankruptcy Discharge Letter: This type of discharge letter is issued to individuals who have filed for Chapter 7 bankruptcy, which involves the liquidation of assets to repay creditors. The Chapter 7 discharge letter signifies that the debtor's eligible debts have been effectively wiped out. 2. Chapter 13 Bankruptcy Discharge Letter: This discharge letter is provided to individuals who have filed for Chapter 13 bankruptcy, which involves a repayment plan supervised by the court. The Chapter 13 discharge letter is issued once the debtor has completed the repayment plan, indicating that the remaining eligible debts have been discharged. The Alabama Post Bankruptcy Petition Discharge Letter is a crucial document for individuals seeking to rebuild their financial lives after bankruptcy. It confirms that the debtor is no longer legally obligated to repay discharged debts, providing them with the opportunity to start anew and move forward with a clean financial slate. This letter is recognized by creditors, lenders, and financial institutions as proof that the debts have been legally forgiven. To obtain the Alabama Post Bankruptcy Petition Discharge Letter, debtors must complete all the necessary bankruptcy requirements, including attending mandatory credit counseling sessions, filing accurate and complete bankruptcy forms, and adhering to the court's instructions throughout the process. Once the bankruptcy court has confirmed the discharge of eligible debts, the debtor will receive the discharge letter via mail. It is important to keep the Alabama Post Bankruptcy Petition Discharge Letter in a safe place, as it may be required for future financial transactions, credit applications, or when providing documentation to potential lenders. Having this document readily accessible ensures that individuals can demonstrate their financial rehabilitation and eligibility for new credit opportunities. Overall, the Alabama Post Bankruptcy Petition Discharge Letter is a significant milestone in the bankruptcy process, signaling the completion of debt repayment or the elimination of eligible debts. It is an essential document for individuals seeking a fresh financial start and serves as a testament to their dedication to overcoming financial hardships.

Alabama Post Bankruptcy Petition Discharge Letter

Description

How to fill out Alabama Post Bankruptcy Petition Discharge Letter?

If you wish to complete, obtain, or printing legal file web templates, use US Legal Forms, the most important assortment of legal forms, that can be found on the web. Make use of the site`s basic and convenient lookup to discover the documents you want. A variety of web templates for organization and individual reasons are sorted by types and says, or key phrases. Use US Legal Forms to discover the Alabama Post Bankruptcy Petition Discharge Letter with a handful of mouse clicks.

Should you be previously a US Legal Forms customer, log in for your profile and then click the Down load button to have the Alabama Post Bankruptcy Petition Discharge Letter. Also you can access forms you in the past delivered electronically from the My Forms tab of the profile.

If you are using US Legal Forms initially, follow the instructions below:

- Step 1. Be sure you have selected the form for that right metropolis/nation.

- Step 2. Use the Review method to look over the form`s content. Never forget about to read through the description.

- Step 3. Should you be not satisfied together with the develop, make use of the Search industry near the top of the screen to locate other versions from the legal develop web template.

- Step 4. When you have found the form you want, click on the Get now button. Opt for the prices program you favor and add your credentials to sign up for the profile.

- Step 5. Approach the deal. You may use your bank card or PayPal profile to perform the deal.

- Step 6. Find the format from the legal develop and obtain it in your system.

- Step 7. Comprehensive, revise and printing or indicator the Alabama Post Bankruptcy Petition Discharge Letter.

Each legal file web template you acquire is yours for a long time. You have acces to each and every develop you delivered electronically in your acccount. Click the My Forms area and pick a develop to printing or obtain once again.

Remain competitive and obtain, and printing the Alabama Post Bankruptcy Petition Discharge Letter with US Legal Forms. There are millions of specialist and status-particular forms you may use to your organization or individual requirements.

Form popularity

FAQ

The court may check with the Official Receiver that you are entitled to an automatic discharge. You should receive a certificate confirming your discharge within about four weeks. If you write to the Official Receiver, he will provide a letter, at no charge, confirming your date of discharge.

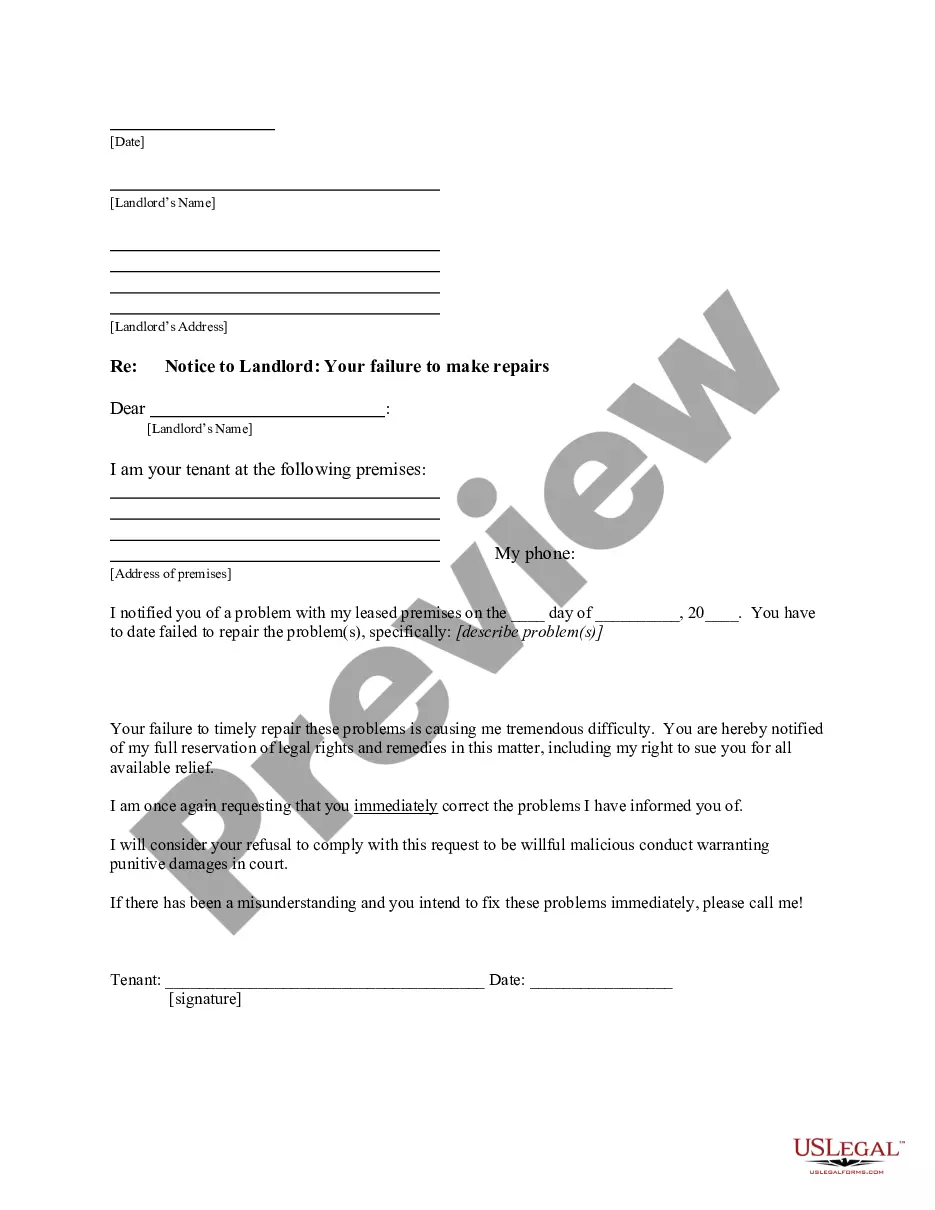

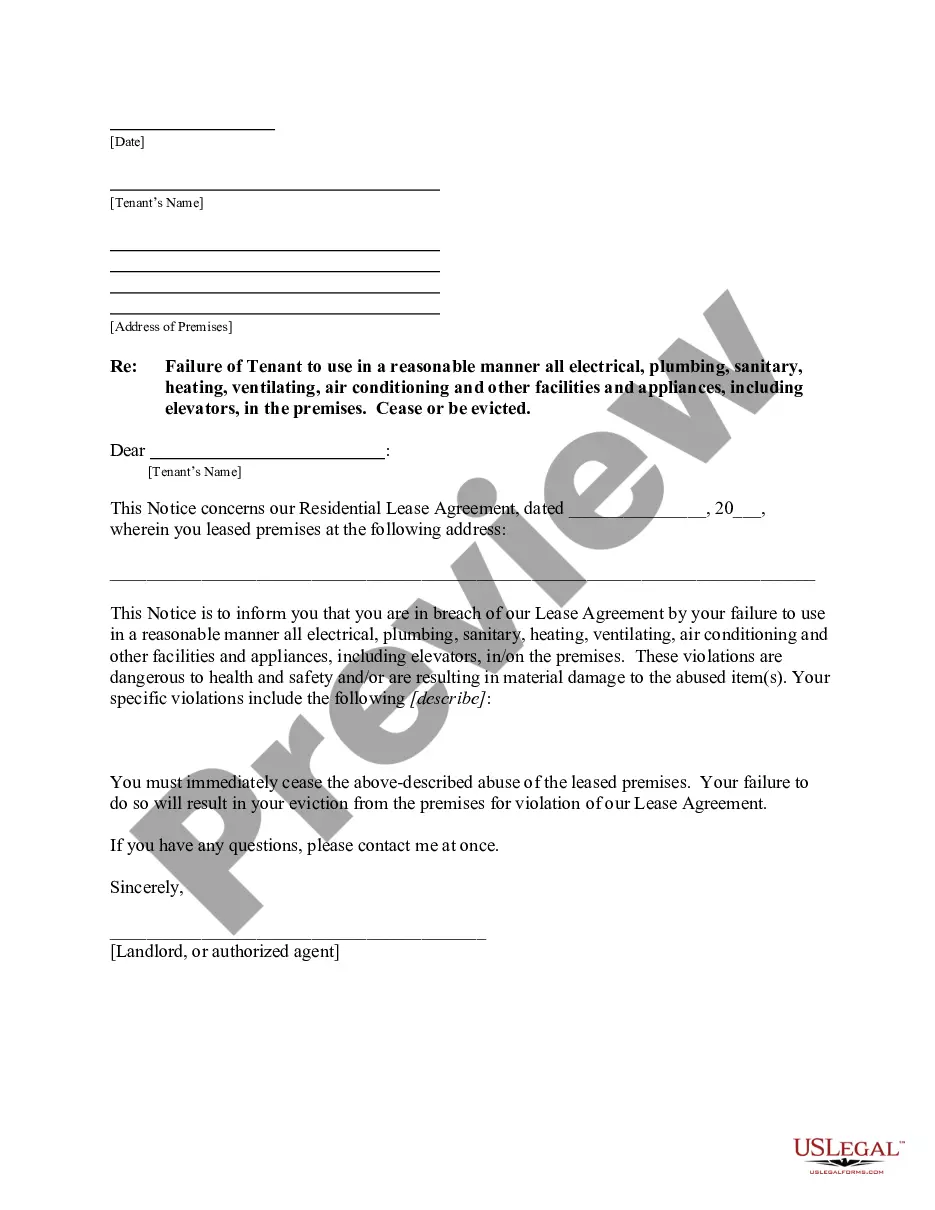

A "discharge letter" is a term used to describe the order that the bankruptcy court mails out toward the end of the case. The order officially discharges (wipes out) qualifying debt, such as credit card and utility bill balances, medical debt, and personal loans.

Following a bankruptcy discharge, debt collectors and lenders can no longer attempt to collect the discharged debts. That means no more calls from collectors and no more letters in the mail, as you are no longer personally liable for the debt. A bankruptcy discharge doesn't necessarily apply to all of the debt you owe.

Following a bankruptcy discharge, debt collectors and lenders can no longer attempt to collect the discharged debts. That means no more calls from collectors and no more letters in the mail, as you are no longer personally liable for the debt. A bankruptcy discharge doesn't necessarily apply to all of the debt you owe.

How long can Chapter 7 trustee keep case open? A. The Chapter 7 trustee can keep the case open for about four to six months after filing the bankruptcy papers. However, this does not end with discharge, but with the court's final decree.

Give your name, address and court number (to be taken from the latest correspondence about your bankruptcy). The court may check with the Official Receiver that you are entitled to an automatic discharge. You should receive a certificate confirming your discharge within about four weeks.

If the trustee finds hidden assets, the trustee can ask the court to revoke or take back your discharge. The trustee can do this at any time before the case closes or, even after, up to one year after the discharge date.

The trustee can seize the rest. If you became entitled to receive the funds before you filed and you DID NOT report them on your bankruptcy forms, the trustee can seize all of the funds. Continue reading and learning! Will filing Chapter 7 bankruptcy help you?

The trustee will use these statements to get a glimpse into your financial history. Your bankruptcy trustee can ask for up to two years of bank statements. The trustee will look at your statements to verify your monthly payments to make sure they match the expenses you put on your bankruptcy forms.