Alabama Monthly Retirement Planning

Description

How to fill out Monthly Retirement Planning?

If you desire to be thorough, acquire, or produce legal document templates, use US Legal Forms, the largest assortment of legal documents, available online.

Leverage the site's user-friendly and accessible search to find the documents you need.

A variety of templates for business and personal purposes are categorized by types and suggestions, or keywords.

Every legal document template you acquire is yours to keep indefinitely. You will have access to every form you purchased in your account.

Navigate to the My documents section and select a form to print or download again.

- Utilize US Legal Forms to obtain the Alabama Monthly Retirement Planning with just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click on the Get button to acquire the Alabama Monthly Retirement Planning.

- You can also access documents you previously obtained from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the template for the correct city/state.

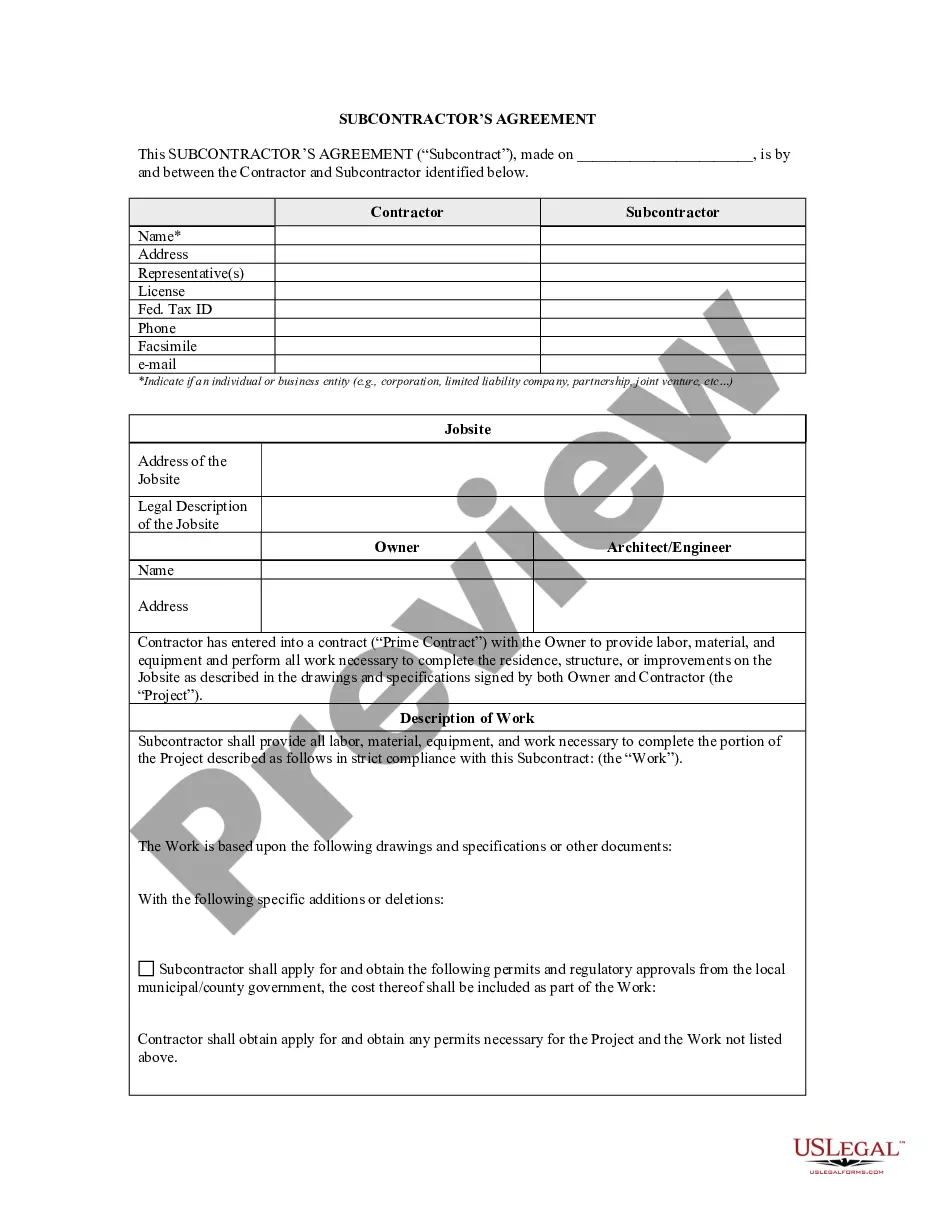

- Step 2. Use the Preview option to review the document’s content. Be sure to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find other templates in the legal document repository.

- Step 4. After you have located the document you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Retrieve the format of the legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Alabama Monthly Retirement Planning.

Form popularity

FAQ

The average monthly Social Security benefit can vary widely based on your earnings history and the age at which you retire. For someone retiring at 62, benefits may range around $1,800 to $2,000 monthly, but exact figures depend on various factors. Incorporating Social Security income is crucial in your Alabama Monthly Retirement Planning for a comprehensive financial outlook.

A member is vested when he or she has 10 years of creditable service. 2022 Being vested qualifies you for a monthly. retirement check once you reach age 60 under. Tier 1 or age 62 (56 FLC) under Tier 2, even if you.

The Public School Retirement System of Missouri (PSRS) is a defined benefit (DB) retirement plan that provides service retirement and disability benefits to qualified members, and survivor benefits to qualified beneficiaries.

The TRS was established October 1, 1940, by the Alabama Legislature for the purpose of providing retirement allowances for teachers of the state of Alabama. Benefits are calculated as a percentage of average final compensation multiplied by years of creditable service.

What is the Rule of 80? This provision creates a so-called Rule of 80, a new definition of Normal Retirement for members of the Hybrid Defined Benefit Component. This allows members to claim a full, unreduced pension benefit if their combined age and years of service equal at least 80, beginning at age 50.

The ASRS is a defined benefit plan and is tax qualified under section 401(a) of the Internal Revenue Code. It provides for a lifelong benefit based on years of service earned, or worked, and your ending salary.

Your RSA pension schemes benefits will provide you (or your spouse or civil partner, in the event of your death) with a steady income for life, and normally has some increases to protect it against inflation (defined in the Scheme Rules).

Alabama's retirement plans qualify as a 401(a) plan. Each plan is available to different types of employees, depending on your profession. Many full-time, regular, public employees are eligible for the Employees' Retirement System (ERS). If you are eligible, you must participate in the system.

Tier 1 members are eligible for retirement benefits at age 60 with at least 10 years of service. If you have 25 years of service, you can retire at any age and apply for full retirement benefits from RSA. Tier 2 members are eligible for retirement benefits at age 62 with at least 10 years of service.

Tier 1 members are eligible for retirement benefits at age 60 with at least 10 years of service. If you have 25 years of service, you can retire at any age and apply for full retirement benefits from RSA. Tier 2 members are eligible for retirement benefits at age 62 with at least 10 years of service.