Alabama Monthly Retirement Planning is a process designed to help individuals effectively prepare for financial security during their retirement years in the state of Alabama. It involves carefully evaluating one's financial situation, setting specific retirement goals, and formulating a comprehensive plan to achieve those goals. With the assistance of retirement planning professionals, individuals can make informed decisions about their savings, investments, and income sources to ensure a comfortable and worry-free retirement. The specific types of Alabama Monthly Retirement Planning available may include: 1. Alabama Monthly Retirement Planning for State Employees: This specialized retirement planning program caters specifically to individuals employed by the state of Alabama. It helps state employees maximize their retirement benefits, understand the state pension system, and make informed decisions about additional savings and investments for a secure retirement. 2. Alabama Monthly Retirement Planning for Private Sector Employees: This type of retirement planning focuses on individuals working in the private sector in Alabama. It provides guidance on saving for retirement through employer-sponsored retirement plans such as 401(k)s or individual retirement accounts (IRAs). It also addresses investment strategies and asset allocation to ensure long-term financial stability. 3. Alabama Monthly Retirement Planning for Small Business Owners: Small business owners face unique challenges when it comes to retirement planning. This type of retirement planning in Alabama assists small business owners in setting up retirement plans for themselves and their employees, such as Simplified Employee Pension (SEP) IRAs or solo 401(k)s. It also offers strategies for effectively managing business finances while prioritizing retirement savings. 4. Alabama Monthly Retirement Planning for Medicare and Healthcare: As individuals approach retirement, healthcare expenses become a significant consideration. This type of retirement planning focuses on understanding Medicare options available in Alabama and strategizing ways to cover additional healthcare costs effectively. It may also provide guidance on long-term care insurance and retirement healthcare savings accounts. 5. Alabama Monthly Retirement Planning for Estate Planning: Estate planning is an essential aspect of retirement planning. This specialized program assists Alabama residents in creating comprehensive estate plans that outline their wishes for the distribution of assets, minimizing estate taxes, and ensuring financial security for loved ones once retired. In conclusion, Alabama Monthly Retirement Planning encompasses various types of retirement planning tailored to specific groups of individuals, including state employees, private sector employees, small business owners, and those concerned with healthcare and estate planning. Through careful evaluation of financial circumstances, goal setting, and professional guidance, individuals can secure a comfortable and financially stable retirement in Alabama.

Alabama Monthly Retirement Planning

Description

How to fill out Alabama Monthly Retirement Planning?

If you wish to comprehensive, obtain, or print legal file templates, use US Legal Forms, the greatest collection of legal kinds, which can be found on the web. Utilize the site`s simple and convenient research to obtain the files you require. Various templates for organization and specific reasons are sorted by types and suggests, or search phrases. Use US Legal Forms to obtain the Alabama Monthly Retirement Planning in a couple of clicks.

If you are already a US Legal Forms buyer, log in to the account and click on the Acquire button to get the Alabama Monthly Retirement Planning. You can also access kinds you in the past acquired from the My Forms tab of the account.

If you use US Legal Forms initially, refer to the instructions beneath:

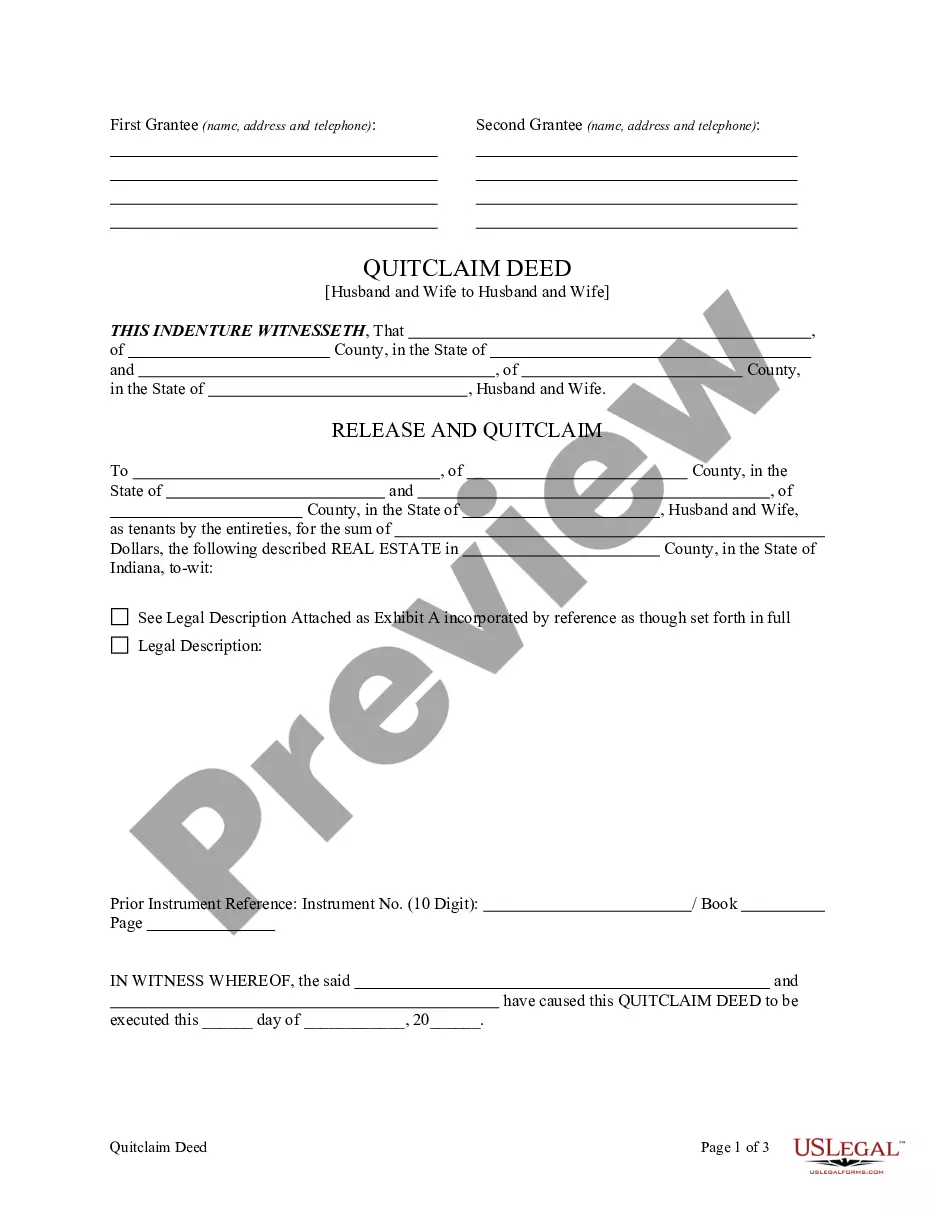

- Step 1. Be sure you have chosen the shape for that appropriate metropolis/nation.

- Step 2. Take advantage of the Review choice to examine the form`s articles. Don`t forget about to read through the description.

- Step 3. If you are not satisfied with the form, utilize the Search discipline near the top of the display screen to discover other types in the legal form web template.

- Step 4. Once you have found the shape you require, select the Acquire now button. Select the prices program you choose and add your references to sign up on an account.

- Step 5. Method the deal. You can use your credit card or PayPal account to finish the deal.

- Step 6. Find the format in the legal form and obtain it on your own product.

- Step 7. Full, change and print or sign the Alabama Monthly Retirement Planning.

Every single legal file web template you get is yours permanently. You might have acces to each and every form you acquired inside your acccount. Select the My Forms area and choose a form to print or obtain once more.

Contend and obtain, and print the Alabama Monthly Retirement Planning with US Legal Forms. There are millions of professional and state-particular kinds you can use to your organization or specific requirements.

Form popularity

FAQ

A member is vested when he or she has 10 years of creditable service. 2022 Being vested qualifies you for a monthly. retirement check once you reach age 60 under. Tier 1 or age 62 (56 FLC) under Tier 2, even if you.

The Public School Retirement System of Missouri (PSRS) is a defined benefit (DB) retirement plan that provides service retirement and disability benefits to qualified members, and survivor benefits to qualified beneficiaries.

The TRS was established October 1, 1940, by the Alabama Legislature for the purpose of providing retirement allowances for teachers of the state of Alabama. Benefits are calculated as a percentage of average final compensation multiplied by years of creditable service.

What is the Rule of 80? This provision creates a so-called Rule of 80, a new definition of Normal Retirement for members of the Hybrid Defined Benefit Component. This allows members to claim a full, unreduced pension benefit if their combined age and years of service equal at least 80, beginning at age 50.

The ASRS is a defined benefit plan and is tax qualified under section 401(a) of the Internal Revenue Code. It provides for a lifelong benefit based on years of service earned, or worked, and your ending salary.

Your RSA pension schemes benefits will provide you (or your spouse or civil partner, in the event of your death) with a steady income for life, and normally has some increases to protect it against inflation (defined in the Scheme Rules).

Alabama's retirement plans qualify as a 401(a) plan. Each plan is available to different types of employees, depending on your profession. Many full-time, regular, public employees are eligible for the Employees' Retirement System (ERS). If you are eligible, you must participate in the system.

Tier 1 members are eligible for retirement benefits at age 60 with at least 10 years of service. If you have 25 years of service, you can retire at any age and apply for full retirement benefits from RSA. Tier 2 members are eligible for retirement benefits at age 62 with at least 10 years of service.

Tier 1 members are eligible for retirement benefits at age 60 with at least 10 years of service. If you have 25 years of service, you can retire at any age and apply for full retirement benefits from RSA. Tier 2 members are eligible for retirement benefits at age 62 with at least 10 years of service.

Alabama's annual cost of living was $42,154 but drops to $23,978 after using Social Security income. GoBankingRates estimates you would need $599,453 to retire in Alabama.