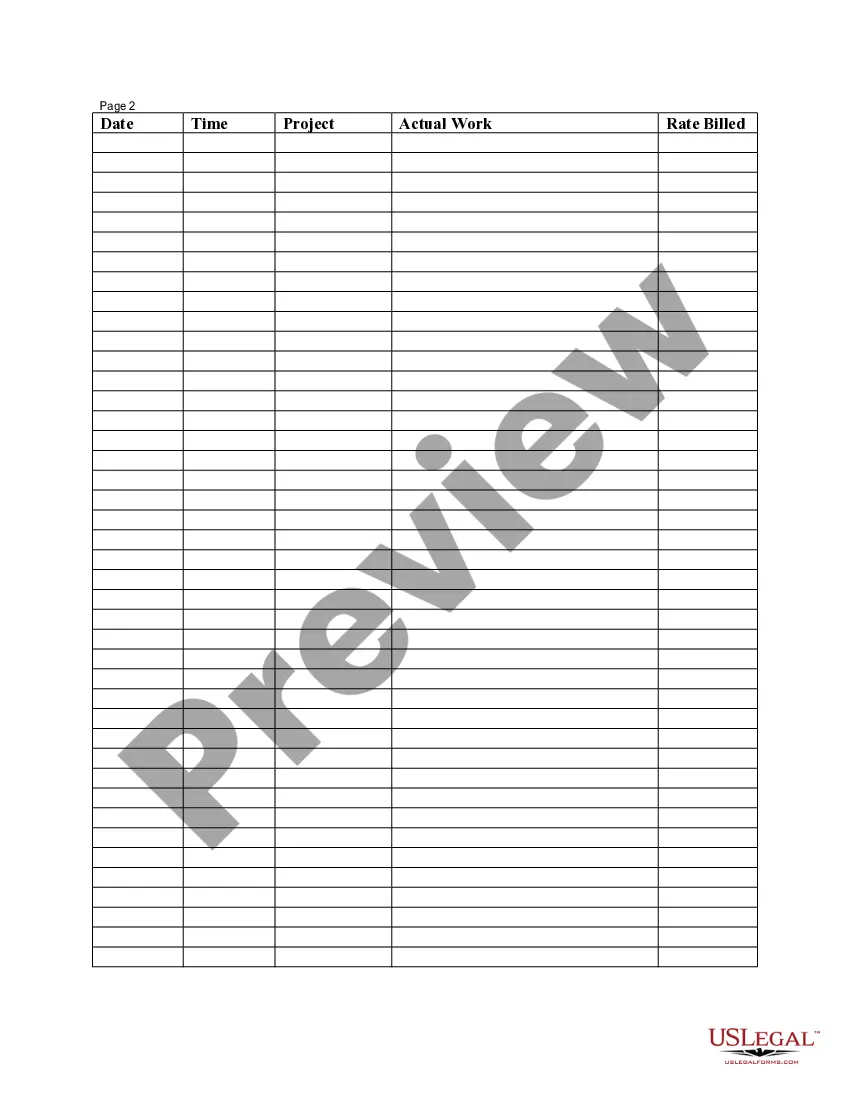

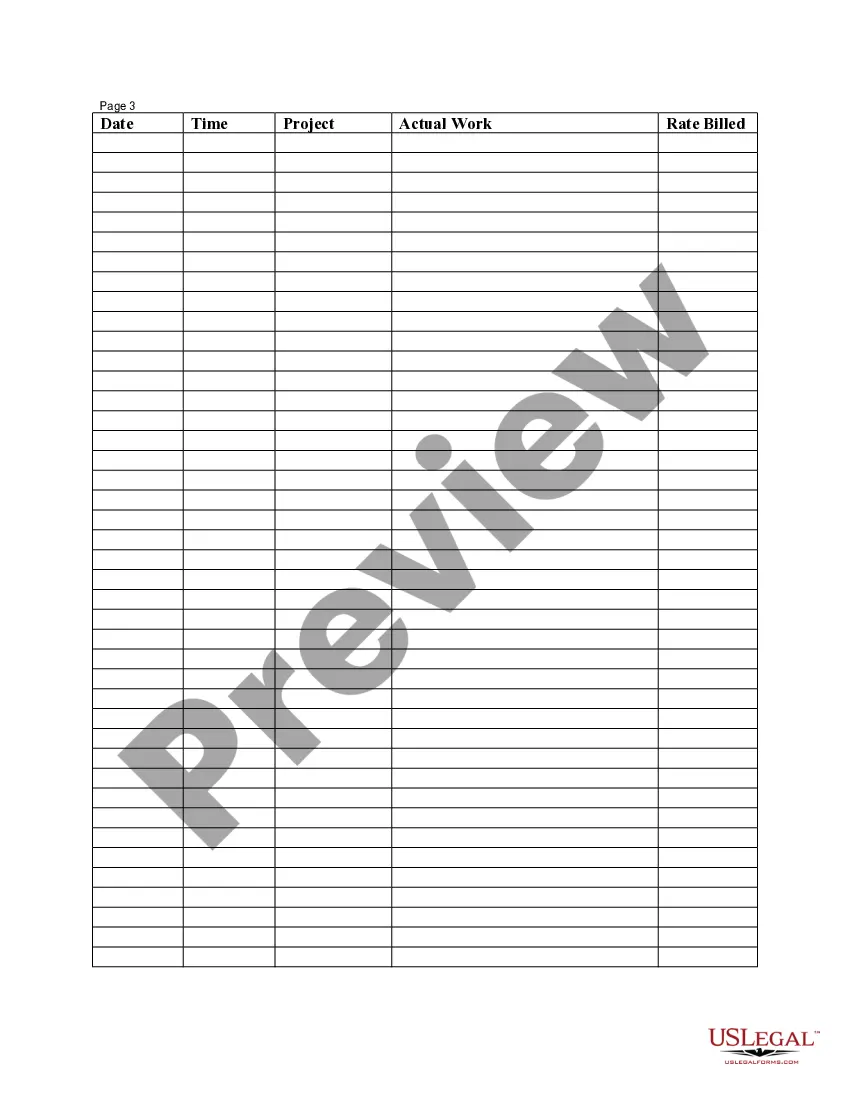

Alabama Employee Time Sheet

Description

How to fill out Employee Time Sheet?

Selecting the optimal endorsed document format can be a challenge.

Certainly, there are numerous templates accessible online, but how can you find the sanctioned version you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Alabama Employee Time Sheet, which can be utilized for business and personal purposes.

If the form does not meet your requirements, use the Search field to find the appropriate version. Once you are certain that the form is accurate, click the Buy now button to obtain the form. Choose the pricing plan you prefer and input the required information. Create your account and complete the order using your PayPal account or credit card. Select the document format and download the legal document template to your device. Complete, edit, print, and sign the acquired Alabama Employee Time Sheet. US Legal Forms is the largest repository of legal forms where you can find various document templates. Utilize this service to download professionally crafted papers that meet state requirements.

- All forms are verified by experts and comply with both state and federal regulations.

- If you are already registered, Log In to your account and then click the Download button to access the Alabama Employee Time Sheet.

- Utilize your account to browse the legal forms you have previously acquired.

- Visit the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

- Firstly, ensure that you have selected the correct form for your city/region. You can preview the form using the Preview button and read the form description to confirm it is the right one for you.

Form popularity

FAQ

Two types of taxes fall under the category of FICA taxes: Medicare taxes and Social Security taxes. Paying FICA taxes is mandatory for most employees and employers under the Federal Insurance Contributions Act.

FICA refers to the combined taxes withheld for Social Security and Medicare (FICA stands for the Federal Insurance Contributions Act). On your pay statement, Social Security taxes are referred to as OASDI, for Old Age Survivor and Disability Insurance.

Alabama Payroll Taxes The state has a progressive income tax, meaning the more money your employees make, the higher the income tax. The tax rate ranges from 2% to 5%. In addition, depending on where in Alabama your employees live or work, certain cities also levy income taxes ranging from 0% to 2%.

Alabama collects a state income tax, with rates of 2%, 4% and 5%. In addition to a state sales tax, counties and cities are allowed to collect taxes on purchases made in their jurisdictions.

Each new employee will need to fill out the I-9 Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.

Alabama is one of many states which impose a state tax on personal income. State withholding tax is the money an employer is required to withhold from each employee's wages to pay the state income tax of the employee.

FICA is a U.S. federal payroll tax. It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self- employment. As you work and pay FICA taxes, you earn credits for Social Security benefits.

Go to your myBama account and then go to the Employee tab (Banner Self-Service box, Employee Services folder, Pay Information folder, Direct Deposit document). All new employees registering for direct deposit or current employees making changes to their accounts must use the online form.

It stands for the Federal Insurance Contributions Act and is deducted from each paycheck. Your nine-digit number helps Social Security accurately record your covered wages or self- employment. As you work and pay FICA taxes, you earn credits for Social Security benefits.

Who Qualifies for a FICA Tax Refund? If you are in the United States on an F-1, J-1, M-1, Q-1 or Q-2 visa or are classified as a non-resident immigrant, you qualify for a FICA tax refund. The refund also applies to those who overpay the system once they reach the wage base limit of $142,800 in 2021.