Alabama Challenge to Credit Report of Experian, TransUnion, and/or Equifax

Description

How to fill out Challenge To Credit Report Of Experian, TransUnion, And/or Equifax?

Choosing the best lawful papers design might be a have a problem. Needless to say, there are a lot of themes accessible on the Internet, but how would you discover the lawful kind you will need? Use the US Legal Forms web site. The assistance gives thousands of themes, such as the Alabama Challenge to Credit Report of Experian, TransUnion, and/or Equifax, that can be used for enterprise and private requires. Each of the forms are inspected by professionals and fulfill state and federal needs.

If you are presently authorized, log in to the accounts and click on the Acquire switch to have the Alabama Challenge to Credit Report of Experian, TransUnion, and/or Equifax. Make use of your accounts to look from the lawful forms you possess purchased formerly. Visit the My Forms tab of your respective accounts and acquire another backup from the papers you will need.

If you are a whole new user of US Legal Forms, listed below are straightforward instructions that you should adhere to:

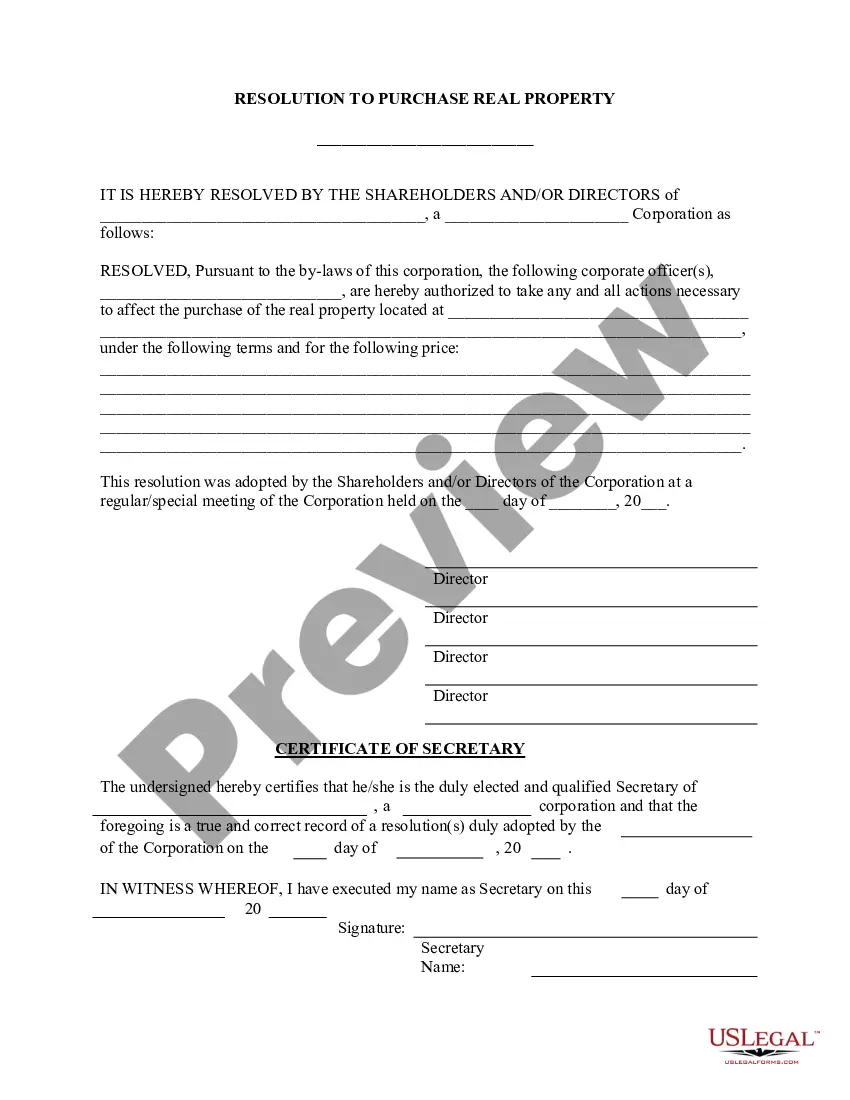

- First, make certain you have chosen the appropriate kind for your personal city/area. You may look through the form utilizing the Review switch and read the form information to make certain this is basically the best for you.

- When the kind is not going to fulfill your preferences, take advantage of the Seach area to obtain the correct kind.

- Once you are sure that the form is acceptable, go through the Buy now switch to have the kind.

- Select the rates program you would like and enter the necessary information and facts. Make your accounts and pay money for the order with your PayPal accounts or Visa or Mastercard.

- Choose the file structure and obtain the lawful papers design to the gadget.

- Comprehensive, change and print and signal the received Alabama Challenge to Credit Report of Experian, TransUnion, and/or Equifax.

US Legal Forms will be the biggest catalogue of lawful forms in which you can see numerous papers themes. Use the company to obtain appropriately-made files that adhere to express needs.

Form popularity

FAQ

Freezing your credit is free, and you'll need to do it with all three credit bureaus to lock down each of your credit reports. And again, the freeze will stay in place until you lift it.

The law was passed in 1970 and amended twice. It is primarily aimed at the three major credit reporting agencies ? Experian, Equifax and TransUnion ? because of the widespread use of the information those bureaus collect and sell.

By phone: To initiate a dispute by phone, you'll call the number displayed on your Experian credit report. If you'd like to have a copy of your credit report delivered to you by mail, call 866-200-6020. By mail: You can dispute without a credit report by writing to Experian, P.O. Box 4500, Allen, TX 75013.

If you want to freeze your credit, you need to do it at each of the three major credit bureaus: Equifax (1-800-349-9960) TransUnion (1-888-909-8872) Experian (1-888-397-3742) .

To freeze your credit, you have to contact each of the three credit bureaus individually. Placing a credit freeze is free for you and your children, as is lifting it when applying for new credit.

The Bottom Line You are entitled by law to freeze your credit reports anytime, for free. To do so, you must request a security freeze at each of the national credit bureaus individually. Freezing your credit limits criminals' ability to open loans and credit card accounts in your name.

A freeze can give you a false sense of security ? you may still be susceptible to credit fraud or other fraud involving your Social Security number.

If you identify an error on your credit report, you should start by disputing that information with the credit reporting company (Experian, Equifax, and/or Transunion). You should explain in writing what you think is wrong, why, and include copies of documents that support your dispute.