Alabama Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty

Description

How to fill out Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice Or Course Of Dealing Stockbroker Churning - Violation Of Blue Sky Law And Breach Of Fiduciary Duty?

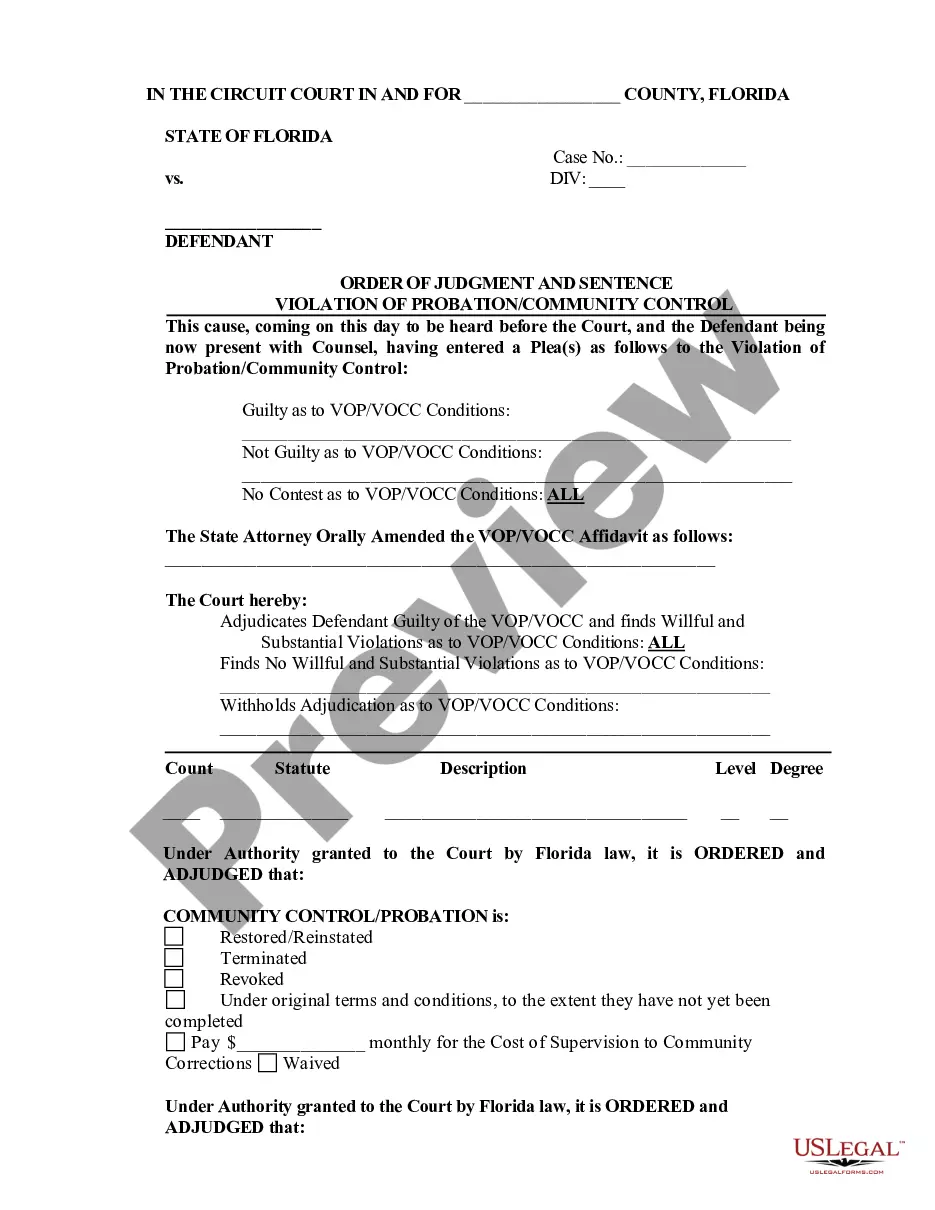

Choosing the right legitimate record format can be quite a have difficulties. Needless to say, there are tons of web templates available online, but how do you get the legitimate form you want? Make use of the US Legal Forms internet site. The service gives a large number of web templates, including the Alabama Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty, that can be used for business and private requires. Each of the types are checked out by professionals and meet up with federal and state requirements.

In case you are previously signed up, log in in your account and click the Download button to find the Alabama Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty. Utilize your account to appear through the legitimate types you possess ordered in the past. Proceed to the My Forms tab of the account and get one more version from the record you want.

In case you are a whole new end user of US Legal Forms, listed here are basic recommendations so that you can comply with:

- Very first, make certain you have selected the right form for your personal town/state. You can look over the shape while using Preview button and browse the shape outline to make certain this is basically the best for you.

- When the form does not meet up with your expectations, make use of the Seach discipline to obtain the proper form.

- Once you are certain that the shape is proper, click the Acquire now button to find the form.

- Opt for the rates program you would like and enter the needed information. Design your account and pay money for an order using your PayPal account or credit card.

- Opt for the file structure and down load the legitimate record format in your product.

- Comprehensive, edit and print out and indicator the obtained Alabama Jury Instruction - 4.4.3 Rule 10(b) - 5(c) Fraudulent Practice or Course of Dealing Stockbroker Churning - Violation of Blue Sky Law and Breach of Fiduciary Duty.

US Legal Forms may be the largest library of legitimate types in which you can see a variety of record web templates. Make use of the service to down load appropriately-produced files that comply with express requirements.