Alabama Net Lease of Equipment (Personal Property Net Lease) with no Warranties by Lessor and Option to Purchase is a legal agreement that outlines the terms and conditions under which a lessee can lease equipment from the lessor. This contract provides detailed specifications, usage limitations, and financial obligations for both parties involved in the transaction. In this type of net lease, the lessor transfers the right to use the equipment to the lessee for a specified period, typically for business or commercial purposes. The lessee undertakes the responsibility to maintain and operate the equipment while assuming all associated costs, including repairs, insurance, and taxes. The lessor, however, does not provide any warranties regarding the equipment's condition or fitness for a particular purpose. This form of net lease also includes an option to purchase the equipment at the end of the lease term. The lessee has the opportunity to exercise this option by paying a predetermined purchase price within a specified timeframe. By doing so, the lessee gains ownership of the equipment, eliminating the need for further lease payments. It is important to note that there might be variations of the Alabama Net Lease of Equipment (Personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, depending on the unique requirements of the lessor and lessee. These variations may include: 1. Short-term Net Lease: This type of net lease has a shorter duration, typically ranging from a few months to a year. It is commonly used when the lessee only requires equipment for a specific project or a temporary period. 2. Long-term Net Lease: In contrast to a short-term net lease, a long-term net lease extends over a more extended period, often several years. This option is suitable for lessees who require equipment for ongoing business operations. 3. Conditional Net Lease: A conditional net lease puts certain conditions on the lessee's ability to exercise the option to purchase. For example, the lessee may need to fulfill specific performance metrics or meet financial obligations before becoming eligible to buy the equipment. 4. Master Net Lease: A master net lease allows the lessee to add or replace equipment during the lease term without requiring separate agreements for each addition or replacement. It provides flexibility to adapt to changing business needs. 5. Finance Net Lease: In a finance net lease, the lessor acts as a financing entity, allowing the lessee to make lease payments with an option to purchase the equipment at the end. This type of net lease is common when the lessee intends to eventually own the equipment. These variations demonstrate the flexibility of the Alabama Net Lease of Equipment (Personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. Each type can be customized to meet the specific requirements and preferences of the parties involved in the agreement, ensuring a mutually beneficial transaction.

Alabama Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

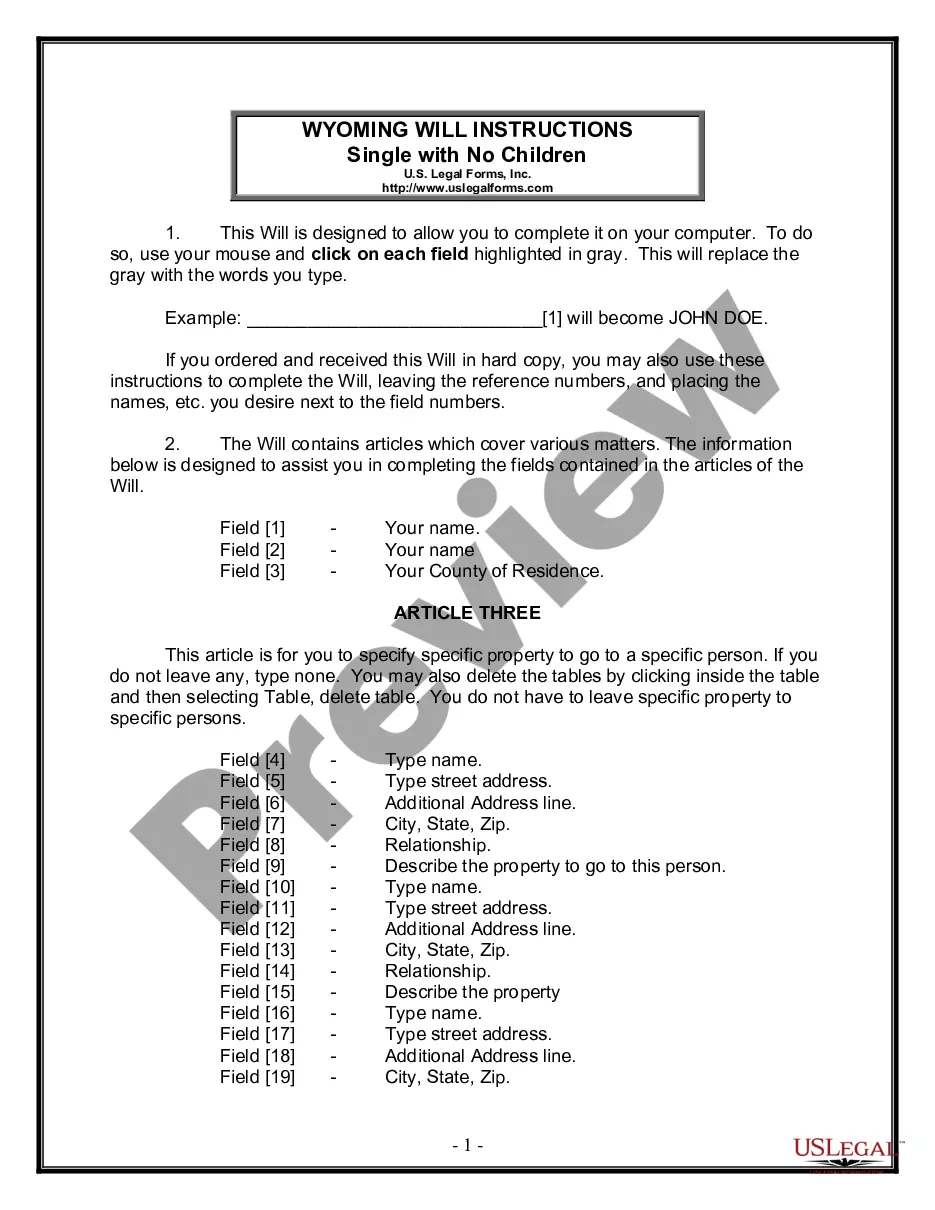

How to fill out Alabama Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

You may commit hrs online looking for the legal file design that suits the federal and state demands you need. US Legal Forms offers 1000s of legal kinds that are analyzed by specialists. It is simple to download or print out the Alabama Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase from our assistance.

If you have a US Legal Forms bank account, you are able to log in and click on the Download switch. After that, you are able to comprehensive, revise, print out, or indication the Alabama Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase. Each and every legal file design you buy is your own property forever. To get another version associated with a bought kind, visit the My Forms tab and click on the related switch.

If you are using the US Legal Forms website the very first time, adhere to the basic directions listed below:

- Very first, make sure that you have selected the right file design for that area/town of your choosing. Look at the kind information to make sure you have picked the correct kind. If accessible, take advantage of the Preview switch to search with the file design at the same time.

- If you would like discover another version from the kind, take advantage of the Look for field to find the design that meets your needs and demands.

- Once you have discovered the design you want, click Buy now to continue.

- Select the rates prepare you want, enter your references, and register for your account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal bank account to purchase the legal kind.

- Select the format from the file and download it to your system.

- Make alterations to your file if necessary. You may comprehensive, revise and indication and print out Alabama Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase.

Download and print out 1000s of file templates using the US Legal Forms website, that provides the largest variety of legal kinds. Use skilled and status-distinct templates to deal with your company or individual demands.

Form popularity

FAQ

There are three main types of net leases: single net leases, double net leases, and triple net leases. When a tenant signs a single net lease, they pay one of the three expense categories: taxes, maintenance, and insurance fees.

The three most common types of leases are gross leases, net leases, and modified gross leases....3 Types of Leases Business Owners Should UnderstandThe Gross Lease. The gross lease tends to favor the tenant.The Net Lease. The net lease, however, tends to favor the landlord.The Modified Gross Lease.

There are different types of leases, but the most common types are absolute net lease, triple net lease, modified gross lease, and full-service lease.

Learn more about Equipment Leasing!Sale/Leaseback: (allows you to use your equipment to get working capital)True Lease or Operating Equipment Leases: (Also known as fair market value leases)The P.U.T. Option Lease (Purchase upon Termination)TRAC Equipment Leases.More items...

The term net lease refers to a contractual agreement where a lessee pays a portion or all of the taxes, insurance fees, and maintenance costs for a property in addition to rent. Net leases are commonly used in commercial real estate.

Most financial leases are "net" leases, meaning that the lessee is responsible for maintaining and insuring the asset and paying all property taxes, if applicable. Financial leases are often used by businesses for expensive capital equipment.

Net leases generally include property taxes, property insurance premiums, or maintenance costs, and are often used in commercial real estate. In addition to triple net leases, the other types of net leases are single net leases and double net leases.

The term "net lease" is distinguished from the term "gross lease". In a net lease, the property owner receives the rent "net" after the expenses that are to be passed through to tenants are paid.

The term net lease refers to a contractual agreement where a lessee pays a portion or all of the taxes, insurance fees, and maintenance costs for a property in addition to rent. Net leases are commonly used in commercial real estate.