Alabama Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

Have you ever found yourself in a scenario where you need paperwork for either business or personal reasons nearly every day.

There are numerous authentic document formats accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast selection of template formats, such as the Alabama Private Annuity Agreement, that are designed to comply with federal and state regulations.

Once you find the appropriate form, click on Acquire now.

Choose the pricing plan you want, provide the necessary information to create your account, and complete the transaction using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Alabama Private Annuity Agreement anytime if needed; just follow the necessary form to download or print the document template. Utilize US Legal Forms, one of the most extensive collections of legitimate forms, to save time and avoid errors. The service delivers professionally created legal document formats that you can use for a variety of purposes. Create an account on US Legal Forms and start making your life easier.

- If you're already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Alabama Private Annuity Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

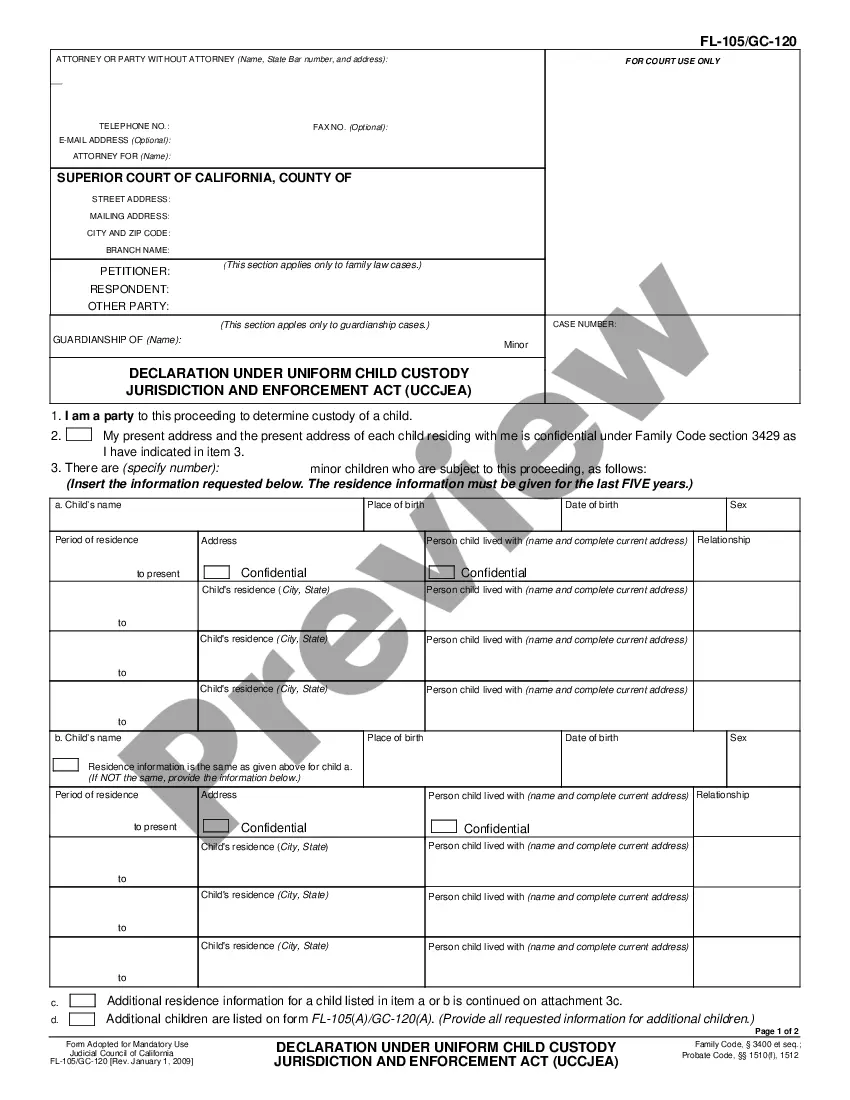

- Locate the form you require and ensure it is for the correct city/region.

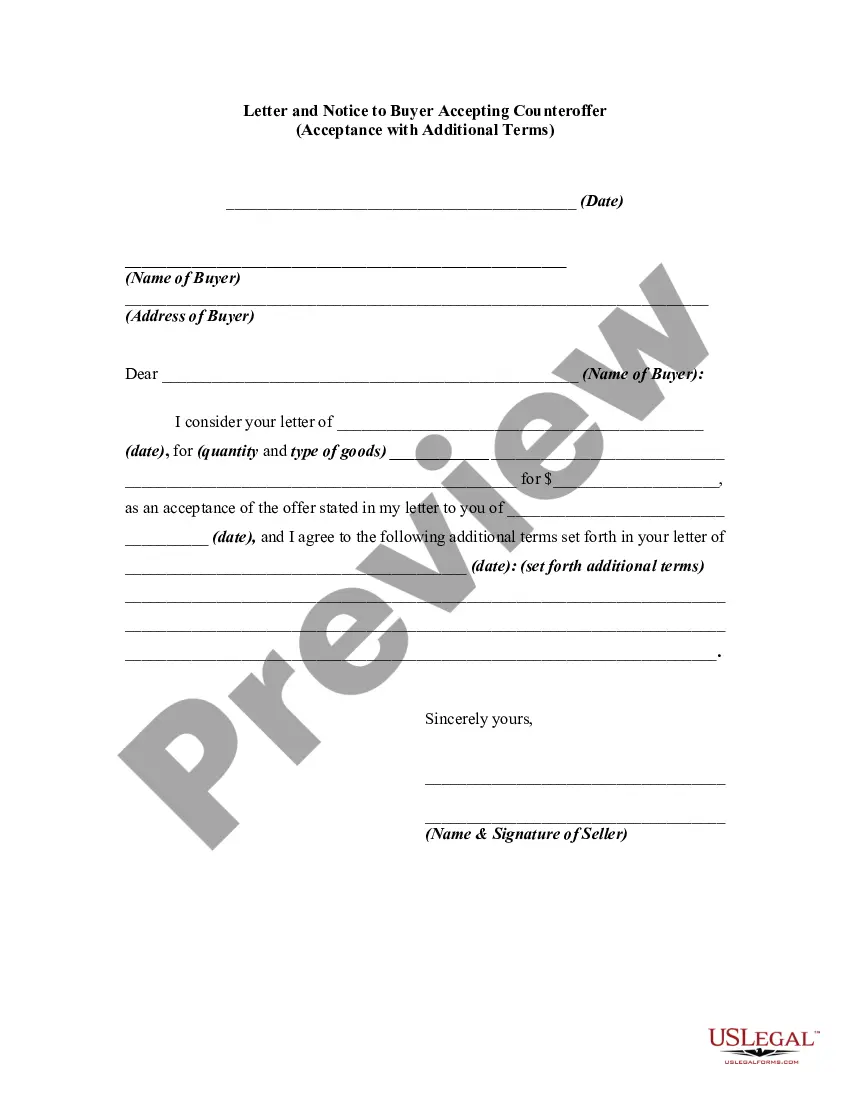

- Utilize the Preview button to inspect the form.

- Review the information to confirm that you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

The monthly payout for a $100,000 annuity varies based on factors like interest rates and the payout option selected. Generally, if you choose a fixed-income option, you can expect a range between $500 to $700 each month. For precise calculations, consider using the Alabama Private Annuity Agreement with a qualified advisor to analyze your specific situation.

Form 40A is Alabama's Individual Resident Income Tax Return (short version) and it applies to full year residents only. Please keep in mind that if you file Form 40A close to the deadline, there might be a delay of 90 days until you receive the refund.

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed-upon schedule in exchange for the property transfer.

Income Exempt from Alabama Income TaxationUnited States Civil Service Retirement System benefits.State of Alabama Teachers Retirement System benefits.State of Alabama Employees Retirement System benefits.State of Alabama Judicial Retirement System benefits.Military retirement pay.More items...

The purpose of regulation 129 is to provide standards for the disclosure of certain minimum information about annuity contracts to protect consumers and foster consumer education.

Income Taxes in AlabamaAll other forms of retirement and investment income including income from annuities are taxed in Alabama. All interest income except that earned from government bonds is subject to Alabama income tax as well.

Even though traditional pension benefits aren't subject to tax in Alabama, amounts paid through IRAs and employer-sponsored defined-contribution retirement plans such as 401(k) plan accounts are included in taxable income for Alabama income tax purposes.