Alabama Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

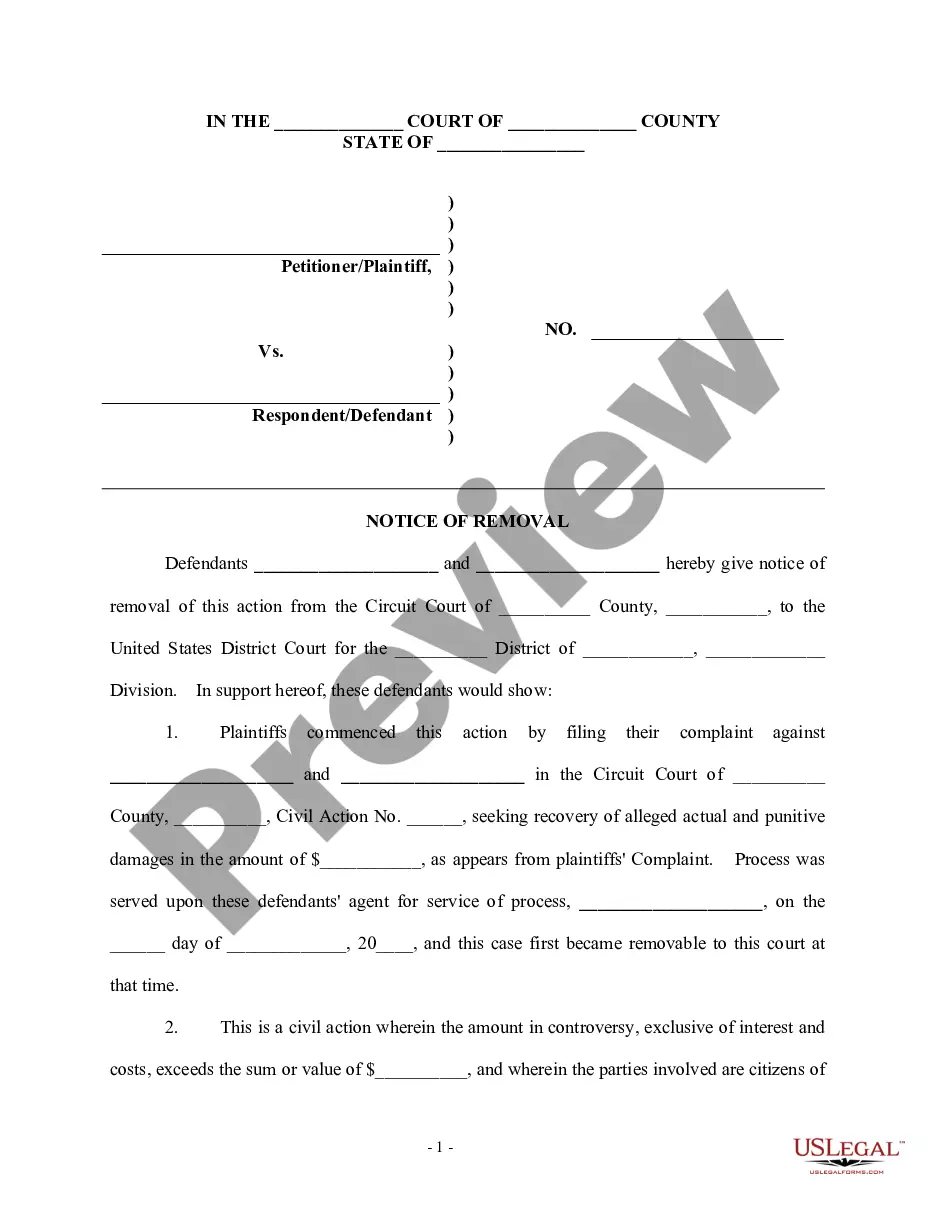

How to fill out Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

If you want to comprehensive, down load, or print out authorized document web templates, use US Legal Forms, the largest collection of authorized types, which can be found on the web. Use the site`s simple and easy handy look for to obtain the files you want. Different web templates for organization and individual purposes are sorted by classes and suggests, or key phrases. Use US Legal Forms to obtain the Alabama Liquidation of Partnership with Authority, Rights and Obligations during Liquidation within a couple of click throughs.

When you are already a US Legal Forms client, log in to your account and then click the Download key to get the Alabama Liquidation of Partnership with Authority, Rights and Obligations during Liquidation. You may also entry types you formerly delivered electronically in the My Forms tab of your account.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have chosen the form to the proper town/region.

- Step 2. Make use of the Review method to look through the form`s information. Do not forget to see the outline.

- Step 3. When you are not happy with the kind, use the Lookup field on top of the screen to get other variations of the authorized kind format.

- Step 4. Once you have discovered the form you want, click on the Purchase now key. Pick the pricing plan you prefer and add your accreditations to sign up to have an account.

- Step 5. Process the financial transaction. You can use your charge card or PayPal account to complete the financial transaction.

- Step 6. Select the structure of the authorized kind and down load it on your system.

- Step 7. Total, modify and print out or signal the Alabama Liquidation of Partnership with Authority, Rights and Obligations during Liquidation.

Each and every authorized document format you get is your own property eternally. You might have acces to each kind you delivered electronically inside your acccount. Click the My Forms area and decide on a kind to print out or down load once again.

Contend and down load, and print out the Alabama Liquidation of Partnership with Authority, Rights and Obligations during Liquidation with US Legal Forms. There are thousands of specialist and status-particular types you can use for your organization or individual requires.

Form popularity

FAQ

Liability for General and Limited Partners Limited partners cannot incur obligations on behalf of the partnership, participate in daily operations, or manage the operation. Because limited partners do not manage the business, they are not personally liable for the partnership's debts.

A liquidation marks the official ending of a partnership agreement. To end the partnership, the parties involved sell the property the business owns, and each partner receives a share of the remaining money.

If the partnership decides to liquidate, the assets of the partnership are sold, liabilities are paid off, and any remaining cash is distributed to the partners according to their capital account balances.

Therefore, strictly speaking, a minor cannot be a full-fledged partners. But with the consent of all the partners he can be admitted into partnership for benefits only. He is not personally liable to third parties for the debts of the firm. Was this answer helpful?

The following four accounting steps must be taken, in order, to dissolve a partnership: sell noncash assets; allocate any gain or loss on the sale based on the income-sharing ratio in the partnership agreement; pay off liabilities; distribute any remaining cash to partners based on their capital account balances.

In order to dissolve a partnership, the following four accounting steps must be executed: sell noncash assets; allocate any gains or losses arising from the sale based on the partnership agreement; pay off liabilities; distribute the remaining funds based on capital account balances of the partners.

B. A person admitted as a partner into an existing partnership is not personally liable for any partnership obligation incurred before the person's admission as a partner.

Key Takeaways. A general partnership is a business made up of two or more partners, each sharing the business's debts, liabilities, and assets. Partners assume unlimited liability, potentially subjecting their personal assets to seizure if the partnership becomes insolvent.

Limited Liability Partnership (LLP) This type of partnership can ensure that not all partners have personal liability for the acts of other partners.

All partners will share profits and losses equally, unless otherwise agreed. one partner cannot be expelled by the other partners unless otherwise agreed. a partner is only responsible for partnership debts and liabilities that arise after the person becomes a partner.