The Alabama Unrestricted Charitable Contribution of Cash refers to the tax deduction available to individuals or businesses who donate funds to qualifying charitable organizations in Alabama. By making an unrestricted cash contribution, donors can help support various causes and programs and receive tax benefits in return. This type of contribution allows individuals or businesses to give money to a charitable organization without specifically designating how it should be used. Unlike restricted contributions which are often directed towards specific projects or initiatives, unrestricted donations provide flexibility to the organization as they can allocate funds according to their priorities. The Alabama Unrestricted Charitable Contribution of Cash is an essential means for individuals and businesses to actively contribute to the betterment of their communities. By donating cash, donors provide crucial financial support to charitable organizations, enabling them to carry out their missions and make a positive impact on society. When making such contributions in Alabama, it is important to ensure that the recipient organization qualifies as a charitable organization under the relevant tax laws. These organizations typically include nonprofit entities that focus on various humanitarian, educational, religious, or environmental causes. Some examples of Alabama Unrestricted Charitable Contributions of Cash include donations to food banks, homeless shelters, educational foundations, healthcare organizations, animal welfare groups, youth programs, and arts and culture institutions. By contributing cash to these organizations, individuals and businesses can help address pressing social issues, promote education, reduce poverty, improve healthcare access, foster artistic endeavors, and enhance the overall quality of life in Alabama communities. Taking advantage of the Alabama Unrestricted Charitable Contribution of Cash offers multiple benefits. Donors can reduce their taxable income by claiming deductions on their state taxes. Additionally, these contributions allow individuals and businesses to actively participate in shaping and supporting programs and causes they care about. It is crucial to keep detailed records of cash donations and obtain receipts from charitable organizations as documentation for tax purposes. By carefully adhering to the relevant guidelines and retaining the necessary documentation, individuals and businesses can fully leverage the benefits associated with the Alabama Unrestricted Charitable Contribution of Cash. In summary, the Alabama Unrestricted Charitable Contribution of Cash provides an opportunity for individuals and businesses in Alabama to make a positive impact on various causes and organizations. By donating cash to qualifying charitable organizations, donors not only support valuable initiatives but also receive tax benefits. Whether contributing to education, health, poverty reduction, or arts and culture, the Alabama Unrestricted Charitable Contribution of Cash allows donors to actively participate in creating a better future for their communities.

Alabama Unrestricted Charitable Contribution of Cash

Description

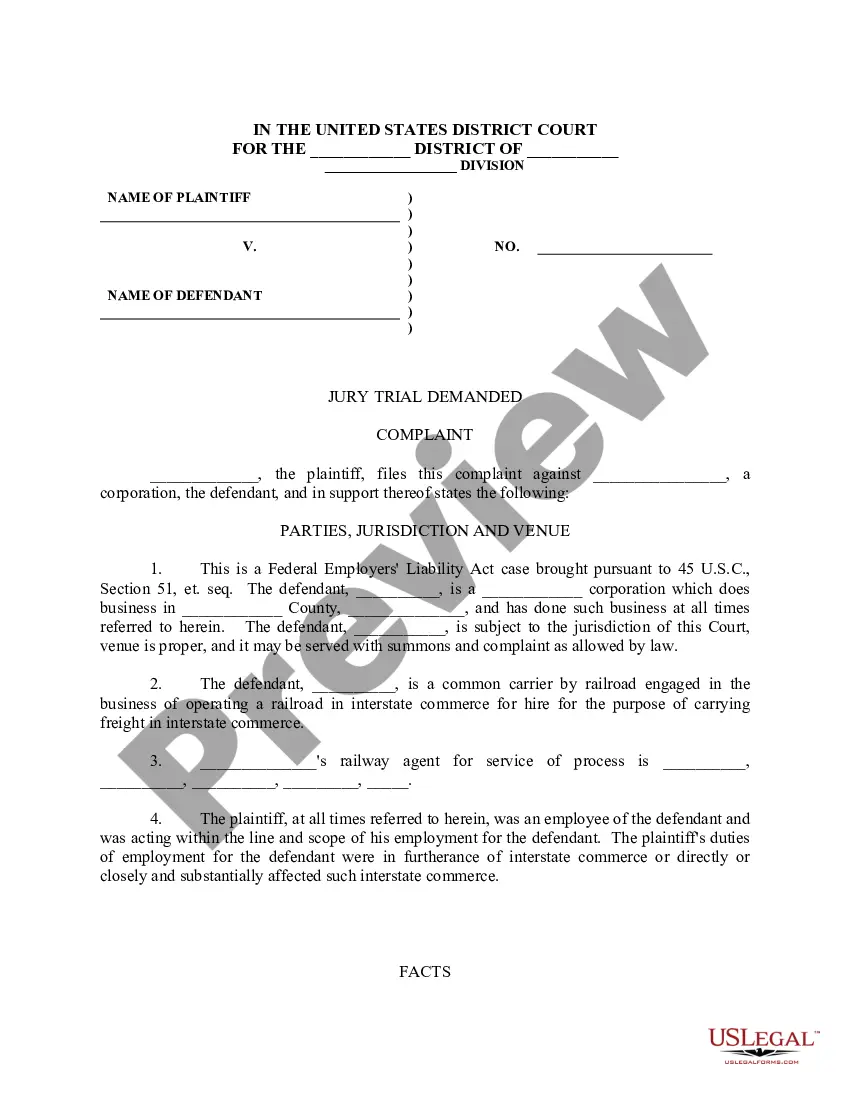

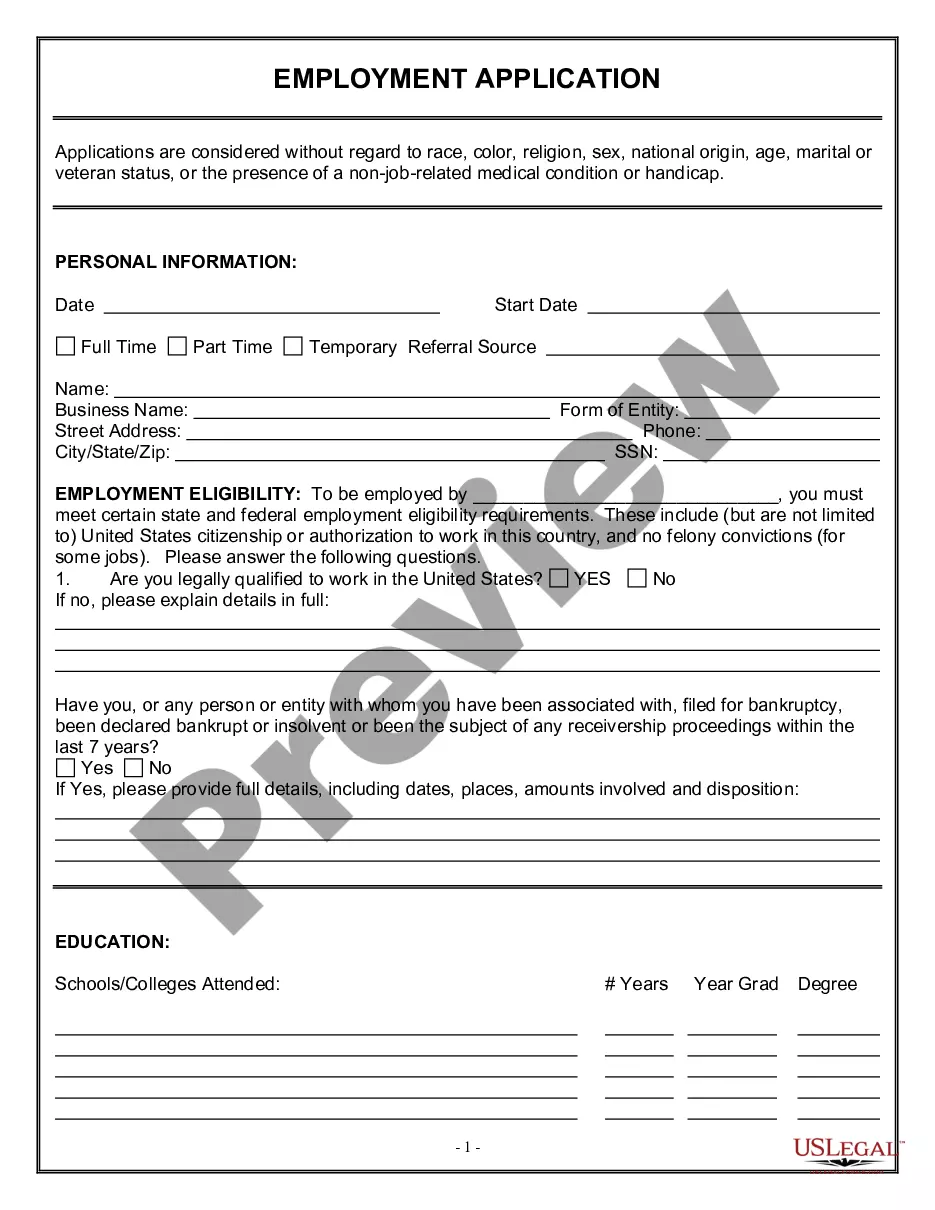

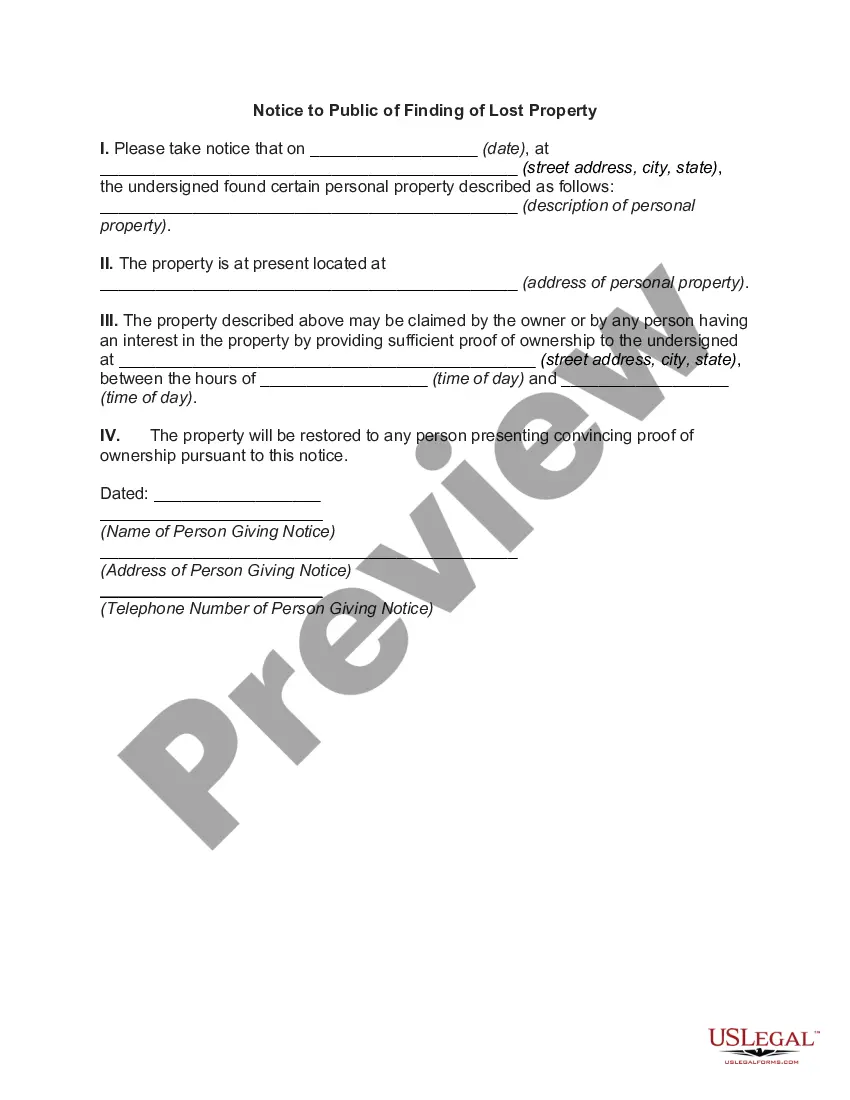

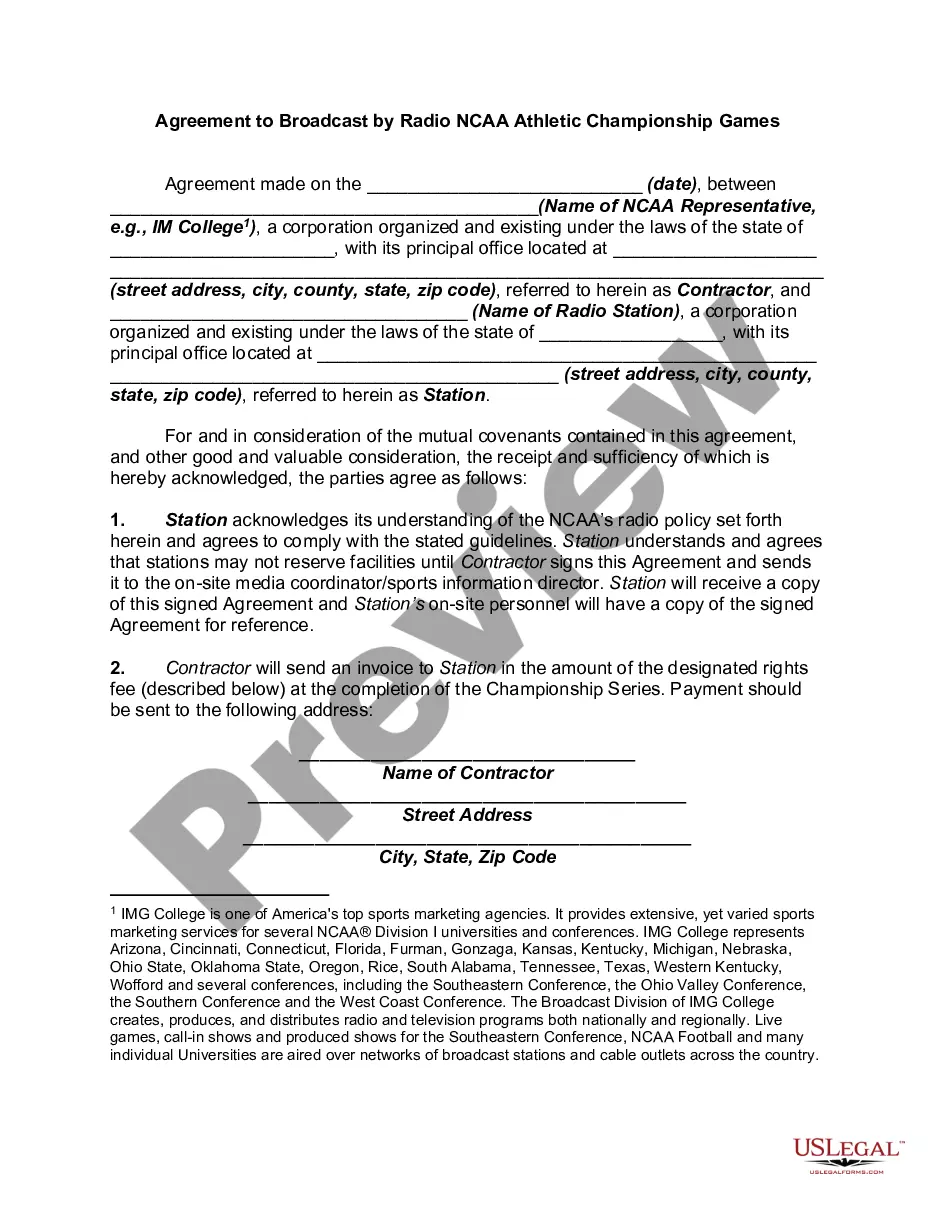

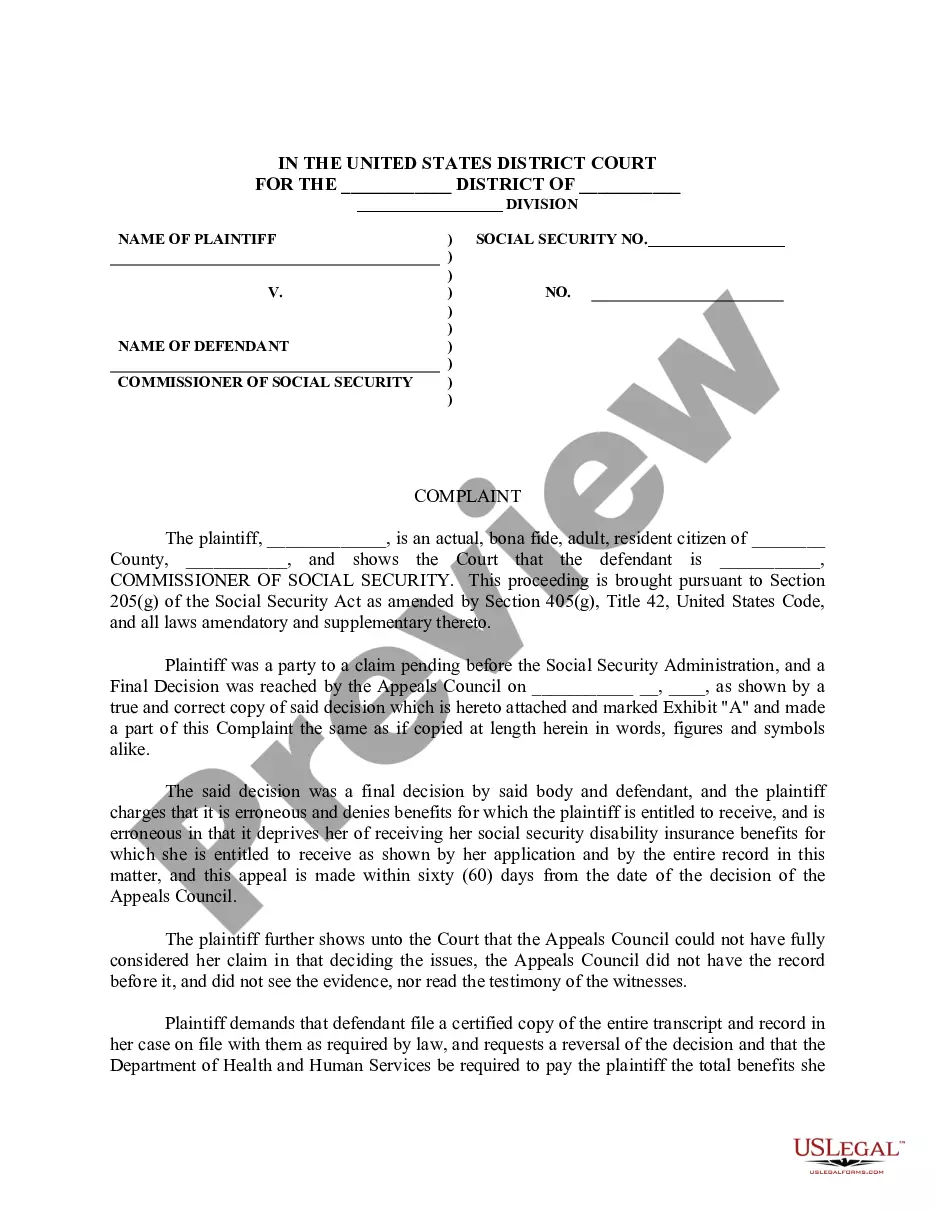

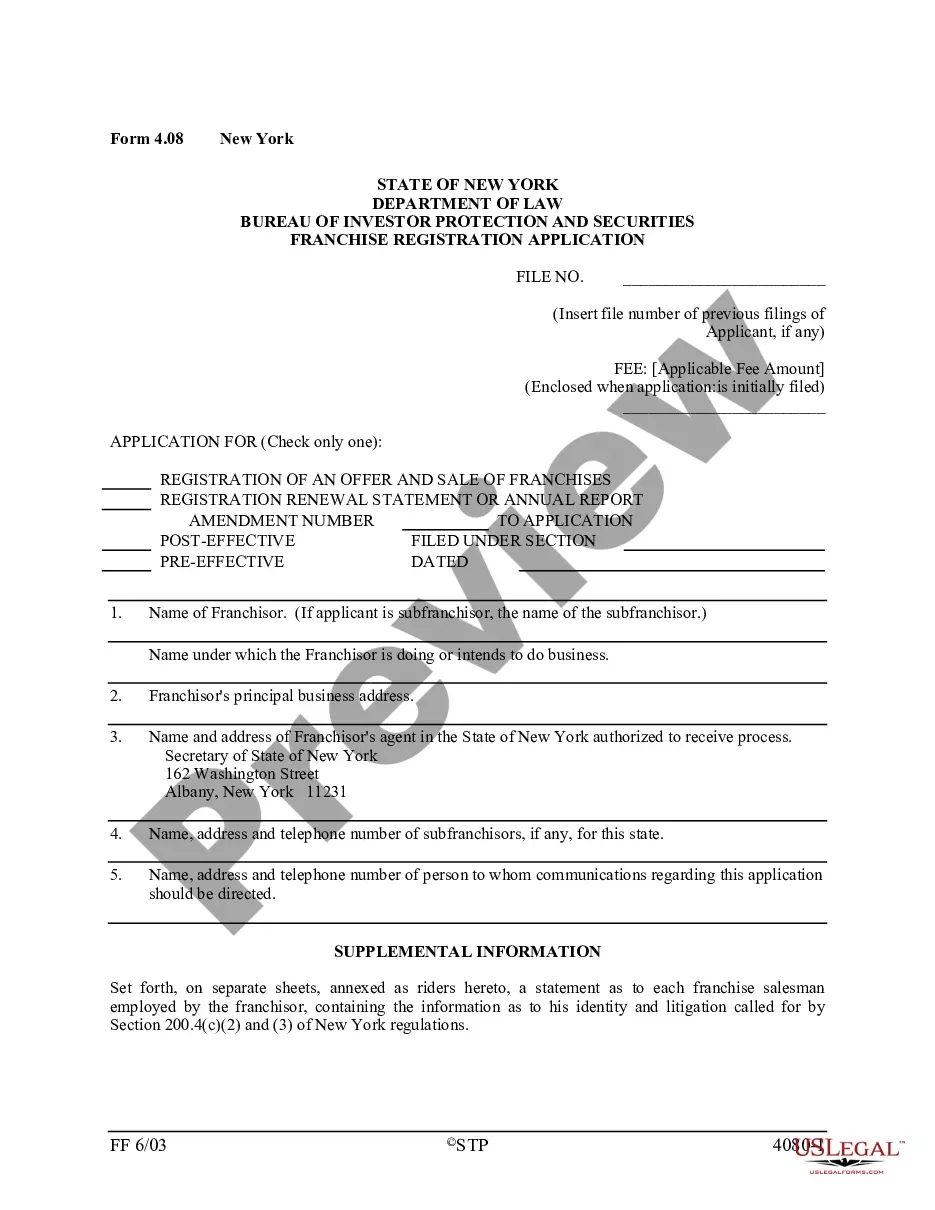

How to fill out Alabama Unrestricted Charitable Contribution Of Cash?

US Legal Forms - among the most significant libraries of authorized varieties in America - offers a wide array of authorized document templates you can acquire or print. While using internet site, you can find a large number of varieties for enterprise and personal purposes, categorized by categories, suggests, or search phrases.You can get the most recent variations of varieties much like the Alabama Unrestricted Charitable Contribution of Cash in seconds.

If you have a monthly subscription, log in and acquire Alabama Unrestricted Charitable Contribution of Cash in the US Legal Forms library. The Down load key will appear on every single form you see. You have accessibility to all earlier delivered electronically varieties in the My Forms tab of your own bank account.

If you want to use US Legal Forms initially, here are basic guidelines to get you began:

- Be sure to have chosen the right form for your area/state. Select the Review key to examine the form`s content. See the form description to actually have chosen the appropriate form.

- When the form does not match your needs, take advantage of the Look for area on top of the screen to discover the one that does.

- In case you are happy with the shape, affirm your decision by clicking the Buy now key. Then, choose the rates prepare you prefer and provide your credentials to sign up for the bank account.

- Method the purchase. Make use of your credit card or PayPal bank account to complete the purchase.

- Select the file format and acquire the shape on your own gadget.

- Make adjustments. Fill out, change and print and signal the delivered electronically Alabama Unrestricted Charitable Contribution of Cash.

Each and every template you put into your money lacks an expiry particular date and is also the one you have for a long time. So, if you would like acquire or print yet another copy, just proceed to the My Forms portion and click on in the form you need.

Gain access to the Alabama Unrestricted Charitable Contribution of Cash with US Legal Forms, the most comprehensive library of authorized document templates. Use a large number of skilled and status-particular templates that meet up with your company or personal demands and needs.

Form popularity

FAQ

When you don't itemize your tax deductions, you typically won't get any additional tax savings from donating to charity. However, in 2021, U.S. taxpayers can deduct up to $300 in charitable donations made this year, even if they choose to take the standard deduction.

Rules Around Donation Tax Receipts The IRS considers each donation separately. It doesn't matter whether the donation to one organization reaches the $250 limit.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

For the 2021 tax year, you can deduct up to $300 per person rather than per tax return, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize. The CARES Act eliminated the 60% limit for cash donations to public charities.

You can deduct up to $300 if you're single or married filing separately (or $600 if you're married filing jointly) for cash contributions made to qualifying charitieseven if you don't itemize.

For the 2021 tax year, you can deduct up to $300 per person rather than per tax return, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize. The CARES Act eliminated the 60% limit for cash donations to public charities.

Your deduction for charitable contributions generally can't be more than 60% of your adjus- ted gross income (AGI), but in some cases 20%, 30%, or 50% limits may apply. The 60% limit is suspended for certain cash contributions.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.

Expanded tax benefits help individuals and businesses give to charity during 2021; deductions up to $600 available for cash donations by non-itemizers.