Alabama Guaranty without Pledged Collateral is a type of loan guarantee offered in the state of Alabama. This financial service ensures the repayment of a loan by an individual or company, without having to provide any collateral as security. It serves as a reassurance to lenders that in case of default by the borrower, the guarantor will step in and fulfill the repayment obligations. This type of guarantee provides an accessible solution for borrowers who may not have valuable assets or collateral to secure a loan. With Alabama Guaranty without Pledged Collateral, individuals and businesses can obtain credit and fulfill their financial needs without the burden of offering collateral. There are different variations of Alabama Guaranty without Pledged Collateral that cater to different borrowing situations: 1. Personal Guaranty: This type of guarantee is provided by individuals who personally guarantee the repayment of a loan on behalf of the borrower. When obtaining a personal loan or even a small business loan, lenders often require a personal guarantor to provide assurances of repayment. 2. Corporate Guaranty: In the context of business loans, a corporate guarantor ensures repayment of the loan by the borrowing company. This type of guarantee is commonly required by lenders when extending credit to small or newly established businesses. 3. Government Guaranty: The Alabama state government may offer Guaranty without Pledged Collateral programs to promote economic development or assist certain sectors. These programs aim to stimulate lending activities by mitigating the risk for lenders through government-backed guarantees. 4. Non-profit Guaranty: Certain non-profit organizations may act as guarantors to facilitate financing for individuals or businesses that lack collateral but have a compelling business case or personal situation. By offering Alabama Guaranty without Pledged Collateral, financial institutions encourage lending to a wider range of borrowers, thereby supporting economic growth and fostering access to capital. This type of guaranty minimizes risk for lenders and makes loans more obtainable for individuals or businesses with limited collateral assets. As a result, borrowers can acquire the necessary funds to meet their financial needs, whether it be personal aspirations or entrepreneurial ambitions.

Alabama Guaranty without Pledged Collateral

Description

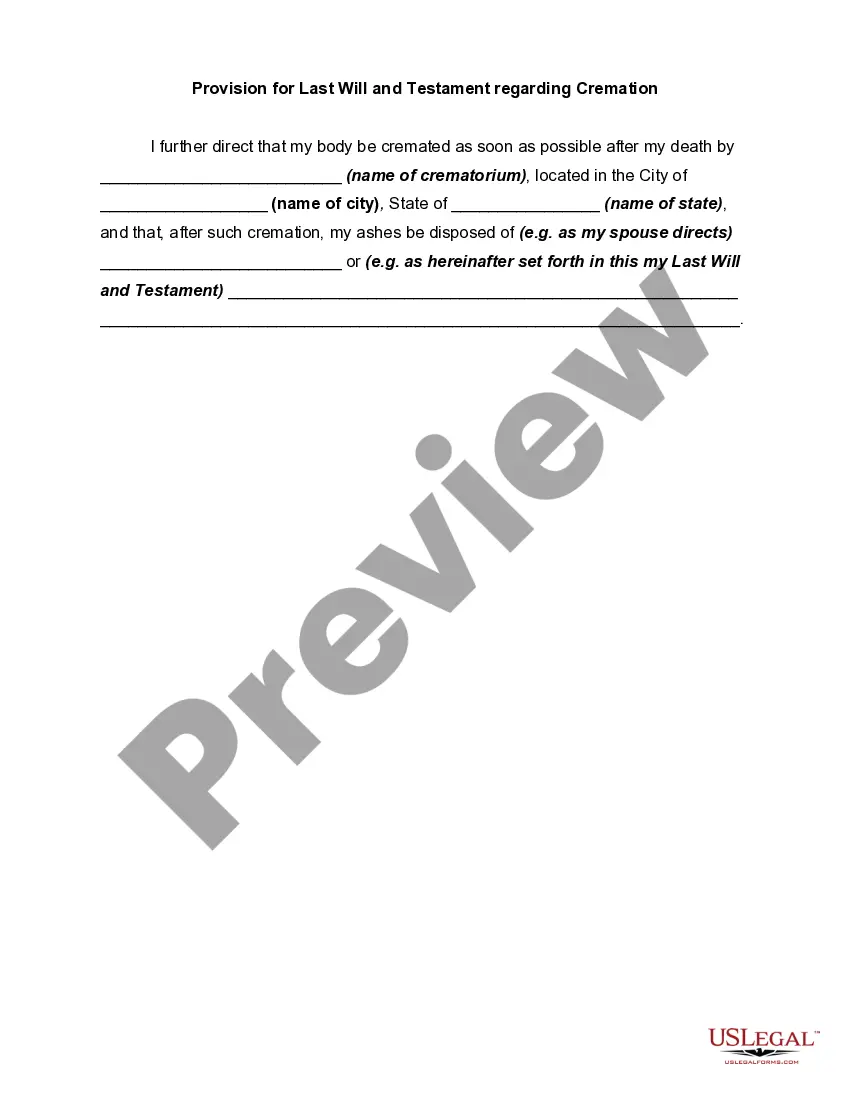

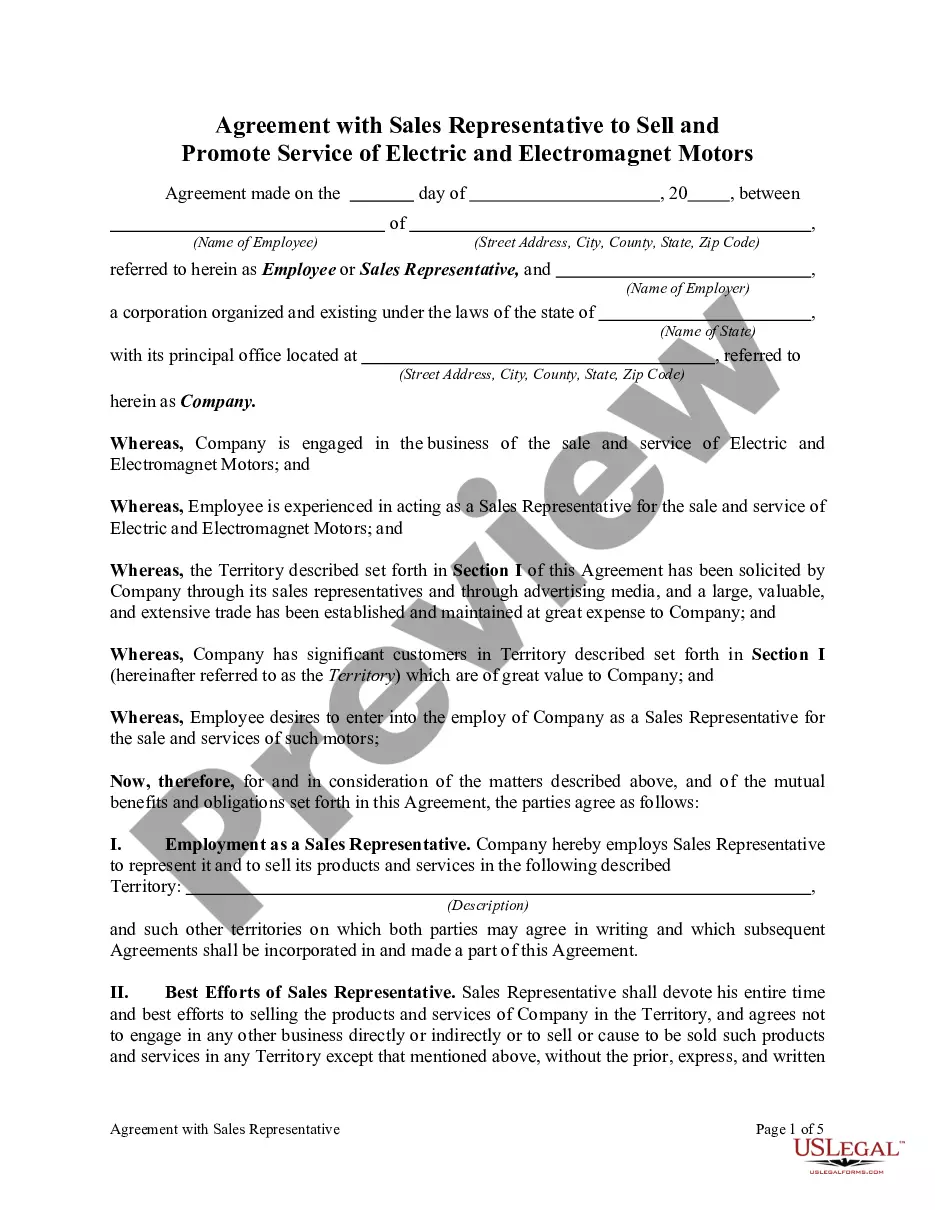

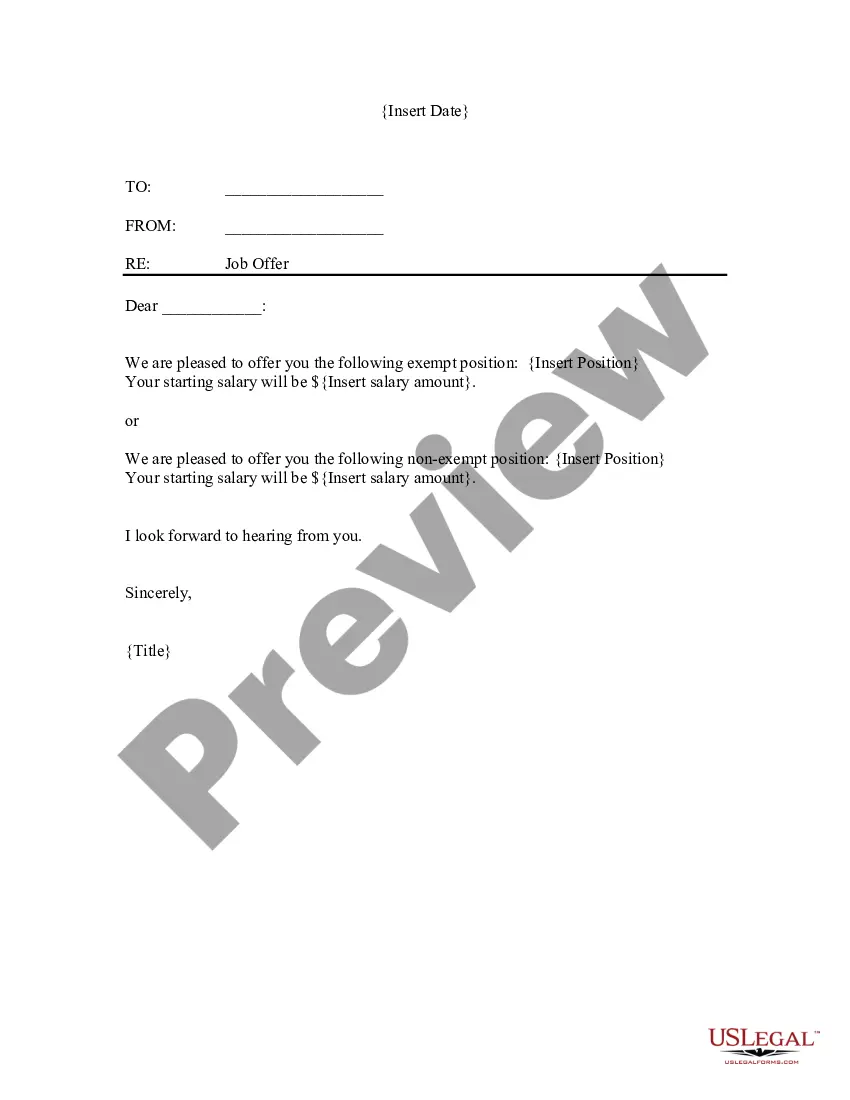

How to fill out Alabama Guaranty Without Pledged Collateral?

US Legal Forms - one of several greatest libraries of legal types in the States - delivers a wide array of legal papers web templates you can download or produce. While using website, you may get thousands of types for enterprise and personal functions, categorized by categories, states, or keywords.You can find the latest versions of types such as the Alabama Guaranty without Pledged Collateral within minutes.

If you already possess a registration, log in and download Alabama Guaranty without Pledged Collateral from your US Legal Forms local library. The Download option will appear on each and every type you view. You have accessibility to all in the past downloaded types within the My Forms tab of your own account.

If you wish to use US Legal Forms initially, listed here are basic guidelines to help you get started:

- Ensure you have chosen the right type for your personal area/county. Go through the Review option to review the form`s content. See the type information to ensure that you have selected the correct type.

- When the type doesn`t fit your requirements, take advantage of the Look for field at the top of the monitor to get the one which does.

- When you are happy with the shape, affirm your choice by clicking the Get now option. Then, choose the rates program you want and supply your credentials to register to have an account.

- Process the purchase. Utilize your charge card or PayPal account to accomplish the purchase.

- Pick the format and download the shape on the gadget.

- Make adjustments. Load, change and produce and sign the downloaded Alabama Guaranty without Pledged Collateral.

Each design you included with your money lacks an expiration time and it is your own permanently. So, if you would like download or produce another copy, just visit the My Forms section and then click around the type you need.

Get access to the Alabama Guaranty without Pledged Collateral with US Legal Forms, by far the most comprehensive local library of legal papers web templates. Use thousands of expert and state-specific web templates that satisfy your company or personal demands and requirements.

Form popularity

FAQ

A Pledge Loan means using money you have in savings or a CD as collateral for a loan. If you don't pay back the loan, the lender uses the money you pledged to pay back the loan. You will pay a slightly higher interest rate on the loan than you are earning on your savings.

A pledged asset is collateral held by a lender in return for lending funds. Pledged assets can reduce the down payment that is typically required for a loan as well as reduces the interest rate charged. Pledged assets can include cash, stocks, bonds, and other equity or securities.

A pledge, also called a pawn or a security interest, is a piece of property, or chattel, used to secure financing. A pledge can be any physical thing with liquid value, although the type of property that a lender requires typically relates to the reason for the loan.

Types of Collateral You Can UseCash in a savings account.Cash in a certificate of deposit (CD) account.Car.Boat.Home.Stocks.Bonds.Insurance policy.More items...?

Collateral, a borrower's pledge to a lender of something specific that is used to secure the repayment of a loan (see credit). The collateral is pledged when the loan contract is signed and serves as protection for the lender.

An unsecured loan is a loan that doesn't require any type of collateral. Instead of relying on a borrower's assets as security, lenders approve unsecured loans based on a borrower's creditworthiness. Examples of unsecured loans include personal loans, student loans, and credit cards.

WHAT IS PLEDGING OF SECURITIES? Pledging here refers to an activity in which the borrower (pledgor) of funds uses securities as a form of collateral to secure the funds it borrows or takes from the lender (Pledgee).

As nouns the difference between pledge and collateral is that pledge is a solemn promise to do something while collateral is a security or guarantee (usually an asset) pledged for the repayment of a loan if one cannot procure enough funds to repay (originally supplied as "accompanying" security).

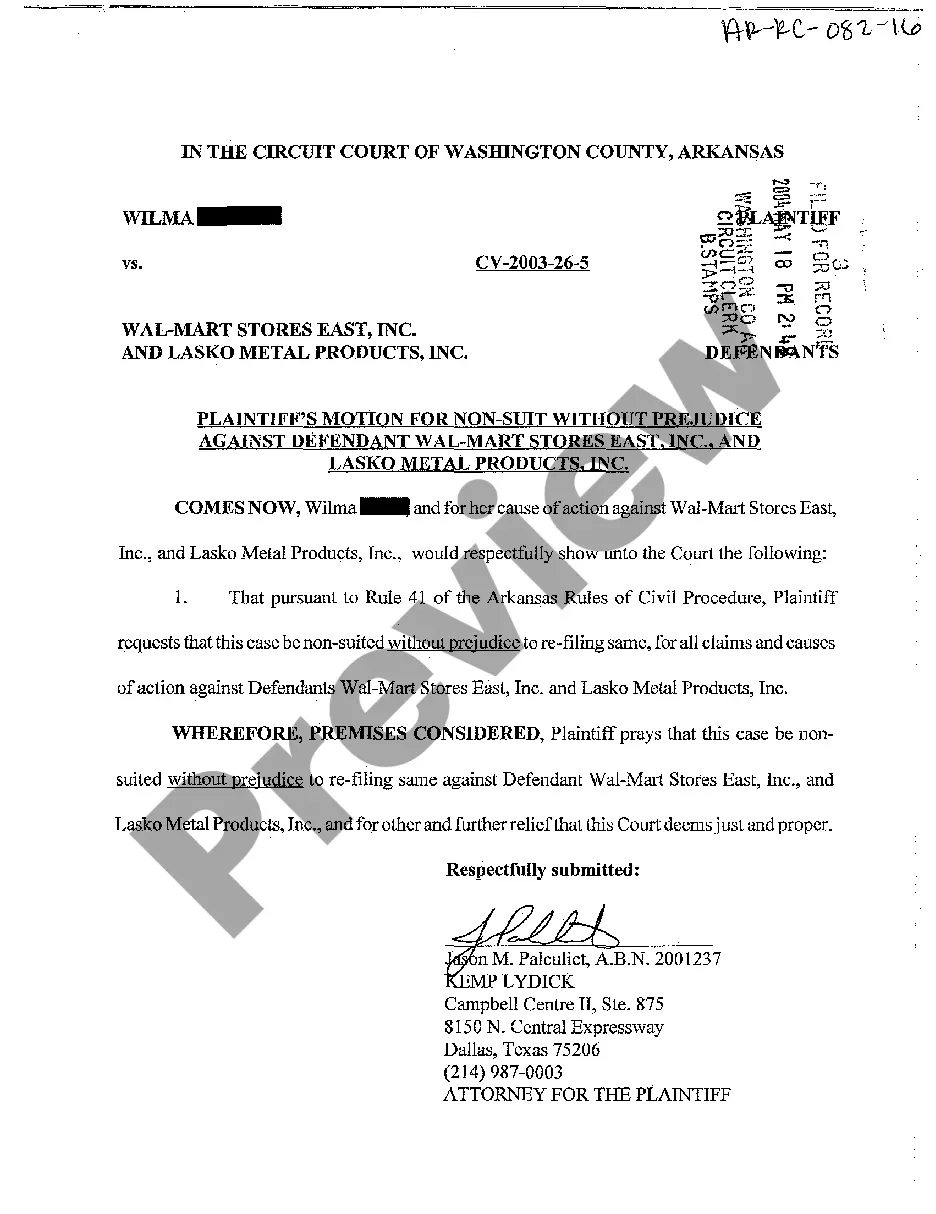

Examples of collateral documents are a security agreement, guarantee and collateral agreement, pledge agreement, deposit account control agreement, securities account control agreement, mortgage, and UCC-1s.