Alabama Self-Employed Independent Contractor Agreement is a legal document that outlines the working relationship between a self-employed individual, also known as an independent contractor, and a hiring party or client in the state of Alabama. It governs the terms and conditions of the engagement, ensuring both parties are aware of their rights and obligations. This agreement covers essential aspects such as the scope of work, payment terms, intellectual property rights, confidentiality, termination clauses, and dispute resolution mechanisms. By establishing clear guidelines, it helps prevent misunderstandings and potential legal disputes that may arise during the course of the engagement. Keywords: Alabama, Self-Employed, Independent Contractor Agreement, legal document, working relationship, hiring party, client, terms and conditions, engagement, rights, obligations, scope of work, payment terms, intellectual property rights, confidentiality, termination clauses, dispute resolution. Different types of Alabama Self-Employed Independent Contractor Agreements: 1. Alabama Consulting Independent Contractor Agreement: This type of agreement is specifically tailored for individuals providing consulting services as independent contractors in Alabama. It may include additional clauses related to consulting deliverables, consulting fees, and client expectations. 2. Alabama Construction Independent Contractor Agreement: Designed for construction industry professionals operating as independent contractors in Alabama, this agreement addresses industry-specific requirements such as project timelines, materials, permits, and compliance with building codes and safety regulations. 3. Alabama Freelance Independent Contractor Agreement: Freelancers offering various creative services, such as writing, graphic design, or web development, can use this type of agreement to outline deliverables, project timelines, revisions, and ownership of creative work in the state of Alabama. 4. Alabama Driver Independent Contractor Agreement: This agreement caters to individuals who provide transportation or delivery services as independent contractors in Alabama. It may include stipulations pertaining to vehicle maintenance, insurance coverage, working hours, and payment terms unique to the transportation industry. 5. Alabama Healthcare Independent Contractor Agreement: Tailored for healthcare professionals, such as physicians, therapists, or nurses, who work as independent contractors in Alabama. This agreement may cover aspects specific to healthcare, such as patient confidentiality, compliance with HIPAA regulations, and professional liability insurance requirements. Keywords: consulting, construction, freelance, driver, healthcare, industry-specific, project timelines, materials, permits, compliance, creative services, deliverables, revisions, ownership, transportation, delivery services, vehicle maintenance, insurance coverage, healthcare professionals, patient confidentiality, HIPAA regulations, professional liability insurance.

Independent Contractor Agreement

Description

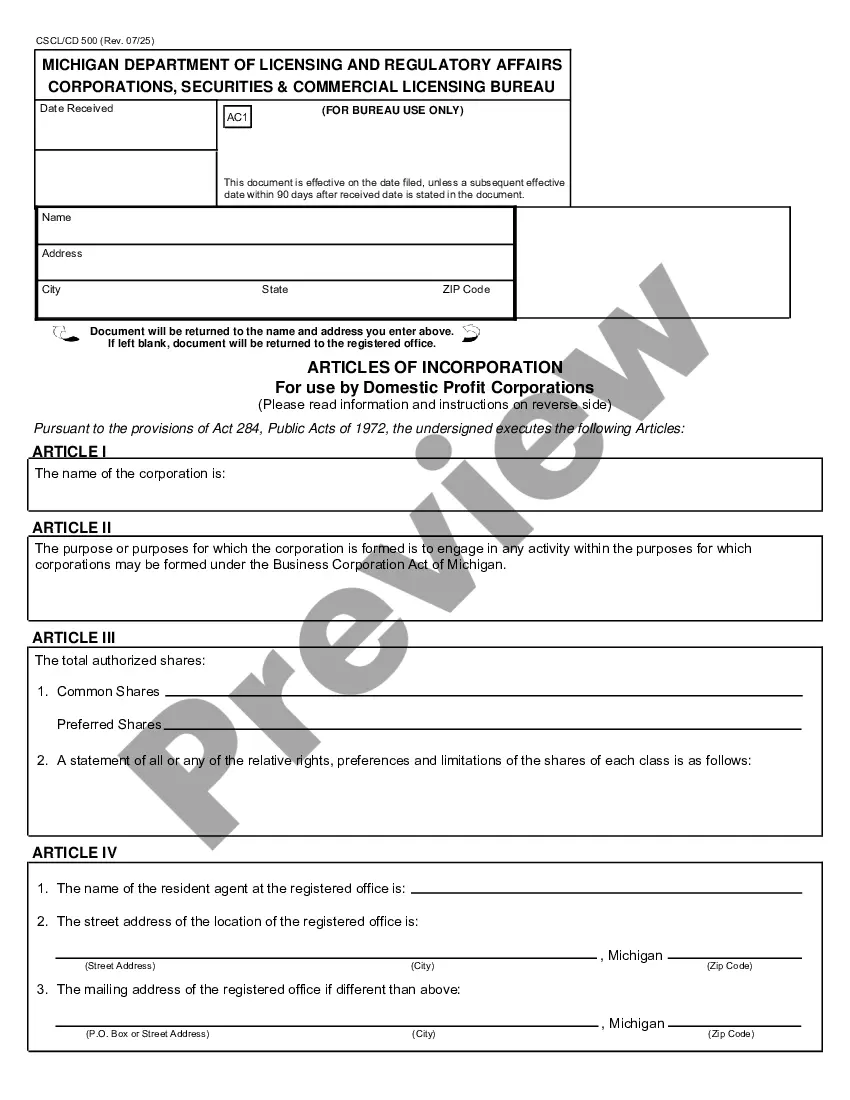

How to fill out Alabama Self-Employed Independent Contractor Agreement?

Choosing the right lawful papers design can be a have difficulties. Naturally, there are a lot of web templates available on the Internet, but how do you discover the lawful type you require? Take advantage of the US Legal Forms web site. The assistance delivers 1000s of web templates, like the Alabama Self-Employed Independent Contractor Agreement, that you can use for organization and personal demands. Every one of the varieties are examined by pros and satisfy state and federal demands.

In case you are currently listed, log in in your account and click the Obtain switch to find the Alabama Self-Employed Independent Contractor Agreement. Use your account to look from the lawful varieties you have acquired previously. Proceed to the My Forms tab of the account and obtain another version of your papers you require.

In case you are a fresh consumer of US Legal Forms, here are basic guidelines that you should adhere to:

- Initially, ensure you have selected the right type for your area/region. You can examine the shape using the Preview switch and study the shape description to guarantee this is the best for you.

- In case the type fails to satisfy your expectations, make use of the Seach field to get the right type.

- Once you are sure that the shape is proper, go through the Purchase now switch to find the type.

- Choose the pricing prepare you desire and enter the needed information. Design your account and buy the transaction using your PayPal account or bank card.

- Opt for the document structure and down load the lawful papers design in your device.

- Complete, change and produce and sign the attained Alabama Self-Employed Independent Contractor Agreement.

US Legal Forms is definitely the largest collection of lawful varieties where you can discover numerous papers web templates. Take advantage of the service to down load skillfully-created documents that adhere to status demands.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

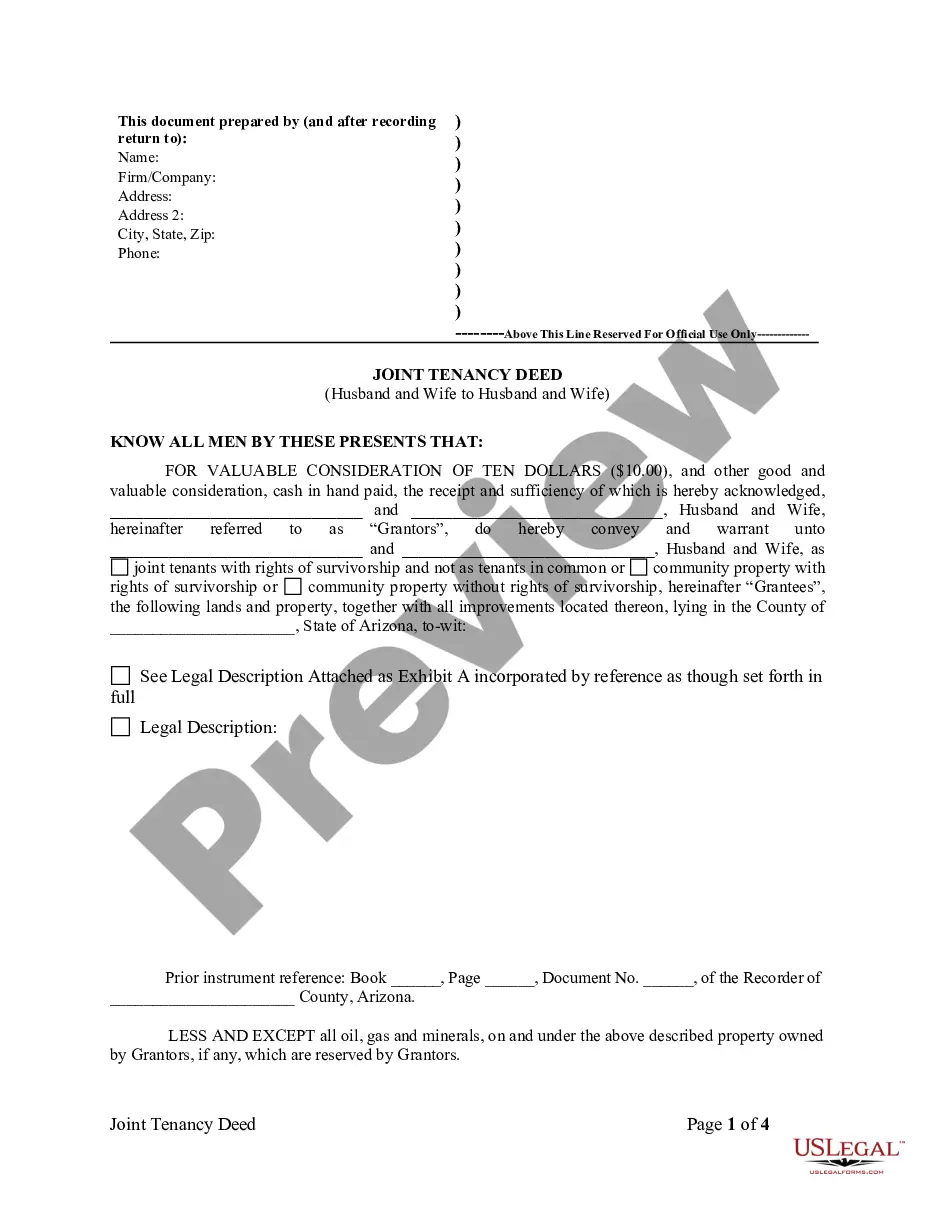

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?

If you intend to work as a contractor in Alabama, you must register and obtain a business license as stated above.

Ten Tips for Making Solid Business Agreements and ContractsGet it in writing.Keep it simple.Deal with the right person.Identify each party correctly.Spell out all of the details.Specify payment obligations.Agree on circumstances that terminate the contract.Agree on a way to resolve disputes.More items...

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.