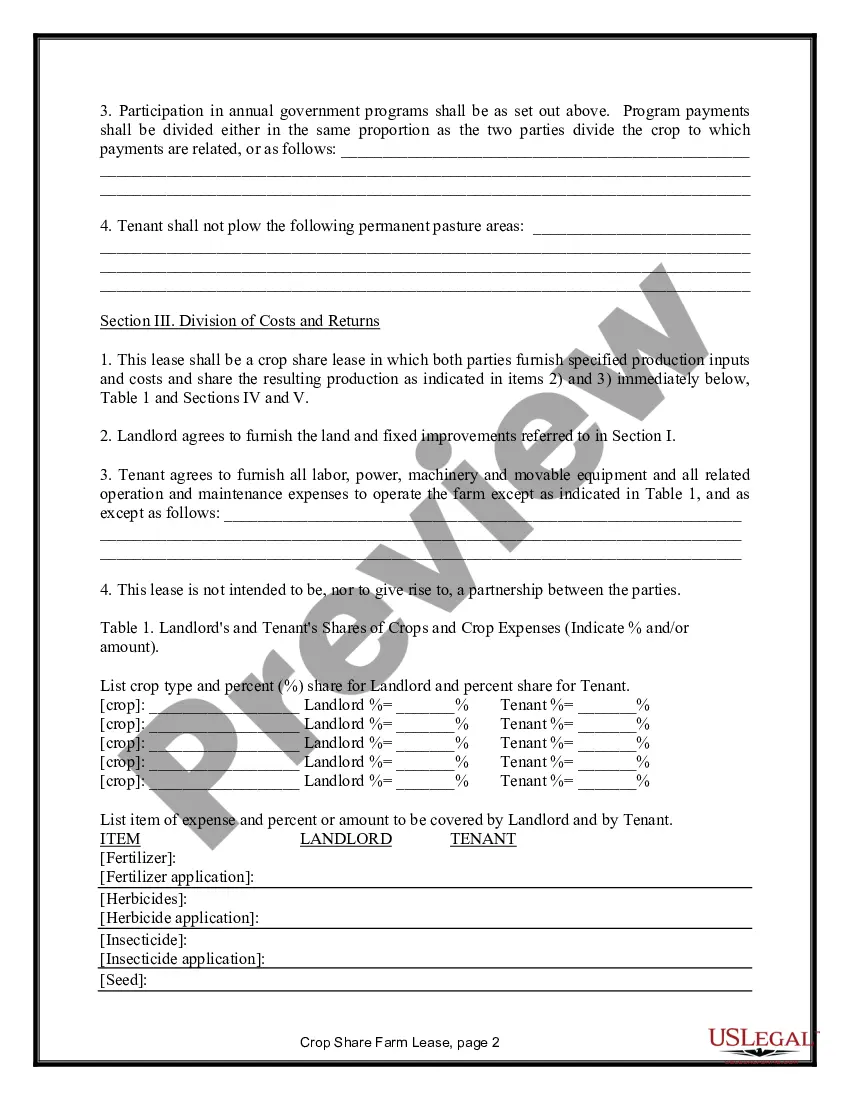

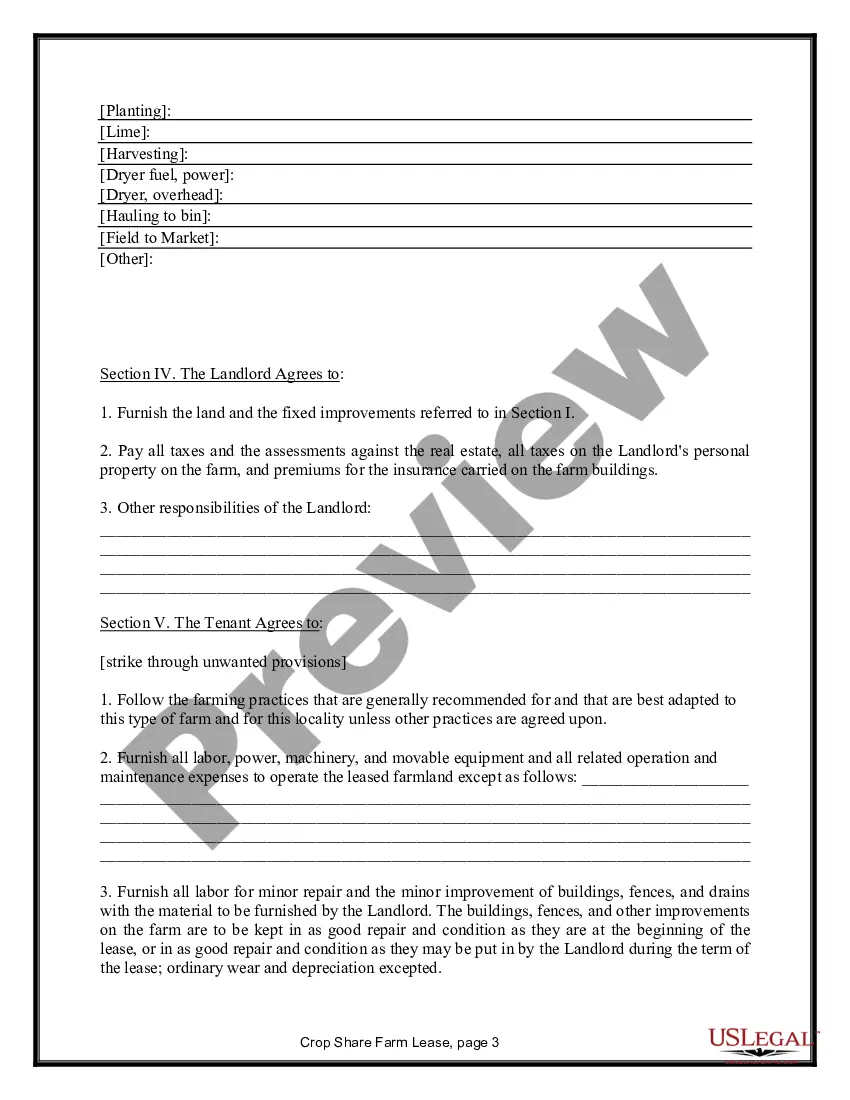

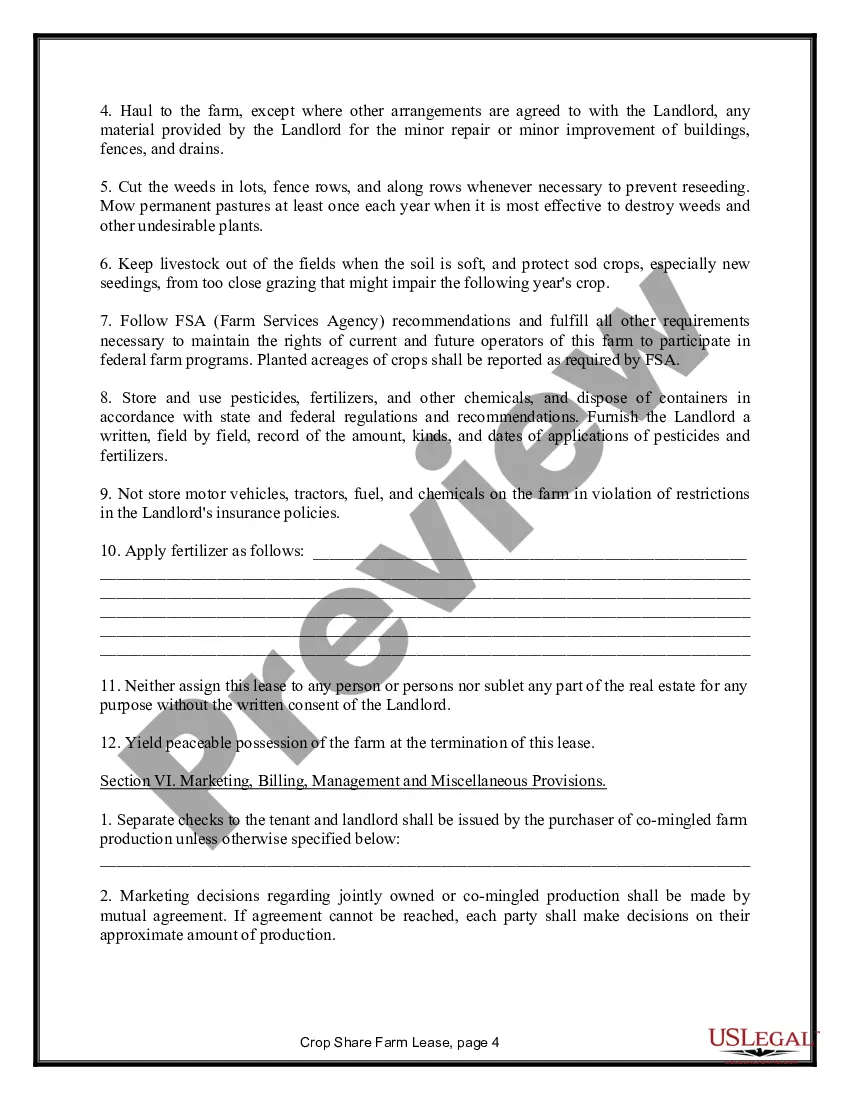

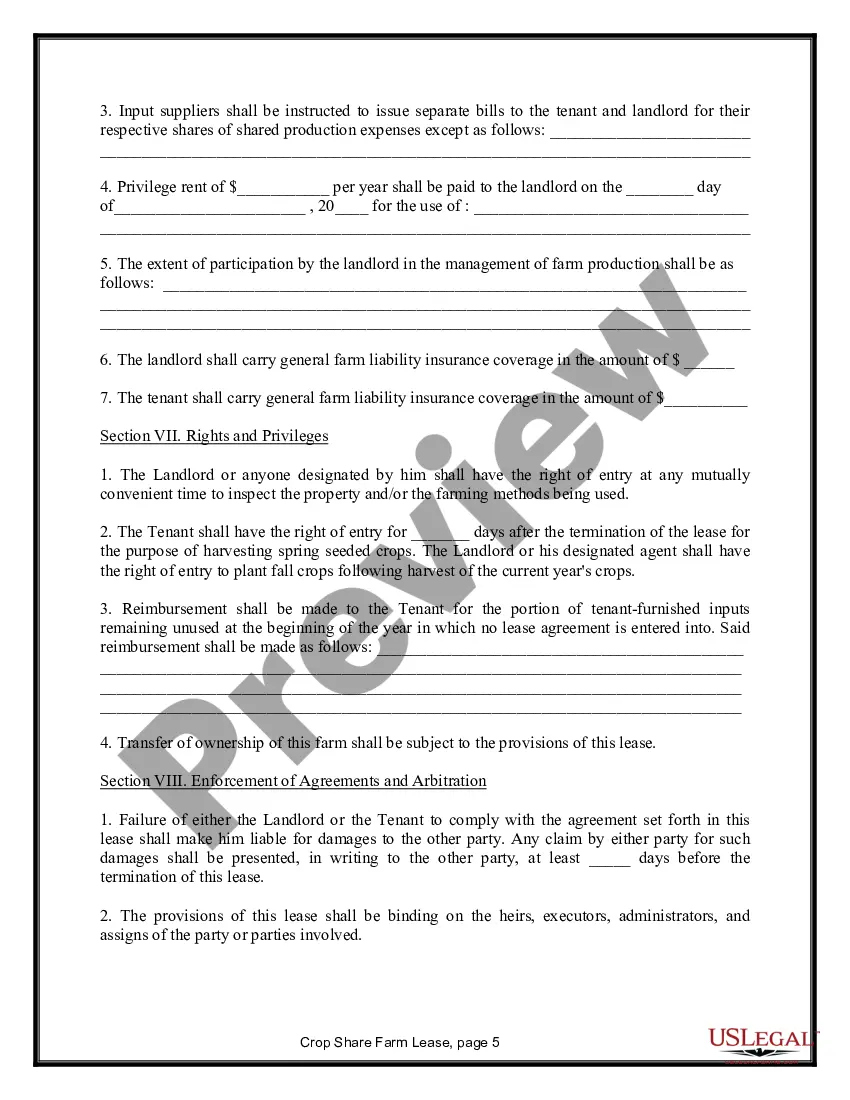

Alabama Farm Lease or Rental — Crop Share is an agreement between a landowner (lessor) and a farmer (lessee) in Alabama, where the lessee rents or leases a piece of agricultural land for the purpose of cultivating crops and sharing the resulting produce with the landowner. This type of lease arrangement is commonly utilized in Alabama as a way to mutually benefit both parties involved. Crop Share agreements can vary in their terms and conditions, but the core concept revolves around a fair distribution of risks and rewards between the landowner and the farmer. Instead of paying cash rent to lease the land, the farmer shares a portion of the crop produced. This arrangement allows the farmer to access land without a significant upfront cost, while the landowner can maintain a stake in the agricultural operations and potentially increase their income. There are different types of Alabama Farm Lease or Rental — Crop Share agreements that can be customized based on the preferences and goals of the parties involved. Some common variations include: 1. One-Third Crop Share: In this arrangement, the farmer and the landowner split the crop generated on a one-third basis. The farmer bears all production costs, such as purchasing seeds, fertilizers, and farm equipment, while the landowner provides the land and sometimes contributes to certain expenses like property taxes. 2. Half Crop Share: This type of agreement divides the crop equally between the farmer and the landowner. The responsibilities and costs are also shared equally, including inputs and maintenance of the land, encouraging a fair partnership between the parties. 3. Variable Crop Share: This lease structure allows for a flexible distribution of crop share percentages based on prevailing factors such as market conditions, input costs, or crop yields. By utilizing a variable crop share, both the landowner and farmer can adapt to the ever-changing agricultural landscape and adjust their shares accordingly. 4. Custom Farming Agreements: These agreements often involve the farmer managing the landowner's agricultural activities entirely, including crop selection, planting, cultivation, harvesting, and marketing. The farmer uses their own inputs and resources while providing the landowner with a predetermined rate per acre or a fixed amount. In summary, Alabama Farm Lease or Rental — Crop Share agreements offer an attractive leasing option for both landowners and farmers. By sharing the risks and rewards of agricultural production, the parties involved can establish a mutually beneficial relationship to optimize land utilization and promote sustainable farming practices.

Alabama Farm Lease or Rental - Crop Share

Description

How to fill out Alabama Farm Lease Or Rental - Crop Share?

If you have to total, obtain, or print out authorized papers themes, use US Legal Forms, the most important collection of authorized kinds, that can be found on the Internet. Use the site`s simple and easy hassle-free lookup to find the files you require. Different themes for company and personal purposes are sorted by categories and claims, or key phrases. Use US Legal Forms to find the Alabama Farm Lease or Rental - Crop Share in just a number of clicks.

In case you are previously a US Legal Forms customer, log in to your bank account and click the Obtain option to find the Alabama Farm Lease or Rental - Crop Share. You can even accessibility kinds you earlier downloaded in the My Forms tab of your respective bank account.

Should you use US Legal Forms the very first time, refer to the instructions below:

- Step 1. Be sure you have selected the form to the correct metropolis/country.

- Step 2. Take advantage of the Review solution to look over the form`s information. Never forget to see the description.

- Step 3. In case you are unsatisfied using the form, make use of the Search field on top of the display screen to locate other versions in the authorized form web template.

- Step 4. Once you have identified the form you require, go through the Acquire now option. Pick the pricing program you favor and put your references to register to have an bank account.

- Step 5. Method the transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to complete the transaction.

- Step 6. Choose the structure in the authorized form and obtain it on your system.

- Step 7. Full, change and print out or indication the Alabama Farm Lease or Rental - Crop Share.

Each authorized papers web template you get is your own permanently. You may have acces to each and every form you downloaded within your acccount. Click the My Forms segment and select a form to print out or obtain again.

Contend and obtain, and print out the Alabama Farm Lease or Rental - Crop Share with US Legal Forms. There are millions of skilled and state-distinct kinds you can use to your company or personal needs.

Form popularity

FAQ

Most farmers find that a combination of both ownership and leasing is desirable, especially when capital is limited. For many new farmers, especially in areas where land is quite expensive, leasing land is often the best option.

The traditional share arrangement for a grain crop like corn or wheat is one-third to the landowner and two-thirds to the tenant. Usually, the expenses paid, and crop received, are equal to the share i.e. the landowner would pay one-third of the expenses and receive one-third of the crop.

Statewide Farmland Cash Rent Cropland averaged $66.5 per acre in Alabama, down 2 percent from 2020. Irrigated cropland had a rental rate of $120 per acre, a decrease of $15 from 2020, while non-irrigated cropland received a rate of $64 per acre, which follows six years of rates at $22 or $23.

With a land lease agreement (also known as a ground lease), you purchase the home but rent the land. One of the main advantages is the lower price of this unique arrangement. One of the main disadvantages is that you will not be able to build valuable equity in the land on which you live.

Cash rent for pasture is unchanged at $12.50 per acre. In Alabama, cash rent for cropland averaged $61.50 per acre, an increase of $3.50 from last year.

The advantages of the first are that the tenant in many cases is free to manage the farm as he pleases, and as a long-time proposition he may pay less rent than under crop-sharing arrangements. The chief disadvantage is that the tenant agrees to pay a definite sum before he knows what his income will be.

A farm lease is a written agreement between a landowner and a tenant farmer. Through a farm lease, the landowner grants the tenant farmer the right to use the farm property. Key terms of basic leases include the length of the lease, rent amounts and frequency of payment, how to renew or end the lease, and more.

Over the last 20 years, the price of farmland per acre in alabama has risen by an average of 4.8% per year to $3,500 per acre as of 2019. This represents an increase of $2,050 per acre of farmland over this time period.

Farmland has historically been a good investment. Unfortunately, not many investors have been able to benefit from this asset class, given the high upfront costs of buying farmland.

With a crop-share lease, the landlord receives a share of the crops produced in exchange for the use of the land by the tenant. The amount of the share typically depends on local custom. The landlord usually agrees to pay a portion of the input costs under a crop-share lease.