Statutory Guidelines [Appendix A(7) IRC 5891] regarding rules for structured settlement factoring transactions.

Alabama Structured Settlement Factoring Transactions

Description

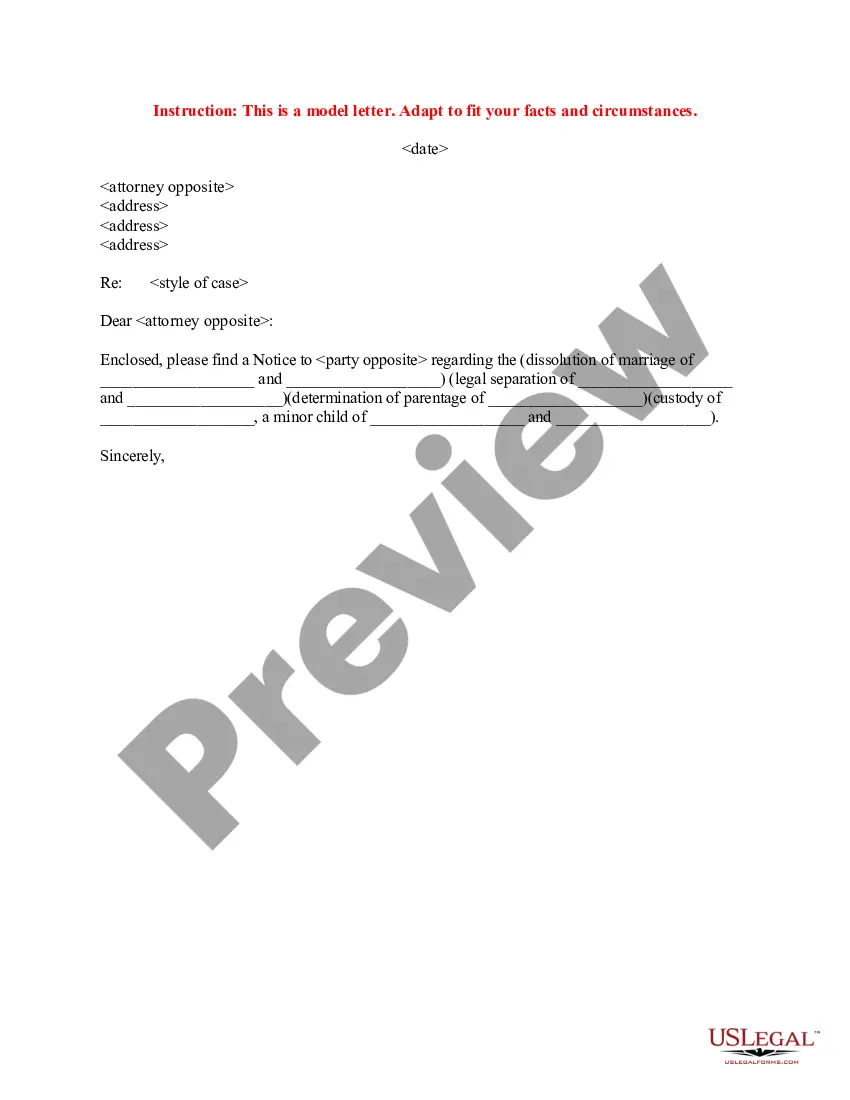

How to fill out Structured Settlement Factoring Transactions?

If you need to full, acquire, or produce legitimate document themes, use US Legal Forms, the greatest collection of legitimate forms, that can be found online. Take advantage of the site`s basic and hassle-free look for to get the documents you will need. A variety of themes for enterprise and individual functions are categorized by groups and claims, or keywords and phrases. Use US Legal Forms to get the Alabama Structured Settlement Factoring Transactions in just a few click throughs.

Should you be previously a US Legal Forms customer, log in to the bank account and click the Down load option to get the Alabama Structured Settlement Factoring Transactions. You can also gain access to forms you earlier delivered electronically within the My Forms tab of your own bank account.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Make sure you have selected the shape for the right area/nation.

- Step 2. Use the Preview method to check out the form`s articles. Do not neglect to read the explanation.

- Step 3. Should you be not satisfied with the form, make use of the Research field at the top of the screen to locate other variations in the legitimate form design.

- Step 4. After you have discovered the shape you will need, click the Acquire now option. Pick the rates prepare you choose and add your credentials to register for an bank account.

- Step 5. Process the purchase. You can utilize your charge card or PayPal bank account to perform the purchase.

- Step 6. Choose the format in the legitimate form and acquire it on your own product.

- Step 7. Total, revise and produce or indication the Alabama Structured Settlement Factoring Transactions.

Every single legitimate document design you buy is your own property eternally. You might have acces to each and every form you delivered electronically in your acccount. Click on the My Forms section and choose a form to produce or acquire yet again.

Remain competitive and acquire, and produce the Alabama Structured Settlement Factoring Transactions with US Legal Forms. There are many professional and condition-certain forms you can utilize for your enterprise or individual needs.

Form popularity

FAQ

The Five Steps for Selling a Structured Settlement: Check with a lawyer and local laws to find out if your settlement can be sold. Decide if selling is a good idea, depending on your goals and financial situation. Research quotes and pick a trustworthy company. Attend your court date.

Cashing out a structured settlement can be a good way to access a significant amount of cash. But before making such a significant decision, review all of the costs carefully. If you decide to proceed with a sale, get offers from at least two to three different buyers to ensure you're getting the best deal possible.

Different Types of Structured Settlement Payouts Temporary life annuity. Joint and survivor annuity. Deferred lump-sum. Percentage increase annuity. Step annuities.

Structured settlements can provide long-term monthly payments in workers' compensation/medical malpractice cases. With a structured settlement annuity, there's no risk of outliving the money. Future payments can last for the claimant's lifetime.

The term ?structured settlement factoring transaction? means a transfer of structured settlement payment rights (including portions of structured settlement payments) made for consideration by means of sale, assignment, pledge, or other form of encumbrance or alienation for consideration.

Structured Settlement calls people on old and expired debts, to get your Debit or Credit Card and make payments that are usually outside the statute of limitations.

What is a Structured Settlement? A structured settlement annuity (?structured settlement?) allows a claimant to receive all or a portion of a personal injury, wrongful death, or workers' compensation settlement in a series of income tax-free periodic payments.