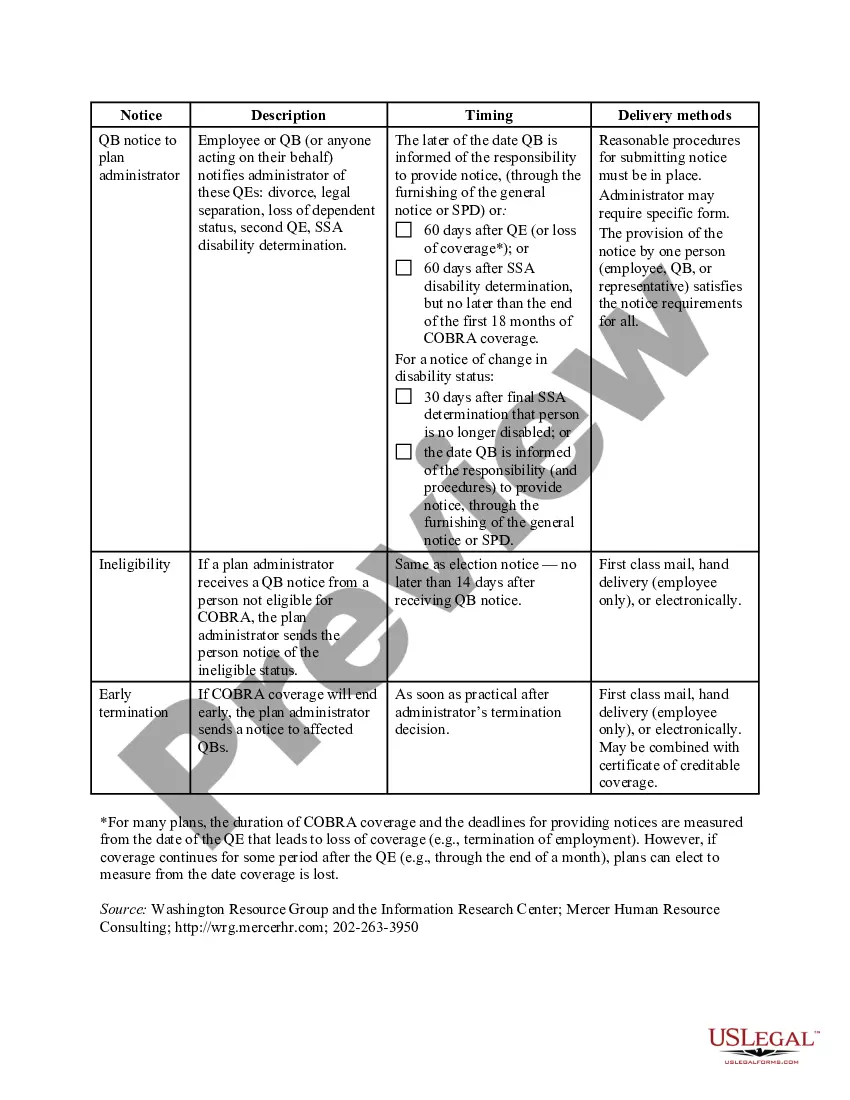

Alabama COBRA Notice Timing Delivery Chart

Description

How to fill out COBRA Notice Timing Delivery Chart?

Have you ever been in a situation where you need documentation for either business or personal reasons almost every single day.

There are numerous legal document templates accessible online, but finding reliable versions isn’t straightforward.

US Legal Forms provides thousands of form templates, including the Alabama COBRA Notice Timing Delivery Chart, which can be tailored to comply with state and federal standards.

When you find the appropriate form, click Buy now.

Select the pricing plan you wish, complete the necessary details to create your account, and pay for the order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Afterward, you can download the Alabama COBRA Notice Timing Delivery Chart template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Use the Review option to evaluate the form.

- Read the details to confirm that you have selected the right form.

- If the form is not what you’re looking for, use the Search field to find the form that aligns with your needs and requirements.

Form popularity

FAQ

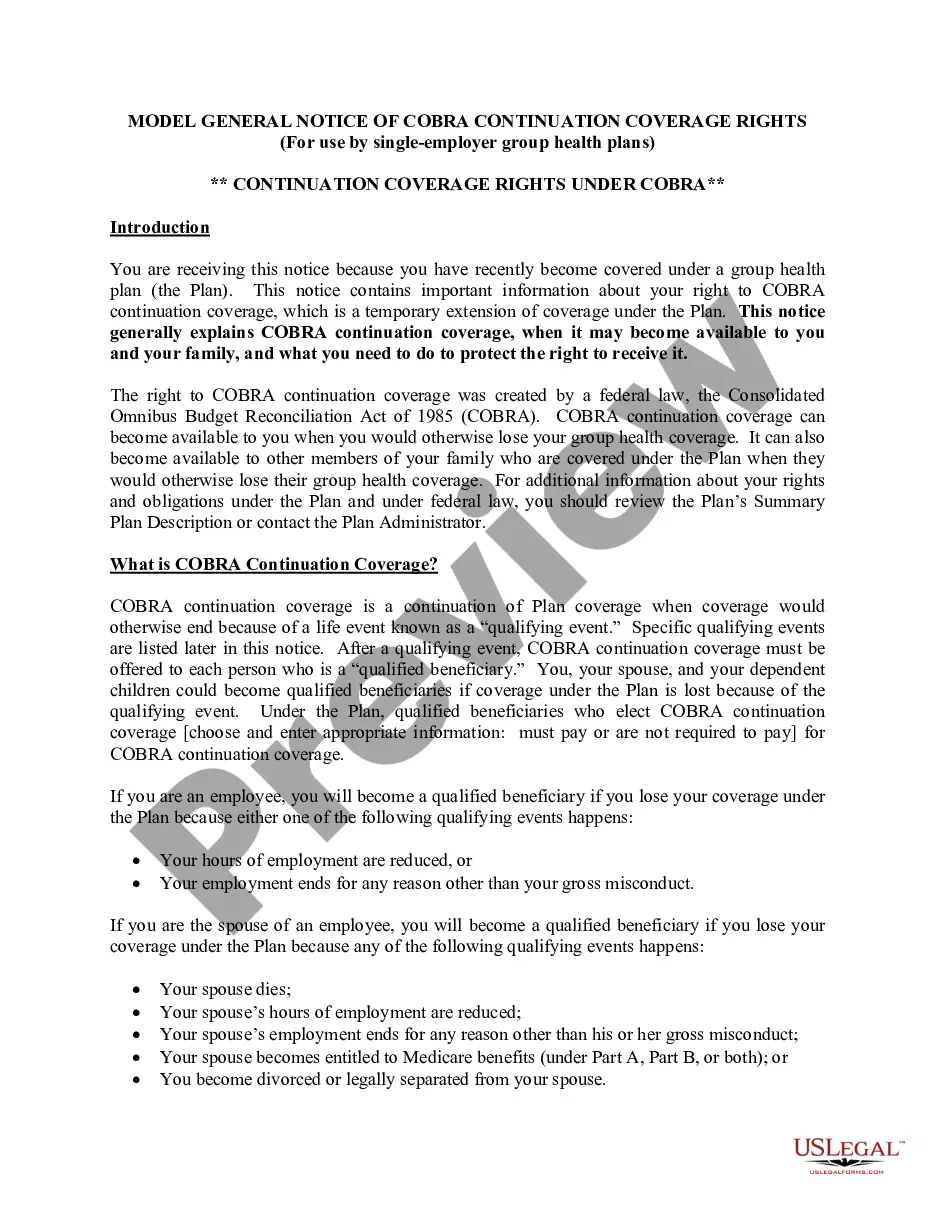

Are there penalties for failing to provide a COBRA notice? Yes, and the penalties can be substantial. Under the Employment Retirement Income Security Act of 1974 (ERISA), a penalty of up to $110 per day may be imposed for failing to provide a COBRA notice.

Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event. You are responsible for making sure your COBRA coverage goes into and stays in effect - if you do not ask for COBRA coverage before the deadline, you may lose your right to COBRA coverage.

COBRA continuation coverage may be terminated if we don't receive timely payment of the premium. What is the grace period for monthly COBRA premiums? After election and initial payment, qualified beneficiaries have a 30-day grace period to make monthly payments (that is, 30 days from the due date).

Employers who fail to comply with the COBRA requirements can be required to pay a steep price. Failure to provide the COBRA election notice within this time period can subject employers to a penalty of up to $110 per day, as well as the cost of medical expenses incurred by the qualified beneficiary.

COBRA allows a 30-day grace period. If your premium payment is not received within the 30-day grace period, your coverage will automatically be terminated without advance warning. You will receive a termination letter at that time to notify you of a lapse in your coverage due to non-payment of premiums.

Q11: How long does COBRA coverage last? COBRA requires that continuation coverage extend from the date of the qualifying event for a limited period of 18 or 36 months.

If You Do Not Receive Your COBRA PaperworkReach out to the Human Resources Department and ask for the COBRA Administrator. They may use a third-party administrator to handle your enrollment. If the employer still does not comply you can call the Department of Labor at 1-866-487-2365.

Initial COBRA notices must generally be provided within 14 days of the employer notifying the third-party administrator (TPA) of a qualifying event.