Alabama Notice of Annual Report of Employee Benefits Plans

Description

How to fill out Notice Of Annual Report Of Employee Benefits Plans?

US Legal Forms - one of the most important collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the site, you can access numerous forms for both business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms such as the Alabama Notice of Annual Report of Employee Benefits Plans in seconds.

If you already have an account, Log In and retrieve the Alabama Notice of Annual Report of Employee Benefits Plans from your US Legal Forms library. The Download button will appear on each form you view. You can access all previously saved forms in the My documents tab of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill, edit, print, and sign the saved Alabama Notice of Annual Report of Employee Benefits Plans.

Every template you add to your account has no expiration date and belongs to you forever. So if you wish to download or print another copy, just go to the My documents section and click on the form you need.

Access the Alabama Notice of Annual Report of Employee Benefits Plans with US Legal Forms, the most extensive collection of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements and needs.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you've selected the correct form for your city/state.

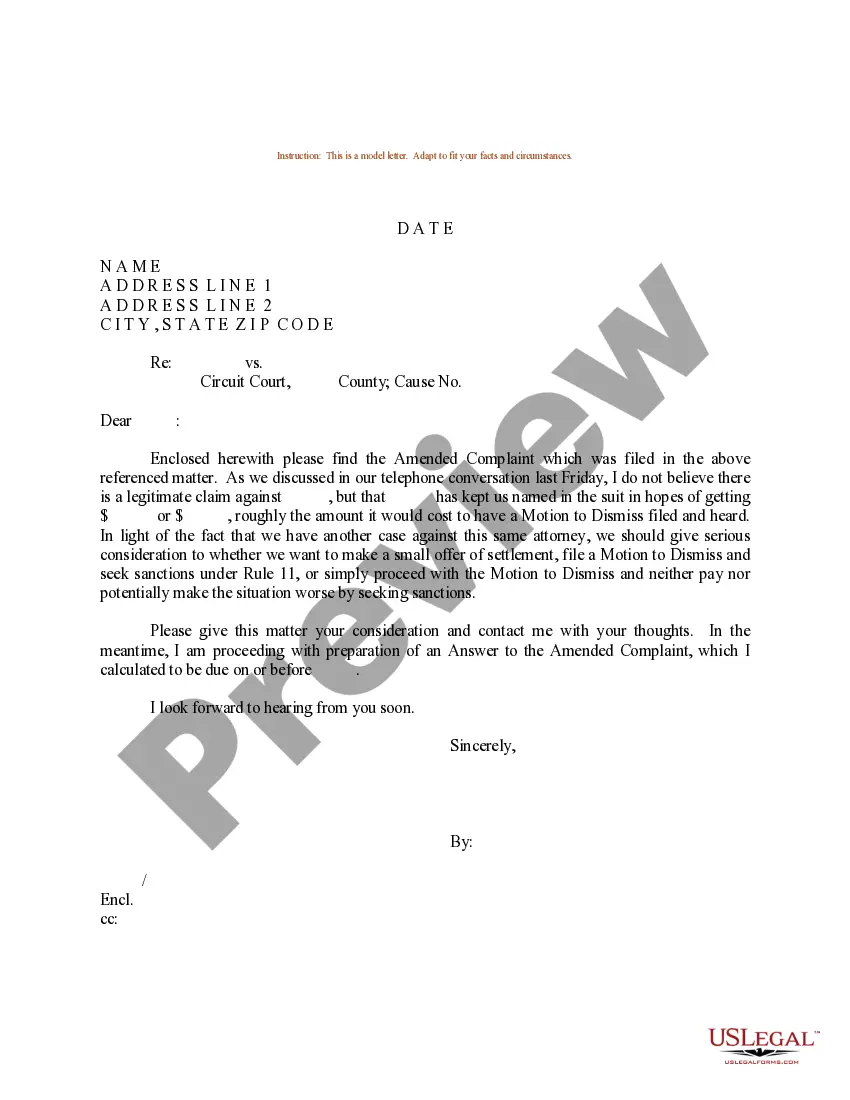

- Click the Preview button to review the form's content.

- Check the form description to confirm you have chosen the right one.

- If the form doesn’t meet your needs, use the Search box at the top of the screen to find a suitable one.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose the pricing plan you prefer and enter your information to register for an account.

Form popularity

FAQ

Term Life Coverage amounts from $25,000 to $250,000 for members and spouses up to age 65. Guaranteed Issue Term Life $10,000 coverage with no health questions! Available up to age 65. Senior Whole Life Coverage for ASEA members and spouses ages 45 75.

Active employees contributing to the Teachers' Retirement System of Alabama and who have completed one year of service are covered under the system's Pre-Retirement Death Benefit (PRDB) and Term Life Insurance (TLI) plan.

The maximum rate is 6.2 percent. New employers will continue to pay the entry rate of 2.7 percent.

The State Employees' Health Insurance Plan (SEHIP) is a self-insured employer group health benefit plan. This means that the State of Alabama assumes the risk of providing health care benefits for its employees instead of paying a risk premium to a third party to provide health insurance coverage.

State Employee BenefitsHealth Insurance. Choose from a variety of health benefit plans for you and your family.Dental Insurance. Employees and their eligible dependents can choose the dental plan right for them.Vision Care Insurance.Employee Assistance Program (EAP).Medical Reimbursement Accounts.Long-Term Care.

Please email status@labor.alabama.gov or call (334) 954-4730.

Inclusive of the 0.06% Employment Security Enhancement Assessment (ESA), an Employer's rate can vary from 0.20% to 6.80% depending on the one of four rate schedules in effect, plus any applicable shared cost.

The rates are to include an employment security assessment of 0.06%. The unemployment tax rate for new employers is to be 2.7% in 2020, unchanged from 2019. Alabama's unemployment-taxable wage base is to be $8,000 for 2020, unchanged from 2019.

Inclusive of the 0.06% Employment Security Enhancement Assessment (ESA), an Employer's rate can vary from 0.20% to 6.80% depending on the one of four rate schedules in effect, plus any applicable shared cost.

Tax rates range from 0.65% to 6.8% and include an employment security assessment of 0.06%. The unemployment tax rate for new employers is 2.7% in 2021, unchanged from 2020. Alabama's unemployment-taxable wage base is $8,000.