Alabama Order for Relief in an Involuntary Case - B 253

Description

How to fill out Order For Relief In An Involuntary Case - B 253?

If you wish to comprehensive, obtain, or produce authorized document layouts, use US Legal Forms, the greatest variety of authorized forms, which can be found on the Internet. Utilize the site`s basic and handy lookup to obtain the paperwork you want. A variety of layouts for enterprise and individual reasons are sorted by categories and suggests, or keywords. Use US Legal Forms to obtain the Alabama Order for Relief in an Involuntary Case - B 253 within a handful of clicks.

In case you are previously a US Legal Forms buyer, log in in your profile and then click the Download switch to obtain the Alabama Order for Relief in an Involuntary Case - B 253. Also you can access forms you in the past delivered electronically from the My Forms tab of your profile.

If you work with US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Ensure you have selected the shape to the right city/nation.

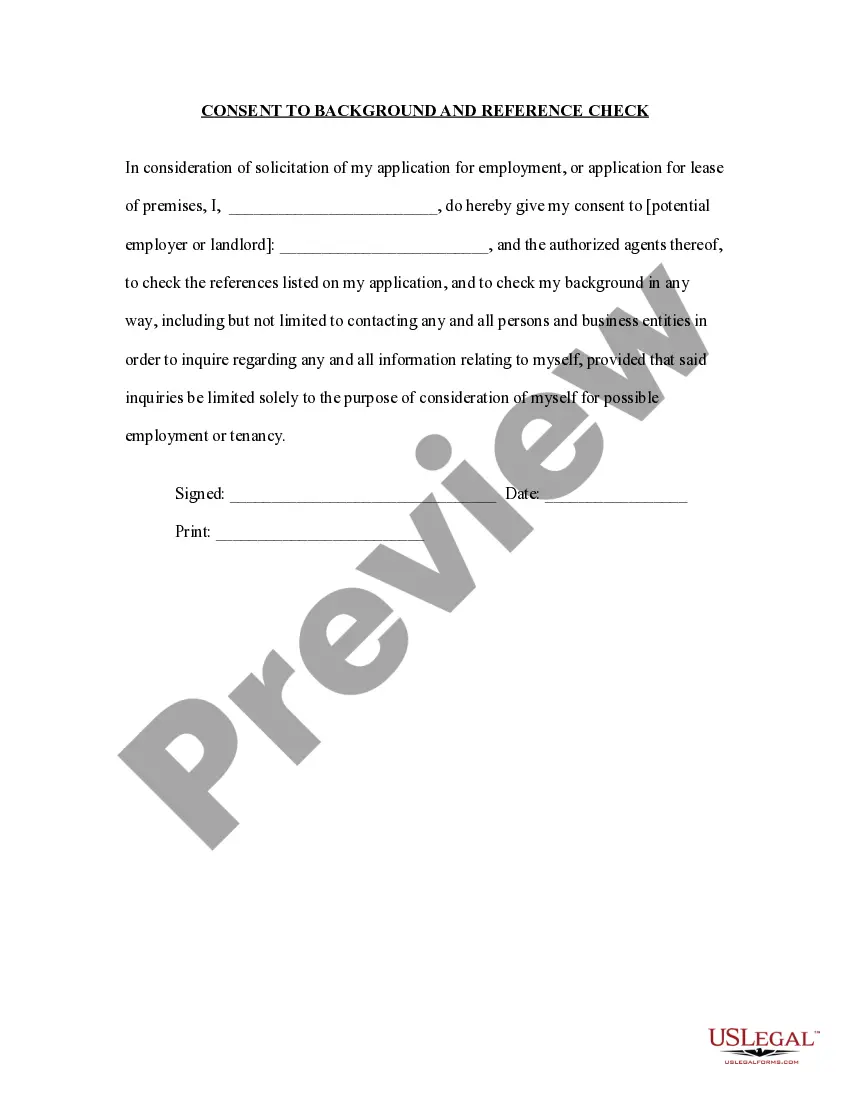

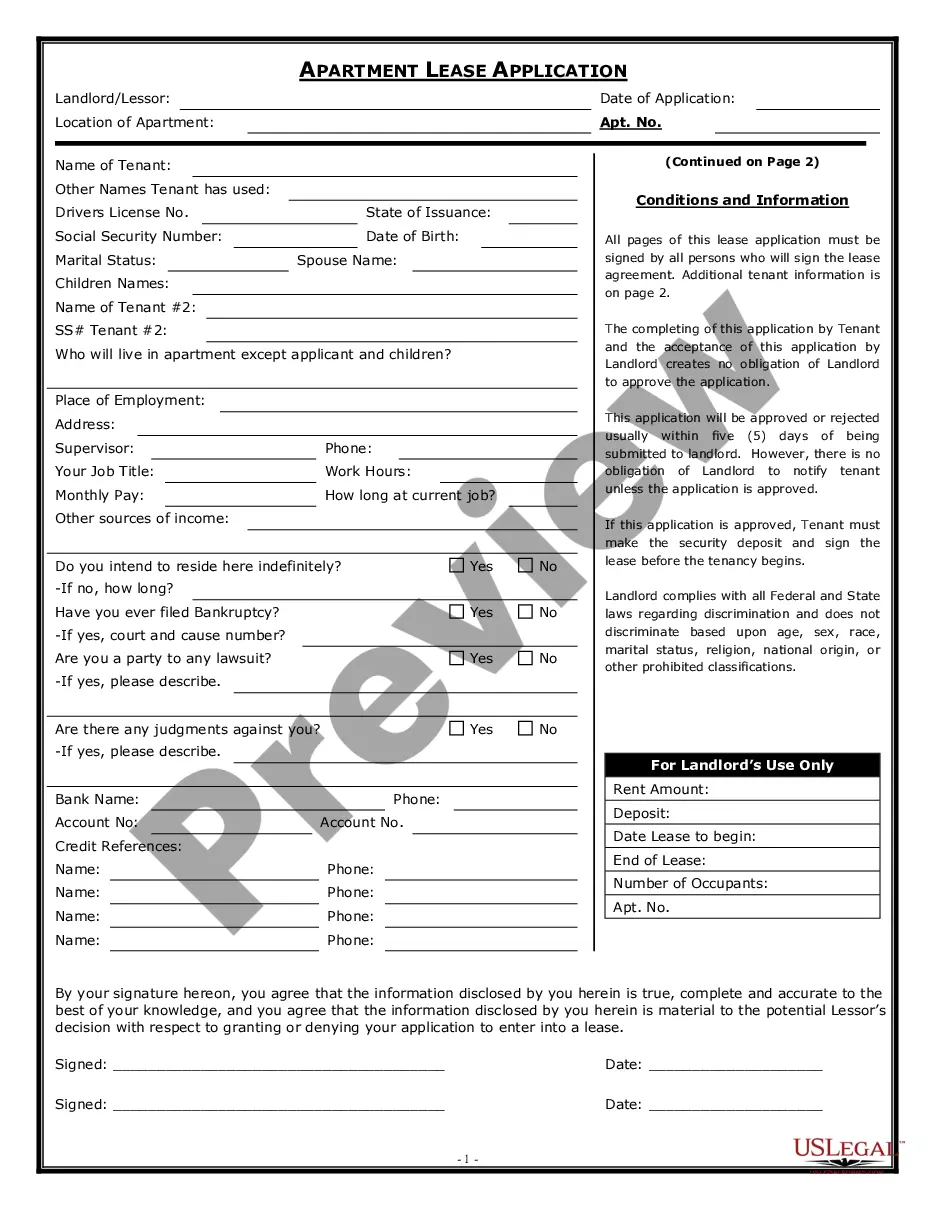

- Step 2. Utilize the Preview solution to check out the form`s information. Never forget to learn the explanation.

- Step 3. In case you are not happy together with the form, use the Research area on top of the display screen to locate other models from the authorized form format.

- Step 4. Upon having identified the shape you want, select the Get now switch. Opt for the rates strategy you favor and add your references to register for an profile.

- Step 5. Approach the financial transaction. You may use your credit card or PayPal profile to accomplish the financial transaction.

- Step 6. Find the structure from the authorized form and obtain it on your own product.

- Step 7. Total, change and produce or sign the Alabama Order for Relief in an Involuntary Case - B 253.

Every authorized document format you buy is your own property for a long time. You have acces to each form you delivered electronically with your acccount. Click the My Forms area and pick a form to produce or obtain once more.

Remain competitive and obtain, and produce the Alabama Order for Relief in an Involuntary Case - B 253 with US Legal Forms. There are millions of expert and condition-certain forms you may use for your enterprise or individual requires.

Form popularity

FAQ

In most Chapter 13 Plans, the Debtor is required to make payments to their secured creditors outside the Plan. When these payments are not made, a secured creditor can file a Motion for Relief seeking relief from the Automatic Stay so they can take action against the collateral (i.e. your house or car).

The determination that a person or entity is a debtor under the Bankruptcy Code. In a voluntary bankruptcy case, the filing of the bankruptcy petition constitutes an order for relief (§ 301(b), Bankruptcy Code).

An order for relief on an involuntary petition will be entered only after (i) the filing of a consent to its entry by the putative debtor, (ii) the filing of a certification of counsel that the petition has been served in ance with the Rules and that no answer has been filed by the putative debtor within the time ...

Motion for Relief from the Automatic Stay is a request by a creditor to allow the creditor to take action against the debtor or the debtor's property that would otherwise be prohibited by the automatic stay.

"Order for relief" is to a court order determining that a debtor is subject to the control of the bankruptcy court. It means a debtor obtain a discharge from all debts that arose before the date of the order for relief. It is obtained through a properly filed voluntary petition.