Alabama Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005

Description

How to fill out Statement Of Current Monthly Income And Disposable Income Calculation For Use In Chapter 13 - Post 2005?

It is possible to invest hrs online trying to find the legal document format which fits the federal and state requirements you want. US Legal Forms gives a huge number of legal forms which can be analyzed by experts. It is possible to download or produce the Alabama Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005 from the service.

If you have a US Legal Forms profile, you are able to log in and then click the Download switch. Next, you are able to complete, modify, produce, or indication the Alabama Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005. Each and every legal document format you buy is your own property forever. To get yet another version of the obtained develop, go to the My Forms tab and then click the related switch.

If you use the US Legal Forms web site initially, stick to the easy instructions beneath:

- Initial, make sure that you have chosen the best document format for that area/city of your choosing. See the develop explanation to make sure you have chosen the appropriate develop. If accessible, take advantage of the Review switch to appear with the document format as well.

- If you wish to locate yet another edition from the develop, take advantage of the Search discipline to obtain the format that suits you and requirements.

- Once you have discovered the format you would like, simply click Buy now to carry on.

- Choose the costs strategy you would like, enter your credentials, and register for a free account on US Legal Forms.

- Full the transaction. You can utilize your credit card or PayPal profile to fund the legal develop.

- Choose the structure from the document and download it to the device.

- Make changes to the document if necessary. It is possible to complete, modify and indication and produce Alabama Statement of Current Monthly Income and Disposable Income Calculation for Use in Chapter 13 - Post 2005.

Download and produce a huge number of document layouts making use of the US Legal Forms Internet site, that offers the greatest collection of legal forms. Use professional and express-distinct layouts to take on your company or individual requirements.

Form popularity

FAQ

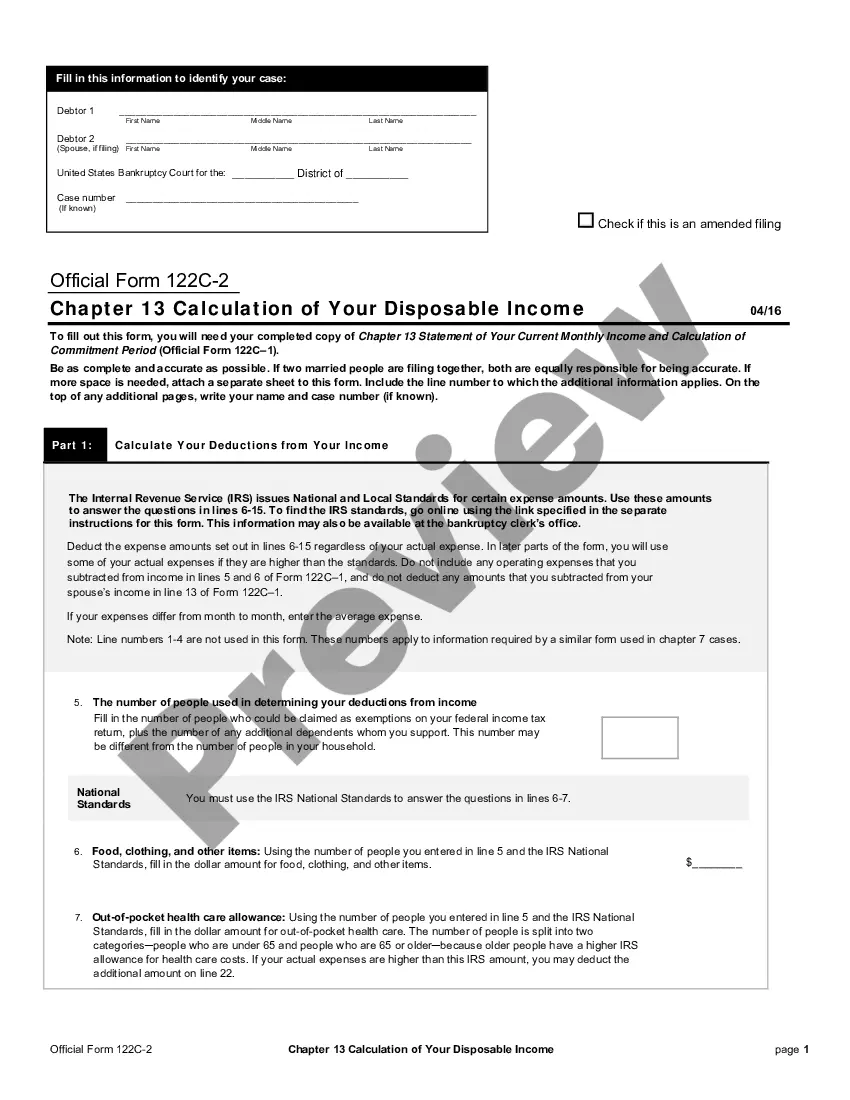

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

What is Disposable Personal Income? After-tax income. The amount that U.S. residents have left to spend or save after paying taxes is important not just to individuals but to the whole economy. The formula is simple: personal income minus personal current taxes.

To calculate your monthly payment amount in a Chapter 13 bankruptcy, calculate your income for the six months before your bankruptcy filing. Deduct allowable expenses to determine your disposable income. Pay your priority debtors and any secured debts that you want to keep after the bankruptcy.

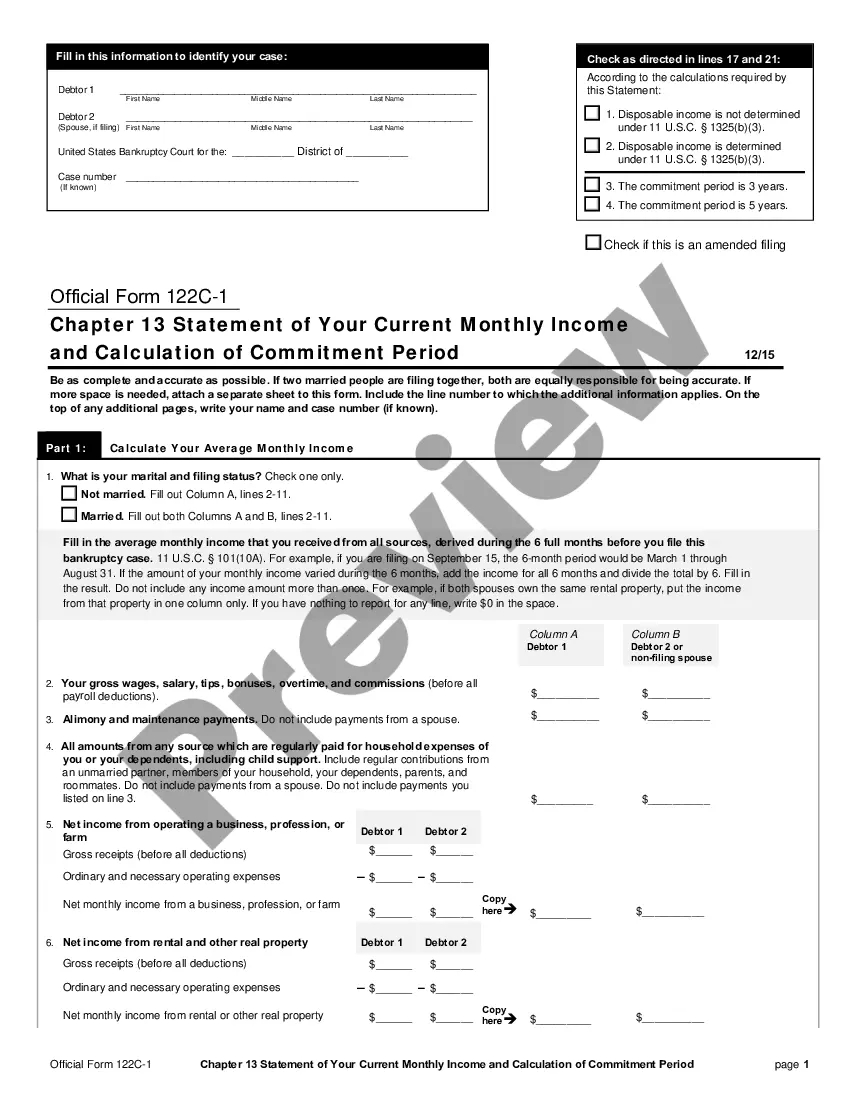

For a Chapter 13, the ?Chapter 13 Statement of Your Current Monthly Income and Calculation of Commitment Period? (Form 122C-1) tells the court your average monthly income. Your income is compared to the median income for your state, which will assist in calculating your disposable income.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

To calculate the total average monthly payment, add all amounts that are contractually due to each secured creditor in the 60 months after you file for bankruptcy. Then divide by 60.

A debtor must have enough income, after deducting allowable expenses, for all debt obligations. A debtor may include income from a working spouse even if the spouse has not filed jointly for bankruptcy, wages and salary, self-employment income, Social Security benefits, and unemployment benefits.

How Is Disposable Income Calculated? Your last six months of income divided by six to get average monthly income. If you own a business or work for yourself, you must calculate average monthly income. Any money you get from rent on an asset you own, interests, dividends or royalties.