Alabama Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005

Description

This form is data enabled to comply with CM/ECF electronic filing standards. This form is for post 2005 act cases.

How to fill out Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005?

If you wish to full, obtain, or print out lawful record layouts, use US Legal Forms, the biggest variety of lawful types, which can be found online. Utilize the site`s basic and practical lookup to get the documents you require. Various layouts for enterprise and person functions are sorted by groups and claims, or keywords. Use US Legal Forms to get the Alabama Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005 with a number of click throughs.

When you are presently a US Legal Forms customer, log in in your account and then click the Obtain option to find the Alabama Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005. Also you can accessibility types you in the past downloaded from the My Forms tab of your account.

If you are using US Legal Forms the very first time, follow the instructions beneath:

- Step 1. Make sure you have selected the form for your correct town/nation.

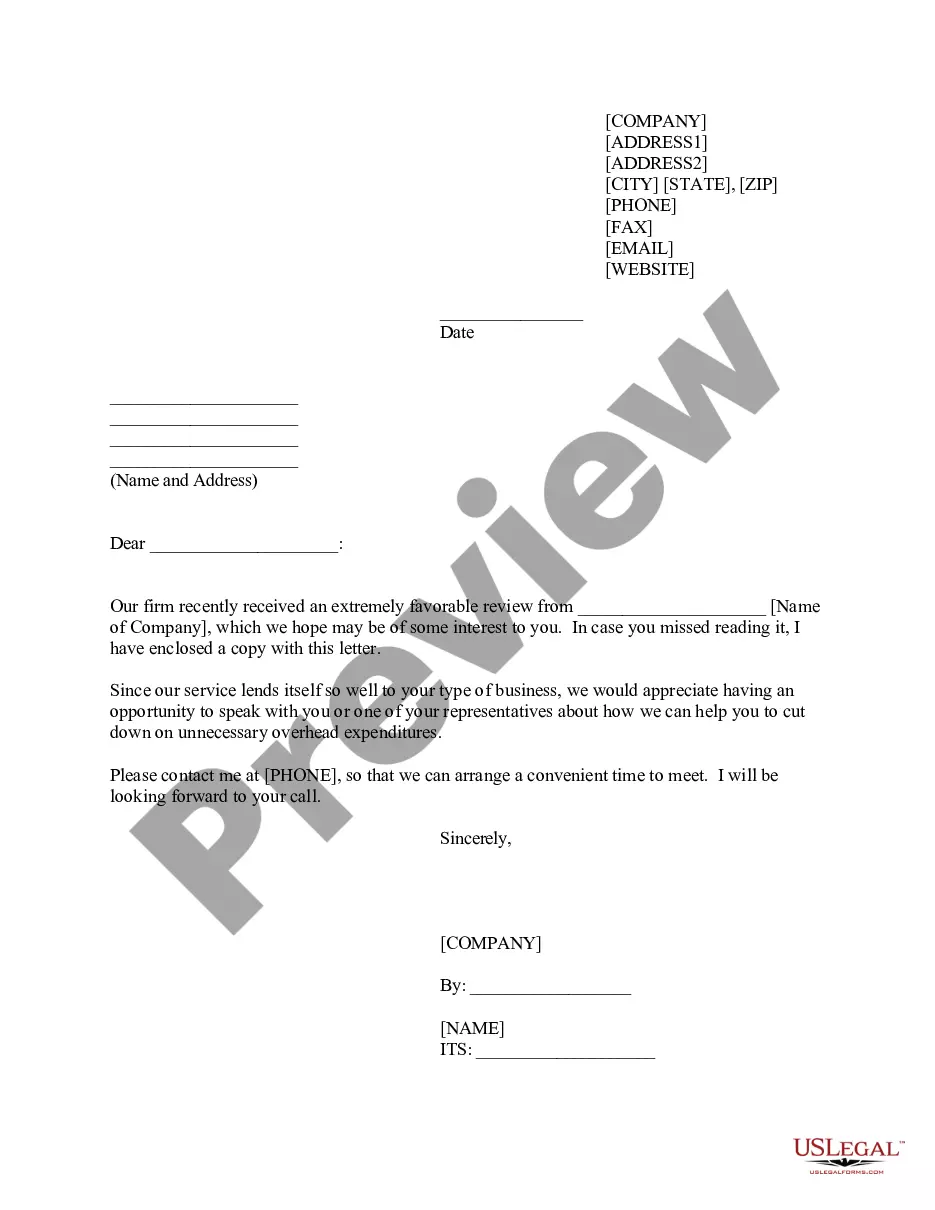

- Step 2. Utilize the Review choice to look over the form`s information. Don`t neglect to read the outline.

- Step 3. When you are not satisfied together with the type, utilize the Lookup industry on top of the monitor to get other types of the lawful type web template.

- Step 4. Once you have identified the form you require, go through the Get now option. Choose the costs strategy you choose and add your accreditations to register for the account.

- Step 5. Approach the financial transaction. You should use your credit card or PayPal account to complete the financial transaction.

- Step 6. Choose the structure of the lawful type and obtain it on your system.

- Step 7. Comprehensive, change and print out or sign the Alabama Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005.

Every single lawful record web template you purchase is yours permanently. You possess acces to each and every type you downloaded in your acccount. Go through the My Forms area and select a type to print out or obtain yet again.

Compete and obtain, and print out the Alabama Creditors Holding Secured Claims - Schedule D - Form 6D - Post 2005 with US Legal Forms. There are many skilled and express-certain types you can utilize for your enterprise or person demands.

Form popularity

FAQ

Schedule D is part of a series of documents a debtor files with the bankruptcy court. It is formally called "Official Bankruptcy Form 106D" or "Schedule D - Creditors Who Have Claims Secured by Property." Unlike unsecured debts like medical bills or credit cards, secured debts have collateral like cars and houses.

Unsecured Creditors, like credit card issuers, suppliers, and some cash advance companies (although this is changing), do not hold a lien on its debtor's property to assure payment of the debt if there is a default. The secured creditor holds priority on debt collection from the property on which it holds a lien.

Some of the most common types of unsecured creditors include credit card companies, utilities, landlords, hospitals and doctor's offices, and lenders that issue personal or student loans (though education loans carry a special exception that prevents them from being discharged). Unsecured Creditor Defined, Types, vs. Secured Creditor - Investopedia investopedia.com ? terms ? unsecuredcreditor investopedia.com ? terms ? unsecuredcreditor

Official Form 106Sum. Summary of Your Assets and Liabilities and Certain Statistical Information. 12/15. Be as complete and accurate as possible. If two married people are filing together, both are equally responsible for supplying correct information.