Alabama Schedule 14B Information

Description

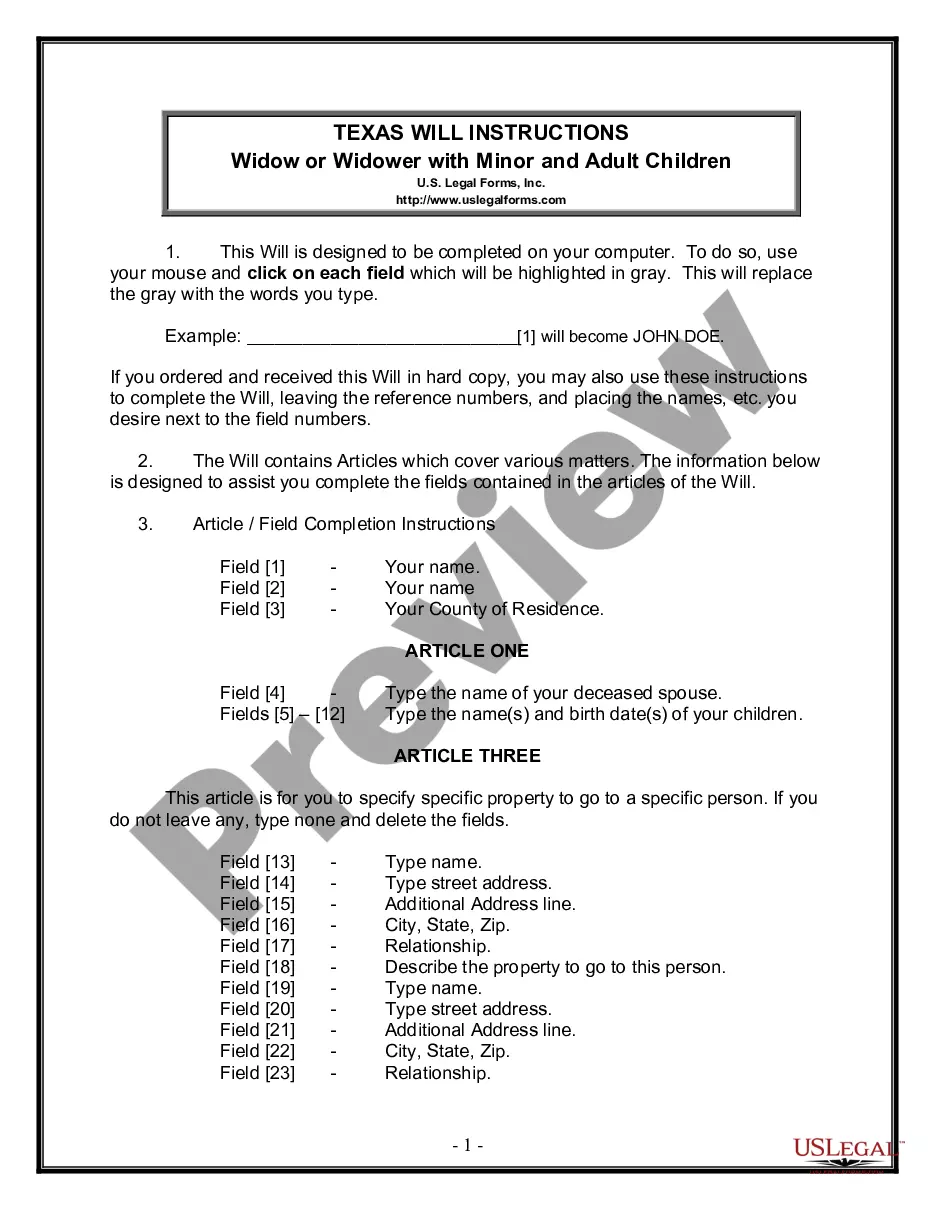

How to fill out Schedule 14B Information?

Choosing the best authorized record template can be a have a problem. Of course, there are a lot of layouts available online, but how will you discover the authorized form you need? Utilize the US Legal Forms website. The assistance delivers 1000s of layouts, including the Alabama Schedule 14B Information, that you can use for enterprise and personal demands. Every one of the types are checked out by specialists and satisfy federal and state requirements.

Should you be previously signed up, log in for your account and then click the Download key to get the Alabama Schedule 14B Information. Utilize your account to appear with the authorized types you have bought in the past. Proceed to the My Forms tab of your own account and have an additional copy in the record you need.

Should you be a new customer of US Legal Forms, here are straightforward instructions for you to stick to:

- Initially, ensure you have chosen the right form for your city/state. It is possible to check out the shape using the Preview key and study the shape explanation to ensure it is the right one for you.

- If the form does not satisfy your preferences, use the Seach area to find the correct form.

- Once you are positive that the shape is proper, click the Purchase now key to get the form.

- Pick the pricing program you want and enter in the essential information. Build your account and pay money for an order utilizing your PayPal account or Visa or Mastercard.

- Select the document formatting and down load the authorized record template for your product.

- Comprehensive, edit and printing and indicator the attained Alabama Schedule 14B Information.

US Legal Forms is definitely the biggest library of authorized types where you can see various record layouts. Utilize the service to down load skillfully-created papers that stick to express requirements.

Form popularity

FAQ

The penalty for failure to timely pay the amount of tax shown due on an Alabama business privilege tax return equals to 1% of the amount of tax shown due on the return for each month the tax is unpaid ? not to exceed 25% of the amount shown due on the return.

In order to successfully file your Alabama Business Privilege Tax, you'll need to do the following: Find your business entity's due date and determine your filing fees. Download and complete your tax return. File your return and pay your business privilege tax.

Ing to the Alabama business privilege tax law, every corporation, limited liability entity, and disregarded entity doing business in Alabama or organized, incorporated, qualified, or registered under the laws of Alabama is required to file an Alabama Business Privilege Tax Return and Annual Report.

Last summer, Governor Kay Ivey signed into law Act No. 2022-252, which amends the law regarding the minimum business privilege tax to be paid by small businesses, reducing the minimum-required fee from $100 to $50 in 2023 and to $0 in 2024.

How do I make a Payment for Business Privilege Tax? Pay via Credit/Debit card or ACH online with MyAlabamaTaxes. Billing payments can be made at Pay Bill. Taxpayer Assistance Group (TAG): To make a credit card payment by phone, please contact the Alabama Department of Revenue Taxpayer Assistance Group at 334-353-8096.

Determination Period for Initial Returns An Alabama business privilege tax initial return is due two and one half months after the date the entity was organized in Alabama or the date the entity qualified to do business in Alabama.

The CPT form is filed with the Alabama Department of Revenue. PPT ? S Corps, Limited Liability Companies, and PLLCs file a PPT form for their business privilege tax. The PPT form also includes the AL-, which is used for the annual report. Both are filed with Alabama's Department of Revenue.

The rate is based on the ability to pay and is determined by the entity's federal taxable income apportioned to Alabama. The rate rages from $. 25 to $1.75 for each $1,000 of net worth in Alabama.