Alabama Approval of Incentive Stock Option Plan

Description

How to fill out Approval Of Incentive Stock Option Plan?

You are able to devote time on-line attempting to find the authorized document web template that fits the state and federal needs you require. US Legal Forms provides 1000s of authorized kinds that are evaluated by experts. It is simple to obtain or print the Alabama Approval of Incentive Stock Option Plan from our support.

If you have a US Legal Forms account, you are able to log in and then click the Obtain key. Following that, you are able to full, edit, print, or indication the Alabama Approval of Incentive Stock Option Plan. Each authorized document web template you get is your own property permanently. To obtain another duplicate of any acquired kind, go to the My Forms tab and then click the related key.

If you are using the US Legal Forms internet site for the first time, adhere to the basic directions under:

- First, be sure that you have selected the right document web template for the state/area of your liking. See the kind description to ensure you have chosen the appropriate kind. If offered, utilize the Preview key to look with the document web template too.

- In order to get another edition in the kind, utilize the Research discipline to get the web template that fits your needs and needs.

- After you have identified the web template you want, click on Purchase now to continue.

- Select the rates strategy you want, type in your credentials, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You can utilize your bank card or PayPal account to purchase the authorized kind.

- Select the structure in the document and obtain it for your device.

- Make changes for your document if possible. You are able to full, edit and indication and print Alabama Approval of Incentive Stock Option Plan.

Obtain and print 1000s of document themes utilizing the US Legal Forms site, which provides the greatest assortment of authorized kinds. Use expert and condition-specific themes to take on your business or specific needs.

Form popularity

FAQ

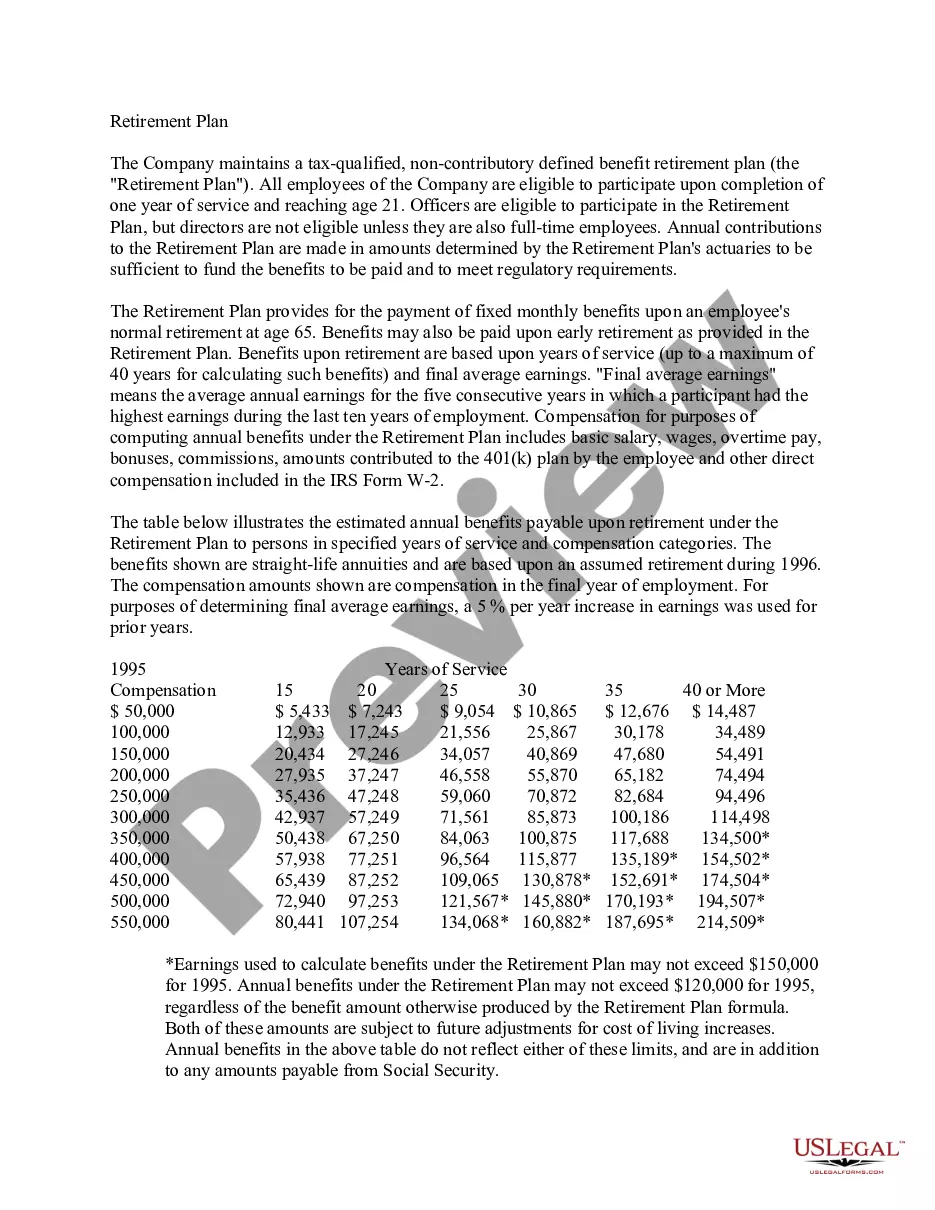

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

To receive the incentive, you must hold (keep) ISOs for at least one year after exercise and two years after the grant date. If you hold your stock for at least a year after purchase, you will pay the lower capital gains tax rate on the increase in value.

Incentive stock options (ISOs) are a form of equity compensation that allows you to buy company shares for a specific exercise price. ISOs are a type of stock option?they are not actual shares of stock; you must exercise (buy) your options to become a shareholder.

The US federal tax laws do not generally address the level of approval required for equity awards, but the tax rules that govern the qualification of so-called incentive stock options require that the options be granted under a shareholder-approved plan.

It can provide significant financial benefits If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant.

These grants come in the form of regular call options and give an employee the right to buy the company's stock at a specified price for a finite period of time. ESOs can have vesting schedules that limit the ability to exercise.

An option grant is a right to acquire a set number of shares of stock of a company at a set price.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.