Alabama Nonqualified Stock Option Plan of the Banker's Note, Inc.

Description

How to fill out Nonqualified Stock Option Plan Of The Banker's Note, Inc.?

Choosing the best legal file web template might be a have difficulties. Needless to say, there are plenty of templates accessible on the Internet, but how do you get the legal develop you will need? Take advantage of the US Legal Forms internet site. The assistance provides a large number of templates, like the Alabama Nonqualified Stock Option Plan of the Banker's Note, Inc., which you can use for business and private needs. Every one of the varieties are examined by experts and fulfill state and federal demands.

If you are presently authorized, log in in your bank account and click on the Down load switch to have the Alabama Nonqualified Stock Option Plan of the Banker's Note, Inc.. Make use of bank account to check with the legal varieties you may have acquired earlier. Proceed to the My Forms tab of the bank account and acquire another version in the file you will need.

If you are a whole new user of US Legal Forms, here are basic instructions that you can follow:

- Initial, make sure you have selected the appropriate develop for your personal city/region. You can examine the shape using the Review switch and look at the shape explanation to ensure it is the right one for you.

- In case the develop is not going to fulfill your needs, use the Seach discipline to obtain the correct develop.

- Once you are certain that the shape would work, click on the Acquire now switch to have the develop.

- Choose the pricing prepare you want and type in the essential information and facts. Design your bank account and buy the transaction utilizing your PayPal bank account or credit card.

- Pick the submit format and obtain the legal file web template in your system.

- Total, modify and printing and indicator the received Alabama Nonqualified Stock Option Plan of the Banker's Note, Inc..

US Legal Forms is the greatest local library of legal varieties for which you can see various file templates. Take advantage of the company to obtain expertly-produced documents that follow express demands.

Form popularity

FAQ

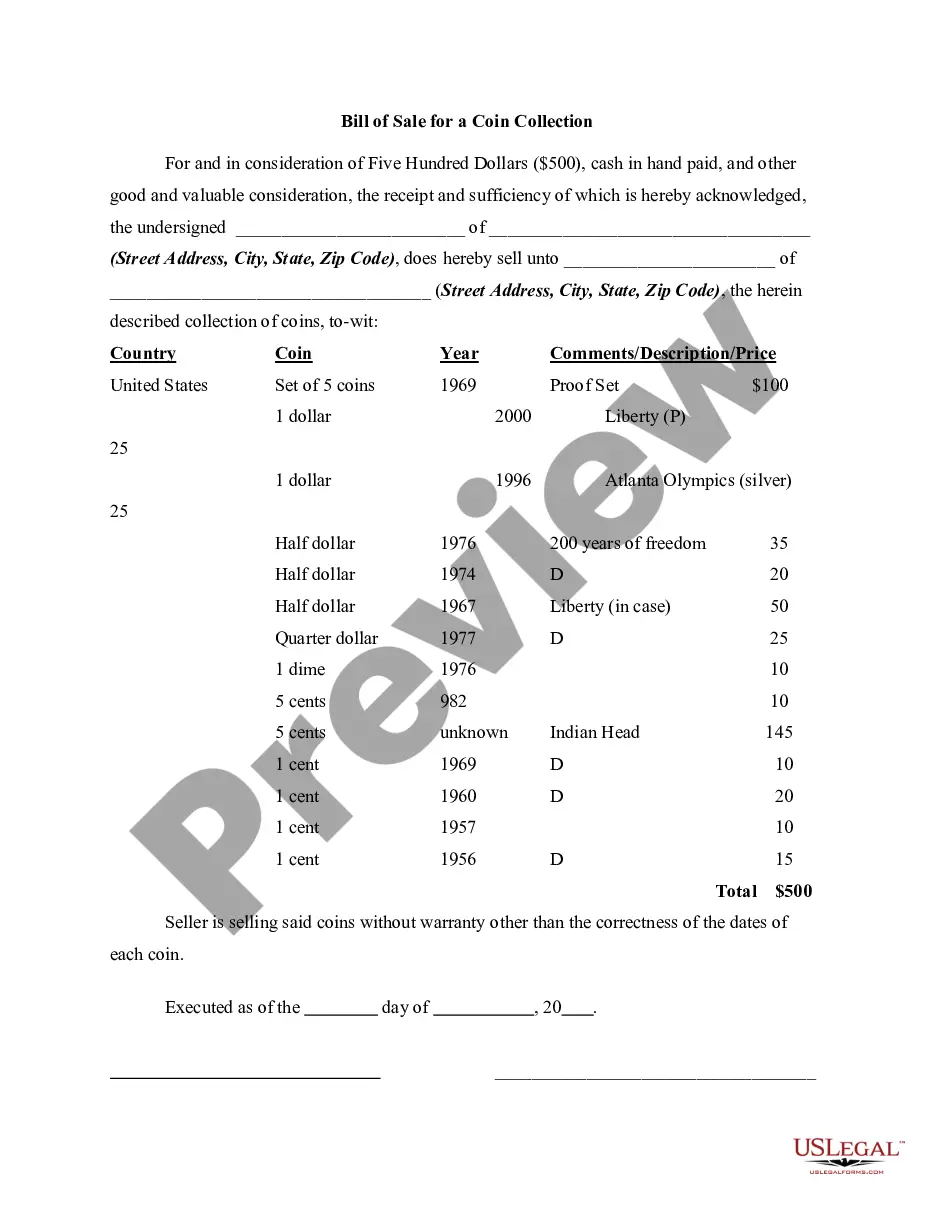

Here's a real-world example: If you exercise one of these NSOs, you'll pay your company $3 to buy a share. But the IRS views that share to be worth $35. The difference between the $3 and the $35 counts as a $32 phantom gain (also called the spread). The phantom gain is taxed at ordinary income rates.

In this situation, you exercise your option to purchase the shares but you do not sell the shares. Your compensation element is the difference between the exercise price ($25) and the market price ($45) on the day you exercised the option and purchased the stock, times the number of shares you purchased.

Income tax upon exercise When you exercise NSOs and opt to purchase company shares, the difference between the market price of the shares and your NSO strike price is called the ?bargain element.? The bargain element is taxed as compensation, which means you'll need to pay ordinary income tax on that amount.

Non-qualified stock options require payment of income tax of the grant price minus the price of the exercised option. NSOs might be provided as an alternative form of compensation. Prices are often similar to the market value of the shares.

Examples of NSOs If you had the option to purchase 100 shares, you could pay $1,000 to exercise those options at $10 per share. If the stock price rose to $20 per share, you could exercise the options for $1,000, then sell the 100 shares for $20 per share, or $2,000. You'd make $1,000 in profit.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.

Options that exceed the $200,000 threshold are ?non-qualified securities? and thus do not qualify for the Stock Option Deduction.