Alabama Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options

Description

How to fill out Stock Option Plan Of Hayes Wheels International, Inc., Which Provides For Grant Of Incentive Stock Options And Nonqualified Stock Options?

Are you in the place where you will need documents for either organization or individual reasons almost every time? There are a variety of authorized document layouts available on the net, but discovering ones you can rely on isn`t straightforward. US Legal Forms provides a huge number of type layouts, just like the Alabama Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options, which can be created to fulfill federal and state needs.

Should you be previously informed about US Legal Forms internet site and get a free account, just log in. Afterward, you can acquire the Alabama Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options design.

Unless you have an accounts and want to start using US Legal Forms, follow these steps:

- Find the type you require and make sure it is for your appropriate town/area.

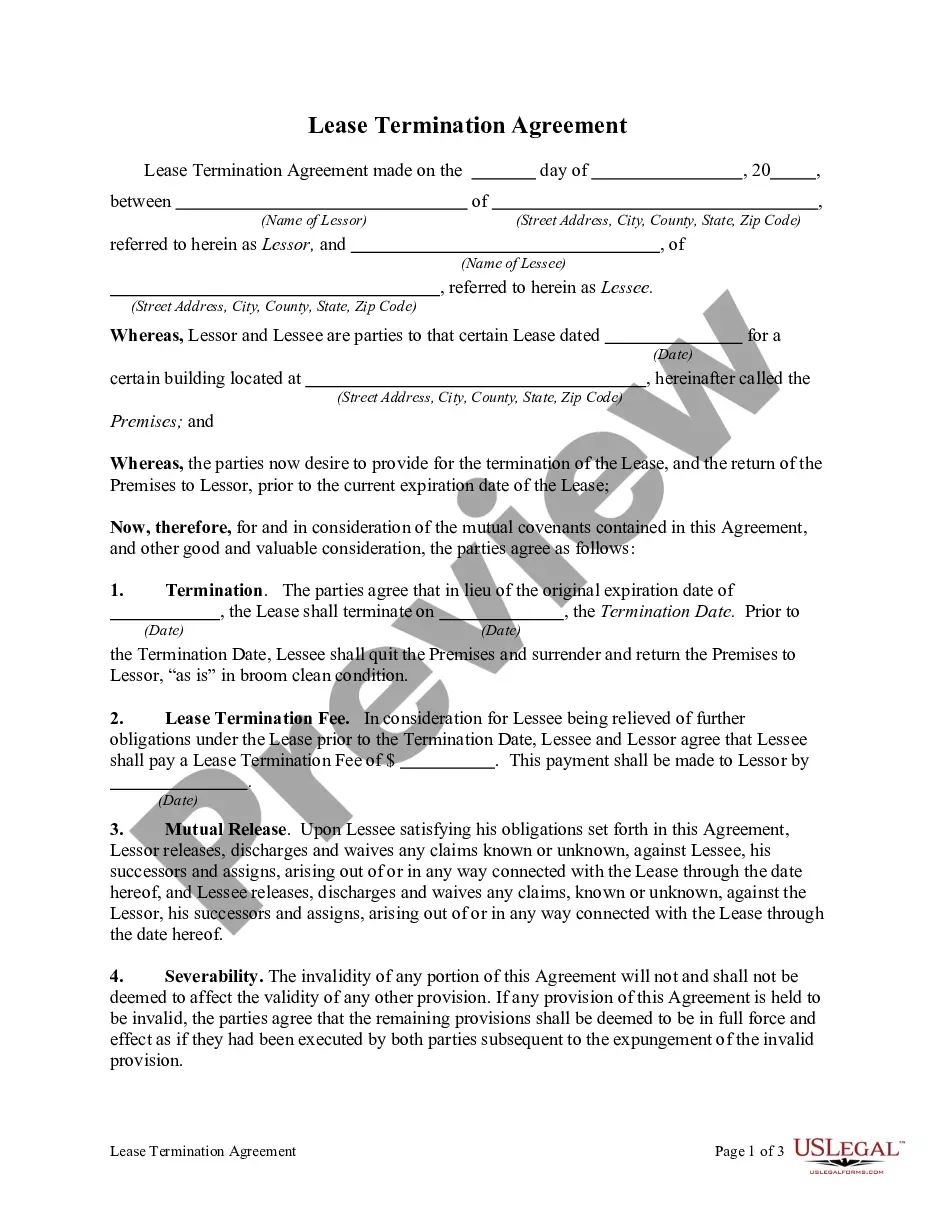

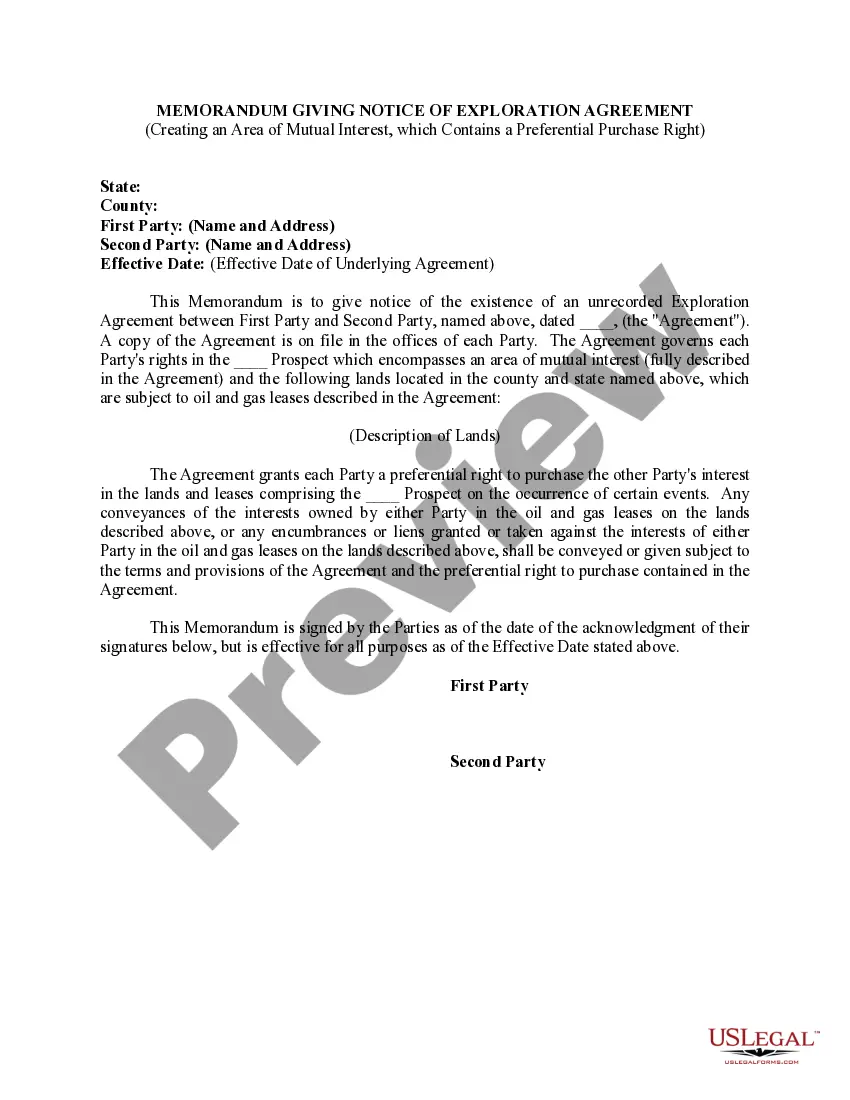

- Make use of the Review option to examine the shape.

- Read the information to ensure that you have selected the correct type.

- When the type isn`t what you are looking for, use the Research area to get the type that meets your requirements and needs.

- When you get the appropriate type, just click Purchase now.

- Select the costs prepare you need, submit the required information to generate your bank account, and pay for your order using your PayPal or bank card.

- Choose a hassle-free file structure and acquire your copy.

Find every one of the document layouts you may have purchased in the My Forms menu. You can obtain a further copy of Alabama Stock Option Plan of Hayes Wheels International, Inc., which provides for grant of Incentive Stock Options and Nonqualified Stock Options whenever, if necessary. Just select the necessary type to acquire or print the document design.

Use US Legal Forms, one of the most substantial variety of authorized types, in order to save efforts and stay away from faults. The support provides expertly created authorized document layouts which you can use for a selection of reasons. Create a free account on US Legal Forms and begin creating your lifestyle easier.

Form popularity

FAQ

NSOs vs. RSUs NSOs give you the option to buy stock, but you might decide to never exercise them if the company's valuation falls below your strike price. In comparison, restricted stock units (RSUs) are actual shares that you acquire as they vest. You don't have to pay to exercise RSUs; you simply receive the shares.

Non-qualified stock options are issued at a grant price. The grant price is the price at which you can buy the company stock. Your options come with a vesting schedule. During the time between the grant date of your options and the day they vest, you can't exercise your option.

How are NSOs taxed when exercised? In short: You pay ordinary income tax rates on the difference between the strike price and the 409A valuation. Your employer already withholds a part, but it's the bare minimum (usually 25%)

Options that exceed the $200,000 threshold are ?non-qualified securities? and thus do not qualify for the Stock Option Deduction.

Profits made from exercising qualified stock options (QSO) are taxed at the capital gains tax rate (typically 15%), which is lower than the rate at which ordinary income is taxed. Gains from non-qualified stock options (NQSO) are considered ordinary income and are therefore not eligible for the tax break.

Nonqualified: Employees generally don't owe tax when these options are granted. When exercising, tax is paid on the difference between the exercise price and the stock's market value. They may be transferable. Qualified or Incentive: For employees, these options may qualify for special tax treatment on gains.

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit. The profit on qualified ISOs is usually taxed at the capital gains rate, not the higher rate for ordinary income.

Non-qualified Stock Options (NSOs) are stock options that, when exercised, result in ordinary income under US tax laws on the difference, calculated on the exercise date, between the exercise price and the fair market value of the underlying shares.