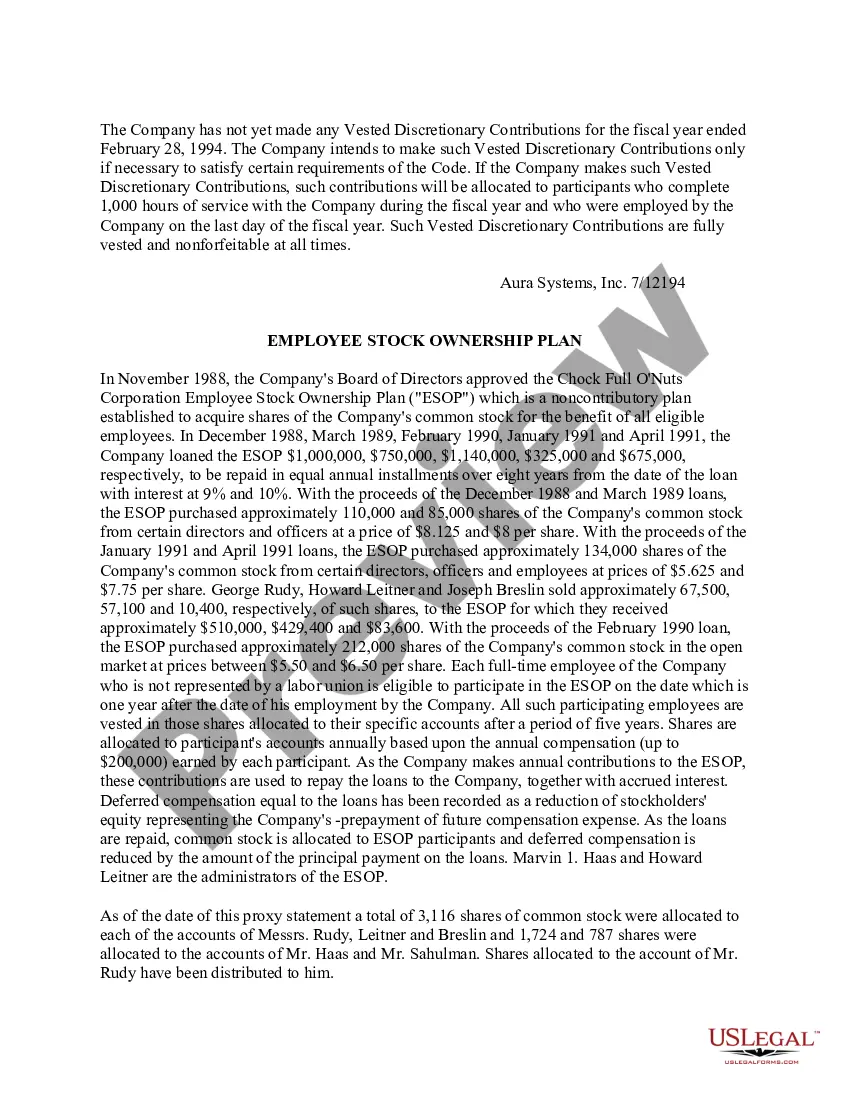

Alabama Employee Stock Ownership Plan of Aura Systems, Inc.

Description

How to fill out Employee Stock Ownership Plan Of Aura Systems, Inc.?

Discovering the right legitimate file format can be a have a problem. Naturally, there are a lot of templates available on the net, but how will you obtain the legitimate form you require? Make use of the US Legal Forms web site. The services provides thousands of templates, including the Alabama Employee Stock Ownership Plan of Aura Systems, Inc., which can be used for organization and private requires. Each of the varieties are checked out by experts and meet up with federal and state specifications.

If you are already registered, log in to your accounts and click the Obtain key to find the Alabama Employee Stock Ownership Plan of Aura Systems, Inc.. Use your accounts to check throughout the legitimate varieties you have purchased earlier. Proceed to the My Forms tab of the accounts and acquire one more backup of the file you require.

If you are a fresh consumer of US Legal Forms, listed here are straightforward instructions so that you can stick to:

- First, ensure you have selected the proper form to your town/county. You are able to look over the form making use of the Review key and browse the form information to make certain this is the right one for you.

- When the form does not meet up with your preferences, use the Seach industry to discover the appropriate form.

- When you are sure that the form is suitable, select the Buy now key to find the form.

- Choose the costs plan you desire and enter in the needed info. Design your accounts and purchase your order with your PayPal accounts or credit card.

- Select the file format and acquire the legitimate file format to your gadget.

- Total, revise and produce and indication the received Alabama Employee Stock Ownership Plan of Aura Systems, Inc..

US Legal Forms may be the largest collection of legitimate varieties in which you can find various file templates. Make use of the company to acquire expertly-manufactured paperwork that stick to state specifications.

Form popularity

FAQ

Benefits of an ESOP Over 401K ESOPs offer far more benefits than 401ks. For this reason, satisfaction?both from employees and employers?with ESOPs tends to be far higher than that of 401ks. ESOPs most-effectively reward workers both for their increased productivity but also for their continued employment.

An employee stock ownership plan (ESOP) is a structure set up by a company to give employees an ownership stake in the business. Companies set up ESOPs to compensate and incentivise employees, and to align everyone in the business behind the same mission and vision.

1.Exit without exercising stock options Employees who leave the organization before completing the vesting period forfeit the right to own any stock. Even if the contract offers a partial vesting option, and they do not complete any of the conditions, they still forfeit the rights to own the stock.

While ESOPs offer tax benefits and can boost employee morale, there are downsides to keep in mind. These programs can be expensive and potentially lower the value of your business, which could impact your long-term exit strategy.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate succession planning, allowing a company owner to sell his or her. shares and transition flexibly out of the business.