Alabama Proposal to decrease authorized common and preferred stock

Description

How to fill out Proposal To Decrease Authorized Common And Preferred Stock?

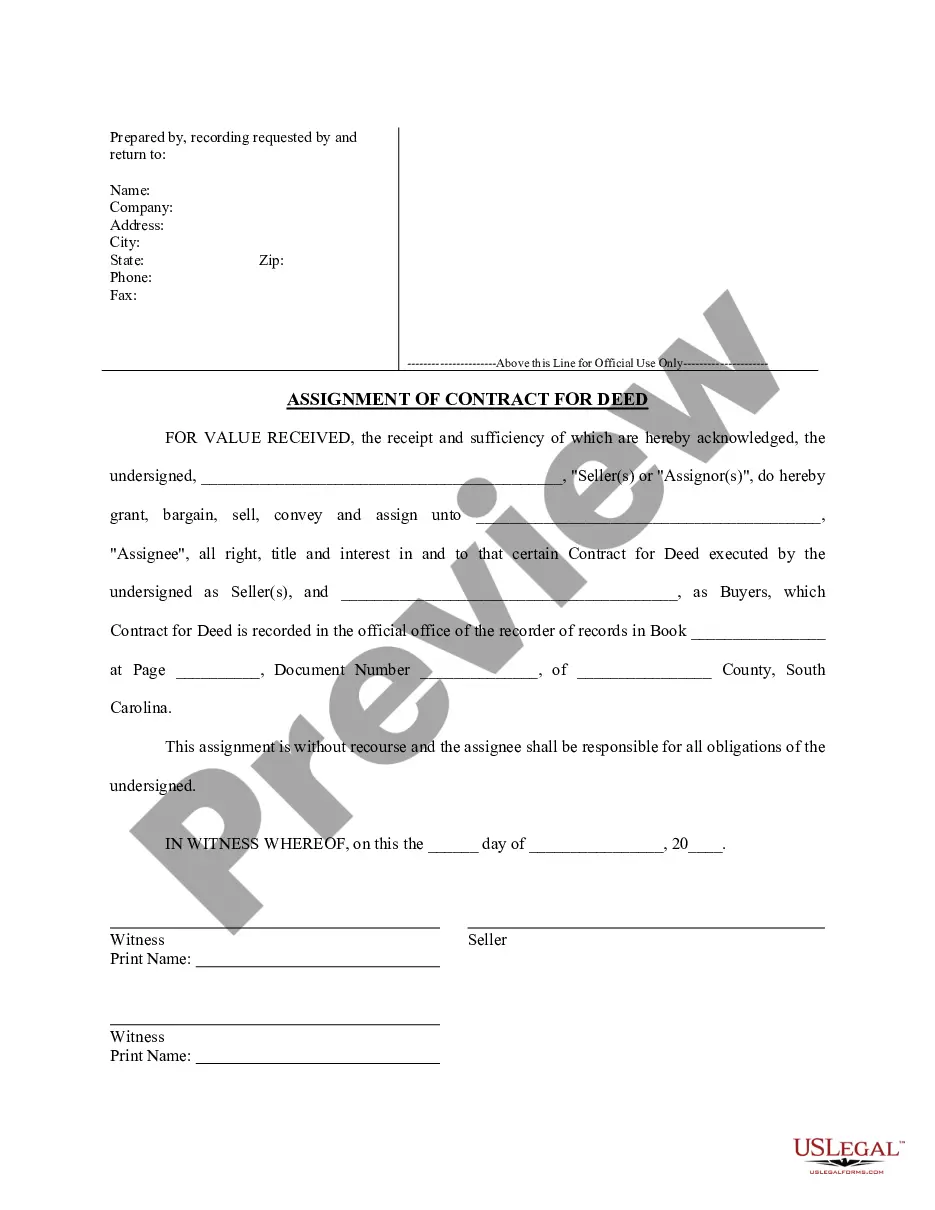

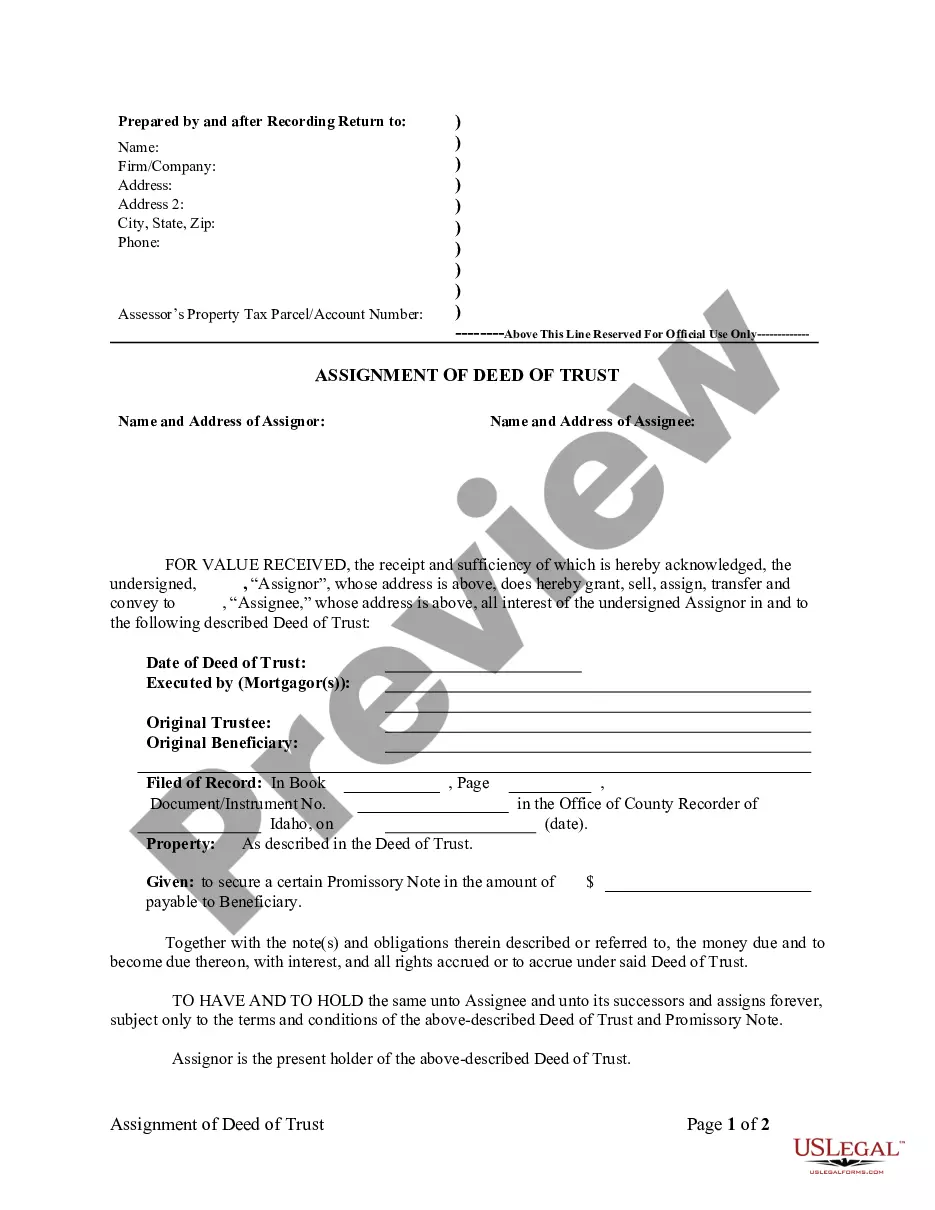

Finding the right legal file design can be quite a have a problem. Naturally, there are a lot of templates available on the net, but how would you discover the legal kind you will need? Utilize the US Legal Forms web site. The service offers thousands of templates, such as the Alabama Proposal to decrease authorized common and preferred stock, that can be used for enterprise and personal demands. Each of the types are checked out by professionals and satisfy state and federal needs.

Should you be currently registered, log in for your bank account and click on the Acquire switch to find the Alabama Proposal to decrease authorized common and preferred stock. Make use of bank account to appear throughout the legal types you have ordered in the past. Go to the My Forms tab of your own bank account and acquire an additional version from the file you will need.

Should you be a brand new customer of US Legal Forms, listed here are basic guidelines for you to adhere to:

- Initially, ensure you have selected the correct kind to your town/area. You may look over the form making use of the Review switch and look at the form description to make certain it is the right one for you.

- When the kind is not going to satisfy your requirements, take advantage of the Seach field to obtain the appropriate kind.

- Once you are certain that the form is proper, click the Acquire now switch to find the kind.

- Opt for the pricing program you would like and enter the needed information. Build your bank account and pay for your order using your PayPal bank account or charge card.

- Select the file structure and download the legal file design for your device.

- Complete, change and print out and signal the attained Alabama Proposal to decrease authorized common and preferred stock.

US Legal Forms will be the biggest library of legal types that you can discover different file templates. Utilize the service to download expertly-made files that adhere to express needs.

Form popularity

FAQ

Preferred Shareholders: have priority over common stock in certain areas such as the right to receive dividends and the distribution of assets if the corporation is liquidated BEFORE common shareholders. However, preferred shareholders usually HAVE NO RIGHT TO VOTE.

Preferred shareholders have priority over common stockholders when it comes to dividends, which generally yield more than common stock and can be paid monthly or quarterly.

Preferred stockholders are the only corporate constituents who straddle the line?their participation being both corporate and contractual.

Preferred stock also takes precedence over common stock, so if a company can't pay a dividend, it must first settle any outstanding amount to preference shareholders before offering to pay ordinary shareholders. In liquidation, the company's assets distribute last to common stockholders.

Preferred shareholders have priority over a company's income, meaning they are paid dividends before common shareholders. Common stockholders are last in line when it comes to company assets, which means they will be paid out after creditors, bondholders, and preferred shareholders.

Common stock, as its name implies, is one of the most ordinary types of stock. It gives shareholders a stake in the underlying business, as well as voting rights to elect a board of directors and a claim to a portion of the company's assets and future revenues.

Preferred stocks are senior (i.e., higher ranking) to common stock but subordinate to bonds in terms of claim (or rights to their share of the assets of the company, given that such assets are payable to the returnee stock bond) and may have priority over common stock (ordinary shares) in the payment of dividends and ...

For legal purposes it's considered equity, like common stock, rather than debt, though it functions much like debt. Like the payments on common stock, the company is not able to deduct payments to its preferred stock from its taxable income.