Alabama Approval of Authorization of Preferred Stock In Alabama, the Approval of Authorization of Preferred Stock refers to a crucial legal process allowing a corporation to issue preferred stock as a means of raising capital. Preferred stock is a type of ownership interest in a corporation that grants certain advantages over common stockholders, such as priority in dividend payments and liquidation. The approval process for authorization of preferred stock in Alabama involves a series of steps to ensure compliance with state laws and regulations. These procedures safeguard the interests of the corporation and its investors, providing a transparent framework for issuing preferred stock. Companies seeking to utilize preferred stock as a financing tool must adhere to these regulations to proceed with the process. The Alabama Approval of Authorization of Preferred Stock encompasses various types, each serving different purposes within corporate finance. These different types of preferred stock are designed to meet diverse investor needs and preferences. Some commonly recognized types include: 1. Cumulative Preferred Stock: This type of preferred stock entitles holders to accumulate unpaid dividends if they're unable to be paid in a particular year. These accumulated dividends, also known as dividends in arrears, must be paid to the preferred stockholders before any dividends can be declared for common stockholders. 2. Convertible Preferred Stock: Convertible preferred stock offers the flexibility to convert holdings into a predetermined number of common shares at the discretion of the stockholder. This feature allows investors to benefit from potential future increases in the corporation's stock price. 3. Participating Preferred Stock: By holding participating preferred stock, investors are entitled to additional dividends alongside common stockholders. This type of preferred stock allows investors to receive greater financial returns to the event the corporation performs exceptionally well. 4. Callable Preferred Stock: Callable preferred stock provides the corporation with the right to redeem or repurchase the stock from shareholders at a specific price at a later date. This allows the issuing company to control its equity structure and adjust it according to changing business needs or market conditions. It is important for companies seeking to authorize preferred stock in Alabama to understand the distinctions and features of each type. This knowledge will enable them to determine which form of preferred stock best suits their financial requirements and align with the preferences of potential investors. In conclusion, the Approval of Authorization of Preferred Stock is a vital aspect of corporate finance in Alabama. It involves a comprehensive process that ensures compliance with state regulations, allowing corporations to issue different types of preferred stock. By understanding the various types, companies can make informed decisions to raise capital and attract investors effectively.

Alabama Approval of authorization of preferred stock

Description

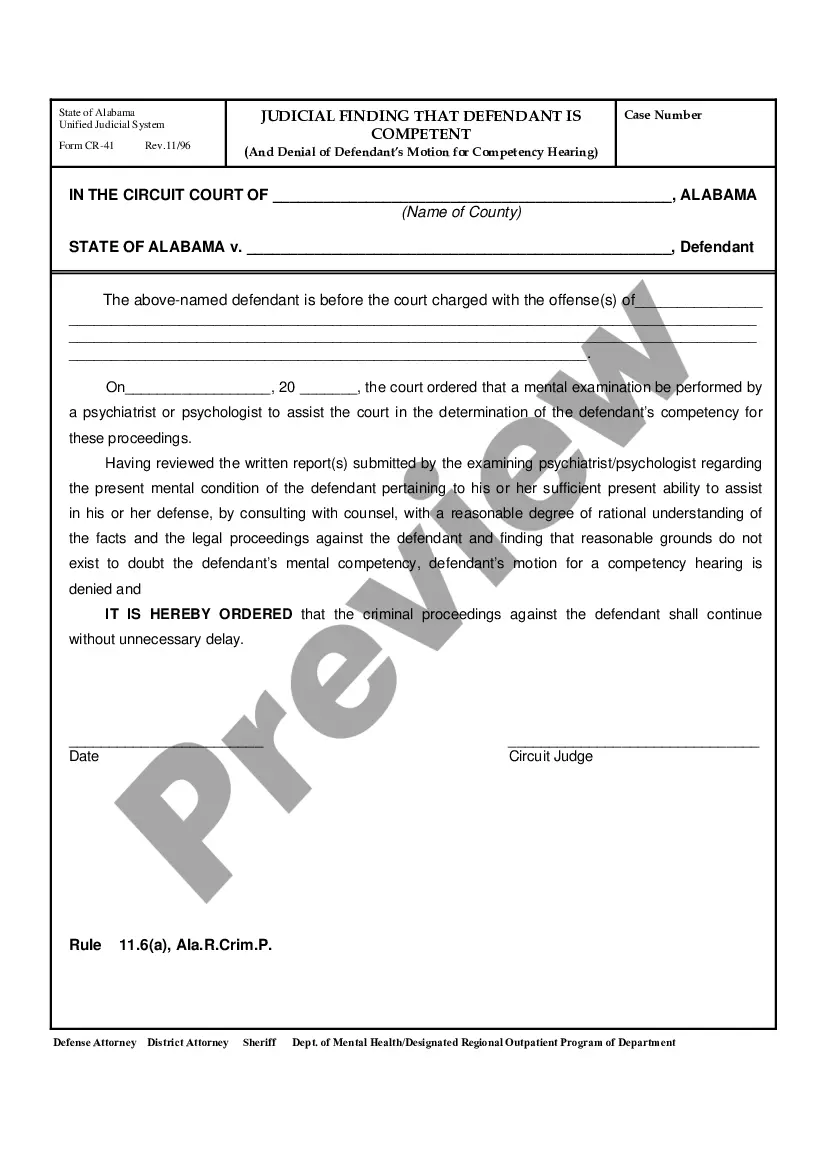

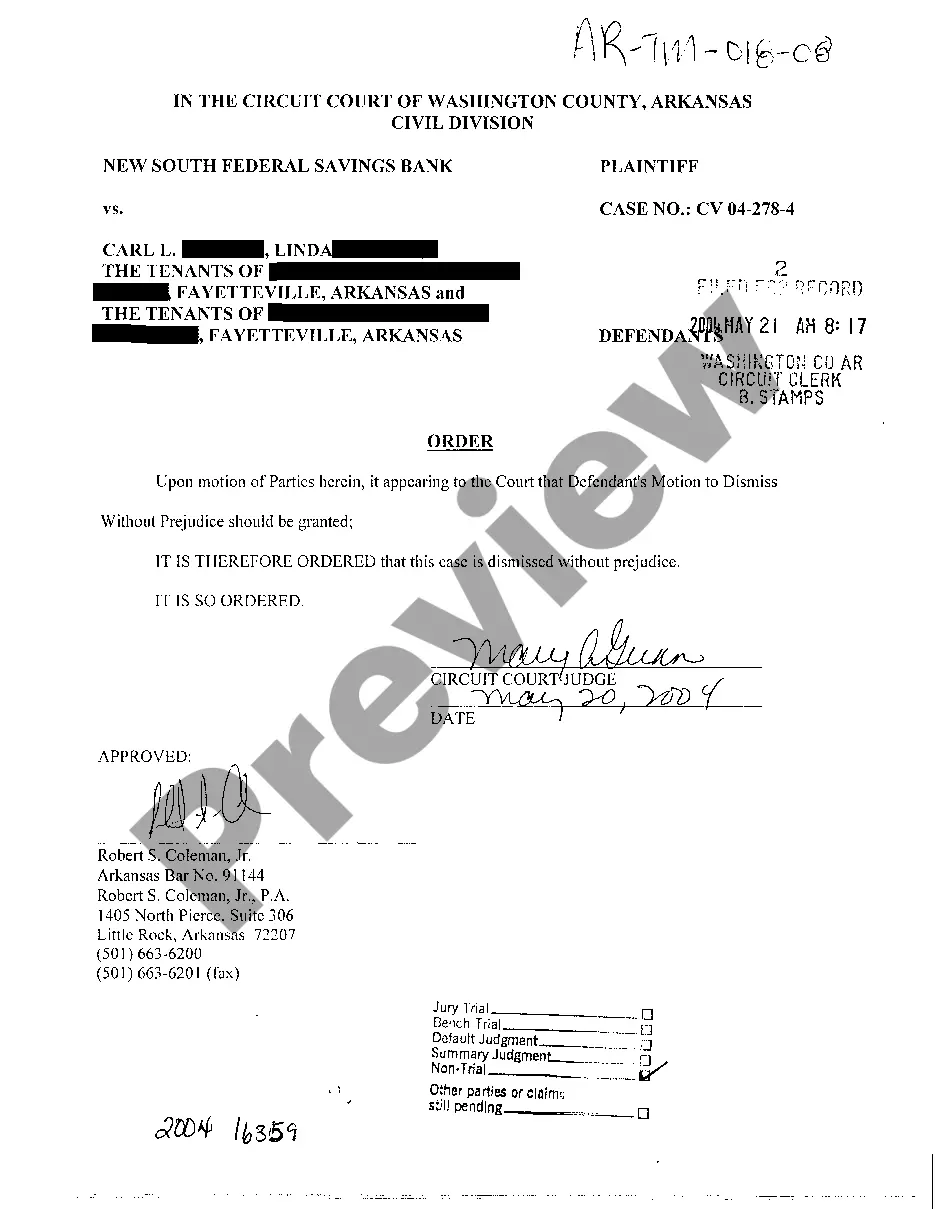

How to fill out Alabama Approval Of Authorization Of Preferred Stock?

If you wish to total, download, or printing legal file themes, use US Legal Forms, the largest collection of legal kinds, that can be found on-line. Take advantage of the site`s simple and easy handy look for to discover the papers you need. A variety of themes for organization and person uses are categorized by categories and claims, or keywords. Use US Legal Forms to discover the Alabama Approval of authorization of preferred stock within a handful of clicks.

In case you are presently a US Legal Forms customer, log in in your accounts and click on the Down load switch to have the Alabama Approval of authorization of preferred stock. You may also access kinds you previously acquired within the My Forms tab of your respective accounts.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Make sure you have selected the shape for your correct town/land.

- Step 2. Make use of the Preview option to check out the form`s articles. Never forget to see the explanation.

- Step 3. In case you are unsatisfied using the kind, utilize the Research area at the top of the display to discover other variations of your legal kind format.

- Step 4. After you have identified the shape you need, click on the Purchase now switch. Choose the pricing prepare you choose and include your references to sign up for the accounts.

- Step 5. Method the transaction. You may use your Мisa or Ьastercard or PayPal accounts to finish the transaction.

- Step 6. Find the structure of your legal kind and download it on your device.

- Step 7. Comprehensive, change and printing or signal the Alabama Approval of authorization of preferred stock.

Every single legal file format you buy is your own property eternally. You may have acces to every single kind you acquired in your acccount. Select the My Forms section and select a kind to printing or download once again.

Compete and download, and printing the Alabama Approval of authorization of preferred stock with US Legal Forms. There are thousands of expert and express-certain kinds you can use for your organization or person requirements.

Form popularity

FAQ

Unlike shareholders in a corporation, LLCs are not taxed as a separate business entity. Instead, all profits and losses are ?passed through? the business to each member of the LLC. LLC members report profits and losses on their personal federal tax returns, just like the owners of a partnership would.

To start a corporation in Alabama, you'll need to do three things: appoint a registered agent, choose a name for your business, and file a Certificate of Incorporation with the Alabama Secretary of State. You can file this document online or by mail.

Pursuant to Code of Alabama, 1975, Section 8-6-3(j)(8), an applicant may be denied registration if he or she is insolvent. Applicants may be required to submit a current attested balance sheet in order to confirm compliance.

1975, § 8-6-11(a)(9), any offer or sale of securities which is made in compliance with the following requirements of this rule will be deemed to be an exempt transaction and Code of Ala.

?When used in this title, unless the context otherwise requires? (1) The term ''security'' means any note, stock, treasury stock, security future, security-based swap, bond, debenture, evidence of indebtedness, certificate of interest or participation in any profit-sharing agreement, collateral-trust certificate, ...

Section 8-6-17 - Prohibited Acts Regarding Offer, Sale, or Purchase of Securities. Prohibited acts regarding offer, sale, or purchase of securities. (3) Engage in any act, practice or course of business which operates or would operate as a fraud or deceit upon any person.