Alabama Proxy Statement of Bank of Montana System

Description

How to fill out Proxy Statement Of Bank Of Montana System?

Have you been inside a position the place you require files for sometimes enterprise or individual purposes just about every time? There are plenty of legitimate file themes accessible on the Internet, but finding kinds you can rely is not straightforward. US Legal Forms offers a huge number of form themes, much like the Alabama Proxy Statement of Bank of Montana System, which are written to satisfy state and federal requirements.

When you are already informed about US Legal Forms website and have an account, simply log in. Afterward, it is possible to acquire the Alabama Proxy Statement of Bank of Montana System format.

Should you not come with an profile and want to begin to use US Legal Forms, adopt these measures:

- Find the form you require and ensure it is to the appropriate metropolis/state.

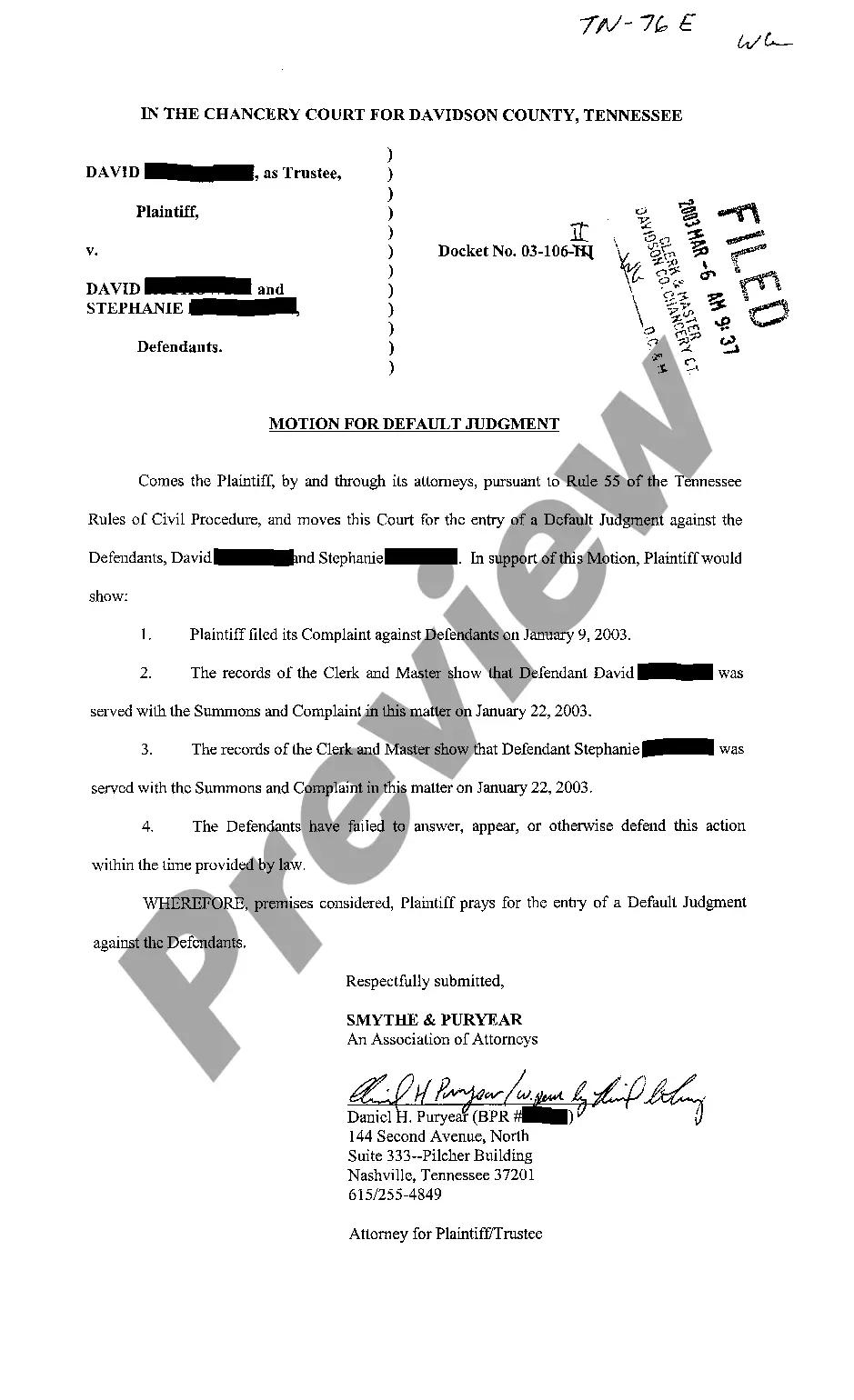

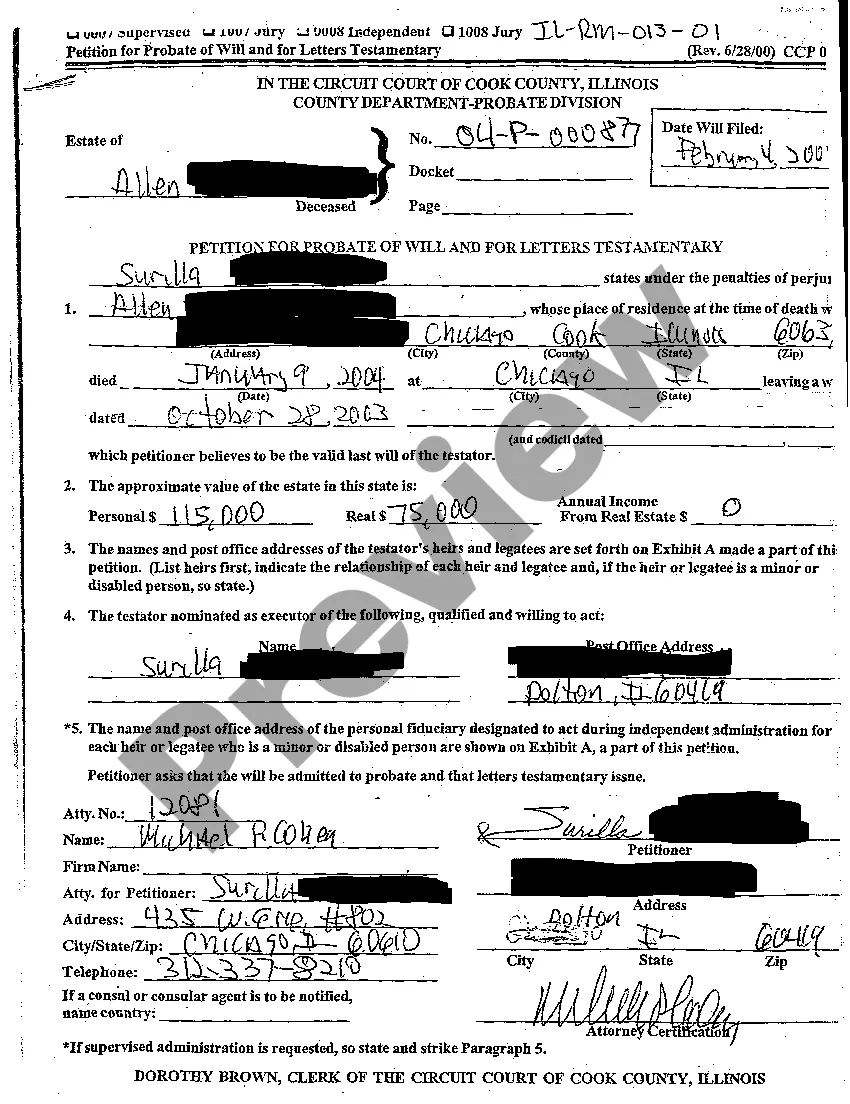

- Take advantage of the Preview option to analyze the form.

- Read the description to actually have chosen the proper form.

- In the event the form is not what you`re seeking, make use of the Lookup area to obtain the form that suits you and requirements.

- If you discover the appropriate form, click on Purchase now.

- Select the rates prepare you would like, complete the required information and facts to make your account, and pay money for the transaction using your PayPal or bank card.

- Choose a handy data file structure and acquire your version.

Get every one of the file themes you possess purchased in the My Forms menu. You can get a extra version of Alabama Proxy Statement of Bank of Montana System any time, if needed. Just select the required form to acquire or printing the file format.

Use US Legal Forms, one of the most comprehensive assortment of legitimate forms, in order to save time as well as stay away from errors. The support offers skillfully created legitimate file themes which can be used for an array of purposes. Create an account on US Legal Forms and commence making your lifestyle easier.