Alabama Stock Option Plan is a type of employee benefit plan offered by Star States Corporation, a renowned company in Alabama. This plan allows employees of the corporation to purchase company stock at a predetermined price within a specific time frame. The primary purpose of this plan is to motivate and retain talented employees by providing them with a unique opportunity to share in the company's growth and success. The Alabama Stock Option Plan offers various types of options to eligible employees, each with its own specifications and benefits. These options include: 1. Incentive Stock Options (SOS): SOS are typically granted to key employees and offer tax advantages. They allow employees to purchase company stock at a discounted price, known as the exercise price or strike price. Employees can exercise SOS after a predetermined vesting period and hold onto the shares for a certain period to avail themselves of favorable capital gains tax treatment. 2. Non-Qualified Stock Options (Nests): Nests, also known as non-statutory options, are more flexible than SOS but do not provide the same tax advantages. Employees using Nests have the freedom to exercise the options at any time, subject to the plan's rules and regulations. The purchase price is determined as the fair market value on the day of exercise, and taxes are applicable on the difference between the exercise price and fair market value. 3. Restricted Stock Units (RSS): RSS are another type of stock option available under the Alabama Stock Option Plan. Unlike traditional stock options, RSS grant employees a specific number of shares at a future date, usually after a vesting period. The value of RSS is determined by the market price of the company's stock on the vesting date. Upon vesting, employees receive the equivalent number of shares or the cash equivalent based on the current stock price. The Alabama Stock Option Plan of Star States Corporation serves as an excellent tool for attracting and retaining top talent in the state. The options and benefits offered contribute to employee motivation and loyalty, enhancing their commitment towards the company's success. By participating in this plan, employees have a unique opportunity to become shareholders and benefit from the growth and prosperity of the corporation.

Alabama Stock Option Plan of Star States Corporation

Description

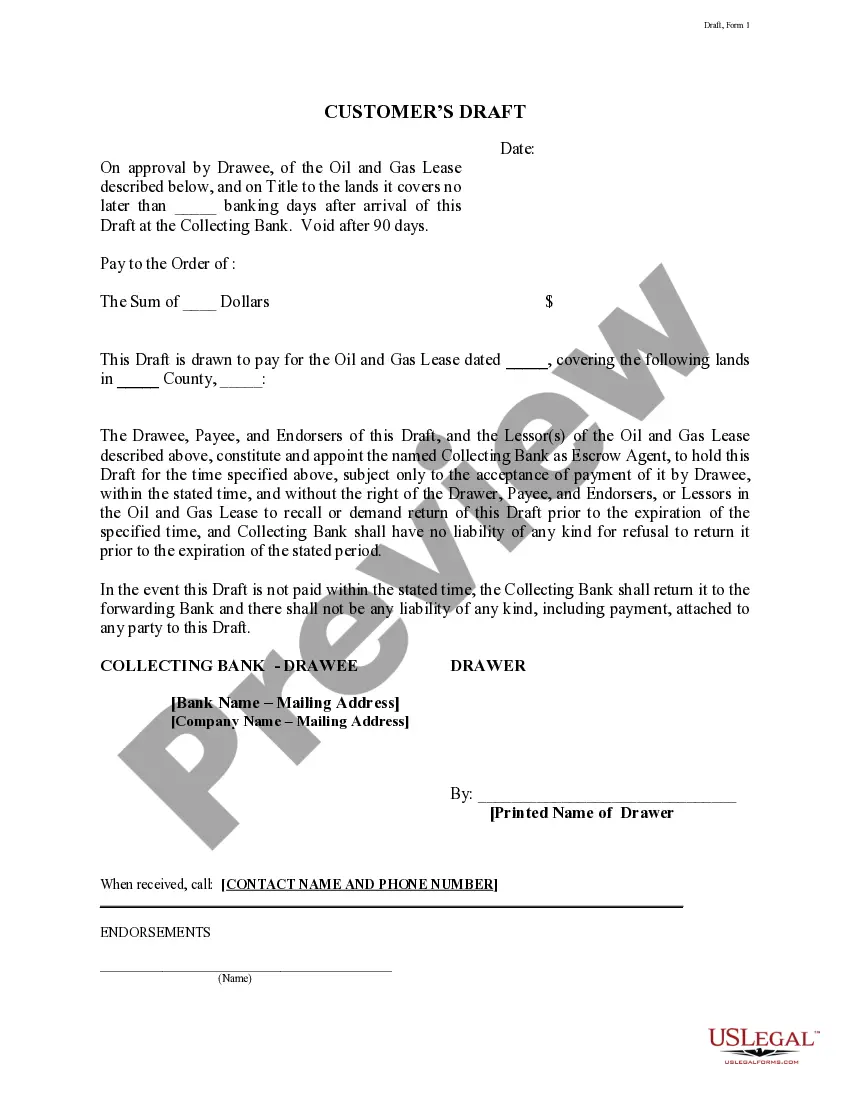

How to fill out Alabama Stock Option Plan Of Star States Corporation?

Are you currently in the placement the place you need files for possibly business or person functions just about every day time? There are tons of authorized record themes available on the Internet, but finding types you can rely isn`t straightforward. US Legal Forms provides a large number of type themes, like the Alabama Stock Option Plan of Star States Corporation, that are published in order to meet federal and state needs.

Should you be already informed about US Legal Forms internet site and get a free account, basically log in. After that, you are able to obtain the Alabama Stock Option Plan of Star States Corporation format.

If you do not have an account and need to begin using US Legal Forms, follow these steps:

- Obtain the type you need and ensure it is for the right metropolis/county.

- Make use of the Review option to examine the form.

- Read the explanation to ensure that you have chosen the appropriate type.

- If the type isn`t what you`re seeking, make use of the Look for field to obtain the type that fits your needs and needs.

- Whenever you get the right type, click Acquire now.

- Select the pricing plan you want, submit the desired info to make your bank account, and pay money for your order with your PayPal or bank card.

- Pick a handy document file format and obtain your version.

Discover each of the record themes you may have purchased in the My Forms food list. You can get a extra version of Alabama Stock Option Plan of Star States Corporation whenever, if needed. Just click on the needed type to obtain or produce the record format.

Use US Legal Forms, probably the most comprehensive variety of authorized kinds, in order to save efforts and steer clear of mistakes. The support provides professionally manufactured authorized record themes which you can use for an array of functions. Generate a free account on US Legal Forms and start generating your life easier.

Form popularity

FAQ

The standard stock option plan grants your employee a stock option that invests over four years. After the first year, there's a cliff?they don't own anything for their first 12 months, but after their first year, they invest in 25% of all the options you give them.

A stock option plan is a mechanism for affording selected employees and executives or managers of a company the opportunity to acquire stock in their company at a price determined at the time the options are granted and fixed for the term of the options.

Notably, employee stock options are not actual shares. They are an opportunity for employees to exercise (purchase) a specified amount of company shares at an agreed-upon price (the strike price) with the hope that they will sell their purchased shares for a higher price than they paid for.

After the employee terminates, the company can make the distribution in shares, cash, or some of both. Cash is paid to the employee directly. Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Stock options allow employees to buy a piece of your company at a discount in exchange for their dedication and commitment. As a small business, you can consider offering stock options as a great way to compensate employees and help build a hardworking and innovative staff.

Incentive stock options (ISOs) are popular measures of employee compensation, granting rights to company stock at a discounted price at a future date. This type of employee stock purchase plan is intended to retain key employees or managers.

Stock options are a form of equity compensation that allows an employee to buy a specific number of shares at a pre-set price. Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees.