Title: The Alabama Proposed Merger with the Grossman Corporation: A Comprehensive Overview Keywords: Alabama, Proposed merger, Grossman Corporation, acquisition, corporate consolidation, synergy, strategic alliance, business expansion Introduction: The Alabama Proposed Merger with the Grossman Corporation has been one of the most significant developments in the business landscape recently. This article aims to provide a detailed description of this exciting collaboration, shedding light on its potential impact, benefits, and key considerations. Through this merger, Alabama seeks to forge a strategic alliance with the Grossman Corporation, leveraging synergies and expanding its business horizons. 1. Background: The proposed merger between Alabama and the Grossman Corporation signifies a strategic move towards corporate consolidation and growth. Both organizations have extensive expertise in their respective industries and recognize the potential benefits of combining forces to achieve a competitive edge. 2. Objectives: The primary goal of the proposed merger is to capitalize on shared resources, specialized knowledge, and market presence. By joining hands, Alabama and the Grossman Corporation aim to create a powerhouse that can drive innovation, enhance productivity, and capture new market opportunities together. 3. Merger Types: a. Vertical Merger: This type of merger involves two companies in the same industry but different stages of production. For instance, Alabama might consider merging with the Grossman Corporation, which operates in a complementary vertical within their industry value chain. This merger would enhance efficiency, streamline operations, and minimize costs. b. Horizontal Merger: In a horizontal merger, two companies in the same industry come together to form a stronger entity. If Alabama and the Grossman Corporation belong to similar markets, this type of merger could lead to increased market share, reduced competition, and expanded reach. c. Conglomerate Merger: This merger type involves organizations operating in unrelated industries. If Alabama decides to merge with the Grossman Corporation, which has diverse business interests, they would aim to achieve new revenue streams, diversify risk, and explore previously untapped markets. 4. Synergy and Benefits: By merging with the Grossman Corporation, Alabama stands to benefit from synergies that surpass individual capabilities. Some potential advantages include: — Enhanced product portfolio and market reach — Increased economies of scale and reduced costs — Access to new technologies, patents, and intellectual property — Shared research and development efforts leading to accelerated innovation — Consolidation of talent, expertise, and complementary skill sets — Strengthened financial position, attracting investors and facilitating future growth 5. Key Considerations: a. Regulatory Approval: Alabama and the Grossman Corporation must gain regulatory approval to proceed with the proposed merger. Compliance with laws and regulations is crucial to ensuring that both companies comply with antitrust and competition regulations. b. Cultural Integration: Successful mergers entail a smooth integration of corporate cultures to foster collaboration, cohesive leadership, and employee morale. Alabama and the Grossman Corporation need to align their values, management practices, and communication channels to secure post-merger success. c. Transition Planning: Effective transition planning is vital to manage the integration process seamlessly. Developing a detailed plan encompassing employee retention, merging systems and operations, and streamlining administrative processes is essential for minimizing disruption during the transition period. Conclusion: The Alabama Proposed Merger with the Grossman Corporation holds the potential to significantly reshape the business landscape in Alabama and beyond. By leveraging synergies, expanding markets, and combining resources, this merger aims to position the unified entity for sustained growth and success. With careful planning, successful regulatory approval, and a focus on cultural integration, Alabama and the Grossman Corporation can pave the way for a prosperous future together.

Alabama Proposed merger with the Grossman Corporation

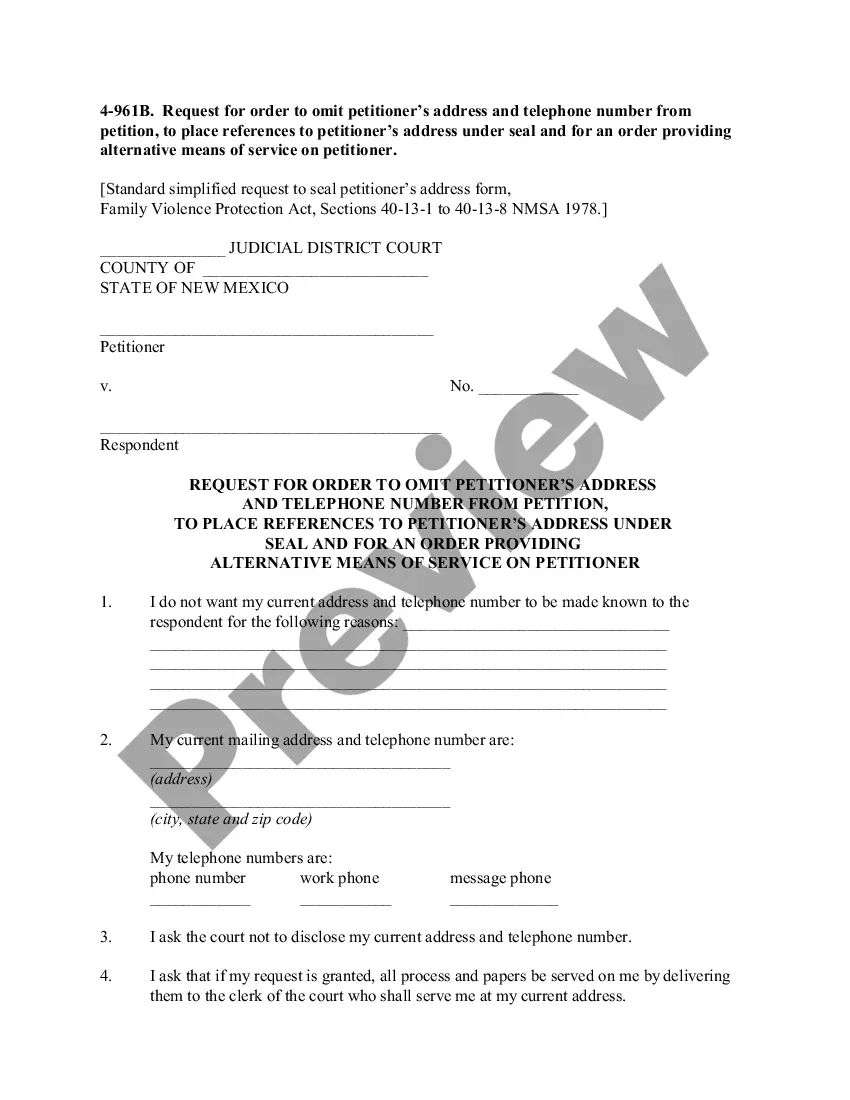

Description

How to fill out Alabama Proposed Merger With The Grossman Corporation?

US Legal Forms - one of many largest libraries of authorized kinds in the USA - gives a wide range of authorized file web templates you can download or printing. Making use of the site, you can get a huge number of kinds for company and specific functions, sorted by categories, suggests, or keywords.You will discover the latest models of kinds like the Alabama Proposed merger with the Grossman Corporation in seconds.

If you currently have a membership, log in and download Alabama Proposed merger with the Grossman Corporation from your US Legal Forms library. The Down load switch can look on every single kind you see. You gain access to all earlier saved kinds in the My Forms tab of your own bank account.

If you want to use US Legal Forms initially, here are simple instructions to get you began:

- Ensure you have selected the best kind for your personal town/county. Select the Review switch to check the form`s articles. See the kind information to ensure that you have selected the right kind.

- When the kind does not match your specifications, take advantage of the Look for field towards the top of the monitor to discover the one that does.

- When you are satisfied with the shape, affirm your option by clicking on the Acquire now switch. Then, choose the rates program you prefer and supply your references to sign up to have an bank account.

- Approach the transaction. Use your Visa or Mastercard or PayPal bank account to complete the transaction.

- Choose the format and download the shape in your device.

- Make modifications. Load, change and printing and indication the saved Alabama Proposed merger with the Grossman Corporation.

Every template you added to your account does not have an expiration particular date and is also yours eternally. So, if you wish to download or printing yet another backup, just go to the My Forms section and then click around the kind you need.

Obtain access to the Alabama Proposed merger with the Grossman Corporation with US Legal Forms, probably the most extensive library of authorized file web templates. Use a huge number of professional and condition-particular web templates that meet your small business or specific demands and specifications.